by Gary Mintchell | Mar 5, 2018 | Operations Management, Software

Calling the action “transformational”, AVEVA completed the incorporation of Schneider Electric Software (Wonderware, Avantis, and so forth) proclaiming “a new software leader is born.” Of course, now the hard part starts. How do they get all these different parts to work together? How do they transform a culture that underwent the shocks of Invensys into the bureaucracy of Schneider Electric into this new company? Or, do they?

“88% of leaders in capital-intensive industries say that digitalisation would increase their revenues*”, said Craig Hayman, Chief Executive Officer at AVEVA. “Yet less than half of these companies are actually in the process of adopting a digital strategy. This represents an incredible opportunity for AVEVA to be our customer’s digital transformation partner.”

“Digitalisation demands a fundamental rethink of the way organisations operate. They need to be confident that their technology investment will deliver a high return on capital and can lower the total cost of asset ownership. AVEVA’s combination of proven solutions, industry-specific knowledge and a global partner ecosystem will drive innovation across capital-intensive industries, as companies plan their digital transformation journey,” Mr Hayman added.

The combination brings together AVEVA’s design, engineering and construction capabilities with Schneider Electric’s industrial software business, which ranges from simulation through to real-time manufacturing operations management. It creates a global leader in engineering and industrial software, expanding the markets and industries the company serves. Customers can benefit from improved profitability, efficiency and performance.

The net effect is to move AVEVA into direct competition with parts of Siemens and its digitalization strategy following the acquisition of UGS some years ago. Does this mean that there might be an AVEVA Mindsphere on the horizon? We’ll see.

by Gary Mintchell | Sep 6, 2017 | Commentary, News, Software

A little consolidation in the industrial software space. Remember when Schneider Electric was shopping its software division a couple of years ago and came up with a reverse acquisition with AVEVA? And the deal fell apart almost a year ago?

Well, it seems that Schneider spent the year internally restructuring such that it could pull off this weird financial transaction. Announced Monday evening, the two companies have reached an agreement to ship SE software to AVEVA forming a new company with SE as a 60% owner and AVEVA holds the other 40%. Plus AVEVA shareholders get some cash in the deal.

Management touts the transaction as having a clear and compelling business logic. Reasons include building a “global leader in engineering and industrial software”, covering entire asset lifecycle management, and positioned for further acquisitions.

I’ve believed that Schneider would sell off its software businesses ever since the deal for Invensys was announced. Some venture capitalists have talked with me about potential acquisitions. Evidently no one wanted to buy it. I thought maybe Wonderware could make it on its own as a spinoff, but there probably wasn’t enough financial payoff for Schneider with that sort of deal.

However, this also isn’t a clear divestiture. One is left wondering what the future will bring in a couple of years when this transaction matures.

The Management of the Enlarged AVEVA Group will be comprised of:

- Key members of the existing executive management team of AVEVA, namely Dave Wheeldon (Chief Technology Officer and currently also Deputy Chief Executive Officer) and Steen Lomholt-Thomsen (Chief Revenue Officer) are expected to remain in place following completion;

- Ravi Gopinath, currently Executive Vice President of the Schneider Electric Software Business, will be appointed as Chief Operating Officer of the Enlarged AVEVA Group. He will report to the Chief Executive Officer of the Enlarged AVEVA Group; and

- David Ward will continue in his current role as Chief Financial Officer of AVEVA, until a new Chief Executive Officer is appointed. Following such appointment it is intended that David Ward will be appointed to the role of Company Secretary of the Enlarged AVEVA Group.

I received this from Vertical Research Partners analyst Jeff Sprague:

- Deal Structure Overview – Schneider Electric announced today the combination of its industrial software business and AVEVA to create a global leader in engineering and industrial software. On completion, Schneider will own 60% of the combined new AVEVA group while existing AVEVA shareholders will have 40% equity ownership. However, SU is contributing a little over 60% of the proforma EBITA in addition to a £550MM payment, and allowing AVEVA to distribute a £100mm dividend to AVEVA shareholders at or around completion. Schneider will benefit from unlocking the higher trading multiple of its Software business outside of the Group structure, in addition to future synergies (unquantified). We estimate the transaction creates 42 euro cents of value to SU’s stock price. Closing is expected to be at or around end of 2017.

- Strategic Rationale – The combined company will provide engineering services and industrial software, with combined revenues of £657.5mm and adjusted EBITA of £145.8mm for the financial year ended March 2017. The combined portfolio will cover process simulation to design and construction to manufacturing operations/ optimization. As shown below, AVEVA is very strong in the front end design and engineering work while SU is strong in O&M and asset optimization. The company noted an ability to create a more streamlined solution as it will control both ends of the spectrum. Management also indicated plans to scale up with future M&A. AVEVA will also enhance the value proposition of Schneider’s existing IOT platform (ExoStructure).

The only interest I’ve seen with total asset lifecycle management is with the OIIE platform from MIMOSA (download whitepaper from my site). A few end-user companies have shown interest in that, but I don’t know that the combined companies will offer much of a competitive advantage in that regard. That would require strong management bringing the disparate parts together into a whole.

For example, I only point to GE Digital whose recent public woes with the Predix system point to the difficulties of software integration.

by Gary Mintchell | Jul 1, 2016 | Manufacturing IT, Operations Management, Software

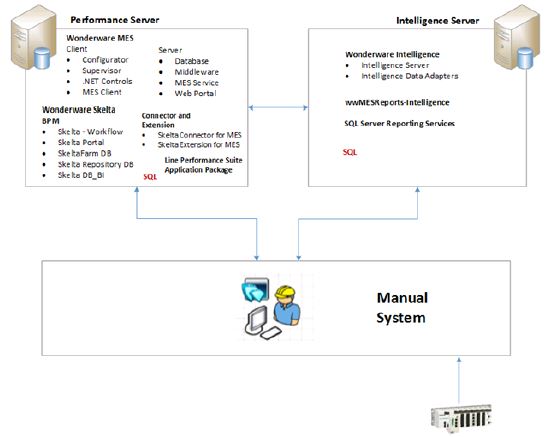

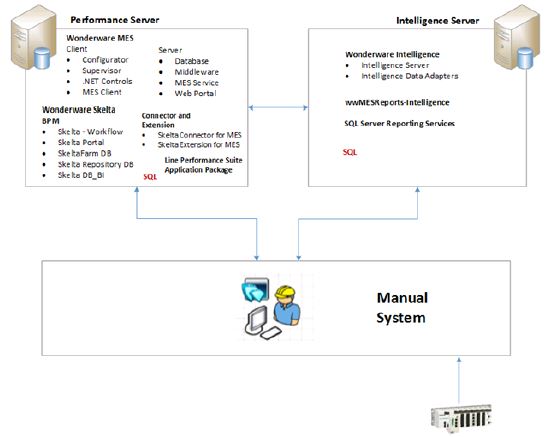

Schneider Electric software aims to boost process line improvement tool for food & beverage and consumer packaged goods (CPG) manufacturers. It announced yesterday availability of Line Performance Suite for Food & Beverage and Consumer Packaged Goods manufacturers.

Schneider Electric software aims to boost process line improvement tool for food & beverage and consumer packaged goods (CPG) manufacturers. It announced yesterday availability of Line Performance Suite for Food & Beverage and Consumer Packaged Goods manufacturers.

This single purpose app is built atop Wonderware MES software. These apps are a growing trend in the industry. Another trend is moving the investment in software from the capital expenditure budget (CapEx) to operations budget (OpEx). Schneider Electric has priced this offering as a subscription service to meet those customer needs.

Turnkey productivity improvement software

Addressing process improvement, Line Performance Suite offers a turnkey line enhancement and productivity improvement solution that can be used across operations.

“Users of the Line Performance Suite can unlock hidden capacity in production lines to help drive improved profitability, higher quality and enhanced Overall Equipment Efficiency (OEE),” said Doug Warren, Vice President, Industry Solutions at Schneider Electric Software. “Integrated reporting and analysis ensures packaging line output is optimized, providing greater understanding to locate process weaknesses and maintain maximum throughput. What results is better intelligence on line performance for more informed decision making.”

“Users of the Line Performance Suite can unlock hidden capacity in production lines to help drive improved profitability, higher quality and enhanced Overall Equipment Efficiency (OEE),” said Doug Warren, Vice President, Industry Solutions at Schneider Electric Software. “Integrated reporting and analysis ensures packaging line output is optimized, providing greater understanding to locate process weaknesses and maintain maximum throughput. What results is better intelligence on line performance for more informed decision making.”

Benefits

Identified benefits of Line Performance Suite include:

- Line Performance – remove bottlenecks, reduce downtime and increase availability to gain process metrics for both automated and manual production lines

- Product Quality – lower scrap rates and improve first pass yields to achieve better quality and right first time metrics

- Visibility to Process Metrics – gain visibility to Key Performance Indicators (KPIs) to achieve real-time access to critical operating parameters

Included in the offering is Schneider Electric’s Customer FIRST Software Maintenance and Support Program. This program enables access to the latest software upgrades, expert technical assistance and self-help tools to improve operational effectiveness.

Economic development

In one of those interesting coincidences, last week I had a breakfast meeting with two people from the Singapore Economic Development agency. They touted an investment by Schneider Electric in a large software development division. That division—it’s the Industry Solutions Business.

by Gary Mintchell | Mar 7, 2016 | Operations Management, Software

Tim Sowell always packs many operations management ideas into a brief blog post. Sowell is a VP and Fellow at Schneider Electric Software (Wonderware). I’ve looked at his posts before. He is always thinking out in front of most people.

Tim Sowell always packs many operations management ideas into a brief blog post. Sowell is a VP and Fellow at Schneider Electric Software (Wonderware). I’ve looked at his posts before. He is always thinking out in front of most people.

His Feb. 14 post, Composite Frameworks What Are They, the Shift to Model Driven vs. Custom: How Do They Play?, takes a look at moving the user experience of operations management software into newer territory.

He probably says much more, but this is the take I’m going to analyze. He’s pointing out the difficulties of using traditional approaches to programming and presenting User Interfaces in a way that keeps pace with today’s expectations.

“Traditionally companies have built User Interfaces to an API, with the calls needed to execution actions and transactions; these have worked well especially within a plant. But a key to operational systems being effective and agile is their ability to adapt on a regular basis. This requires a sustainable and evolving system. This is especially important in form/ transaction activities where information is provided and where actions/ data input, and procedures need to be carried out.”

He does not stop there but proceeds to enumerate some challenges:

- Operational Process cross-over functional domains and applications

- Lack of governance

- AgilityResponsive manufacturing business processes

- Increase the performance of their people assets

- Too much Custom Code, making it unmanageable and evolutionary

He wonders why we can’t use techniques gleaned from Business Process Modeling. That’s a good question! He notes that some people will say that BPM is not real-time like manufacturing/industrial applications are. But he rebuts that “this also aligns with what the industrial world is very comfortable world with—that of ‘stable in control loops’.”

Operations management solutions

Here are some proposed solutions:

- Providing a graphical configuration environment for the capture and defining of operational process including the validation of data input, and guiding actions, working inline with the user Interface/ forms etc.

- Providing a framework for building of reusable forms, and reusable procedures that can be managed as templates and standards to enforce consistent operational practices.

- Empowering the operational domain people to develop, evolve and manage their procedures.

“Most of all empowering the different roles in the plant, that operational close loop moving to an “activity” centric system where information, and action is driven from a consistent operational model and practices.”

This is a consistent Sowell message. Let’s see what we can template-ize or project as a model rather than custom code everything.

More and more owner/operators and users I talk to are getting tired of the expense and lead-time for custom coded projects. They need the speed and flexibility of using models and standards for application implementation. I think this is where Sowell was headed (if not, he’ll correct me, I’m sure). This will serve to move industry forward as a more profitable contributor to enterprise health.

by Gary Mintchell | Jan 6, 2016 | Operations Management

Tim Sowell of Schneider Electric Software (Wonderware) thinks out in front of the curve. His customer contacts help keep him on his toes. His new year’s kick-off blog post revealed four key areas for the coming year based on a conversation with a customer.

Tim Sowell of Schneider Electric Software (Wonderware) thinks out in front of the curve. His customer contacts help keep him on his toes. His new year’s kick-off blog post revealed four key areas for the coming year based on a conversation with a customer.

These insights should turn our attention away from media glitz and toward doing real work using technologies plus insights.

You might ask what about “big data” and the “internet of things” but these are technologies that will be part of the enabling system for a new operational solution.

In his previous blog he had asked, “how much transformation was happening?” He received a comment from a friend saying the momentum of change is well underway, and happening at increasing pace.

There were 4 areas that he felt his business and associated industry where trying grapple with to stay ahead.

1/ Agility of effective, valued products and brands to the market. So the challenge of “new product Innovation” and then “New Product Introduction” and delivering it to the market at the correct margin to be competitive in timely manner is a whole focus. His comment was this is the core competitive advantage that his company identifies.

2/ Operational Workforce transformation. He agrees with me that too much focus has been on the “aging workforce issue” and that most of HR and Operational teams have missed the bigger transformation, and that is the one of new generation work methods and transformation in workspace that goes with it. He felt like his company woke up to this mid way thru last year when they could not just not fill positions, but are having significant challenges in retaining talent, not within the company but in roles. He felt like initially people thought that would just get a transition to a new workforce yes younger of different experience. But they had not realized that way in which people will work, think, interact, and gain satisfaction will also change. [I think this is a key insight. For years I have written and spoken about getting past the “aging workforce” discussion. In many cases companies had to bring previously laid off engineers back as contractors in order to get essential engineering done. They just couldn’t get the new people needed using the same old tools and methods. Gary]

3/ “Planet Awareness, Image”. He raised this as a real strategy for evolving the brand of the company to been seen as proactive to the environment, to attract further “feeling satisfaction” of customers. He also stated that government regulation, and increasing costs of disposing of waste, and energy costs also are now seen a significant bottom line costs, and must be managed more efficiently. But during this discussion, it was also clear that the perception of being “proactive to the environment” in use of energy, carbon footprint, environment etc was also a key strategy for attractive talent to work in the company. [This idea has been coming for many years. I am happy to see it gaining traction in a major company. I think leadership in our industry that attracts bright, young people must tap into larger societal themes. Gary.]

4/ Transparency across the total product value chain. [Technology has been moving us this direction for some time. Once again, human work is catching up to the technological capabilities. Gary]

It was clear that the 4 strategies was really about changing the way in which the company manages and executes operational work, no matter how big or small.

Pillars of Operational Solution approach:

- Everyone having access to information and knowledge no matter their state or location, this means internet becomes a part of the solution backbone.

- Cyber Security is very much top of mind, both in strategy to secure, manage, to contain cost and risk.

- Data validation/ and contextualization, if transparency and faster decisions are required how do you gain consistent information across different sites. \

- Delivering a new “operational Workspace/ experience” that has embedded knowledge that does not get stale, and enables imitative learning for a dynamic and collaborative workforce.

Schneider Electric software aims to boost process line improvement tool for food & beverage and consumer packaged goods (CPG) manufacturers. It announced yesterday availability of Line Performance Suite for Food & Beverage and Consumer Packaged Goods manufacturers.

Schneider Electric software aims to boost process line improvement tool for food & beverage and consumer packaged goods (CPG) manufacturers. It announced yesterday availability of Line Performance Suite for Food & Beverage and Consumer Packaged Goods manufacturers. “Users of the Line Performance Suite can unlock hidden capacity in production lines to help drive improved profitability, higher quality and enhanced Overall Equipment Efficiency (OEE),” said Doug Warren, Vice President, Industry Solutions at Schneider Electric Software. “Integrated reporting and analysis ensures packaging line output is optimized, providing greater understanding to locate process weaknesses and maintain maximum throughput. What results is better intelligence on line performance for more informed decision making.”

“Users of the Line Performance Suite can unlock hidden capacity in production lines to help drive improved profitability, higher quality and enhanced Overall Equipment Efficiency (OEE),” said Doug Warren, Vice President, Industry Solutions at Schneider Electric Software. “Integrated reporting and analysis ensures packaging line output is optimized, providing greater understanding to locate process weaknesses and maintain maximum throughput. What results is better intelligence on line performance for more informed decision making.”

Tim Sowell always packs many operations management ideas into a brief blog post. Sowell is a VP and Fellow at Schneider Electric Software (Wonderware). I’ve looked at his posts before. He is always thinking out in front of most people.

Tim Sowell always packs many operations management ideas into a brief blog post. Sowell is a VP and Fellow at Schneider Electric Software (Wonderware). I’ve looked at his posts before. He is always thinking out in front of most people.

Tim Sowell of Schneider Electric Software (Wonderware) thinks out in front of the curve. His customer contacts help keep him on his toes. His

Tim Sowell of Schneider Electric Software (Wonderware) thinks out in front of the curve. His customer contacts help keep him on his toes. His