by Gary Mintchell | Aug 17, 2015 | Automation

AutomationDirect’s blog often discusses new products the company is introducing. These are many as the company has transitioned from PLC Direct with a catalog sales model dating from the mid-90s selling Koyo PLCs rejected by Siemens when it had acquired that division of Texas Instruments to the present super-distributor model.

Recently they posted an article on the history of the PLC. It is an interesting read. Entirely not self-serving.

I do remember the company from the early 2000s when it was a pioneer of adding Ethernet to its controller line. My interviews with the engineer who developed all that technology were always enlightening.

This is an interesting read, worth a few minutes of your time.

by Gary Mintchell | Jul 30, 2015 | Commentary, Manufacturing IT, News, Operations Management, Software

OK, so I was wrong. Well, I was right and wrong.

OK, so I was wrong. Well, I was right and wrong.

My analysis of the Schneider acquisition of Invensys (Foxboro, Wonderware, et. al.) centered on European competition. Namely that as Schneider assembled a large industrial technology powerhouse it was looking at Siemens and ABB—its next-door rivals.

Schneider was already a competitor in the electrical power industry. Acquiring the process automation technologies business with Invensys brought it into more complete competition with ABB.

Software

On the other hand, I thought that Schneider might divest the software business partly because it never really had very much in the way of software.

OK, I was wrong.

Schneider announced last week that “it has reached a preliminary, non-binding agreement with AVEVA Group PLC (“AVEVA”) on the key terms and conditions of a combination of selected Schneider Electric industrial software assets and AVEVA (forming the “Enlarged AVEVA Group”).

On the surface this appears to be a strange marriage. In fact, my friend Walt Boyes did an anti-Schneider rant on his blog this morning. Amongst the rumors he alluded to about Schneider management and how Clayton Christensen’s analysis of acquisitions predicted that the acquisition would go south, he also misunderstood, I think, the implications of this move.

AVEVA is a construction engineering software company. It provides the front-end engineering for plants that Foxboro, Triconix, Avantis, and other ex-Invensys brands operate and maintain.

Design to operate

The upshot is that Schneider should be able to provide an end-to-end solution for process industries similar to what Siemens has done for discrete manufacturing with the integration of UGS and the Siemens PLM division.

By the way, this latter is an example of how a large company can beneficially absorb an acquisition. The merger has worked very well. Other European companies have closely watched this acquisition model. I believe that Schneider will have learned from it.

I wonder what implications for the OpenO&M Initiative and the OGI Pilot program—an ongoing effort to use standards to move data from the engineering design database to the operations & maintenance database. AVEVA was a key player.

Transaction details

It is expected that the proposed transaction would:

1. create a global leader in industrial software, with a unique portfolio of asset management solutions from design & build to operations, with both scale and a distinct market position to address critical customer requirements along the full asset life cycle in key industrial and infrastructure markets;

2. unlock additional value at enlarged AVEVA and Schneider Electric through the potential for material revenue and costs synergies, leveraging on complementary end-markets exposures, customer bases and product portfolios;

3. establish a ‘best in class’ management team and increased brand profile for attracting further talent; and

4. realize the full value of the contributed industrial software assets.

The enlarged AVEVA would have combined revenues and Adjusted EBITA of c. £534 million and c. £130 million, respectively. It is expected that the Enlarged AVEVA Group will continue to be admitted to listing on the Official List of the UK Listing Authority and to trade on the London Stock Exchange plc’s main market for listed securities. Schneider Electric intends to comply with the Listing Rules of the UKLA. As part of the transaction, Schneider Electric would contribute a selection of its industrial software assets to AVEVA and make a cash payment of £550m to AVEVA, (which would subsequently be distributed to AVEVA shareholders excluding Schneider Electric) in exchange for the issuance of new AVEVA shares, giving Schneider Electric a majority stake of 53.5% in the Enlarged AVEVA Group on a fully-diluted basis. Schneider Electric would fully consolidate the business in its Group financials.

In addition to any consultation procedures involving the personnel’s representative bodies that may be required, the transaction remains subject to, amongst other things, the completion of mutual due diligence to the satisfaction of both parties, agreement on the terms of legal documentation, the approval of the respective Boards of Schneider Electric and AVEVA, AVEVA shareholder approval and relevant anti-trust and regulatory approvals (if required). In accordance with the applicable law and regulation of the United Kingdom, a more detailed public announcement has been released today and is available on the AVEVA and Schneider Electric websites as well as on the AMF (French regulatory authority) website.

A further announcement will be made as and when appropriate.

by Gary Mintchell | Jun 26, 2015 | Automation

One day in my Inbox appeared an infographic (The Stimulating World of Programmable Logic Controllers) from Udemy–a training marketplace. The email featured some PLC training. This brought back vivid memories of my PLC training class in the Cleveland area many years ago. Anyway, enjoy:

by Gary Mintchell | Feb 5, 2015 | Automation, News, Technology

This was an interesting email. Siemens invited me to a webinar where I could learn how easy it now is to use TIA Portal software for automation and control development work building upon my knowledge of Rockwell Automation’s Studio 6000 software.

When I sold Allen-Bradley back in the 90s, I went head-to-head with Modicon (remember it?). Just as I left for greener pastures called Control Engineering, Schneider Electric acquired Modicon. That was the end of effective competition in the automation and control space in North America. There are a number of companies—all good companies with good products—which remain niche players here. We can count B&R, Beckhoff, Automation Direct, Mitsubishi, Omron.

Aside from Automation Direct, which had always carefully calculated its space and structured the company to capitalize on its space with a profitable business plan, executives from each of the others has proclaimed to me that they will be the one to knock off Number One Rockwell from its perch in North America.

Siemens

Back in the 90s again, I had a few customers using TI PLCs. One of them bought a PLC 5 from me. The other one told me he could get the same thing he was buying from a new company that sent him a catalog—PLCDirect, which became AutomationDirect. I thought, wow, PLCs by mail. This is becoming a commodity market.

What had happened was that TI sold its PLC business to Siemens. I figured it was an opening for me to sell against. I batted .500.

I used to joke that Siemens bought the business and then successfully drove market share from 4% to 2%. It just kept hanging on. Not unlike Rockwell in Siemens’ home turf in Europe.

Then a couple of things happened. First, Chrysler got into financial trouble (again) and sold to first one then another European company. Suddenly Siemens had a strong entry point into North American automotive manufacturing. Second, Siemens brought a couple of smart and visionary leaders into its North American division—Helmuth Ludwig and Raj Batra.

I no longer have a feel for market share, but given all the dynamic factors, I believe that Siemens has made more inroads than any of its predecessors. Rockwell has not indicated any concern, yet, with any counter moves. But things are heating up.

Siemens is pressing hard. This webinar that shows the capability of TIA Portal is a start. (I’ve seen the product. It looks good. But then, so does Studio 5000. Competition is a wonderful thing for customers.)

Siemens is also making the biggest company splash at next week’s ARC Forum in Orlando. The huge Yokogawa and Mitsubishi parties are in the distant past. GE has an invitation-only breakfast (read as, no competitors allowed). ABB has a lunch. But Siemens is sponsoring the Wednesday evening dinner and party at Epcot with a special press event preceding.

As I’ve often said, I love competition.

by Gary Mintchell | Dec 15, 2014 | Automation, Industrial Computers, Security, Technology

I have seen several industrial control systems entrants into the North American market. All thought they’d knock off market-leader Rockwell Automation. Several are still around. They have build nice businesses. They have not displaced Rockwell as the dominant PLC in the market.

I have seen several industrial control systems entrants into the North American market. All thought they’d knock off market-leader Rockwell Automation. Several are still around. They have build nice businesses. They have not displaced Rockwell as the dominant PLC in the market.

But…Is there a vulnerability?

I recently heard from Bob Honor. I’ve known him for years. The last I had talked with him, he was given the unenviable task of organizing a sales force to sell MES solutions for Rockwell.

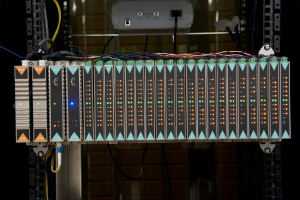

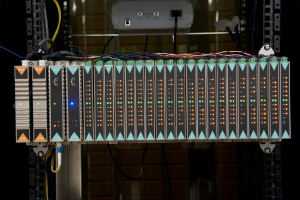

He has left Rockwell to co-found a new Industrial Control Systems (ICS) supplier. This platform is designed from the ground up as a secure platform. Rethinking the entire ICS paradigm, the Bedrock Automation team has built what it is calling a “new epoch of industrial automation.”

If you go to the Website and sign up for the email newsletter, I believe you will get a link to download a whitepaper that goes into some depth to explain the new design.

Here’s the introduction to the paper, “This white paper is the first in a series to outline a new epoch of industrial automation. All aspects of control system reliability, security and lifecycle cost have been rethought from first principles. The result is a new ICS platform we call Open Secure Automation. OSA delivers a user-centric renaissance of improved reliability, embedded security and lower cost.”

There are many interesting ideas in the platform and design. Perhaps I can get Bob or an engineer on the phone for a podcast interview after the first of the year. [Note: At no time did he tell me he was displacing Rockwell.]

Other competitors were (or thought they were) better, faster, cheaper at the same game.

Bedrock is attempting to change the game. Check it out and send me your thoughts. Is this enough of a game changer to disrupt the industry? For sure, I’ll be keeping an eye on developments.