by Gary Mintchell | Mar 1, 2017 | Commentary, News

My friends over at the PwC industrial manufacturing practice have taken a look at 2017 industrial manufacturing trends. The report was composed by Marian Mueller, Bobby Bono, Steve Pillsbury, and Barry Misthal. I will summarize here. Check out the link for more in-depth discussion.

I think they have nailed most of the ideas coming up. Some of these will be difficult for suppliers to either swallow or develop. Likewise, customers may not always like increased connectivity back to the supplier. Pay for performance, so far, has not been a winner. Customers begin to think they are paying too much if performance really does increase. Then they want to go back to a fixed price <sigh>.

Six Industrial Manufacturing Trends

1. Leverage data and analytics in a new business model

By upgrading their technical capabilities, industrial manufacturers can bundle a variety of services enabled by connectivity and data, replacing the increasingly outmoded model of selling one big complex machine under warranty and a service agreement for maintenance and repair.

2. Innovate pricing

As technology begins to alter the relationship between industrial manufacturers and their customers, the traditional pricing model for the service contract must be changed as well, from pay-for-product to pay-for-performance. Condition-based maintenance, driven by predictive and interconnected industrial technology, will become commonplace. This should translate into fewer visits from repair technicians. As a result, customers will naturally expect more favorable terms, which can be facilitated by sharing risk.

3. Develop strategic partnerships — carefully

Industrial manufacturers must become more active players in the technology ecosystem, seeking expertise outside the industry in order to develop equipment connectivity, data analysis, and software development that are beyond their current abilities. For example, recognizing that it cannot grow the ecosystem alone, at least one major industrial company has aligned with a wide range of technology firms to create a dedicated cloud-based platform that can run industrial workplaces. Leaders have to balance the practice of close collaboration with strategic partners against the need to stay flexible in contracting and partner selection, all while maintaining their hold on their markets.

4. Mine operational data

If connected machines — the primary components of IoT — are to be the backbone of industry in the near future, industrial manufacturers will have to figure out how to manage the data coming from an avalanche of sensors, integrated equipment and platforms, and faster information processing systems. There is a critical need to hire people who can mine these bits and bytes of information and work more closely with customers to use the data to improve equipment performance and open new revenue streams. Indeed, the anticipated efficiency returns from digitization over the next five years across all major industrial sectors are substantial: nearly 3 percent in additional revenue and 3.6 percent in reduced costs per year, according to a recent PwC survey of companies.

5. Decide what intellectual property to share and what to develop

Many industrial manufacturers find it difficult to manage digitization and big data analytics because their internal IT systems are so unwieldy. As company operations have grown more complex, expanding into new global markets and product lines and integrating newly acquired firms over many years, the old enterprise resource planning (ERP) systems that were meant to drive efficiency and coordination have proliferated into a tangled mass of disparate networks.

Industrial manufacturers must begin the process of overhauling their IT systems, creating a completely new architecture that can serve as the backbone for internal and external technology initiatives. In this new approach, it is imperative that IT systems communicate throughout the organization with standardized protocols.

6. Create strategies for talent development and retention

In the digitization sweepstakes, industrial manufacturers often find themselves at a disadvantage when trying to attract and retain talent. For example, in the U.S. many of the best and brightest STEM (science, technology, engineering, and math) students would prefer to work in Silicon Valley, where innovation is on the menu for breakfast, lunch, and dinner, rather than in the stodgier old-world locales where many industrial manufacturers have their plants and headquarters.

Succeeding in challenging times

The next wave of leaders in industrial manufacturing will build an ecosystem that capitalizes on the promise of analytics and connectivity to maximize efficiency for themselves and their customers.

by Gary Mintchell | Feb 15, 2017 | Automation, Process Control

A long-time dream of enabling operators to see the profit impacts of process changes is a giant step closer to reality.

Much of my early career involved the intersection of engineering and profitability. No surprise that I valued my conversations with Peter Martin over the years. He has long been a proponent of just such technology and workflow.

Now at Schneider Electric (but still Foxboro), he has an organizational stability that may get the job done. Enter “EcoStruxure Profit Advisor.”

Developed through a partnership with Seeq, a leading provider of software and services that enable data-driven decision making, EcoStruxure Profit Advisor uses Big Data analytics to measure the financial performance of an industrial operation in real time, from the equipment asset level of a plant up to the process unit, plant area, plant site and enterprise levels. On-premise or cloud-enabled, it works seamlessly with any process historian to mine both historical and real-time data. It then processes that data through Schneider Electric’s proprietary segment-specific accounting algorithms to determine real-time operational profitability and potential savings.

Controlling Business Variables in Real Time

“While many companies are getting really good at controlling the efficiency of their operations in real time, they’re still managing their business month to month. That just doesn’t work anymore,” said Peter Martin, vice president of innovation, Schneider Electric Process Automation. “Business variables are changing so quickly—sometimes by the minute—that by the time companies receive updates from whatever enterprise resource planning systems they use, the information is no longer relevant to the business decisions they need to make or should have made. If they want to change the game, they need to control their other real-time business variables, including their safety, their reliability and especially their operational profitability. Profit Advisor allows them to do that.”

Because current cost accounting systems only measure the financial performance of the industrial operation at the overall plant level, it is difficult for companies to truly understand the financial impact—positive and negative—operational changes have on business performance. To address that need, Profit Advisor allows plant personnel to see and understand the ROI and business value their actions, activities and assets are contributing to the business in real time. It empowers the workforce to make better business decisions with a variety of data analytics, which can be displayed in various formats, to help drive operational profitability improvements, safely.

Innovating at Every Level to Deliver Value-focused IIoT

“Our customers are struggling with many issues, including the sheer speed of business and how to manage and use emerging technology to their advantage,” said Chris Lyden, senior vice president, Process Automation, Schneider Electric. “Everyone wants to talk about all this new technology without focusing on what value it can deliver. From our perspective, the digitization of industry is a real opportunity for our customers. We’re taking a value-focused approach to IIoT because we know our ability to innovate at every level can help our customers control their productivity and profitability in real time. That’s the only reason we should be talking about IIoT to begin with.”

Profit Advisor layers real-time accounting models onto the Seeq Workbench to become a scalable, repeatable and easy-to-implement solution for multiple segments, enabling customers to both measure and control their profitability. And because it can be integrated with Schneider Electric’s simulation and modelling software in a digital twin environment, users are further enabled to forecast profitability under different conditions or if changes to the operation are made.

Overall, the software provides

- Historical Data Review: Profit Advisor can evaluate the historical performance of the plant to assess its operational profitability, helping plant personnel analyze and understand how the

operation performed during different conditions. It enables the workforce to identify true performance-improving initiatives. And since it can be tied to individual pieces of equipment, it can provide that information down to even the smallest asset in the operation.

- Real Time Performance Indication: Profit Advisor can indicate current performance and inform plant personnel when their operating decisions are making the business more profitable. Actual ROI and return on improvements will be visible, enabling plant personnel to concentrate and refine their efforts to the actions that provide the greatest financial returns. It also enables plant personnel to determine which parts of operation are constraining operational profitability and accurately estimate the business value their decisions might actually create.

- Profit Planning: Profit Advisor empowers process engineers to predict the profitability of the changes they are proposing, which will substantially minimize project risk and help to eliminate waste.

Check out this YouTube video.

Control Advisor

Schneider Electric, the global specialist in energy management and automation, has added a new enterprise-wide IIoT plant performance and control optimization software to its PES and Foxboro Evo process automation systems and Foxboro I/A Series distributed control system. Leveraging Expertune PlantTriage technology, EcoStruxure ControlAdvisor, a native smart decision-support tool, provides plant personnel actionable real-time operating data and predictive analytics capabilities so they can monitor and adjust every control loop across

multiple plants and global sites 24/7. The software empowers them to optimize the real-time efficiency of the process throughout the plant lifecycle and to contribute directly to improved business

by Gary Mintchell | Dec 9, 2016 | Automation, News, Technology, Wireless

Imagine what you could know about your plant or factory if you could get many more sensors around the area. This was the dream behind the development of robust wireless sensor networks for industrial and manufacturing applications.

Here is a new entrant bearing much promise. Swift Sensors Inc. debuted Dec. 8 as an Industrial IoT company providing a cloud-based wireless sensor system for industrial and commercial applications. The company fundamentally replaces a hodge-podge of manual processes and disparate sensors with a low-cost, unified sensor system delivering real-time actionable data — dramatically transforming business process efficiency and reliability. Swift Sensors technology monitors temperature, humidity, vibration, motion, activity, location, electric voltage and current.

“Businesses are frequently limited in their ability to efficiently monitor critical equipment and processes because of expensive, manual traditional systems. Swift Sensors extends the reach and efficiency of sensor monitoring, while offering new opportunities to enhance performance using analytics and optimization,” said Sam Cece, CEO of Swift Sensors. “Our low-cost, instant deployment allows businesses to rapidly adapt to regulatory compliance initiatives and commence predictive maintenance programs.”

Swift Sensors released its cloud wireless sensor system after 18 months of development and successful deployment with various customers, including Kraft Heinz, Sysco Foods, and McDonalds.

“We deployed hundreds of wireless sensors from Swift Sensors to upgrade our existing sensors and automate our manual monitoring processes. My team now focuses their time on important daily tasks rather than manually checking temperatures or equipment status. We’ve saved hundreds of hours in productivity during the past year and improved operations,” said William Thacker, Engineering Supervisor at the Kraft Heinz Company.

Swift Sensor’s next generation cloud wireless sensor system includes customizable real-time monitoring, alerts and analytics. The company’s mission is to improve business efficiency and reliability by making actionable data and analytics globally accessible; providing businesses a way to actively avoid disasters rather than passively waiting to remedy costly failures.

A variety of industrial, commercial and service businesses can now take advantage of Swift Sensors affordable, scalable sensor system, integrating their sensor data across multiple areas for maximum impact. Sample sectors include:

- Food chain (including FSMA compliance)

- Transportation

- Restaurants

- Industrial

- IT Data Centers

- Research & Development

- Power

Low Cost & Scalable, with Actionable Data

Swift Sensors gives companies a cost-effective way to accelerate a broad range of business goals:

- Companies place the Swift Sensors plug and play matchbook-size wireless sensors wherever they would like to capture data and insights from their physical environment.

- The sensors transmit the relevant data via either Bluetooth Low Energy (BLE) or RF to a Swift Sensors Bridge, a small appliance that connects the sensors to the secure Swift Sensors Cloud using Wi-Fi, Ethernet, and/or cellular communication.

- Administrators then utilize the Swift Sensors web-based dashboard to configure the sensor system for data monitoring and analysis from any location.

Authorized company employees use the cloud-based dashboard to access sensor data and, based on their role, sophisticated analytics using their desktop and mobile devices. Businesses can create reports and send notifications via email/SMS/phone call based on customizable thresholds.

Pricing and Availability

The Swift Sensors Cloud Wireless Sensor System is available immediately. Individual sensor and bridge appliance pricing start at $79 and $349, respectively, with a low monthly cloud subscription fee for access to the Swift Sensors Dashboard with an unlimited number of users.

Swift Sensors Founding Team

Swift Sensors was founded in May 2015 and began development immediately. The three founders are Dean Drako – Executive Chairman, Sam Cece – CEO, and Dr. Kelly Jones – CTO.

Dean Drako has founded and run several successful companies. He is best known as former president and CEO of Barracuda Networks, which he founded to solve the spam and email security problem, growing the company from a concept to become a cloud and IT security industry leader with more than $200 million in annual sales, 1000 employees, and 150,000 customers.

Sam Cece was previously CEO of Virtual Bridges and CloudTools, acquired by Nimboxx and SolarWinds respectively. As CEO of StrongMail Systems, he expanded the company’s initial customer base to hundreds of business customers; StrongMail was named to the 2012 Forrester Wave Report shortlist.

Kelly Jones was Engineering VP for Virtual Bridges/Cloudtools. Previously, he was a Director at Dell, managing technology teams supporting the majority of Dell’s operational public cloud environment and accounted for 80% of Dell’s SaaS revenue. Jones was also: VP of technology for Message One, acquired by Dell, meeting all delivery dates and achieving 99.999% service availability; founder of PANACYA, acquired by Research in Motion; and Chief Security Scientist for Computer Associates Int’l.

by Gary Mintchell | Dec 7, 2016 | Commentary, News

Here is a bold manufacturing revival proposal from someone who has been deep in strategy. I worked with John A. Bernaden in his roles with Rockwell Automation and the Smart Manufacturing Leadership Coalition. Now retired, he evidently has time on his hands to think. I saw his blog post go up before he sent me his press release.

[Disclaimer: Bernaden is retired and no longer works for either organization nor speaks for them.]

Not one to be bashful, Bernaden begins, “Wall Street’s short-sighted leadership of U.S. Manufacturing has created a crisis!”

“They reap; but they do not sow. They restructure to take billions; but they do not reinvest to make trillions. They destroy industries; but they do not build new ones,” said John A. Bernaden, co-founder and past vice chairman of the Smart Manufacturing Leadership Coalition, Inc., a Washington DC nonprofit group.

Past bipartisan 20th Century U.S. industrial policies and Congressional programs have been complacent in creating this crisis, he continued.

“We need new leadership to create and construct a new era of revolutionary, highly-automated, IT-driven, super-productive, 21st Century Smart Manufacturing with a long-term vision to make America’s manufacturing great again,” Bernaden said.

Other nations have long-term policies and long-range programs to more smartly support their manufacturers at home and abroad, he said pointing to a new “Policy Makers Guide to Smart Manufacturing” published last week by the Information Technology and Information Foundation (ITIF), a Washington DC think-tank. The report provides a comprehensive summary of the long-term Smart Manufacturing policies and long-range programs established by other governments around the world, most notably by China, Germany, Japan and Korea.

“As a leader who values building things, President-elect Trump will soon have an opportunity to smartly lead our nation’s Manufacturing, to renovate the world’s oldest factories, as well as to start a construction wave of smart new factories and plants in every State in America,” said Bernaden.

To achieve the President’s huge vision to make American manufacturing great again, Bernaden drafted a bold $2 trillion to $3 trillion U.S. Manufacturing Stimulus Package with almost no cost to taxpayers for Congress to consider that he released today.

Here is the gist of his proposal. Comments welcome, but I’d suggest making them on John’s site. I did graduate studies in political science, but I have little appetite for politics anymore. The refreshing thing about this proposal, however, is that I find even “conservative” business leaders going to Washington or their state capitals with their collective hands out wanting a gift. This proposal supposedly eschews that.

Between $2 trillion to $3 trillion from repatriated corporate wealth stranded overseas could catalyze a construction wave of between 2,000 to 3,000 new factories — highly-automated, super-productive smart plants, via a stimulus package developed by Bernaden, co-founder and past vice chairman of the Smart Manufacturing Leadership Coalition, Inc., a five-year-old Washington DC non-profit group. Disclaimer, Bernaden is no longer affiliated with either Rockwell or SMLC. This is his proposal all by himself.

Corporations that repatriate past overseas earnings and purchase 20-year USA Industrial Bonds will annually receive 1/20th of their investment totally tax-free, although at a zero interest rate. USA Industrial Bond funds will then become 20-year interest-free loans for States to use in stimulating the construction of new smart factories, mainly by midsize manufacturers.

To avoid federal or state governments picking “winners and losers” which has been a historic failing of past U.S. industrial policies, according to Bernaden, each state’s Governor will appoint 15-member commissions, chiefly consisting of manufacturing and business leaders, to make loan decisions.

State commissions will make loans that range from $500 million to $5 billion to construct smart factories, with typical costs averaging $1 billion each. If multinational corporations repatriate $2 trillion tax-free by investing in these USA Industrial Bonds, a state like Alabama’s share will be $34 billion to loan to business leaders who could construct about 34 smart manufacturing plants, according to Bernaden.

American midsize manufacturers, in a “Mittelstand” movement, are expected to construct most of these new factories because of this unprecedented access to billion-dollar-size, long-term interest-free loans. In Germany, the “Mittelstand” or midsize manufacturers, are renown as the engine of their economy. The Trump-size stimulus plan is also expected to create millions of new jobs needed to operate as well as supply, support and service these newly constructed 21st Century smart factories

[Gary talking again] I find the interesting thing about this proposal to be reference to a highly successful strategy from Germany. The US seems to venerate hugeness. In the common business mind small to medium businesses exist for the purpose of acquisition to make larger companies even larger. But this inevitably stifles innovation and competition. Things grow stagnant.

Unfortunately, I doubt that a politician exists that has a clue about the German Mittelstand. Further, none seem to have any clues about manufacturing or technology. We elect lawyers and career politicians who in many cases never worked a day in their lives building things. Prove me wrong, I dare you. [Please note: in this entire conversation I’ve not said anything about the opinion spectrum or political parties.]

Further unfortunately, I don’t find Mr. Trump to be a manufacturing guy. He negotiates deals, buys properties, builds hotels and other buildings. However, he claims true religion on helping the manufacturing guy. Here’s hoping this proposal gets a little visibility and at the least spurs some conversations around the country.

by Gary Mintchell | Nov 29, 2016 | Internet of Things, News, Operations Management, Organizations, Standards

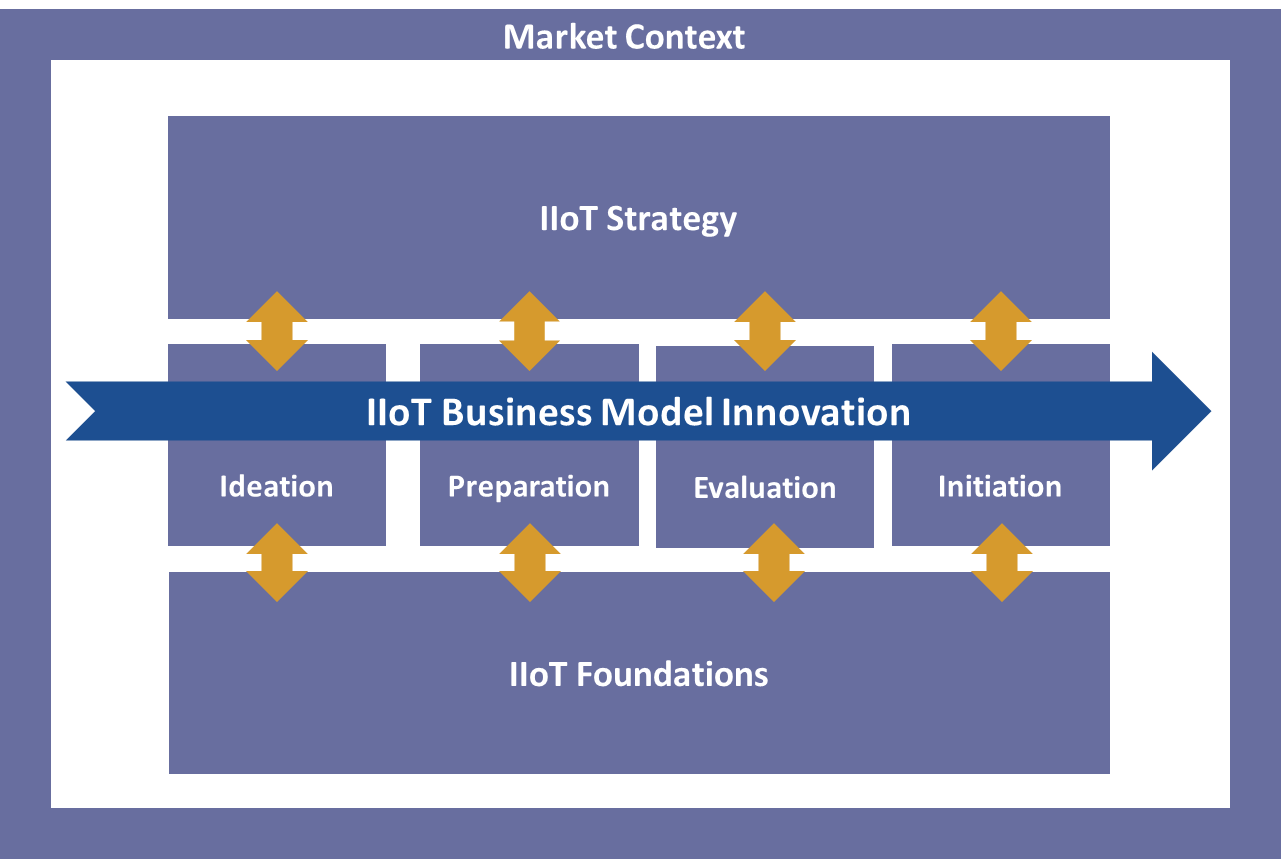

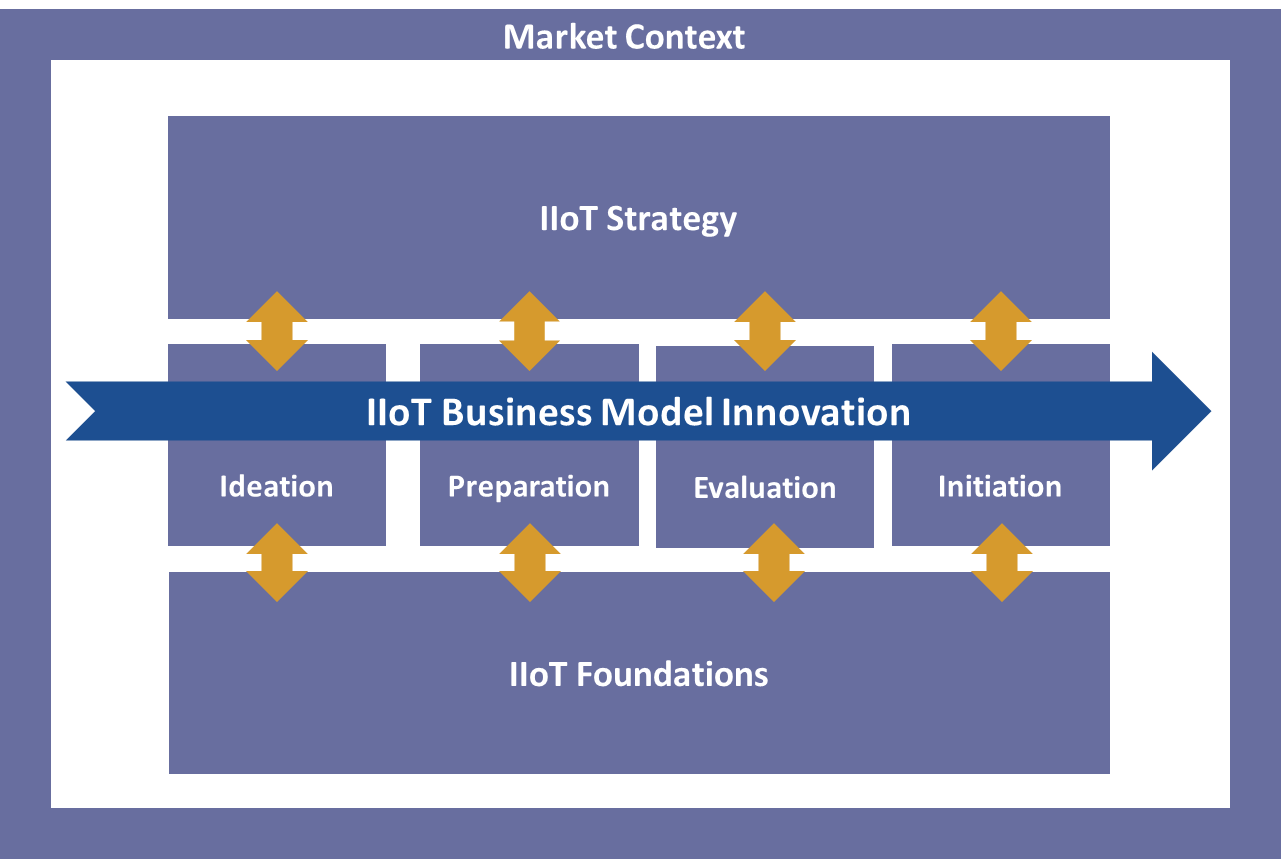

IIoT Business Model

In another advancement for the Industrial Internet of Things, The Industrial Internet Consortium (IIC), the global, member-supported organization that promotes the accelerated growth of the Industrial Internet of Things (IIoT), announced the publication of the Business Strategy and Innovation Framework (BSIF). The BSIF helps enterprises to identify and analyze issues that must be addressed to capitalize on the opportunities emerging within the IIoT.

“Everybody knows that the Industrial Internet of Things will completely transform the way that business works. What’s not clear is exactly how to deploy these new IIoT concepts to best effect,” said Jim Morrish, Chair of the Business Strategy Task Group, and Founder and Chief Research Officer, Machina Research. “What the IIC’s Business Strategy and Innovation Framework provides is a toolkit for identifying, prioritizing and initiating the deployment of those crucial IIoT initiatives. It’s a significant step forward for the IIoT industry in terms of working to capitalize on the huge opportunities presented by this new technology wave.”

The BSIF serves as a reference document for chief executives in enterprises planning to engage in IIoT concepts. A single-source compendium of the issues and challenges enterprises should consider before they deploy IIoT initiatives, the BSIF details frameworks and concepts to help enterprises increase value for users, customers and partners while at the same time helping to reduce market and technical uncertainties.

The BSIF outlines a comprehensive set of best practices for companies engaging in IIoT, but companies are free to adopt a lighter touch or use an existing internal project model, especially within smaller companies. Alternatively, a range of project support processes may already be in place and the approach documented in the BSIF may be used to enhance existing infrastructures to address new IIoT opportunities (particularly for larger companies).

“The IIC’s Business Strategy and Innovation Framework is an important industry milestone,” said Jim Nolan, EVP, IoT Solutions, InterDigital. “It offers timely, strategic guidance to the many organizations that are beginning to implement IIoT solutions.”

The BSIF is the most in-depth Industrial IoT-focused business strategy framework comprising expert vision, experience and business strategy best practices from IIC members, including Bosch Software Innovations, InterDigital, Hewlett Packard Enterprise, and Machina Research. The BSIF is available free of charge. For more information about the BSIF, click here.

The Business Strategy and Innovation Framework provides a high-level identification and analysis of issues that any enterprise will need to address to capitalize on the opportunities emerging from this current revolution that is the IIoT. This comprehensive document is a product of the Business Strategy Task Group, a strategy-focused task group within the Industrial Internet Consortium’s Business Strategy and Solution Lifecycle Working Group.

The Business Strategy and Innovation Framework describes the requirements to succeed in IIoT:

- An IIoT strategy and goals

- A structured framework to target and select the right IIoT opportunities

- A system in place to identify, assess and initiate IIoT opportunities

IIoT requires enterprises to rethink their current business models. This is necessary regardless of whether they actually adopt IIoT solutions internally: Industry is moving toward IIoT adoption, and enterprises that keep pace with this trend will undoubtedly have a strong competitive advantage.

Contributors to the Business Strategy and Innovation Framework dedicated their valuable time and expertise in authoring, editing and other ways. In particular, we would like to thank the following contributing members and their organizations:

- Veronika Brandt – Bosch Software Innovations

- Ken Figueredo – InterDigital, Inc.

- Steve Haldeman – Hewlett Packard Enterprise

- Jim Morrish – Machina Research, Chair of the Industrial Internet Consortium Business Strategy Task Group