by Gary Mintchell | May 31, 2019 | Automation, Commentary, News, Technology

The popular saying holds that the future is here just unevenly distributed. According to a survey released by PWC and The Manufacturing Institute, that thought is certainly true about the Fourth Industrial Revolution (which PwC labels 4IR but many others label Industry 4.0). This research confirms my observations that many manufacturers have projects at a variety of stages, while many others have adopted a wait-and-see attitude.

The report notes that fourth industrial revolution has been met with both enthusiasm and fence-sitting. While sentiments and experiences have been mixed, most business leaders are now approaching 4IR with a sense of measured optimism. Indeed, larger systemic changes are underway, including building pervasive digital operations that connect assets, developing connected products and managing new, real-time digital ties to customers via those products.

While manufacturers recognize the potential value of advanced technologies and digital innovation—particularly robotics, the Industrial Internet of Things (IIoT), cloud computing, advanced analytics, 3D printing, and virtual and augmented reality—they are still deliberating how and where to invest and balancing the hype with their own level of preparedness. Meanwhile, they’re also well aware of the significant changes 4IR will bring to a new manufacturing workforce—that is, one that is increasingly symbiotic and increasingly beneficial for many workers and manufacturers alike.

This narrative is reflected in a new survey of US-based manufacturers carried out by PwC and The Manufacturing Institute, the workforce and thought leadership arm of the National Association of Manufacturers. We see a definitive—and, indeed, inevitable—shift to 4IR as companies seek to integrate new technologies into their operations, supply chain, and product portfolio. At the same time, they acknowledge that scaling, justifying 4IR investments, and dealing with uncertainty surrounding use cases and applications usher in a new set of challenges.

Some key survey findings include:

• While the sector as a whole is making assertive forays into 4IR, many manufacturers still inhabit the awareness and pilot phases. Nearly half of manufacturers surveyed reported that they are in the early stages of a smart factory transition (awareness, experimental, and early adoption phases).

• Manufacturers do expect the transition to accelerate in the coming years—73% are planning to increase their investment in smart factory technology over the next year.

• While we see a number of fence-sitters, the bulk of manufacturers are indeed prioritizing 4IR, the digital ecosystem, and emerging technologies. 31% report that adopting an IoT strategy in their operations is “extremely critical” while 40% report that it’s “moderately critical.”

• About 70% of manufacturers say the biggest impacts of robotics on the workforce in the next five years will be an increased need for talent to manage in a more automated, flexible production environment and the opening of new jobs to engineer robotics and their operating systems.

…While adopters have identified clear signs of success. Though most manufacturers are still climbing the 4IR adoption curve—albeit at different speeds—those that have made progress are reporting a modicum of performance boosts measured by productivity gains, reduced labor costs, new revenue streams from IoT-connected products and services, as well as improved workforce retention and worker safety. Those that have effectively defined their use cases with a focus on outcomes rather than technology are seeing early wins, and are looking for ways to generate even more value.

The Takeaway

Manufacturers are seeking to balance 4IR hype and reality. And most acknowledge that sitting back and waiting for the inevitable may not be an option.

The road may be longer than the hype would have companies believe, but preparing for and embracing change is a muscle many of today’s manufacturers are ready to flex. Those that can build on their ad hoc pilots and prioritize investments and strategies with their long-term desired business outcomes will be better positioned to create lasting value for their organization.

by Gary Mintchell | Oct 29, 2018 | Commentary, News

Merger and Acquisition (M&A) activity in the industry segment I cover seems to have been hot for some time. I, along with others dependent upon the strength of the industry like say magazine media companies, view market consolidation as having the potential for decreasing revenues. Fewer companies makes for a less vibrant marketplace. Just take a look at the size of the magazines covering controls and automation these days.

Although this report covers a much broader segment than controls and automation, I always study the quarterly PwC M&A report carefully. And here is Q3 2018.

Global industrial manufacturing M&A results for Q3 2018 experienced a significant pull back in deal value from the Q2 2018 historic high with aggregate disclosed value of $11.7 billion, which is a 73% decrease quarter on quarter and a 52% decrease compared to the three-year quarterly average. The most recent quarter is directionally consistent with the 42% decrease seen in global cross-sector M&A deal value from Q2 2018. Since PwC’s last publication, the US administration has taken steps to implement tariffs on imported goods and a trade war has ensued. The uncertainty around how this will affect the M&A landscape more heavily weighed on industrial manufacturing than other sectors this quarter.

Looking at deal volume, there were 477 deals announced in Q3 2018 compared to 612 deals announced in Q2 2018, a 22% decline. The three-year average number of announced deals was 624 to which the 3Q 2018 results represent a 23% decline.

Worldwide cross-sector and industrial manufacturing deal making had been humming along with five and four consecutive quarters of deal value growth, respectively, prior to Q3 2018. The question remains if this contractionary quarter is the beginning of a trend or just a pause in action resulting from uncertainty in the economic, regulatory, and political environments.

Key trends/highlights

- Total aggregate disclosed deal value sank 73% to $11.7 billion in Q3 2018, a 52% drop compared to the three-year quarterly average of $24.2 billion and a 73% decrease from Q2 2018 of $42.9 billion.

- Total deal volume decreased to 477 deals in Q3 2018, a 23% drop compared to the three-year quarterly average of 624 deals and a 22% decrease from the 612 announced deals in Q2 2018.

- There was $78.9 billion of deal value announced for the first nine months of 2018 compared to $60.4 billion for the same period of 2017, a 31% increase.

- There were 1,738 deals announced for the first nine months of 2018 compared to 1,906 deals for the same period 2017, a 9% decrease.

- A $1.2 billion merger was the largest deal announced in the quarter.

by Gary Mintchell | Feb 7, 2018 | Commentary, News

Quick, when you think of self-driving cars and trucks and other news of autonomous vehicles, what comes to mind? OK, maybe an unfair question today given the Waymo v Uber lawsuit trial that began yesterday. But most of us think in terms of passenger cars rather than industrial uses.

PwC worked on a study and Bobby Bono (pictured), Carolyn Lee, and Todd Benigni all of PwC wrote a blog post, Can you be a first mover in industrial mobility? discussing the investment in manufacturing outdistancing the investment in passenger vehicles.

PwC Bobby Bono

When it comes to self-driving vehicles, passenger cars may grab most of the headlines, but they aren’t capturing most of the investment in the space. According to a PwC analysis, of the $6.8 billion raised by autonomous-transport startups since 2012, about 62% has gone to companies working on technology for vehicles ranging from drones to unmanned forklifts and tractor-trailers, all pieces of the larger ecosystem of industrial mobility.

Significantly, these investments in the pioneers of industrial mobility have been accelerating in recent years. From 2012 to 2014, companies working on automobiles received about as much investment ($660 million) as those building non-auto solutions ($702 million). But from 2015 to 2017, non-auto investment increased five-fold to $3.5 billion, while investment in companies working on tech for passenger cars rose a comparatively modest 188% to $1.9 billion.

Why does this matter? The rapid growth in capital pouring into startups working on industrial mobility reveals that hefty bets are being placed on the prospect that the impact of autonomous vehicles may well first made more forcibly upon industrial applications – even as self-driving passenger cars continue to capture consumers’ imagination.

Attitudes toward self-driving trucks are a good example of this cautious approach. Nearly two-thirds of respondents in the survey said they’ll wait and see how the technology evolves before adopting it. That’s especially interesting, given that most all survey respondents estimated that autonomous trucks could slash transportation costs by up to 25%. In a nutshell: they see the potential, but aren’t quite ready to jump in.

Cost is arguably the most important factor keeping manufacturers on the sidelines. The high cost of autonomous technology was the most frequently cited barrier to adoption in our survey, with nearly six in 10 respondents identifying it as a hurdle. At the same time, 86% said advanced industrial mobility’s ability to deliver a cost advantage was among the factors most likely to prompt them to embrace the technology.

With investment in industrial mobility surging, it’s a fair bet that businesses may see autonomous technology’s value proposition start to seem more attractive (and proven) sooner rather than later. And, it only stands to reason that some early adopters – and the early-stage companies developing the technology they implement – will score a competitive edge while their peers loiter on the sidelines.

by Gary Mintchell | Oct 31, 2017 | Commentary, News

I was putting together this piece on mergers and acquisitions when I received word that Emerson had been in conversations to acquire Rockwell Automation. Final price was $27.5 billion. That wasn’t sweet enough. The Rockwell board turned it down.

Note: I feel vindicated. I told an investment company once that they could never touch Rockwell with their war chest of $1 billion. Figured I was safe on that one.

I don’t see Rockwell as wanting to sell. Despite a friend telling me for 15 years that it had to sell, I just never saw that necessity. But I do think that consolidation is rampant in the industry right now. Schneider Electric and ABB have been acquiring strategic companies to compete with Siemens. An Emerson / Rockwell combination would have awesome market share.

Because of weaknesses elsewhere, I’m not sure either really needs the deal to survive. But I think the industry is coming to that point. My thoughts were that the most logical suitors for Rockwell were Emerson and ABB. Sources at ABB have told me that they did the evaluation (of course) and figured that Rockwell would be hard to digest. So, it went with B+R Automation.

My feeling is that this deal is not finished. But it will settle for a while until Rockwell’s share prices stabilize. Then we’ll see. Trying to integrate that Rockwell culture would be a supreme challenge for the best managers, though. It’ll be interesting.

Meanwhile, I received a quarterly update from PwC regarding global industrial manufacturing deals with disclosed values greater than $50 million.

What follows is from the PwC report.

Industrial manufacturing M&A results for Q3 2017 displayed much of the same as the previous quarter with relatively flat value and volume levels. Deal value came in at $16.5 billion while the number of deals announced were 57 compared to 55 in Q2 2017.

Cross sector global and US deal volume has modestly increased for the third consecutive quarter indicating the appetite to seek out M&A plays is still active and healthy. US cross-sector deal volume is substantially up for the first nine months of 2017 vs. 2016 which correlates with

the double digit volume increases seen in the industrial manufacturing sector over the same period.

Although there is an eagerness to investment in technology and innovation, industrial manufacturing remains somewhat risk-averse, especially as it relates to targeting larger size investments. As highlighted in our second quarter report, the slowness of implementing

trade, regulatory and tax reform in the US and the uncertainty of its implications continues to be a barrier to some. Conversely, others have accepted its existence and shifted their investment strategies to mitigate against these uncertainties.

• Deal value for the first nine months of 2017 was $52.6 billion, 18% lower than the first nine months of 2016, while deal volume saw an increase from 150 deals to 170 deals from the first nine months of 2017 vs. 2016.

• Deal value for Q3 2017 was $16.5 billion compared with $16 billion in Q2 2017. Deal volume increased slightly from 55 deals in Q2 2017 to 57 deals in Q3 2017, a 4% increase.

• The average deal size in Q3 2017 was 21% lower than the 2017 YTD quarterly average of $367 million, indicating a preference towards smaller transactions.

• There were four megadeals (deals greater than $1 billion) in Q3 2017 with an aggregate transaction value of $7.7 billion. Three of the deals were crossborder deals.

• The largest deal announced in Q3 2017 was the Swiss firm ABB acquisition of US-based GE Industrial Solutions for $2.6 billion.

• Asia and Oceania remains the most active region, accounting for 56% and 35% of M&A deal volume and value during Q3 2017.

• There were 14 megadeals announced in the first nine months of 2017 ($24.3 billion) compared to 17 in the same period of 2016 ($55.9 billion).

• Seven of the top ten megadeals in the first nine months of 2017 include China or the US as a part of the transaction vs. four over the same period in 2016.

Strategic investors continue to account for the largest share of deal activity in the sector with $12.9 billion of value and 27 deals for the quarter. As shown below, this reflects 78% of value and 65% of volume. Financial investor deal value for the first nine months of 2017 was $15.9 billion vs. $12.8 billion over the same period in 2016. This contribution is consistent with previous quarters and implies the market is more attractive for companies who can create synergies.

Deal value in the industrial manufacturing sector continues to be constrained as deal makers are still wary of the current investment playing field. Many of the same political uncertainties, particularly in the US and Europe, linger and have been the primary influence in declining average deal size over the last three quarters of 2017.

For foreign investors looking to capitalize on attractive businesses in the US there are positive and negative factors simultaneously working against one another. On the positive side, the Federal Reserve sees confidence in the US economy and plans to gradually continue to increase the federal funds rate. However, negative influencing the deals environment is the current administration’s inability to progress its agenda related to tax, trade, and healthcare.

We project the industry will close out the year in similar fashion to each of the three quarters of 2017 unless we see a catalyst event in the market such as tax reform.

Authors

Paul Elie, US Industrial Manufacturing Deals Leader

Bobby Bono, US Industrial Manufacturing Leader

Barry Misthal,Global Industrial Manufacturing Leader

by Gary Mintchell | Jan 16, 2017 | Commentary, News

PwC just sent over its latest Industrial Manufacturers forecast survey—Q4 Manufacturing Barometer. PwC surveyed US industrial manufacturers on their sentiment in the fourth quarter of last year, and one thing was clear – optimism regarding the prospects of the U.S. economy surged in Q4. This was due to an improved outlook by industrial manufacturers, citing higher company forecasts and increased capital spending plans.

Economic Sentiment Shifts Upward as Industrial Manufacturers Forecast Higher Growth Rates Ahead

Optimism regarding the prospects of the U.S. economy surged in our fourth quarter Manufacturing Barometer survey, as industrial manufacturers pointed to an improved outlook, including higher company revenue forecasts and increased capital spending plans. The renewed sense of optimism regarding the direction of domestic commerce raises the question of whether an inflection point has taken place in attitudes among industrial manufacturers. The overall rise in economic sentiment occurred despite continued uncertainty regarding the state of the global economy.

Attitudes concerning the domestic economy soar

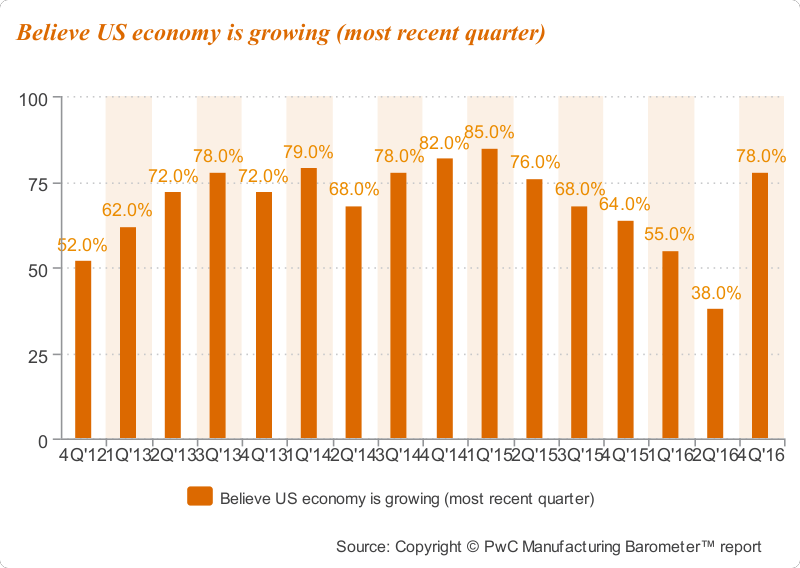

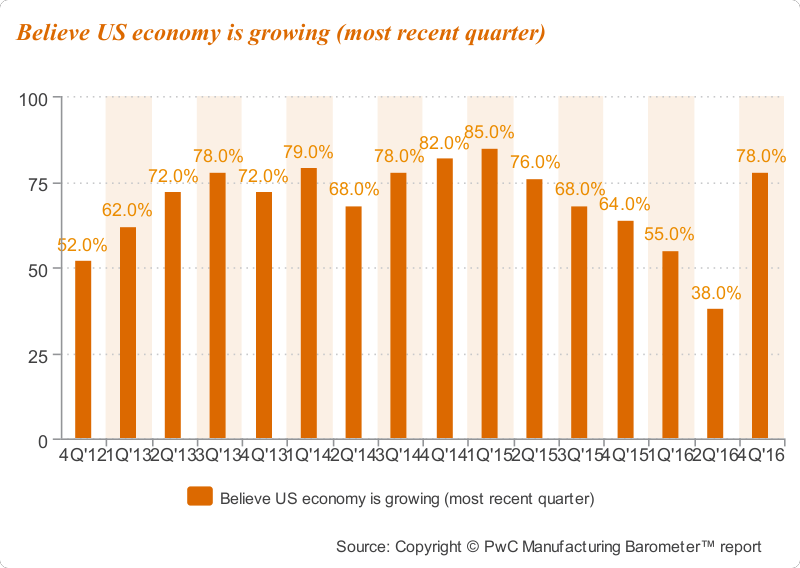

Highlighting the positive findings, 78 percent of the survey respondents believed the domestic economy was growing. This elevated level of sentiment is a dramatic increase from only 38 percent two quarters ago, representing an increase of 40 points. These levels were only 14 to 16 points below the highs of 94 percent back in the second quarter of 2004 and 92 percent in the first quarter of 2006. Moreover, optimism about the domestic economy’s prospects over the next 12 months rose, increasing to 57 percent, up from 35 percent two quarters, a notable 22-point gain.

While international sentiment remains depressed

Conversely, these same industrial manufacturing panelists remain consistently low in their outlook for the world economy. Only 13 percent cited growth in the fourth quarter of 2016, down from 20 percent at mid-year. Their level of optimism about the world economy’s prospects over the next 12 months was only 30 percent, largely in line with the 29 percent level two quarters ago. The majority, 54 percent, remained uncertain, while 16 percent were pessimistic. These numbers tell us that the persistent dichotomy between perceptions of the health of the domestic and worldwide economies has not only lingered among industrial manufacturers, but has become even more dramatic. As prospects for U.S. commerce improve, continued uncertainty regarding the global stage has kept a lid on overseas sentiment.

Company revenue forecasts increase

On the heels of the increase in domestic economic sentiment, industrial manufacturers also raised their forecasts regarding average own-company revenue growth to 4.6 percent, up considerably from 3.6 percent a year ago, with 85 percent of industrial manufacturers expecting positive growth in 2017, and only 4 percent expect negative or zero growth. It is also important to note that a consistency in their expected revenue contribution from international sales to total revenues remained high at 33 percent, despite their general feelings of uncertainty toward the world economy.

Leading to a plan to increase spending

The increased level of optimism regarding the domestic economy supported an uplift in forecasted spending over the next 12 months among industrial manufacturers. Plans for increased capital spending rose to the 60 percent level, close to the manufacturing panel’s high of 67 percent in the fourth quarter of 2011. Increased budget spending was also found for most areas, led by new products or service introductions, 67 percent, up 23 points from a year ago. Still, the capital spending forecasts represented only 2.2 percent of projected sales. In addition, plans for new hiring remained fairly stable at 35 percent, compared to 32 percent two quarters ago, and down from 42 percent in the fourth quarter of 2015.

While headwinds to growth remain the same

Headwinds to growth over the next 12 months remained consistent, led by monetary exchange rate barriers (48 percent), lack of demand (43 percent), and legislative/regulatory pressures (43 percent).

Sentiment points to a brighter future for industrial manufacturers

We certainly welcome the renewed sense of optimism regarding the domestic economy uncovered in our fourth quarter survey. Expectations for higher growth and increased investment spending bode well for the year ahead. The U.S. remains the bright spot in a persistently challenged and uncertain global economy. Time will surely tell if we have entered an inflection point in the industrial manufacturing sector.