A Stunner: ABB Acquires B+R Automation Strengthening It In Machine Automation

Wow, this one surprised me, although I’ve been pondering the automation landscape for a long time. There are two things. One is that you never know when the owners of a “mittlestand” type of company are ready to sell. The other is that ABB has been aggressively divesting rather than acquiring.

The telling comment in the press release, though, goes to the heart of what I’ve been saying about fellow European electrical and automation giant, Schneider Electric. Both have their sites set on Siemens.

Now the problem is the typical one–and a huge one. How do they integrate the companies? All three of the large European companies have had problems integrating acquisitions. We’ll look for things such as executive flight and sales growth. Will customers flock to rival Beckhoff Automation for a pure automation play. The larger pure automation play–Rockwell Automation–seems to have conceded Europe–at least for the time being.

I don’t like just republishing press releases, but in this case (since I woke up three hours after the live press conference was held), you have my analysis. Here is what ABB says:

ABB to acquire B&R

Shaping leadership in industrial automation

- Acquisition of B&R (Bernecker + Rainer Industrie-Elektronik GmbH) will close ABB’s historic gap in machine and factory automation

- Creating a uniquely comprehensive automation portfolio for customers globally

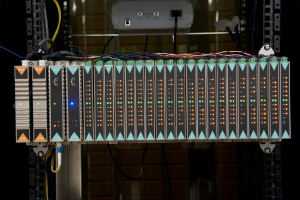

- B&R is a proven innovation leader in Programmable Logic Controllers (PLC), Industrial PCs (IPC) and servo motion-based machine and factory automation

- B&R delivered a revenue CAGR of 11% over last two decades and annual sales of >$600 million in the highly attractive $20 billion machine and factory automation market segment

- B&R’s software and Internet of Things (IoT) solutions further strengthen ABB’s digital offering, ABB Ability™

- Clear commitment to B&R’s growth strategy, mid-term sales ambition of >$1 billion

- Continuity of B&R’s management, founders support integration phase as advisors

- B&R’s headquarters in Eggelsberg, Austria, to become ABB’s global center for machine and factory automation

- Transaction funded in cash, operational EPS accretive in year one, closing expected in summer 2017

- Purchase price not disclosed, multiple in line with peer valuations

ABB announced on April 4, 2017 the acquisition of B&R, the largest independent provider focused on product- and software-based, open-architecture solutions for machine and factory automation worldwide. B&R, founded in 1979 by Erwin Bernecker and Josef Rainer is headquartered in Eggelsberg, Austria, employs more than 3,000 people, including about 1,000 R&D and application engineers. It operates across 70 countries, generating sales of more than $600 million (2015/16) in the $20 billion machine and factory automation market segment. The combination will result in an unmatched, comprehensive offering for customers of industrial automation, by pairing B&R’s innovative products, software and solutions for modern machine and factory automation with ABB’s world-leading offering in robotics, process automation, digitalization and electrification.

Through the acquisition, ABB expands its leadership in industrial automation and will be uniquely positioned to seize growth opportunities resulting from the Fourth Industrial Revolution. In addition, ABB takes a major step in expanding its digital offering by combining its industry-leading portfolio of digital solutions, ABB Ability, with B&R’s strong application and software platforms, its large installed base, customer access and tailored automation solutions.

“B&R is a gem in the world of machine and factory automation and this combination is a once-in-a-lifetime opportunity. This transaction marks a true milestone for ABB, as B&R will close the historic gap within ABB’s automation offering. This is a perfect fit and will make us the only industrial automation provider offering customers the entire spectrum of technology and software solutions around measurement, control, actuation, robotics, digitalization and electrification,” said ABB CEO Ulrich Spiesshofer. “This acquisition perfectly delivers on our Next Level strategy. With our unique digital offering and our installed base of more than 70 million connected devices, 70,000 control systems and now more than 3 million automated machines and 27,000 factory installations around the world, we enable our combined global customer base to seize the huge opportunities of the Fourth Industrial Revolution.”

“This combination offers fantastic opportunities for B&R, its customers and employees. We are convinced that ABB offers the best platform for the next chapter of our growth story. ABB’s global presence, digital offering and complementary portfolio will be key for us to further accelerate our pace of innovation and growth,” said Josef Rainer, co-founder of B&R.

“This is a strong signal for our employees as our operations in Eggelsberg will become ABB’s global center for machine and factory automation,” said Erwin Bernecker, co-founder of B&R. “The most important thing to me is that the companies and their people fit so well together and that our founding location will play such a key role.”

Complementary strengths

With the acquisition, ABB will expand its industrial automation offering by integrating B&R’s innovative products in PLC, Industrial PCs and servo motion as well as its software and solution suite. ABB will offer its customers a uniquely comprehensive, open-architecture automation portfolio.

B&R has grown successfully with a revenue CAGR of 11 % over the last two decades. Revenues more than quintupled since 2000 to more than $600 million (2015/16). The company has a rapidly growing global customer base of more than 4,000 machine manufacturers, a proven track record in automation software and solutions and unrivaled application expertise for customers in the machine and factory automation market segment.

Both companies have complementary portfolios. ABB is a leading provider of solutions serving customers in utilities, industry and transport & infrastructure. B&R is a leading solution provider in the automation of machines and factories for industries such as plastics, packaging, food and beverage. The joint commitment to open architecture increases customer choice and flexibility facilitating connectivity in increasingly digitalized industries.

Substantial investments in innovation

Innovation is at the heart of both companies. B&R invests more than 10 percent of its sales in R&D and employs more than 1,000 people in R&D and application engineering. ABB spends $1.5 billion annually on R&D and employs some 30,000 technologists and engineering specialists. Going forward, ABB and B&R will continue to invest considerably in R&D.

Automation of machines and factories is a key driver of the Fourth Industrial Revolution and the IoT. ABB will continue B&R’s strong solution-based business model and build on its deep domain expertise to develop new software-based services and solutions for end-to-end digitalization. ABB’s industry-leading digital offering, ABB Ability, will now capitalize on the large installed base, application and solution know-how, simulation software expertise and advanced engineering tools of B&R.

Proven integration approach

On closing of the transaction, B&R will become part of ABB’s Industrial Automation division as a new global business unit – Machine & Factory Automation – headed by the current Managing Director, Hans Wimmer. Both companies consider B&R’s management and employees as a key driver of future growth and the business integration together with their counterparts from ABB. The co-founders of B&R, Erwin Bernecker and Josef Rainer, will act as advisors during the integration phase to ensure continuity.

The integration will be growth-focused and live by the “best-of-both-worlds” principle, with ABB adding its own PLC and servo drive activities to the offering of the new business unit in a phased approach. ABB underlines its clear commitment to continuing the B&R growth story by articulating a mid-term sales ambition to exceed $1 billion.

ABB is committed to further investing in the expansion of B&R’s operations and to building on the company’s successful business model and brand. B&R’s headquarters in Eggelsberg will become ABB’s global center for machine and factory automation.

Austria benefits as technology and business hub

With this acquisition, ABB becomes the largest industrial automation player in Austria. ABB has operated in Austria for more than 100 years. With the strong future role, B&R and its headquarters in Austria will play as part of ABB, Austria, particularly Upper Austria, will benefit. The planned expansion of the R&D and production activities in Eggelsberg and Gilgenberg will strengthen Austria’s high-tech industrial landscape.

Transaction financials

The transaction multiple is in line with peer valuations. The parties agreed not to disclose the purchase price. ABB will finance the acquisition in cash. The transaction is expected to be operationally EPS accretive in the first year, and is expected to add significant synergies of about 8% of B&R’s stand-alone revenue in year four. The transaction is expected to close in summer 2017, subject to customary regulatory clearances.