by Gary Mintchell | Sep 14, 2018 | News, Operations Management, Standards

Developing digitalization using standards from plant design engineering through the entire production process and extending to the supply chain remains core to my interests. My past work with MIMOSA pointed to this. Siemens strategic moves are fascinating in this regard.

I started this post just when my project sucked all of my energy and then I went to IMTS. This is significant. Especially competitively. I see Rockwell Automation doing nothing like this—only the investment with PTC gaining a seat on the board and a connection to ThingWorx and Kepware within the company. Meanwhile I just interviewed Gary Freburger and Peter Martin from Schneider Electric process business, and they talked some about the integration with AVEVA along these same lines.

Siemens and Bentley Systems Announcement

In the companies’ latest Alliance Board meeting, Bentley Systems and Siemens decided to further strengthen their strategic alliance. The two companies have decided to extend their existing agreement, to further develop their joint business cooperation and commercial initiatives. Therefore, the joint innovation investment program will be increased from the initial €50 million funding to €100 million. In addition, as a result of the continuous investment of Siemens into secondary shares of Bentley’s common stock the Siemens stake in Bentley Systems now exceeds 9%.

Klaus Helmrich, member of the Managing Board of Siemens AG, said: “I’m very pleased with how strong our alliance started. Now we are investing in the next collaboration level with Bentley, where for instance we will strengthen their engineering and project management tools with Siemens enterprise wide collaboration platform Teamcenter to create a full Digital Twin for the engineering and construction world.”

He added: “Integrated company-wide data handling and IoT connectivity via MindSphere will enable our mutual customers to benefit from the holistic Digital Twins.”

Greg Bentley, Bentley Systems CEO, said: “In our joint investment activities with Siemens to date, we have progressed worthwhile opportunities together with virtually every Siemens business for ‘going digital’ in infrastructure and industrial advancement. As our new jointly offered products and cloud services now come to market, we are enthusiastically prioritizing further digital co-ventures. We have also welcomed Siemens’ recurring purchases of non-voting Bentley Systems stock on the NASDAQ Private Market, which we facilitate in order to enhance liquidity, primarily for our retiring colleagues.”

by Gary Mintchell | Jul 13, 2018 | Data Management, Events, Manufacturing IT

Here I go to yet another IT conference to talk convergence and platform. Salesforce invited me to its summer marketing conference in June and promised an interview with a Vice President. I could take my wife out to a good anniversary dinner, visit family, and go to a tech conference with a good interview all on one trip. Too good to pass up.

This was the Salesforce Connections conference. Not as big as Dreamforce in San Francisco, but still quite large by our standards in manufacturing.

Salesforce is more than the CRM company it was. Many acquisitions later, it has assembled an array of technology. Like all tech companies, it has a platform. In fact due to its open APIs, you could use it, too. Some time ago, I interviewed the CEO of a manufacturing ERP company called Kenandy that was build upon the Salesforce platform. Rootstriker, another ERP company build on the Salesforce platform, recently acquired Kenandy.

Featured in one keynote was an application by MTD, a manufacturer of lawn tractors (Cub Cadet, etc.). No, Salesforce doesn’t run machines. It does help connect the manufacturer with its end customers and then with its dealers with feedback to the manufacturer.

The idea is that customers do online research and so need to be reached in many ways (thus Salesforce marketing). MTD erected an online store on the Salesforce platform (in simplified terms) for direct to the consumer interaction. An order is fulfilled by the local dealer. The dealer still gets margin and relationship and as an extra added bonus, the opportunity for service business. Linking all back to MTD, it gets to know the customer, satisfies the dealer, plus receiving data from the service business feeds back into product development.

Achyut Jajoo, Salesforce VP automotive/manufacturing, told me industry is moving from product centric to system, e.g., autonomous vehicles, mobility services, digital signals; factory automation, geographic expansion, intelligence, vehicle sales. Mobility services lead to transaction service—over air updates, location based services.

He noted that people start online and mostly know what they want before visiting a dealer. Other manufacturing customers tying their whole sales systems back to manufacturing include John Deere and Ecolab.

“State of the Connected Customer” report

Before I went to the conference, Saleforce sent me this interesting report—a survey of over 6,700 consumers and business buyers worldwide that looks at the ever changing landscape of customers’ expectations, the emerging technologies influencing these expectations and the role trust plays in the customer experience.

Customers today are energized by tech innovations — but also plagued by deepening distrust of the companies that provide them. They have high expectations about what makes a great customer experience, and not a lot of patience for companies that fail to deliver.

These trends impact every company, regardless of whether they sell to consumers or business buyers purchasing on behalf of their companies. In this research, “customers” is an aggregate of both consumer and business buyer responses.

The report dives into the nuances of this tricky customer landscape. Here are five of the high-level findings our research brought to light:

1. Customer experience matters even more than you think

Eighty percent of customers say that the experience a company provides is as important as its products or services. A majority take this sentiment a step further by voting with their wallets; 57% have stopped buying from a company because a competitor provided a better experience.

2. B2B expectations mirror B2C standards

The concept of “B2Me” isn’t new, but it’s gathering steam. Eighty-two percent of business buyers want the same experience as when they’re buying for themselves. But only 27% say companies generally excel at meeting their standards for an overall B2B experience, signaling ample room to improve.

3. Companies face new connected mandates

For 84% of customers, being treated like a person — and not a number — is very important to win their business. Another 70% say connected processes are very important to win their business (such as seamless handoffs between departments and channels, or contextualized engagement based on earlier interactions).

Even before a purchase, personalization is hugely important; 59% of customers say tailored engagement based on past interactions is very important to win their business.

While they buy, 78% of business buyers seek salespeople that act as trusted advisors with knowledge of their needs and industry.

4. Technology sets new benchmarks for innovation

Real innovation, not lip service, is a deciding factor for most customers. 56% of customers (including 66% of business buyers) actively seek to buy from the most innovative companies.

While some emerging technologies are only starting to take root, a majority of customers say these technologies have transformed (or are actively transforming) their expectations: the Internet of Things (60%), voice-activated personal assistants (59%), and AI (51%).

5. Facing a crisis of trust: finding the balance between personalization and privacy

Sixty-two percent of customers say they’re more afraid of their data being compromised now than they were two years ago — and nearly half of customers (45%) feel confused about how companies use their data.

82% of customers will share relevant information about themselves in exchange for connections between their digital and in-person experiences.

81% of customers will share relevant information about themselves in exchange for more consultative help from salespeople.

85% of customers will share relevant information about themselves in exchange for proactive customer service.

For 92% of customers, the ability to control what personal information is collected makes them more likely to trust a company with that information.

by Gary Mintchell | Jul 12, 2018 | Automation, News, Technology

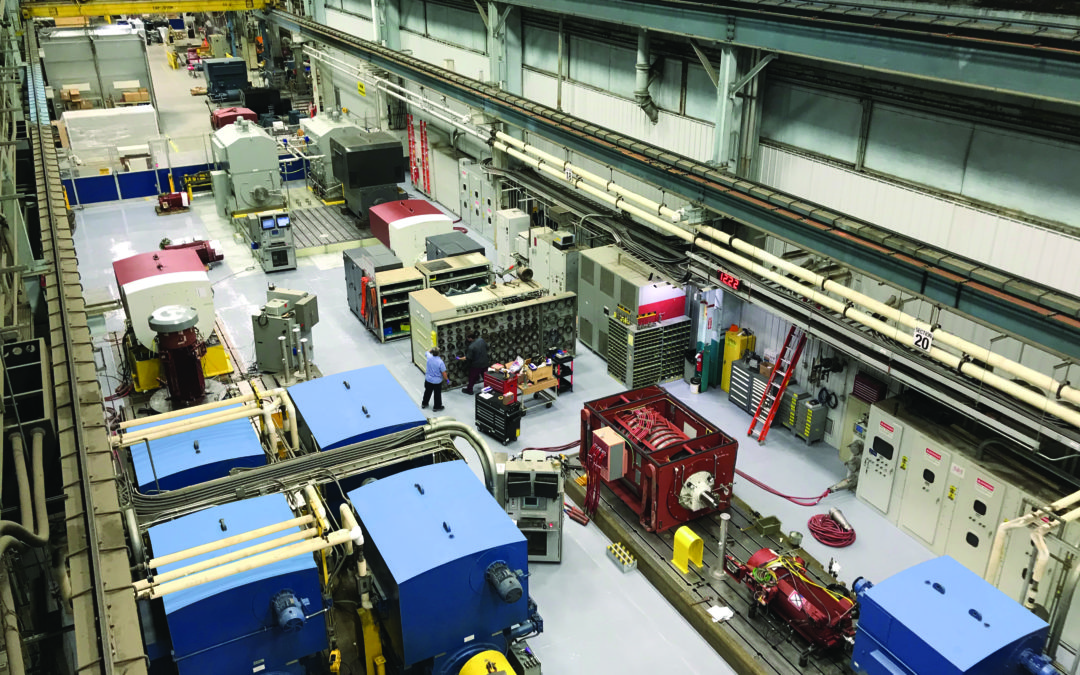

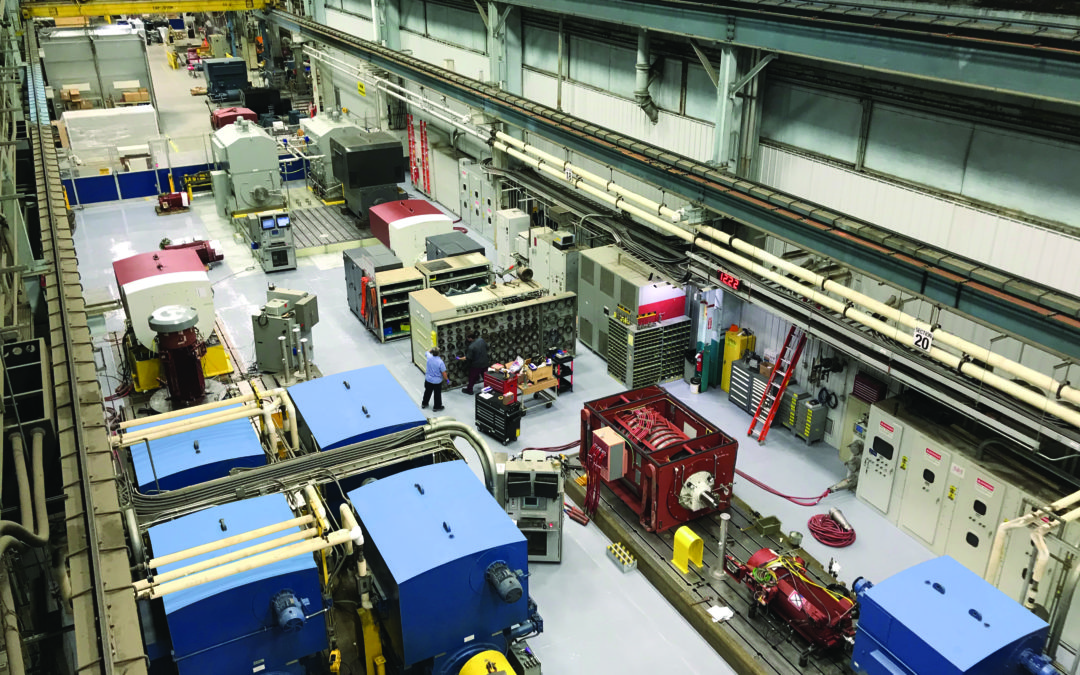

There are electric motors and then there are electric motors. On my recent trip about an hour south to the Siemens electric motor manufacturing plant in Norwood, OH (a suburb of Cincinnati) I was often thinking about the line from Crocodile Dundee when the main character pulled out that child of a sword and Bowie knife and said, “Knife? That ain’t no knife. This is a knife.” When we start talking Medium Voltage motors at greater than 10,000 HP, that’s a motor.

Note: the one in red is a motor under test. Note the size versus the size of the person.

I’ve visited the plant a time or two before but wrote the news for magazines. Only a mention on my blog. When I was there in 2012, they talked about the transformation of the plant from a traditional old-school heavy manufacturing plant to a modern, lean, clean place to work putting out quality products.

The occasion for this visit was to view results of some significant investments by Siemens in maintaining Norwood as a state-of-the-art motor manufacturing plant. There are several new machines for precision machining of large parts. The pièce de résistance however was a new test bed and “Test Center Observatory” where customers can witness the testing of their motors in comfort with a dedicated Ethernet connection so that they can continue working during downtimes in the test process. A complete test regimen can last for several hours or even longer. Some customers come from other countries. Speaking as someone with experience traveling to witness tests on my products for certification, I’d have really appreciated this facility back in the day.

Before I get to the test bed, a brief discussion of digitalization and vibration.

Siemens has developed a digitalization methodology for motors called Drive Train Analytics. They are sensoring more and more in order to monitor and analyze a more complete virtual picture of the motor. Not surprisingly, they use Siemens Mindsphere sending data to the cloud using a variety of analysis tools. Customers have access to these tools in the observatory. Actually, customers could receive a complete virtual runoff of their motor back home. But engineers being engineers, they love to see the hardware in person. So they get both.

Aside from heat, the main killer of motors is vibration. Siemens has taken steps both to reduce vibration in the motor and to reduce ambient vibrations in the test process so that more accurate readings of the motor itself.

Working with customers who provide feedback from their use cases, Siemens developed a new shaft requiring new machining techniques. Some of the advantages of the new shaft include:

- Eliminates variation due to fabrication and spider bar tolerances

- Reduces required balance weight applied during rotor balance

- Removes heat-treatment process

- Improves rotor thermal stability

- More predictable rotor lateral stiffness

- Reduces stress concentration of weldment

The News-Test Observatory

With its celebration of more than 120 years of innovation, market and product leadership, technology and quality, Siemens’ Norwood Motor Manufacturing plant recently opened a new Test Observatory.

Opened in 1898, the Norwood facility has undergone a century of change, as the process to manufacture motors and the technology behind them has improved. Norwood has stood the test of time through three industrial revolutions and is one of the longest continuously operating Siemens’ plants globally. With Industry 4.0 upon us, the mechanical motor of old is now a connected device, a valuable plant floor asset capable of providing vast amounts of data with preventative and predictive analytics to ensure more productivity, efficiency and uptime.

With the largest motor test base in North America, Siemens can combine its century of industry leadership in motor manufacturing with an enhanced customer experience. The new equipment extends Norwood’s testing range from 10,000 horsepower (HP) to 20,000 HP at frequencies from 10 Hz to 300 Hz, thus addressing the market’s increased use of variable frequency drives. The new test observatory, akin to an executive suite, allows customers to participate by observing testing through bay windows, direct cameras and mirroring computers, which display real time critical data being gathered by sensors attached to their motor.

The project, which began in 2016, required the removal of 550 tons of soil and concrete from the site, excavating a 13-foot deep hole, driving 114 pilings for stability and building a huge concrete vault to securely support a fully loaded test stand. The test stand weighs 360 tons and rests on a self-leveling air spring system designed to support 500 tons when loaded with motors and drives.

The testing equipment includes two Sinamics Perfect Harmony GH180 drives and two dynamometers. Generating power to test a 20,000 HP motor requires significant amounts of electricity, and by recycling power to the grid, the new equipment reduces power loss by 90 percent.

“At Norwood, we test every motor that we produce or repair – some 30 to 50 tests per week – and these new facilities give us the ability to conduct as many as five motor tests at a time.” said Tim Bleidorn, Manager, Manufacturing Excellence. “We expect the customer witness tests to average two to three per week and as many as 120 per year.”

In addition to the new test base and observatory, the multi-million dollar investment in Norwood also includes WFL high-precision shaft making equipment and a high-speed balancer, key for two-pole applications at higher speeds and the ability to balance a rotor at up to 12,000 rpm.

“It’s exciting and I’m proud that Siemens is investing in the North American market. We have the No. 1 market share in AboveNEMA motors right now and these new capabilities send a strong signal to our customers and competitors that we intend to maintain that position,” says Ryan Maynus, AboveNEMA Product Manager.

With more than 100 patents, the 350,000 square-foot facility is a cornerstone to Siemens AboveNEMA motors. The ISO-9001 certified plant has produced more than 150,000 high voltage motors since 1898. The Norwood plant produces horizontal AC induction motors up to 20,000 horsepower and voltage ranges from 460 to 13,200 volts. The plant also manufactures a complete line of large AC vertical motors up to 8,000 horsepower.

by Gary Mintchell | Jun 7, 2018 | Commentary, News

The 2018 EY Industrial Products Survey was conducted among 500 Industrial Products (IP) executives whose businesses yield over $1B in annual revenue. These surveys are coming in with similar results. You can look at the results and say “Wow, almost half of executives at these companies see innovation as important, or see technology as important” or “How can half of all executives surveyed not see how important innovation is”.

I’ve had experience in manufacturing and marketing leadership and have studied it for many more years—and I lay most of the problems with manufacturing business squarely with (lack of) managerial leadership. I see these results and think that there will be many winners and just as many losers in the coming years.

The study surveyed executives from a variety of sectors including, aerospace and defense, industrial and mechanical components, machinery and electrical systems, chemicals and base materials, packaging and paper and wood. The survey was conducted between February 22, 2018 and March 22, 2018. The purpose of the study was to evaluate where IP companies fall on their journey towards continuous innovation.

Move over R&D: IP companies see digital technology and innovation as their path to success

- 48% Percentage of respondents who view innovation as quite/extremely important for company success

- 43% Percentage of businesses who are learning from and/or following the technology industry to influence innovation at their company

- 67% Percentage of companies who plan to make significant levels of investment in innovation past traditional R&D over the next three years

- 52% Percentage of businesses that say the adoption of emerging technologies will be quite important or critical to the success of their business in the next three years

Additional results from the survey include:

Facing a culture crisis: The perception of the IP industry is hindering the talent search

- 67% agree/strongly agree that the image of the industrial products industry hurts when recruiting for needed skills

- 38% that difficulty competing with tech-first companies for top talent is a leading barrier in filling the skills gap

- 25% say that attracting/retaining top talent is one of the biggest drivers of their company’s technology investment

- 64% agree/strongly agree that the IP industry needs to change their culture to thrive

IP is looking for outside inspiration. While the tech industry is the leading source, IP has a ways to go

- 43% of respondents are learning from and/or following the technology industry to influence innovation at their company

- Only 29% of business say they are extremely or quite innovative compared to close competitors

- 82% of respondents have made minimal or no investment in AI today

- 22% are learning from and/or following the automotive industry to influence innovation at their own company

- 21% are learning from and/or following the consumer products industry to influence innovation at their own company

Robotics, mobile and big data, oh my! What is getting the largest share of investment attention?

- 63% of respondents say that technology investments have driven measureable returns in agility to a significant/meaningful extent

- 46% are making substantial or major investments in robotics and 56% predict they will in the next three years

- 31% of businesses are increasing investment in emerging technologies in response to US tax reform

- 31% says that big data/analytics will be most influential on their business over the next three years

Not a matter of if but when disruption will hit. IP companies are staying nimble in order to prepare

- 49% of businesses say that preparation for disruption will be quite important or critical to the success of their business in the next three years

- 52% of businesses say that flexibility to adapt to trends will be quite important or critical to the success of their business in the next three years

- 53% of businesses say that access to specialized skills for emerging tech will be quite important or critical to the success of their business in the next three years

by Gary Mintchell | Apr 5, 2018 | Data Management, News

Innovation springs from small and new companies, so holds Andrew Johnson, CEO of ShelfAware, a software startup in the what could be called the MRO commodity business. His family business, Oringsales.com, is a master distributor of those crucial but often overlooked components called O-rings. Suppliers to maintenance shops and OEMs have been tackling vendor managed inventory and other inventory tracking processes for many years. But how do you economically track something as small as an O-ring?

The brothers running the distributorship business figured out that RFID tags were becoming inexpensive enough to warrant use in small bags of these small components. They wrote an application, embedded RFID tags on the bags, and established a workflow. Originally for their customers of O-rings, customers soon demanded the system for other small components, as well.

The key proposition—remotely monitor consumption of small parts. He calls it get “the dudes in trucks” off the streets to better utilize their time rather than driving around counting parts.

Johnson is entrepreneurial and evangelistic. He told me, ”I’m reaching out to you because I have a message I would like to send to our USA manufacturing friends that I think they would find very interesting. The time is now to innovate our manufacturing infrastructure if we intend on bringing manufacturing back to the USA in a big way. Its easier than ever before to take the tech leap with many Internet of Things systems popping up every month that don’t require integration into your ERP systems to achieve a big ROI. It’s literally plug and play technology for manufactures.

This is his innovation story.

I am a young entrepreneur (32) that has grown up in the industrial manufacturing industry as a member of a family run industrial parts distributor. I spent many summers of my childhood inspecting o-rings, gaskets, and other seals… very exciting summer job. Now I am working with my 3 brothers in our family business as we try to innovate the industrial landscape. We recently invented & patented an intelligent inventory supply chain that is powered by passive RFID technology. We deployed our Internet of Things supply chain system at 3 Midwestern manufactures last year (Eskridge Mfg, Energy Mfg, Oilgear Mfg) and the system is performing better than we could have ever imagined.

Very simply put, our system, ShelfAware, monitors the consumption of commodity inventory in real time using RFID chips that are embedded into the product packaging. This consumption data, Big Data, is then analyzed and fed to the manufacturer’s supply chain partners to guarantee no stock out, lean inventory, and lean inventory pipe-lines which all means the right parts, at the right time, cheaper. Our three key questions we practically chant while working with our system are: Is this Accurate?, Efficient?, Effective?

Yes, RFID inventory systems have been around for years, but never really applied to the consumable commodity products, aka “small parts”. The main tech advancements that have made a system such as ShelfAware viable now are:

- RFID tags are getting really really cheap, sometimes less than $0.05 each

- The internet has allowed the software driving the system to be flexible and easily accessible

- RFID hardware is much less expensive and now highly reliable

The business plan, a bit audacious, announces “The Opportunity to Disrupt a Marketplace with a Collaborative Platform”.

The traditional large industrial supply incumbents who offer vendor managed inventories (VMI) have expanded their product offering horizontally leaving them spread too thin. They are good at some product groups, but great at very few product groups. This has created vulnerabilities related to product expertise like sourcing, engineering, and general product support. ShelfAware intends on exploiting these vulnerabilities by giving many niche product vendors the ability to collaborate on ShelfAware’s IoT Inventory Platform thus creating a more efficient crowd sourced inventory supply chain.

Objective of ShelfAware as a company states “To create an IoT Intelligent Inventory Platform that can support multiple independent product vendors who collectively support large supply chains demanded by Large or complex OEM’s. ShelfAware will create value in the industrial supply market by revolutionizing supply chain theory through the use of a collaborative IoT, RFID Intelligent Inventory Platform.

The Platform must fulfil two primary roles for this supply chain model to be successful with emphasis placed on the IoT vendor collaboration software.

- Deploy an intelligent inventory management system inside manufacturing facilities.

- Deploy a Vendor Side supply chain cooperative system.

I am intrigued by the whole concept. And it seems to be working now, even in its infancy.