by Gary Mintchell | Aug 6, 2020 | Automation, Commentary, Motion Control, News

This week I am attending the Festo Virtual Trade Show and Conference . The website provider is the same one as the Danish company I “toured” last week. It is similar to a concept I saw 20 years ago, but modern technology and design have made the experience very good.

I sat in a couple of conference sessions deepening my understanding of the latest in pneumatics and digitization. The discussion of digitizing and motion was good showing examples from OEE and energy savings. I am not a fan of OEE, but many companies seem fixated on it. It is a number–but I learned how the sausage was made 30 years ago and I remain unconvinced of its real utility. However, if you can digitize to calculate OEE, then you have data you could use in better ways for decision making.

I also learned about applications in process and water treatment.

The metaphor is a trade show lobby with doors for the auditorium for conference sessions, the show floor, information booth. Entering the show floor, there are a number of icons representing booths. Click on a booth and you can choose from short video demonstrations, downloadable papers, and product overviews.

You can attend yet today. It’s worth a look to see what perhaps may be a chunk of the future. I miss the energy and serendipity of live events. But this is an efficient way to collect information saving both the exhibitor and me great expense.

by Gary Mintchell | Jan 27, 2020 | Automation, Technology

As you add electronic sensing and control and networking to machinery, you can take a process to the next level. I’ve been impressed with the growing development of tighter tolerances and then better variety of materials for 3D printing (additive manufacturing). Here is an example of expanding the use of automated “subtractive” manufacturing—micro machining.

6-D Laser LLC was formed in 2018 as an affiliate of leading nanometer-level motion control specialist ALIO Industries, with the mission of integrating ultrafast laser processing with precision multi-axis motion systems. 6-D Laser offers Hybrid Hexapod-based laser micromachining systems for wide-range taper angle control, 5-Axis Laser Gimbal-based systems for laser processing 3D substrates, and unlimited field of view scanning solutions for laser processing large-format substrates.

Coming out of stealth mode and coinciding with its official launch in 2020, 6-D Laser has launched its website (www.6dlaser.com), and has also announced that the company will be showcasing its radical new approach to laser micro processing at the SPIE Photonics West event, booth 2149, 4-6 February in San Francisco, CA.

6D Laser’s central mission addresses limitations of existing laser processing systems which are largely due to sub-optimal positioning systems used by most system integrators. 6-D Laser tackles this problem by integrating ultra-fast laser material processing with the 6-D nanometer-level precision motion control solutions in which ALIO Industries specializes.

At the heart of 6-D Laser’s integrated ultrafast laser micromachining system is ALIO Industries’ Hybrid Hexapod, which takes a different approach to traditional 6 Degree of Freedom (6-DOF) positioning devices, and exhibits much higher performance at extremely competitive prices. Rather than 6 independent legs (and 12 connection joints) ALIO’s approach combines a precision XY monolithic stage, tripod, and continuous rotation theta-Z axis to provide superior overall performance.

The combination of serial and parallel kinematics at the heart of ALIO’s 6-D Nano Precision® is characterized by orders-of-magnitude improvements (when compared to traditional hexapods) in precision, path performance, speed, and stiffness. The Hybrid Hexapod® also has a larger work envelope than traditional hexapods with virtually unlimited XY travel and fully programmable tool center point locations. The Hybrid Hexapod® has less than 100 nm Point Precision® repeatability, in 3-dimensional space.

6D Laser vertically integrates all of the sub-systems required for precision laser micro-processing, and it does this by forming strategic partnerships with key component and subsystem suppliers that are required to achieve the goals of demanding precision applications. In addition to its association with ALIO, 6-D Laser has also partnered with SCANLAB GmbH, which together with ACS Motion Control, has developed an unlimited field-of-view (UFOV) scanning solution for coordinate motion control of the galvo scanner and positioning stages called XLSCAN. 6-D Laser has also partnered with NextScanTechnology to provide high-throughput scanning systems that take advantage of the high rep-rates in currently available in ultrafast lasers, and Amplitude Laser, a key supplier of ultrafast laser systems for industrial applications.

Dr. Stephen R. Uhlhorn, CTO at 6-D Laser says, “Introducing an integrated ultrafast laser micromachining system that combines the positioning capabilities of the Hybrid Hexapod®, with high-speed optical scanning leads to a system that can process hard, transparent materials with wide-range taper angle control for the creation of high aspect ratio features in thick substrates, without limitations on the feature or field size.”

Ultrafast laser ablative processes, which remove material in a layer-by-layer process, result in machined features that have a significant side wall taper. For example, a desired cylindrical hole will have a conical profile. Taper formation is difficult to avoid in laser micromachining processes that are creating deep features (> 100 microns). Precision scanheads can create features with near-zero angle side walls, but they are limited to small angles of incidence (AOI) and small field sizes by the optics in the beamline.

Uhlhorn continues, “6-D Laser’s micromachining system controls the AOI and resulting wall taper angle through the Hybrid Hexapod® motion system, and the programmable tool center point allows for the control of the AOI over the entire galvo scan field, enabling the processing of large features.”

About 6-D Laser LLC

6D Laser, LLC, an affiliate of ALIO Industries, Inc, was founded in 2018 by C. William Hennessey and Dr. Stephen R. Uhlhorn. ALIO Industries is an industry-leading motion system supplier, specializing in nano-precision multi-axis solutions. 6D Laser was formed with the mission of integrating ultrafast laser processing with precision multi-axis motion systems, including ALIO’s Patented Hybrid Hexapod. The integration of ALIO True Nano motion systems with key sub-system suppliers, through strategic partnerships with Amplitude Laser, SCANLAB, and ACS Motion Control, enables a new level of precision and capability for advanced manufacturing.

www.6DLaser.com

www.microprm.com

by Gary Mintchell | Dec 2, 2019 | Automation, News

Just before Thanksgiving, I had the opportunity to talk with Adrian Lloyd, CEO of Interact Analysis. Interact is a new market research and intelligence company composed of industry veterans of other firms. The company researchers perform many more interviews than the industry norm combining with deep regional manufacturing data in order to achieve better and more granular results.

Company CEOs provided insight to me years ago about the accuracy (or lack) of many market analyses. I’m always in search of better information. We’ll try this one.

Interact has just released two reports—low voltage AC drives and motion control.

2019 low voltage AC motor drives report from Interact Analysis

- Decentralized and motor mounted drives to show the strongest growth

- Danfoss overtook Siemens in 2018 to be number 1 drives supplier to the EMEA region

- Cabinet mounted general purpose drives have largest percentage of sales by product type

The research shows that growth in the intralogistics and materials handling sector has led to increased demand for decentralised and motor mounted drives, leading them to show the strongest growth over the five-year forecast period out of all seven product types covered. Cabinet mounted general purpose drives account for nearly half of drive sales globally, but also represent the slowest growing product type.

Meanwhile, from a regional perspective, although ABB is the number 1 drives supplier on a global basis, Danfoss has overtaken Siemens to be number 1 in EMEA. The Americas is predicted to be the fastest growing drives market for 2019, while the market in EMEA is shrinking, and China continues to occupy the largest share of the market (43% by unit shipments in 2019).

Interact Analysis has pioneered a new forecasting approach that gives an unprecedented level of detail. For example, users could choose to view anticipated demand for drives under 2.2 kW in the Indian packaging market. This is possible because the report is underpinned by 12 years of data on industrial production (the value of goods produced) and machinery production (the value of the machines used to produce goods). This information comes from Interact Analysis’s Manufacturing Industry Output Tracker – a big data tool that aggregates national manufacturing surveys from all major manufacturing economies in a set of over 1.2 million datapoints.

Lloyd says of this report: “In 2018 average drive prices fell by 2.7% compared with 2017, and we expect this trend to continue. To compound this, 2019 is experiencing a slowdown in the market. Yet the drives industry has reason for positivity. And not just because we expect the market to rebound in 2020.

“The world is becoming increasingly automated – in fact it is becoming rare to open a national daily newspaper and not read something about how automation is impacting the economy. Automation growth sectors, such as eCommerce warehouses, are creating vast new opportunities for drives. In the longer run, it is very positive for drives manufacturers that our research shows drives buyers increasingly see drives as the front line of predictive maintenance and industrial IoT.

“Most drives reports model industry dynamics by simply comparing the growth of the drives market with the growth of the entire manufacturing sector. Ours is different. Interact Analysis’s Manufacturing Industry Output tracker compares the value of goods produced with the value of machines used to produce goods to give a whole range of fresh new insights unavailable in any other drives report.”

Motion Control Market to Exceed $15bn by 2023

New 2019 motion control market report from Interact Analysis reveals

- Despite a short-term dip in 2019, longer term forecasts predict solid growth

- Increased reliance on industrial robotics a significant contributor

- Growth rate to exceed that of global manufacturing production by 2020

Interact Analysis has released a new market report – Motion Controls – 2019 – pointing to strong growth over the next four years for motion control products.

Despite a small decline in 2019 (-3.8%) the report outlines how the market for motion control products will grow strongly, ultimately exceeding $15bn in 2023. Also noteworthy is the firm’s belief that the motion control market will outpace growth of global manufacturing production from 2020 onwards. The positive outlook holds true despite the torrid time currently facing machine tool vendors which, as the single largest consumer of motion control products, generated over a third of motion control revenues in 2018.

Interact Analysis points to several sectors which are helping to drive a more positive outlook for motion controls. These include food & beverage machinery, packaging machinery, robotics and material handling equipment, especially equipment for warehouse automation and intralogistics. Together these sectors generated just under a quarter of total motion control revenues in 2018 and are forecast to account for closer to 30% in 2023.

The report outlines further factors strengthening the outlook for motion control demand, including the trend for decentralization. Here higher-protection ratings are helping to advance the market for particular motion products. Although even combined the opportunity is small compared to the total (representing only 2.4% of the global market in 2018), the findings show that revenues for both products are projected to experience higher growth than the rest of the market, driving their combined value to exceed $500m in 2023.

Geographically, six regions – China, USA, Japan, Germany, Italy and South Korea – will continue to dominate market revenues. China, in particular, is expected to add significant revenues over the next four years, making it almost twice as big as the United States. In industry terms, sectors utilising metal cutting tools remain the largest in revenue terms, however the strongest overall growth during the forecast period came from mobile robots and industrial robots, which are the only ones forecast to experience growth in 2019 versus 2018.

Tim Dawson, research director for Interact Analysis and principal analyst of the motion controls report, said: “Although the motion control market may be considered fairly mature there are important trends impacting its future growth helping drive revenues at an above average rate for the long-term. Couple that with product releases from new vendors, plus expanding portfolios from existing ones; and the fundamentals for this industry appear very strong, even despite headwinds in certain key sectors.”

by Gary Mintchell | Oct 9, 2018 | Automation, Commentary, News

There was plenty of cool new products unveiled at last week’s Emerson Global Users Exchange. As a former product development manager, I liked the “peanut butter and chocolate” moment when Emerson’s engineers were trying to solve the human location in a plant problem. They realized that many customers already have a WirelessHART mesh network. Why don’t we use location tags with WirelessHART as the communications service? Cool.

Topping the news released during the week was announcement that Emerson has agreed to acquire Intelligent Platforms, a division of General Electric. Intelligent Platforms’ programmable logic controller (PLC) technologies will enable Emerson, a leader in automation for process and industrial applications, to provide its customers broader control and management of their operations.

This is a great acquisition. It reveals Emerson as a company that has its act together. This is the consolidation trend in the industry. Siemens has a complete portfolio (well, mostly). ABB recently acquired B+R Automation in a similar move. Schneider Electric added Foxboro and Triconex from Invensys to its mostly factory automation portfolio. So there are four major companies aligning their competitive offerings. And all are focused on digital transformation for their customers.

Even Rockwell Automation has built a process automation business over time. It recently shunned acquisition with its money and instead invested $1 billion for a little over 8% of PTC in order to achieve a closer partnership with ThingWorx (and a seat on the board). Maybe having an executive on the board, it can learn how Jim Hepplemann managed to build a company through acquisition.

Back to Emerson. GE IP (formerly know as GE Fanuc) has a line of PLCs, motion control, and HMIs. It hasn’t promoted its products for years, but they are still alive and well in Charlottesville, VA. This is a great strategic move.

As for GE? Well, we know that it is having a fire sale. I’d wondered about this part of the business. Now we all wonder about what’s left of GE Digital. We know from a Wall Street Journal article that it’s for sale. And also we know that the board just replaced the CEO evidently for not moving quickly enough. But…will anyone want GE Digital? I’m sure everyone has looked. Here’s a thought. What if it wound up with an IT company to complement these burgeoning IoT practices?

by Gary Mintchell | Nov 21, 2016 | Automation, Motion Control

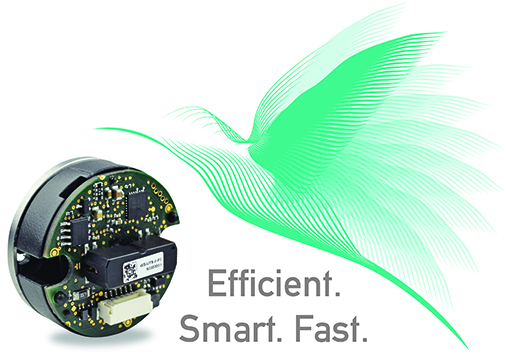

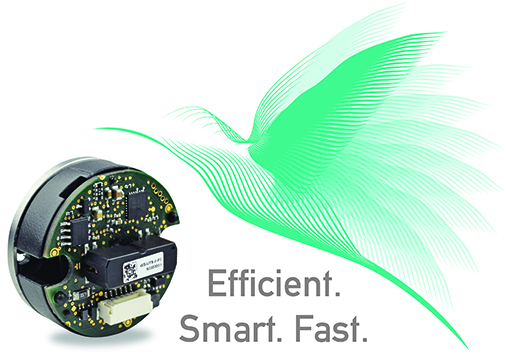

This post regarding magnetic encoders is not my typical news. I met with the company at Automation Fair a couple of weeks ago. It’s the newest thing I’ve heard in encoders in a while. Thought I’d pass it along for all you servo engineers and business development managers out there.

POSITAL’s new family of kit encoders provide the manufacturers of servomotors and other machinery with rugged, accurate and cost-efficient tools for building rotary position measurements into their products. The new kit encoders are based on POSITAL’s self-contained magnetic rotary encoders. Now however, the core components of these instruments are available as separate assemblies that can be readily integrated into other products.

POSITAL’s new family of kit encoders provide the manufacturers of servomotors and other machinery with rugged, accurate and cost-efficient tools for building rotary position measurements into their products. The new kit encoders are based on POSITAL’s self-contained magnetic rotary encoders. Now however, the core components of these instruments are available as separate assemblies that can be readily integrated into other products.

The POSITAL kit encoder components offer a number of advantages over the rotation measuring devices that have traditionally been used with servomotors and rotating equipment. Compared to resolvers, they are more accurate and offer multi-turn measurement capabilities. They also provide digital outputs instead of the analog signals produced by resolvers. While POSITAL’s magnetic encoder technology provides slightly less precision than the best optical disk encoders, it is less costly, less vulnerable to contamination from oil or dust and more resistant to shock and vibration. POSITAL encoders also provide an all-electronic multi-turn absolute position measuring capability that evaluates the full absolute angular position, including the total number of shaft rotations. The rotation counter is powered by the company’s well-proven Wiegand-effect energy harvesting technology so that rotation counts are always accurate, even if the rotations occur when external power is unavailable. This system eliminates the need for backup batteries or for the geared optical disks used in some products.

POSITAL magnetic kit encoders are easy to incorporate into normal manufacturing processes since they don’t require extra-precision, near-cleanroom assembly conditions. A built-in self-calibration capability can compensate for small sensor-to-shaft alignment errors. The electronic components, including Hall-effect sensors, a 32-bit microprocessor and the Wiegand-wire energy harvesting system, are packaged in a convenient 36 mm diameter, 24.2mm deep unit. For servomotors with magnetic brakes, a special magnetic shield has been developed to isolate the magnetic pickups of the measurement system from the external magnetic fields.

POSITAL magnetic kit encoders are easy to incorporate into normal manufacturing processes since they don’t require extra-precision, near-cleanroom assembly conditions. A built-in self-calibration capability can compensate for small sensor-to-shaft alignment errors. The electronic components, including Hall-effect sensors, a 32-bit microprocessor and the Wiegand-wire energy harvesting system, are packaged in a convenient 36 mm diameter, 24.2mm deep unit. For servomotors with magnetic brakes, a special magnetic shield has been developed to isolate the magnetic pickups of the measurement system from the external magnetic fields.

The resolution of the new POSITAL kit encoders is 17 bit, with an accuracy of better than + 0.1°. The operating temperature range is -40 to +105 °C. These devices are available with a variety of non-proprietary communications protocols, including BISS, SSI and RS485-based protocols.

POSITAL is a supplier of advanced industrial position sensors used in a wide variety of motion control and safety systems. The company is also an innovator in product design and manufacturing processes and a pioneer of Industry 4.0 (Industrial Internet of Things/IIoT), offering customers the benefits of built-to-order products combined with the price advantages of mass-production. POSITAL is a member of the international FRABA group, whose history dates back to 1918, when its predecessor, Franz Baumgartner elektrische Apparate GmbH, was established in Cologne, Germany to manufacture relays. Since then, the company has played a trendsetting role in the development of rotary encoders, inclinometers and other sensor products. POSITAL has a global reach with subsidiaries in Europe, North America and Asia – and sales and distribution partners around the world.

POSITAL’s

POSITAL’s POSITAL magnetic kit encoders are easy to incorporate into normal manufacturing processes since they don’t require extra-precision, near-cleanroom assembly conditions. A built-in self-calibration capability can compensate for small sensor-to-shaft alignment errors. The electronic components, including Hall-effect sensors, a 32-bit microprocessor and the Wiegand-wire energy harvesting system, are packaged in a convenient 36 mm diameter, 24.2mm deep unit. For servomotors with magnetic brakes, a special magnetic shield has been developed to isolate the magnetic pickups of the measurement system from the external magnetic fields.

POSITAL magnetic kit encoders are easy to incorporate into normal manufacturing processes since they don’t require extra-precision, near-cleanroom assembly conditions. A built-in self-calibration capability can compensate for small sensor-to-shaft alignment errors. The electronic components, including Hall-effect sensors, a 32-bit microprocessor and the Wiegand-wire energy harvesting system, are packaged in a convenient 36 mm diameter, 24.2mm deep unit. For servomotors with magnetic brakes, a special magnetic shield has been developed to isolate the magnetic pickups of the measurement system from the external magnetic fields.