by Gary Mintchell | Nov 27, 2019 | Data Management, Manufacturing IT, Operations Management

This announcement hits many trends and things you will eventually grow tired of hearing—partnerships, collaboration among companies, ecosystems, Kubernetes, containers, and, yes, 5G. The latter is coming. We just don’t know when and how, yet.

Wind River, a leader in delivering software for the intelligent edge, announced that it is collaborating with Dell EMC as a key hardware partner for distributed edge solutions. A combined software and hardware platform would integrate Wind River Cloud Platform, a Kubernetes-based software offering for managing edge cloud infrastructure, with Dell EMC PowerEdge server hardware. The initial target use case will be virtual RAN (vRAN) infrastructure for 5G networks.

“As telecom infrastructure continues to evolve, service providers are facing daunting challenges around deploying and managing a physically distributed, cloud native vRAN infrastructure,” said Paul Miller, vice president of Telecommunications at Wind River. “By working with Dell EMC to pre-integrate our technologies into a reference distributed cloud solution, we can cost-effectively deliver carrier grade performance, massive scalability, and rapid service instantiation to service providers as their foundation for 5G networks.”

“In a 5G world, new services and applications will not be driven by massively scaled, centralized data centers but by intelligently distributed systems built at the network edge,” said Kevin Shatzkamer, vice president of Enterprise and Service Provider Strategy and Solutions at Dell EMC. “The combination of Dell EMC and Wind River technology creates a foundation for a complete, pre-integrated distributed cloud solution that delivers unrivaled reliability and performance, massive scalability, and significant cost savings compared to conventional RAN architectures. The solution will provide CSPs with what they need to migrate to 5G vRAN and better realize a cloud computing future.”

Wind River Cloud Platform combines a fully cloud-native, Kubernetes and container-based architecture with the ability to manage a truly physically and geographically separated infrastructure for vRAN and core data center sites. Cloud Platform delivers single pane of glass, zero-touch automated management of thousands of nodes.

Dell EMC hardware delivers potent compute power, high performance and high capacity memory is well suited to low-latency applications.

A commercial implementation of the open source project StarlingX, Cloud Platform scales from a single compute node at the network edge, up to thousands of nodes in the core to meet the needs of high value applications. With deterministic low latency required by edge applications and tools that make the distributed edge manageable, Cloud Platform provides a container-based infrastructure for edge implementations in scalable solutions ready for production.

by Gary Mintchell | Oct 25, 2019 | Manufacturing IT, Technology

Salesforce recently began reaching out to me. I found a (to me) surprising connection to industrial / manufacturing applications beyond CRM and the like. In general, more and more applications are moving to the cloud. In Brief: New research finds The Salesforce Economy will create more than $1 trillion in new business revenues and 4.2 million jobs between 2019 and 2024. Salesforce ecosystem is on track to become nearly six times larger than Salesforce itself by 2024, earning $5.80 for every dollar Salesforce makes.

Financial services, manufacturing and retail industries will lead the way, creating $224 billion, $212 billion and $134 billion in new business revenue respectively by 2024.

Salesforce announced new research from IDC that finds Salesforce and its ecosystem of partners will create 4.2 million new jobs and $1.2 trillion in new business revenues worldwide between 2019 and 2024. The research also finds Salesforce is driving massive gains for its partner ecosystem, which will see $5.80 in gains for every $1 Salesforce makes by 2024.

Cloud computing is driving this growth and giving rise to a host of new technologies, including mobile, social, IoT and AI, that are creating new revenue streams and jobs that further fuel the growth of the cloud — creating an ongoing virtuous cycle of innovation and growth. According to IDC, by 2024 nearly 50 percent of cloud computing software spend will be tied to digital transformation and will account for nearly half of all software sales. Worldwide spending on cloud computing between now and 2024 will grow 19 percent annually, from $179 billion in 2019 to $418 billion in 2024.

“The Salesforce ecosystem is made possible by the amazing work of our customers and partners around the world, and because of our collaboration we’re able to generate the business and job growth that we see today,” said Tyler Prince, EVP, Industries and Partners at Salesforce. “Whether it’s through industry-specific extensions or business-aligned apps, the Salesforce Customer 360 platform helps accelerate the growth of our partner ecosystem, and most importantly, the growth of our customers.”

Because organizations that spend on cloud computing subscriptions also spend on ancillary products and services, the Salesforce ecosystem in 2019 is more than four times larger than Salesforce itself and will grow to almost six times larger by 2024. IDC estimates that from 2019 through 2024, Salesforce will drive the creation of 6.6 million indirect jobs, which are created from spending in the general economy by those people filling the 4.2 million jobs previously mentioned.

“The tech skills gap will become a major roadblock for economic growth if we don’t empower everyone – regardless of class, race or gender – to skill up for the Fourth Industrial Revolution,” said Sarah Franklin, EVP and GM of Platform, Developers and Trailhead at Salesforce. “With Trailhead, our free online learning platform, people don’t need to carry six figures in debt to land a top job; instead, anyone with an Internet connection can now have an equal pathway to landing a job in the Salesforce Economy.”

Industry Economic Benefits of the Salesforce Economy

Specifically, Manufacturing industry will gain $211.7 billion in new revenues and 765,800 new jobs will be created by 2024.

Salesforce’s multi-faceted ecosystem is the driving force behind the Salesforce Economy’s massive growth:

- The global ecosystem includes multiple stakeholders, all of which play an integral part in the Salesforce Economy. This includes the world’s top five consulting firms, all of whom have prominent Salesforce digital transformation practices; independent software vendors (ISVs) that build their businesses on the Salesforce Customer 360 Platform and bring Salesforce into new industries; more than 1,200 Community Groups, with different areas of focus and expertise; and more than 200 Salesforce MVPs, product experts and brand advocates.

- Launched in 2006, Salesforce AppExchange is the world’s largest enterprise cloud marketplace, and hosts more than 4,000 solutions including apps, templates, bots and components that have been downloaded more than 7 million times. Ninety-five percent of the Fortune 100, 81 percent of the Fortune 500, and 86 percent of Salesforce customers are using AppExchange apps.

- Trailhead is Salesforce’s free online learning platform that empowers anyone to skill up for the future, learn in-demand skills and land a top job in the Salesforce Economy. Since Trailhead launched in 2014, more than 1.7 million Trailblazers have earned over 17.5 million badges; a quarter of all learners on Trailhead have leveraged their newfound skills to jump-start their careers with new jobs. Indeed, the world’s #1 job site, included Salesforce Developer in its list of best jobs in the US for 2019, noting that the number of job postings for that position had increased 129 percent year-over-year.

by Gary Mintchell | Jun 10, 2019 | Data Management, Internet of Things, Manufacturing IT, Operations Management

The Manufacturing Connection conceived in 2013 when I decided to go it alone in the world from the ideas of a new industrial infrastructure and enhanced connectivity. I even had worked out a cool mind map to figure it out.

Last week I was on vacation spending some time at the beach and reading and thinking catching up on some long neglected things. Next week I am off to Las Vegas for the Hewlett Packard Enterprise “Discover” conference where I’ll be inundated with learning about new ideas in infrastructure.

Meanwhile, I’ll share something I picked up from the Sloan Management Review (from MIT). This article was developed from a blog post by Jason Killmeyer, enterprise operations manager in the Government and Public Sector practice of Deloitte Consulting LLP, and Brenna Sniderman, senior manager in Deloitte Services LP.

They approach things from a much higher level in the organization than I usually do. They recognize what I’ve often stated about business executives reading about all these new technologies, such as, cloud computing, internet of things, AI, blockchain, and others. “The potential resulting haste to adopt new technology and harness transformative change can lead organizations to treat these emerging technologies in the same manner as other, more traditional IT investments — as something explored in isolation and disconnected from the broader technological needs of the organization. In the end, those projects can eventually stall or be written off, leaving in their wake skepticism about the usefulness of emerging technologies.”

This analysis correctly identifies the organizational challenges when leaders read things or hear other executives at the Club talk about them.

The good news, according to the authors: “These new technologies are beginning to converge, and this convergence enables them to yield a much greater value. Moreover, once converged, these technologies form a new industrial infrastructure, transforming how and where organizations can operate and the ways in which they compete. Augmenting these trends is a third factor: the blending of the cyber and the physical into a connected ecosystem, which marks a major shift that could enable organizations to generate more information about their processes and drive more informed decisions.”

They identify three capabilities and three important technologies that make them possible:

Connect: Wi-Fi and other connectivity enablers. Wi-Fi and related technologies, such as low-power wide-area networks (LPWAN), allow for cable-free connection to the internet almost anywhere. Wi-Fi and other connectivity and communications technologies (such as 5G) and standards connect a wide range of devices, from laptops to IoT sensors, across locations and pave the way for the extension of a digital-physical layer across a broader range of physical locations. This proliferation of connectivity allows organizations to expand their connectivity to new markets and geographies more easily.

Store, analyze, and manage: cloud computing. The cloud has revolutionized how many organizations distribute critical storage and computing functions. Just as Wi-Fi can free users’ access to the internet across geographies, the cloud can free individuals and organizations from relying on nearby physical servers. The virtualization inherent in cloud, supplemented by closer-to-the-source edge computing, can serve as a key element of the next wave of technologies blending the digital and physical.

Exchange and transact: blockchain. If cloud allows for nonlocal storage and computing of data — and thus the addition or extraction of value via the leveraging of that data — blockchain supports the exchange of that value (typically via relevant metadata markers). As a mechanism for value or asset exchange that executes in both a virtualized and distributed environment, blockchain allows for the secure transacting of valuable data anywhere in the world a node or other transactor is located. Blockchain appears poised to become an industrial and commercial transaction fabric, uniting sensor data, stakeholders, and systems.

My final thought about infrastructure—they made it a nice round number, namely three. However, I’d add another piece especially to the IT hardware part. That would be the Edge. Right now it is all happening at the edge. I bet I will have a lot to say and tweet next week about that.

by Gary Mintchell | Nov 2, 2018 | Internet of Things

One of the most important technologies for successful implementation of an Industrial Internet of Things program involves moving more computing and storage power to the edge.

GE has been in the news more often than it would like over the past year—my broker just called and in our discussion I mentioned writing an article about GE and he groaned.

However, GE Digital despite rumors to the contrary still lives and released some new products. One is an edge solution and the other an on-prem server solution.

Predix Edge aims at simplifying edge-to-cloud computing. GE Digital also introduced its Predix Private Cloud (PPC) solution, an on-premises deployment of the Predix platform, which gives customers the privacy, security, data sovereignty, and data isolation provided by a private cloud infrastructure.

“More than 70 percent of industrial companies are stuck in pilot purgatory – that is, they are either still at the start or unable to further advance their IIoT initiatives,” said Eddie Amos, Corporate VP, Platform & Industrial Applications, GE Digital. “Companies often face unexpected complexities in the solution design or integration, steep costs or security vulnerabilities. The custom, one-off solutions that tend to grow out of pilot projects further burden companies with ongoing maintenance, patching and upgrading over time. Realizing the full impact of IIoT requires moving beyond the pilot stage with scalable, interoperable solutions – and GE Digital helps lead them through that journey.”

The offerings GE Digital unveiled help companies bridge this gap – and offer businesses flexibility when and where they operate.

Predix Edge securely captures, processes, and analyzes data that can be managed locally or pushed to the cloud, executing the most demanding workloads at the edge and producing insights in near real time. With new functionality to help businesses accelerate the IIoT, Predix Edge provides:

Simple deployment and management capabilities out of the box, allowing users to remotely monitor and manage all their edge devices and heterogenous industrial data from a centralized management console.

Rapid time to value by supporting edge application development for almost all programming languages – such as Java, C++, Go and Python – and coming pre-integrated for use with GE Digital’s leading industrial apps like Asset Performance Management (APM) and Operations Performance Management (OPM).

Support for data storage and analysis online, offline or with intermittent connectivity in remote environments, such as offshore oil rigs or disconnected use cases where internet connectivity is never available. Predix Edge then transfers key data back to the cloud when re-connected.

Edge-to-cloud security and compliance to protect data and operations. The hardened, embedded edge operating system helps manage connected devices and remotely deploy patches, giving users the ability to control security at a deeper level.

Low latency application deployment closer to the originating data, to enable companies with limited connectivity, regulatory requirements or other constraints a way to accelerate time to value.

Processing data and applying analytics close to the device can dramatically reduce downtime, optimize maintenance schedules, and add operational value, all while reducing network and cloud costs. Predix Edge and the Predix platform work seamlessly together to provide distributed IIoT processing and analytics where they’re needed most.

To further help simplify the IIoT process, GE Digital also unveiled Predix Private Cloud (PPC), an on-premises deployment of the Predix platform and portfolio, that offers companies maximum levels of security and privacy.

Already commercially available, PPC enables IIoT connectivity, data, analytics and applications – such as Predix applications or custom applications – to be hosted on-premises, providing customers with multiple ways to deploy the Predix platform. The on-premises offering helps companies operating in high data volume scenarios access data securely in near real time and also manage edge and disconnected environments. PPC is specifically designed to meet privacy, security, data sovereignty anddata isolation requirements based on a customer’s industry, region or country.

by Gary Mintchell | Aug 18, 2018 | Asset Performance Management, Operations Management, Software

Who buys enterprise software applications, how and why? I ran across this article by a contact of mine, Gabriel Gheorghiu, Founder and principal analyst at Questions Consulting, with a background in business management and 15 years experience in enterprise software. I thought it would be most useful. I’m not an ERP analyst, but I have some background and training on the financial side of things. I think this analysis fits with other large-scale software acquisition projects, though, including MES/MOM, analytics, asset performance, and the like.

This will summarize some interesting points. I highly recommend reading the whole thing.

Before we begin, my brief take on enterprise software applications. How many of you have been involved with an SAP acquisition and roll out? How many happy people were there? Same with Oracle or any other ERP, CRM, MES, APM, etc. application. Why did using Microsoft Excel seem to go better?

Well, the big applications all force you to change all your business processes to fit their template. You build Excel to fit what you’re doing. It’s just not powerful enough to do everything, right?

Gheorghiu conducted interviews with 225 companies who were all looking for enterprise resource planning (ERP). The goal of this survey was simple – listen and learn from what these companies had to say about their individual decision-making strategies. We all agree that this is not a simple task. But we also agree that selecting the best ERP software is a critical factor for business success.

Here is why the research phase of this process is considered to be so vital:

- It has the greatest impact on all the subsequent phases and consequently, your final decision.

- Research begins at home – in other words, the first step is to determine your company’s specific and unique needs.

- Once your company has thought through and determined its software requirement, then and only then does the process to evaluate vendors and their offerings begin. This can be a very challenging step because many companies are not equipped with the time, knowledge, or tools to perform this step.

Buyer Profiles: Who’s Looking for ERP and Why?

One problem for analysis is that many are not doing business in just one industry. The breakdown of companies in our business sample, by industry, was as follows: manufacturing (47%), distribution (18%), services (12%), construction (4%), retail (3%), utilities (3%), government (3%), healthcare (3%), and other (10%). However, to complicate matters a little, 20% of manufacturers also manage distribution and some distributors include light manufacturing in their operations, like assembly.

“Companies looking to invest in business software may very well be addressing this additional challenge – looking for a comprehensive package that integrates all aspects of a business. ERP software systems are powerful and comprehensive but are not necessarily known for their agility and ability to accommodate many disparate functions.”

Gheorghiu identifies as a strong influencer consumerization, which changes focus from organization-oriented offerings to end-user focused products. “This was a highly significant turning point in the IT marketplace. By developing new technologies and models that originate in the consumer space rather than in the enterprise sector, software producers opened up the market to a flood of small and medium-sized businesses looking for more cost effective, and less complicated solutions to run their businesses.”

The consumerization of software (as noted above) has precipitated the move by many companies away from enterprise IT towards more streamlined and user friendly consumer-oriented technology. This change is equally relevant for ERP software and manufacturing companies have participated in this very significant development, albeit more cautiously and slowly than SMBs.

Most industries follow a “purposeful implementation” strategy, managing software adoption as a series of “sprints in a well-planned program” rather than insisting on the “all or nothing” approach.

For example, a small company looking to invest in software might decide to begin with an accounting system which can be used alongside point solutions and spreadsheets. As companies grow and their transactions become more complex, they may find that they have also outgrown their initial software selections.

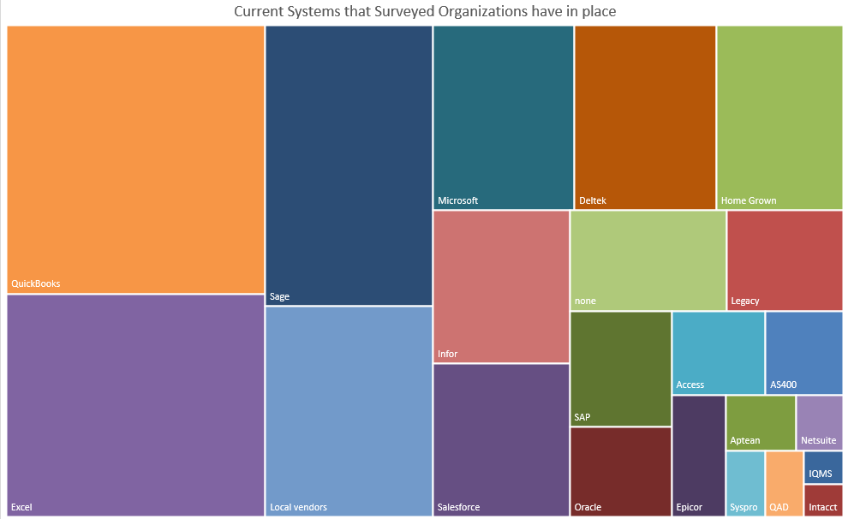

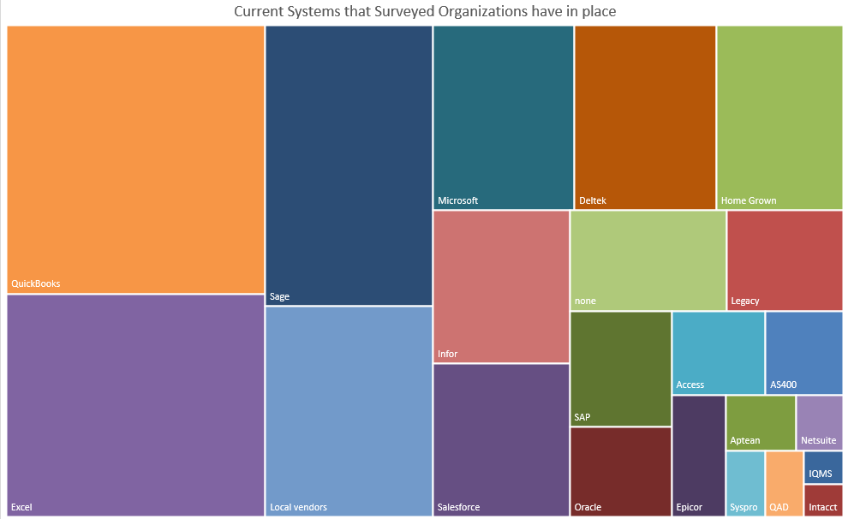

The chart below provides a visual analysis of the mix of software that is currently utilized by our business sample:

Some relevant comments we extracted from our survey included:

- The CEO of a small services company mentioned that he was “tired of the hodgepodge of systems”

- A manufacturer considered their current arrangement to be “very siloed.” Reconciling the inventory balance is a “constant battle.”

Buyer Behavior: How are Companies Approaching ERP Selection?

The selection process is most successful when companies adhere to some basic selection rules: involve as many direct stakeholders as possible and keep business priorities and strategies firmly in mind when making the final decision.

Feature Functions

A software change can trigger a vast administrative upheaval within the company. It is important to carefully analyze the business case for the change and whether it supports the level of disruption as well as the implementation time and spending that will be required. Even if the change may be entirely justified, a well thought out analysis is well worth the time and effort.

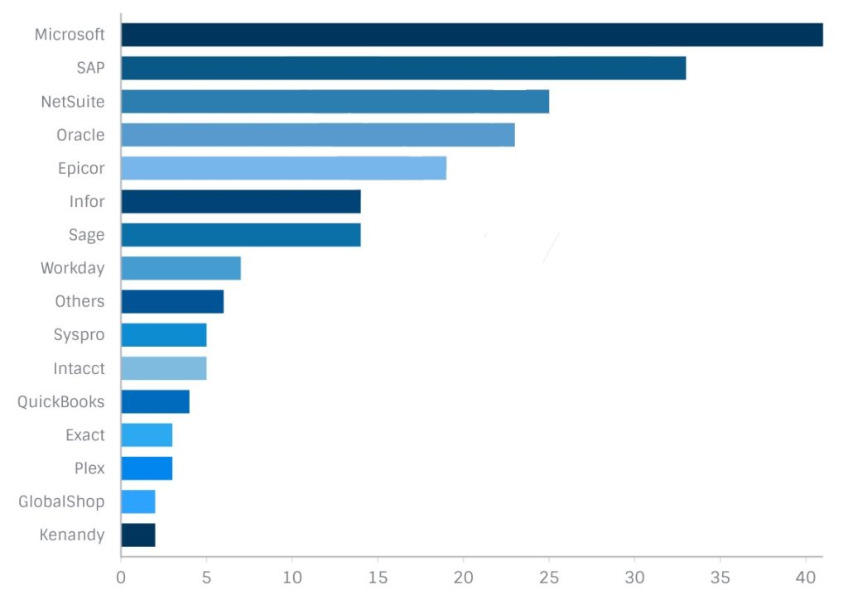

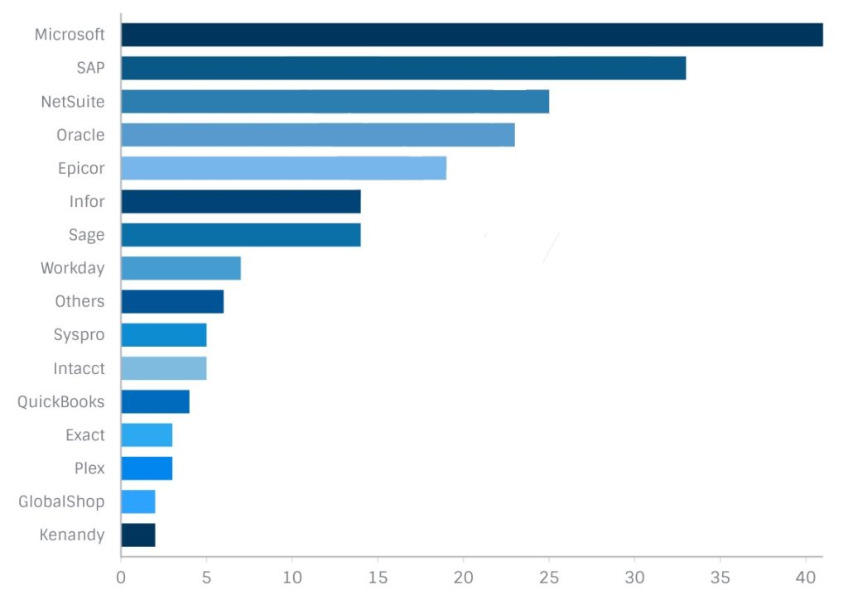

The Vendors in the Spotlight

According to our survey results, the chart below identifies the vendors under consideration by the companies surveyed. A majority of companies (53%) were not, for the moment, looking at specific vendors. However 47% of respondents had narrowed their search to specific vendors.

Who’s Involved in this Decision Selection Process?

Our sample results indicate that the people in charge of the selection process are distributed as follows: employees in the finance and accounting departments (23%), IT department employees (23%). The other important categories were independent consultants helping companies with the selection process (17%), operations managers (17%) and presidents or CEOs (12%). It is worthwhile mentioning that project managers and business analysts only made up 5% of the total.

By far, the most effective method of choosing a software is to employ a collaborative system whereby the actual stakeholders of that system (the end-users) have a direct voice in the decision outcome. As the front-line users of the system, their insight and knowledge is very valuable. Their input along with all the other stakeholders input will produce the best possible outcome of this process.

An ERP system is a major business investment and is best handled with the appropriate amount of time and diligence given to the process.

The advent of cloud computing has indeed radically changed the landscape for deployment of business software. According to a recent press release by Gartner, “by 2020, a Corporate “No-Cloud” policy will be as rare as a “No-Internet” policy is today”. In other words, cloud deployment will become the default by 2020.

Our survey results, in fact, support Gartner’s analysis. Ninety-five percent of companies responded that they were open to a cloud deployment model, while just over 50% were willing to also consider on premises ERP. Of this latter group of respondents, 65% of them were manufacturers and distributors. This makes sense of course, given that these industries made significant investments in hardware and IT personnel and may not be as ready or as willing to move to the cloud model.

As for the preference for cloud computing (as demonstrated by our responses), we argue that it reflects the very strong tendency in the market to opt for simpler, more streamlined and less expensive computing solutions. As more information and assurances of security and stability by cloud providers enter the marketplace, more and more businesses will be convinced that the many benefits of the cloud outweigh some of their remaining concerns. Gartner’s prediction that cloud will increasingly be the default option for software deployment looks to be right on course.

Conclusion

An important consideration for companies embarking on an ERP software selection process – the average lifespan of an ERP system is approximately 5 to 10 years. If we consider important factors like the investment of capital, time, and loss of productivity that the selection and replacement of an ERP system requires, perhaps all companies would be more willing to invest the necessary effort in this process.