by Gary Mintchell | Sep 14, 2018 | News, Operations Management, Standards

Developing digitalization using standards from plant design engineering through the entire production process and extending to the supply chain remains core to my interests. My past work with MIMOSA pointed to this. Siemens strategic moves are fascinating in this regard.

I started this post just when my project sucked all of my energy and then I went to IMTS. This is significant. Especially competitively. I see Rockwell Automation doing nothing like this—only the investment with PTC gaining a seat on the board and a connection to ThingWorx and Kepware within the company. Meanwhile I just interviewed Gary Freburger and Peter Martin from Schneider Electric process business, and they talked some about the integration with AVEVA along these same lines.

Siemens and Bentley Systems Announcement

In the companies’ latest Alliance Board meeting, Bentley Systems and Siemens decided to further strengthen their strategic alliance. The two companies have decided to extend their existing agreement, to further develop their joint business cooperation and commercial initiatives. Therefore, the joint innovation investment program will be increased from the initial €50 million funding to €100 million. In addition, as a result of the continuous investment of Siemens into secondary shares of Bentley’s common stock the Siemens stake in Bentley Systems now exceeds 9%.

Klaus Helmrich, member of the Managing Board of Siemens AG, said: “I’m very pleased with how strong our alliance started. Now we are investing in the next collaboration level with Bentley, where for instance we will strengthen their engineering and project management tools with Siemens enterprise wide collaboration platform Teamcenter to create a full Digital Twin for the engineering and construction world.”

He added: “Integrated company-wide data handling and IoT connectivity via MindSphere will enable our mutual customers to benefit from the holistic Digital Twins.”

Greg Bentley, Bentley Systems CEO, said: “In our joint investment activities with Siemens to date, we have progressed worthwhile opportunities together with virtually every Siemens business for ‘going digital’ in infrastructure and industrial advancement. As our new jointly offered products and cloud services now come to market, we are enthusiastically prioritizing further digital co-ventures. We have also welcomed Siemens’ recurring purchases of non-voting Bentley Systems stock on the NASDAQ Private Market, which we facilitate in order to enhance liquidity, primarily for our retiring colleagues.”

by Gary Mintchell | Aug 20, 2018 | Internet of Things, Manufacturing IT, Operations Management

Siemens is serious about building out its IoT platform, Mindsphere, on it way to realizing the vision of the technology supplier of digital transformation in manufacturing. How else to describe the €0.6 billion (or about $700 million) acquisition of Mendix, a popular low-code application development platform.

Mendix, which was founded in the Netherlands but now has its headquarters in Boston, will continue to operate as usual and keep its name, but Siemens notes that it will also use the company’s technology to accelerate its own cloud, IoT and digital enterprise ambitions.

“As part of our digitalization strategy, Siemens continues to invest in software offerings for the Digital Enterprise. With the acquisition of Mendix, Siemens continues to add to its comprehensive Digital Enterprise and MindSphere IoT portfolio, with cloud domain expertise, cloud agnostic platform solutions and highly skilled people,” said Jan Mrosik, CEO of Siemens’ Digital Factory Division.

Mendix’s service is already deeply integrated into IBMs’, SAP’s and Pivotal‘s cloud services. Mendix co-founder and CEO Derek Roos notes that his company and Siemens first discussed a strategic partnership, but as those talks progressed, the two companies moved toward an acquisition instead. Roos argues that the two companies’ visions are quite similar and that Siemens is committed to helping accelerate Mendix’s growth, extend the company’s platform and combine it with Siemen’s existing MindSphere IoT system.

“If you’ve ever wondered which low-code platform will have the viability to invest and win in the long term, you no longer have to guess,” Roos writes. “This commitment and investment from Siemens will allow us to accelerate R&D and geo-expansion investments significantly. You’re going to see faster innovation, more reach and an even better customer experience from us.”

Over the course of the last few years, ‘low-code’ has become increasingly popular as more and more enterprises try to enable all of their employees to access and use the data they now store. Not every employee is going to learn how to program, though, so tools like Mendix, K2 and others now make it easy for non-developers to quickly built (mostly database-backed) applications. (See my last post on ERP and “consumerization”.)

Here is a longer explanation from Roos’ blog:

[https://www.mendix.com/blog/siemens-to-acquire-mendix/]

As the world around us gets increasingly connected, organizations are facing increasing challenges to cope with vast amounts of data and customers are increasingly expecting entirely new experiences and interactions. New technologies like VR, IoT and AI will drive an incredible convergence between the digital and physical worlds, creating entirely new industries and business moments in which people, data, businesses and things work together, dynamically.

This, once again, will put more pressure on business/IT organizations to adapt and change how apps are built and consumed, in ways that few can comprehend right now. And just like we’ve done for web and mobile applications, we also intend to set the direction and lead the market for our customers in this new era.

And this is where Siemens comes in.

As one of the world’s largest industrial powerhouses, there are few companies on the planet that are dealing more mission-critical data and better positioned to blur the lines between our physical and digital worlds. With millions of connected devices and systems, operations in more than 200 countries, and more than 15,000 software engineers, Siemens has access to know-how, expertise and reach few others can match. Even fewer software companies can attempt to compete with such scale in ‘things’.

Siemens has been on a mission to leverage its foothold and data-rich infrastructure in the physical world, to become a leader in the digital world, investing over $10B in the last decade to acquire and build out software businesses, and to create the Industrial IoT platform, MindSphere.

Our two teams first met over a year ago and what started as a discussion about a strategic partnership, gradually evolved into a much bigger vision. The more time we spent together, the more we realized how our visions were aligned. Together with Joe Kaeser, CEO Siemens AG, Jan Mrosik, CEO Digital Factory Division, and Tony Hemmelgarn, CEO PLM Software, we identified three strategic areas where we could win together:

- Accelerate Mendix’ leadership in low-code by doubling down on R&D investments and geographical expansion: By becoming a part of Siemens, we will be able to access an even bigger investment than going public, and we will immediately get access to an enormous global infrastructure that would take much longer to stand-up ourselves. We are committed to extending our leadership in low-code and will significantly accelerate investments in R&D, Customer Success and global expansion.

- Combine Mendix and MindSphere to create the digital operating system for the physical world: With billions of intelligent devices and machines connected to the cloud, organizations will require a new kind of platform to turn these massive amounts of data into real-time business value. By combining Mendix and MindSphere, we will be in a unique position to bridge the physical and digital worlds.

- Extend the Mendix platform to develop world-class and deeply integrated industry SaaS solutions: Becoming a part of Siemens gives us unprecedented access to deep industry know-how, network and expertise. Together with our partner ecosystem, we’ll be able to extend the Mendix platform with deeply integrated vertical solutions across a wide range of industries. Combining low-code with best-practice solutions and templates will provide even more value and speed to market for our customers.

by Gary Mintchell | Mar 16, 2018 | Automation, Operations Management

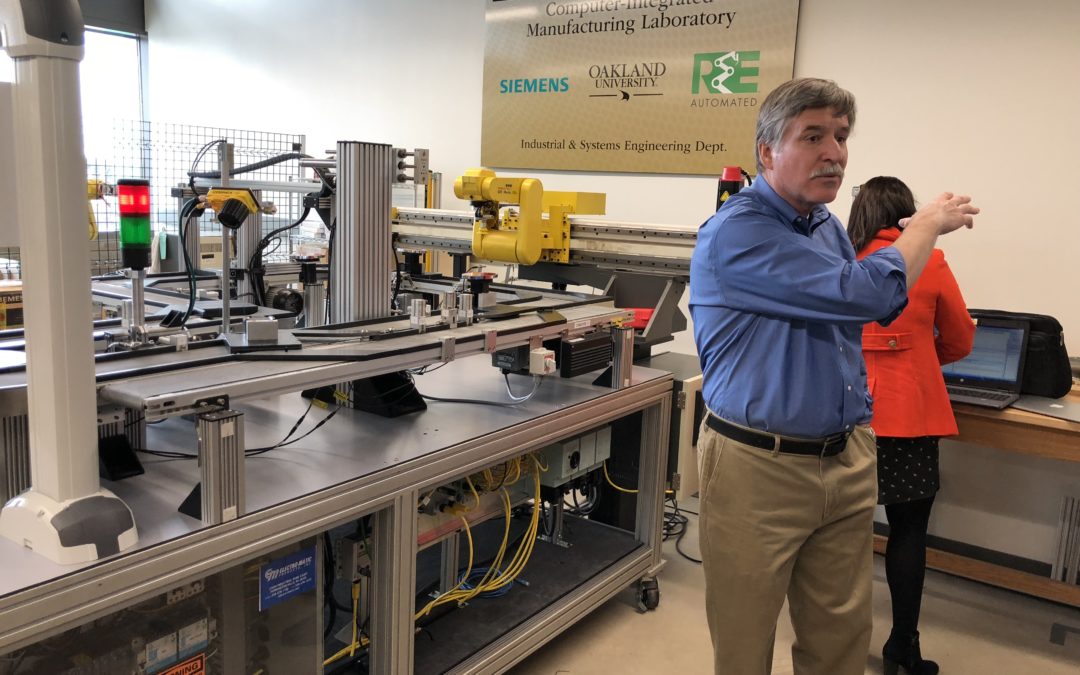

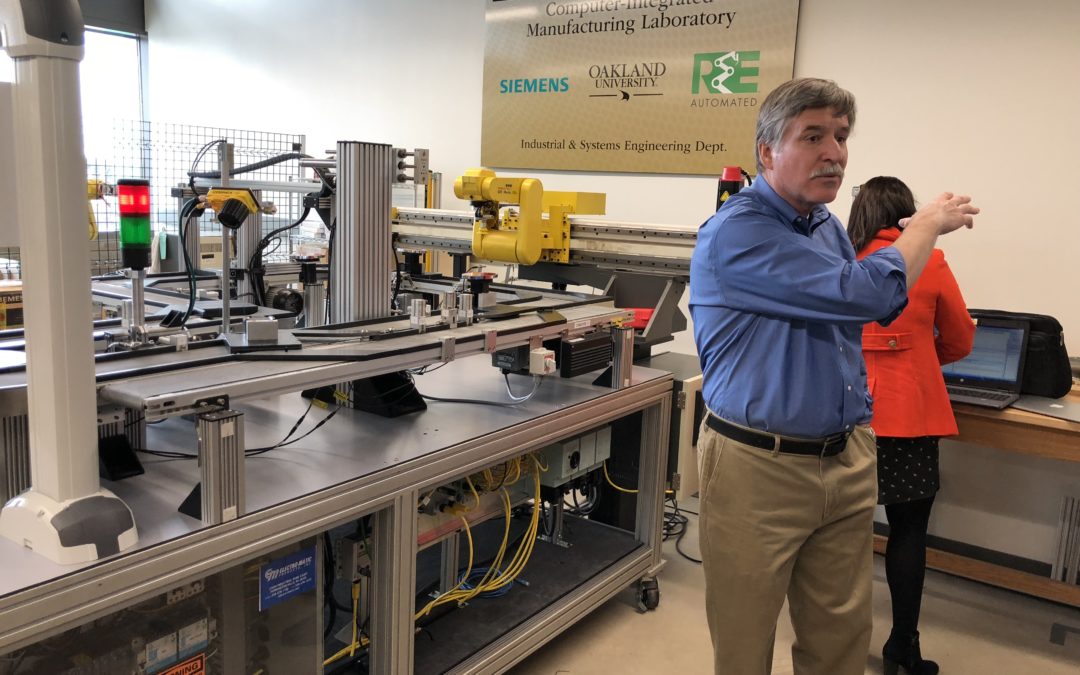

A small group of journalists and writers trekked to the Detroit area March 12-13 to glimpse the future of Manufacturing in America sponsored by Siemens Industry and its local distributor/partner Electro-Matic. We toured the local Founders Brewery facility, visited with faculty and students of Industrial and Systems Engineering at Oakland University, and attended the annual thought leadership panel.

Food and Beverage

Founders Brewery, craft brewery founded in Grand Rapids, MI, built a smaller version of brewery/restaurant in downtown Detroit not far from Ford Field and Greektown. The automated part of the brewery and instrumentation was supplied by Siemens. We toured the brewery, had an awesome sandwich, and sampled some of the many craft beers from founders.

Education

A complete change of pace (well, maybe not as I remember my college days) took us north to Rochester, MI to Oakland University. Robert Van Til, Ph.D., Pawley Professor of Lean Studies and Chair of Industrial and Systems Engineering (ISE), introduced us to his program and several students who explained their experiences both in class and working in local factories.

A complete change of pace (well, maybe not as I remember my college days) took us north to Rochester, MI to Oakland University. Robert Van Til, Ph.D., Pawley Professor of Lean Studies and Chair of Industrial and Systems Engineering (ISE), introduced us to his program and several students who explained their experiences both in class and working in local factories.

Siemens has donated much software and equipment to the program. Students explained how they had been trained in Siemens PLM software and used the simulation application to model real-world problems. They impressed me with a maturity I doubt that I had at that age, but also with how smoothly they integrated Lean Manufacturing concepts with their factory cell simulations.

-> An important point. I hold the impression left over from some years ago that young people view manufacturing negatively—as dark, dirty, unsafe, backwards places to work. Much to the contrary, these students all viewed manufacturing as a place to use their technical training to make an impact. They see how they can contribute to an organization immediately. I guess the work we’ve done over the past 20 years to clean up our factories and apply technology are being rewarded.

Finance 4.0

Nothing beats an early morning meeting to talk finance. Actually, it’s not that bad. Before the Wednesday summit meeting, we met with the Siemens Finance team. Note: we did this last year, as well.

Siemens has identified six challenges for manufacturers on the journey to Industry 4.0. Challenge No. 2 identifies access to finance for the scale of investment over time that manufacturers need to make in digital and automated technology platforms.

The team has released a white paper, “Practical Pathways to Industry 4.0 in the USA.” This would be Finance 4.0 for Industry 4.0. Snipping one section, “Integrated Strategic Finance,” here are a few points:

- Evaluate potential sources of finance for both OPEX and CAPEX

- Consider how you’ll finance all aspects of digital transformation

- Align with strategic growth vision and technology investment

- Find financing partners with willingness and skills for this journey

- Is your CFO a ‘virtuoso’ in linking initiatives to financial outcomes

Siemens Finance has many financial instruments in place to help from brownfield upgrades to greenfield projects—and for complete equipment financing, not only Siemens equipment.

Thought Leadership Summit

Raj Batra, President of Digital Factory for Siemens Industry Inc., took the ball from MC Eddie Murray (former NFL kicker), discussing how manufacturing executives in the US are very optimistic about the near future for manufacturing. One large problem is finding talented people to fill the positions. He also discussed Siemens technology and how it is helping manufacturers, for example like adidas who in this “order the latest fashion online” world need to shrink the 18 month timeline from concept to delivery of new shoes. Siemens PLM to the rescue.

Greg LaMay, Director Global. PLM Implementation for KUKA NA, showed how his team is using Siemens PLM applications to break silos within the company to improve time to ship and customer experiences.

John Greaves, IoT, RF, and Blockchain Solutions Architect (with a portfolio like that, he could probably bring the world to an end 😉 ) at Lowry Solutions, showed how Blockchain (the technology used by Bitcoin, for example) is already used for critical supply chain applications.

Alan Beaulieau, Ph.D., Economist, and President of ITR Economics (check it out, he wrote a column for me at Automation World for several years and he’s a great speaker), gave his usual well researched and reasoned view of the economic scene. Hint: it’s better than you might think reading the newspapers or listening to TV. itreconomics.com

by Gary Mintchell | Jan 12, 2018 | Internet of Things, News, Software

This year has opened more strangely than usual. Looks like I’ll be emphasizing a lot more IT/OT intersection plus digital transformation and Internet of Things. Part of the strangeness is that several of my good friends are on the lookout for new positions. The end of 2017 was harsh for many people. If you need a good sales and/or marketing professional, I can put you in touch with some top people. In fact, my business also sort of tapered off the last part of the year. I thought things were supposed to be good (well, my investment accounts are looking good).

There was no other way than to just string together a number of news items in the Internet of Things and Industrial software space.

• Conferences

• Honeywell Data

• Schneider Award

• Bluetooth at 20

• RFP for IoT Software Platform

Conferences

I am a media sponsor for a couple of upcoming conferences. The strange thing is that I haven’t heard from either one for a while and neither has sent an ad png for me to display.

News also seems to be a little slow. But here are a number of things I’ve compiled over several days along with some upcoming conferences. Hope to see you at some of those.

The 22nd annual ARC Industry Forum in Orlando from February 12-15 on Digitizing and Securing Industry, Infrastructure, and Cities is a great industry meeting place. https://www.arcweb.com/events/arc-industry-forum-orlando

I see ARC Advisory Group, like many of us, must branch out from control and automation in order to find a big enough market to survive. My own practice has shifted from market and industry research and analysis in that space to greater focus on IT/OT, IoT, and digital transformation.

Also on my calendar is the Industry of Things USA (I’m also a media sponsor of the September one in Berlin) from March 7-9 in San Diego. This will be its third year. The organizing group from Berlin (Germany) has been outstanding. This is becoming a place for IT to meet OT. http://industryofthingsworldusa.com

Hannover Fair this year is April 23-27. I’ll go there depending upon sponsorship. Always a great place to meet many influential people.

The Control Systems Integrators Association is meeting from April 24-27 in San Francisco. I have never been to a CSIA meeting. Maybe this year I can slip one in if I don’t go to Germany.

The MESA International USA conference held in conjunction with the Industry Week Manufacturing and Technology conference in Raleigh, NC will be from May 8-10.

Maybe I can make it to the Rockwell Automation annual software bash in San Diego from June 10-15.

Siemens Industry in the USA is holding its automation summit in Marco Island, FL from June 25-28.

If I can afford all the travel, this will be a busy 6 months.

Honeywell

In the realm of industrial software, Honeywell Process Solutions (HPS) today launched its Honeywell Connected Plant Uniformance Cloud Historian. This software-as-a-service cloud hosting solution for enterprise-wide visualization and analysis, helps customers improve asset availability and increase plant uptime.

It claims an industry first by fusing real-time process data analysis of a traditional enterprise historian with a data lake, enabling the integration of production, Enterprise Resource Planning (ERP), and other business data coupled with analytics tools to provide business intelligence. “This allows enterprise data to be analyzed instantly on a scale not previously possible using tools and functions already in use at sites and plants,” says the media release.

“Uniformance Cloud Historian brings the full power of cloud and big data to Honeywell’s traditional process historian for the first time, connecting even the most complex multi-site organizations effortlessly,” said Vimal Kapur, president of Honeywell Process Solutions. “The solution makes it possible to leverage insights found at one plant across all plants, allowing smarter, more strategic decisions to be made and action to be taken.”

Honeywell’s new offering collects, stores and enables replay of historical and continuous plant and production site process data and makes it visible in the cloud in near real time. The historian combines a time series data store, which empowers plant and enterprise staff to execute and make decisions, with a big data lake, which enables data scientists to uncover previously unknown correlations between process data and other business data in the enterprise.

Schneider Award

Last week I wrote about an interview I had with Cognizant, the Indian company that acquired Wonderware’s (Schneider Electric) R&D center. This week, an announcement about an award to Schneider Electric (not sure that these are the same it just reminded me of the Indian connection).

Schneider Electric announced its India-based Software Delivery Center (SDC) was appraised at Level 5 of the CMMI Institute’s Capability Maturity Model Integration (CMMI). With this designation, Schneider Electric’s SDC becomes part of a small group of companies with a CMMI Level 5 assessment in the industrial software industry.

An appraisal at maturity level 5 indicates that the organization is performing at an “optimizing” level. At this level, an organization continually improves its processes based on a quantitative understanding of its business objectives and performance needs. The organization uses a quantitative approach to understand the variation inherent in the process and the causes of process outcomes.

Select achievements include:

• Attaining a schedule variance of less than 1%

• Maintaining effort variances of less than 3%

• Delivering an industry-leading client satisfaction score

Bluetooth is 20

Are you listening to music on your wireless headset while working at the coffee house? Thanks to Bluetooth. Did you know that the technology just turned 20?

Today, the Bluetooth Special Interest Group (SIG) kicks off its 20th anniversary year from the Consumer Electronics Show (CES). Formed in 1998, the Bluetooth SIG started with a handful of companies focused on wire replacement for mobile voice and data. Today over 33,000 member companies are part of an organization dedicated to perfecting and advancing a flexible, reliable, and secure wireless connection solution.

IoT RFP Platform

Here is one that I think merits a deeper dive:

Three of the biggest software vendors in IoT – HPE, PTC, and Wind River (Intel) – have agreed to join the IoT M2M Council’s (IMC) fledgling template RFP Program for IoT Software Platforms, which will be presented at the IMC’s conference at CES.

Using input from many vendors and more than 100 software buyers in an open-source process, the IMC developed a template reference document that will ease buying of IoT software, and later, hardware and connectivity solutions. HPE, PTC, and Wind River have agreed to have their platforms assessed by the IoT M2M Council which represents 25,000 enterprise users and OEMs that buy IoT solutions.

The RFP program will simplify sourcing of IoT platforms for buyers by providing reference documentation and demonstrating capabilities of established software platforms, and for participating vendors, it will ultimately shorten the sales cycle.

The IMC developed a template RFP document earlier this year in a wiki-based, open-source process with input from more than 100 IoT buyers, and has now retained a third-party consultancy to validate vendors against the RFP. The validation process, conducted by UK-based Beecham Research, includes surveying vendors for responses to the RFP, contacting their customers anonymously for references, and a hands-on analysis of the platforms for ease-of-use.

“No other industry group or major consultancy is talking to buyers at scale and looking at the actual IoT sales process. My staff spends a lot of time responding to RFPs. The IMC’s RFP program gives us a report from a credible third-party that allows us to respond to RFPs more quickly, as well as a place to send potential buyers where they can access a template RFP document and learn more. If this program reduces my sales cycle, even just incrementally, it will be well worth it,” says Volkhard Bregulla, VP of Global Industries, Manufacturing, & Distribution at HPE, with a seat on the IMC board.

IMC rank-and-file membership comes from 24 different vertical markets on every continent, and a plurality self-identify as “operations”, meaning that they are unlikely versed in communications technology. “The template RFP provides a non-technical reference, and can go a long way in establishing a common language for IoT technology among people actually doing the buying,” says Bregulla.

by Gary Mintchell | Jun 27, 2017 | Automation, News, Productivity

Siemens holds its Automation Summit this week in Boca Raton, FL, and it kicked off its media program with a round table discussion with the Financing group.

Siemens Financial Services exists as a sales support group to assist customers who perhaps require assistance financing a project. This could involve helping with cash flow or giving the customer some operational flexibility. This often helps smaller businesses as they adapt to the changing business and technology conditions they are facing today.

“Siemens is a one-stop shop.”

They brought back memories of my early sales training on solution sales when they mentioned that Siemens Industry is getting adjusted to solution sales (rather than product sales) and the Siemens sales teams are learning that financial can be a key component of a solution sale.

Siemens is not the only company in this space, by the way, adjusting to a new way of life beyond “selling boxes.”

ROI

Where can Return on Investment (ROI) be found in a digitalization project? Siemens suggests several ways:

• Increase manufacturing productivity

• Reduce energy consumption

• Reduce downtime

• Shorten setup and changeover times

• Improve quality

• Improve planning and forecasting—which leads to

• Reduced inventory

• Reduce waste

What are Industry 4.0 financiers offering that supports this new mindset?

Industry 4.0 Finance can:

• Embed financing options into the initial value proposition, opening a wider range of affordable digital transformation possibilities

• Flex financing periods to suit the pace at which each manufacturer will reduce costs or increase sales as a result of the company’s digital transformation

• Cover the total solution and total cost of ownership (hardware, software, services), allowing manufacturers to secure digital transformation at a guaranteed and sustainable monthly cost

• Employ machine data to ensure finance is based on usage or outcomes, aligning technology capabilities with their resulting commercial benefits

• Use cost-saving or money-making outcomes to fund enabling technology, making digital transformation

• cost neutral

• Build in technology upgrade options so manufacturers do not become trapped in technology obsolescence in a world of quicker innovation cycles

• Bridge the cash-flow gap between technology investment and the resulting benefits to make digital transformation more financially sustainable

Adding fincining assistance as part of a solution sale to help customers overcome a potential obstacle to implementing digitalization and reaping the benefits seems like good business sense.

A complete change of pace (well, maybe not as I remember my college days) took us north to Rochester, MI to

A complete change of pace (well, maybe not as I remember my college days) took us north to Rochester, MI to