by Gary Mintchell | Nov 7, 2019 | News

Several companies send a variety of economic research data. I appreciate a broad view of what’s happening in the world even though we are in a period where many think nations can survive alone (note: check your history; hard to find a time that didn’t exist without international trade).

The Bloomberg New Economy Forum launched a first-of-its-kind index, covering 114 economies accounting for 98% of global GDP. The New Economy Drivers and Disrupters Report introduces a new benchmark that for the first time measures competitiveness against the new disruptive forces sweeping the global economy: automation, digitization, climate change, protectionism, and populism.

“In the New Economy, traditional ways of measuring competitiveness no longer tell the whole story. From protectionism to climate change, new disruptive forces are upending assumptions about how economies grow, and reshuffling the pattern of winners and losers. This report brings transparency to the obstacles economies face, showing who is positioned for success, and who is not,” said Tom Orlik, Chief Economist, Bloomberg Economics.

Bloomberg defines the New Economy as the shift in global economic power, from the traditional seats of power in Europe and North America to emerging economies spanning Asia, Africa, the Middle East and Latin America. The New Economy Drivers and Disrupters Report highlights the complex challenges that come with this shift in power, and concludes that the new economies are poorly positioned for the new disruptive forces. The ‘catch up’ process – which has defined the global economy for the last 50 years, with low-income economies narrowing the gap with high-income – isn’t over. It will become more complicated.

Key findings from the report include:

● The next stage of China’s development will be harder than the last: On the traditional drivers of development, China outperforms most economies. With rapid modernization of infrastructure, advances in education, and investment in research and development, it’s the fourth ranked overall and the highest ranked emerging market. On the disruptive forces reshaping the world economy, from protectionism to climate change, it’s much less well positioned, ranking 50th.

● In terms of economic opportunity, India today looks similar to China at the beginning of its boom: Favorable demographics and a far reaching reform agenda have the potential to super-charge growth. However, there is a barrier to rapid development – the country is even more exposed to disruptive forces than China, as it is ranked 80th. In an age of disruption, late developers will have a more difficult time in catching up.

● Vietnam and Asia’s fourth wave: In Asia, exporting has been the path to prosperity. First Japan, then Korea, then China grew by leveraging their low labor costs to claim global market share. Vietnam has the potential to be part of the fourth wave of development. With a global tilt toward protectionism, however, the export path to prosperity is becoming more difficult to follow. Vietnam ranks 73rd on disrupters.

● Loose BRICS: For more than a decade, the BRICS (Brazil, Russia, India, China and South Africa) have embodied hopes for emerging market economies. Bloomberg’s Index shows that, with the exception of China, they have yet to deliver on their potential. With work still left to do on optimizing traditional drivers of development, the BRICS will have additional difficulty managing the coming disruptive forces of the new economy.

● Disrupting the Advanced Economies: For major advanced economies, the right policy response to disruptive forces will make the difference between extending prosperity and slumping growth. In the U.K., breaking ties with the world’s biggest trade zone could cost 7% of GDP over the next ten years. In the U.S., an immigrant-enhanced workforce and trade-boosted gains in productivity could support annual GDP growth at 2.7% in the next decade. Without them, growth could slump to 1.4%. Germany and Singapore showcase the capacity of high-income countries to manage disruptive forces. Singapore tops our rankings on the digital economy. Germany’s strong institutions and highly educated workforce provide a bulwark against risk.

About New Economy Drivers and Disruptors Report

The New Economy Drivers and Disrupters Report evaluates 114 economies on two sets of metrics. One captures the traditional drivers of development, while the other captures exposure to the disruptive forces creating new risks and opportunities in the new economy. The drivers consist of a composite gauge of productivity, projected growth in the labor force, the scale and quality of investment, and a measure of distance from the development frontier. The disrupters gauge economies’ positions in relation to populism, protectionism, automation, digitization and climate change.

The indices were developed by Tom Orlik, Scott Johnson, and Alex Tanzi of Bloomberg Economics, drawing on data from official, academic, and market sources. Michael Spence, Nobel laureate in economics, advised on the report.

The report includes a series of interactive data visualization graphics that show how economies are positioned relative to their peers, along with the rankings based on the drivers and disrupter metrics. Case studies include:

· “A Rare Trade-War Winner, Vietnam Struggles to Keep its Gains”

· “Chinese Micro Loans Open Window for Small Firms – And More Debt”

· “Climate Change Leaves Zambia Struggling to Keep the Lights On”

· “Poland’s Struggle to Find Workers Leaves Businesses in a Bind”

A series of subsequent case studies will launch weekly leading up to the New Economy Forum.

The New Economy Drivers and Disrupters Report is a proprietary report created by Bloomberg Economics for the New Economy Forum. The forum, co-hosted by Bloomberg and the China Center for International Economic Exchanges is being held in Beijing on November 20-22, 2019, bringing together the world’s most influential business leaders and government officials from more than 60 countries to drive public-private partnerships and action. New economy leaders will convene in China to address the forces of disruption challenging the new economy and catalyze solutions that impact change.

by Gary Mintchell | Dec 19, 2017 | Commentary, News

Is it any wonder about the wisdom of dropping my graduate work in political science while returning to manufacturing and technology?

Try these pieces of obfuscation this week from Washington.

The big tax cut and simplification bill turns out not to simplify anything. Manufacturing organizations sending information to me believe it offers financial rewards to companies who keep workers offshore. Many of us will see little or no tax cut. Do you ever wish like I do that people would mean what they say and say what they mean?

This from FACT. A letter to Congress persons.

On behalf of the Financial Accountability and Corporate Transparency Coalition (FACT) Coalition, we write to urge you to oppose H.R.1, the Tax Cuts and Jobs Act (TCJA). This bill would create significant new tax incentives to move U.S. jobs, profits, and operations overseas, while exploding the deficit. The bill’s complicated structure also creates multiple new loopholes to allow for expanded tax avoidance by large, multinational companies at the expense of small businesses and wholly domestic companies.

The FACT Coalition is a non-partisan alliance of more than 100 state, national, and international organizations working toward a fair tax system that addresses the challenges of a global economy and promoting policies to combat the harmful impacts of corrupt financial practices.[1]

The final conference bill would move the country to a territorial tax system. The primary goal of a territorial system is to permit offshore corporate profits to escape U.S. tax. Taxpayers already lose an estimated $100 billion every year to aggressive tax avoidance by multinational companies.[2] These changes would further incentivize corporate profit shifting abroad — leaving regular taxpayers to pick up the tab.[3]

This is an item from Sara Fischer writing in the Axios Media Trends Newsletter.

Why it matters: Multi-billion-dollar deals — along with regulatory changes such as the repeal of net neutrality rules — are often justified as ways to spur innovation and increase consumer choice, but consumer advocates argue the actions could actually make access to some popular content more expensive. The real question: Is choice at the expense of price really giving consumers what they want?

Those of us who have been around the block a few times know a couple of things. 1) Big companies don’t really innovate—they acquire smaller innovative companies to develop their portfolios. 2) Industry consolidation (mergers) occur during a period when innovation runs out of energy and companies are beginning to fail. What we’re waiting for is the new innovation area.

Climate, Environment, Business

As politicians debate political theory—most likely with an eye toward electoral votes—regarding environmental policy, businesses have long ago discovered that a sound environmental policy reduces costs and improves operations. Try this item from Axios Generate’s Ben Geman.

Coal and climate tussle: Mining giant BHP said Tuesday that it plans to abandon the World Coal Association, and may also leave the U.S. Chamber of Commerce over differences on climate policy, including the Chamber’s opposition to pricing carbon and its attacks on the Paris climate deal. BHP’s newly published review of its membership in trade associations is here. Quick take, via the Financial Times: “The move reflects the growing importance of environmental, social and governance standards within multinationals, which want to protect their brands and insulate themselves from threats posed by activists and consumer boycotts.”

Just for fun.

Here’s one Fun Thing gleaned from the latest Axios newsletter.

Listening to Mozart is said to raise your IQ. Does playing his music make you a better employee? AP’s David McHugh answers from Frankfurt:

- “Definitely so, say many global companies and their workers, above all in Germany and Asia, where accountants, engineers, sales reps and computer specialists bring violins, cellos, oboes and trombones and gather in their spare time to rehearse and perform lengthy, complex pieces of classical music.”

- “A conspicuous number of big German corporate names — along with a handful in Japan and Korea — have their own company-linked symphony orchestra.”

- Why it matters: “The orchestras serve as public relations tools, playing charity concerts and livening up corporate events. … [And] a symphony orchestra is an excellent model for the creative teamwork companies need to compete.”

Well, we have the people from Emerson Automation playing rock and roll at every Exchange these days. Time to pick up that guitar again.

by Gary Mintchell | Jan 16, 2017 | Commentary, News

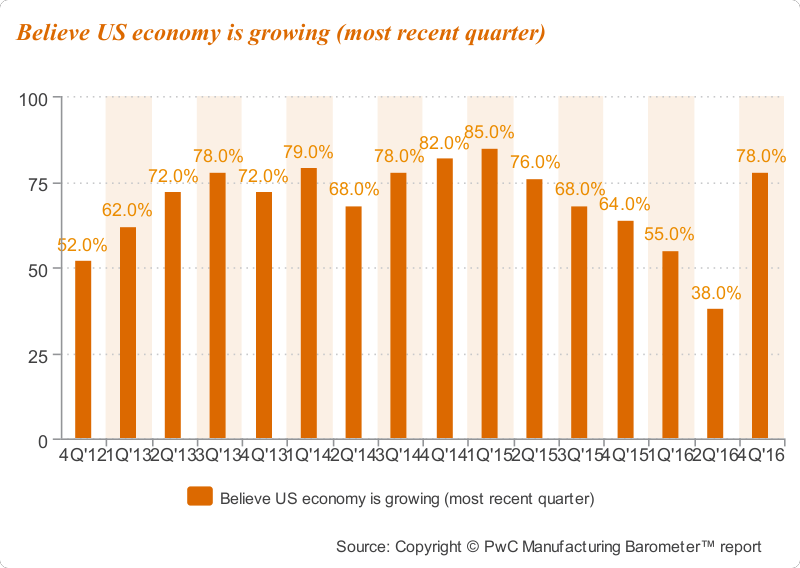

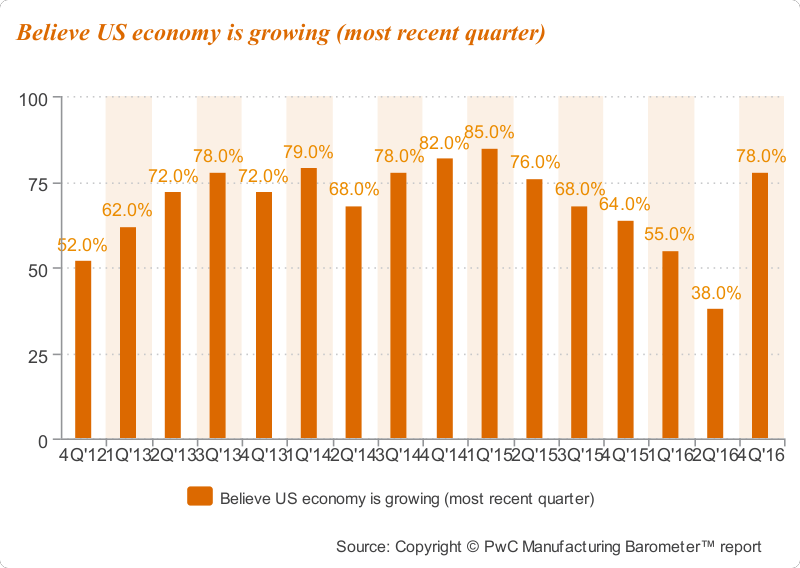

PwC just sent over its latest Industrial Manufacturers forecast survey—Q4 Manufacturing Barometer. PwC surveyed US industrial manufacturers on their sentiment in the fourth quarter of last year, and one thing was clear – optimism regarding the prospects of the U.S. economy surged in Q4. This was due to an improved outlook by industrial manufacturers, citing higher company forecasts and increased capital spending plans.

Economic Sentiment Shifts Upward as Industrial Manufacturers Forecast Higher Growth Rates Ahead

Optimism regarding the prospects of the U.S. economy surged in our fourth quarter Manufacturing Barometer survey, as industrial manufacturers pointed to an improved outlook, including higher company revenue forecasts and increased capital spending plans. The renewed sense of optimism regarding the direction of domestic commerce raises the question of whether an inflection point has taken place in attitudes among industrial manufacturers. The overall rise in economic sentiment occurred despite continued uncertainty regarding the state of the global economy.

Attitudes concerning the domestic economy soar

Highlighting the positive findings, 78 percent of the survey respondents believed the domestic economy was growing. This elevated level of sentiment is a dramatic increase from only 38 percent two quarters ago, representing an increase of 40 points. These levels were only 14 to 16 points below the highs of 94 percent back in the second quarter of 2004 and 92 percent in the first quarter of 2006. Moreover, optimism about the domestic economy’s prospects over the next 12 months rose, increasing to 57 percent, up from 35 percent two quarters, a notable 22-point gain.

While international sentiment remains depressed

Conversely, these same industrial manufacturing panelists remain consistently low in their outlook for the world economy. Only 13 percent cited growth in the fourth quarter of 2016, down from 20 percent at mid-year. Their level of optimism about the world economy’s prospects over the next 12 months was only 30 percent, largely in line with the 29 percent level two quarters ago. The majority, 54 percent, remained uncertain, while 16 percent were pessimistic. These numbers tell us that the persistent dichotomy between perceptions of the health of the domestic and worldwide economies has not only lingered among industrial manufacturers, but has become even more dramatic. As prospects for U.S. commerce improve, continued uncertainty regarding the global stage has kept a lid on overseas sentiment.

Company revenue forecasts increase

On the heels of the increase in domestic economic sentiment, industrial manufacturers also raised their forecasts regarding average own-company revenue growth to 4.6 percent, up considerably from 3.6 percent a year ago, with 85 percent of industrial manufacturers expecting positive growth in 2017, and only 4 percent expect negative or zero growth. It is also important to note that a consistency in their expected revenue contribution from international sales to total revenues remained high at 33 percent, despite their general feelings of uncertainty toward the world economy.

Leading to a plan to increase spending

The increased level of optimism regarding the domestic economy supported an uplift in forecasted spending over the next 12 months among industrial manufacturers. Plans for increased capital spending rose to the 60 percent level, close to the manufacturing panel’s high of 67 percent in the fourth quarter of 2011. Increased budget spending was also found for most areas, led by new products or service introductions, 67 percent, up 23 points from a year ago. Still, the capital spending forecasts represented only 2.2 percent of projected sales. In addition, plans for new hiring remained fairly stable at 35 percent, compared to 32 percent two quarters ago, and down from 42 percent in the fourth quarter of 2015.

While headwinds to growth remain the same

Headwinds to growth over the next 12 months remained consistent, led by monetary exchange rate barriers (48 percent), lack of demand (43 percent), and legislative/regulatory pressures (43 percent).

Sentiment points to a brighter future for industrial manufacturers

We certainly welcome the renewed sense of optimism regarding the domestic economy uncovered in our fourth quarter survey. Expectations for higher growth and increased investment spending bode well for the year ahead. The U.S. remains the bright spot in a persistently challenged and uncertain global economy. Time will surely tell if we have entered an inflection point in the industrial manufacturing sector.

by Gary Mintchell | Jan 7, 2016 | Commentary, News

Just in from PwC–results of its latest manufacturers survey. And it sort of fits with this week’s stock market news–not all that optimistic right now.

Sentiment regarding the direction of the domestic economy moderated further among U.S. industrial manufacturers, according to the Q4 2015 Manufacturing Barometer, released by PwC US today. A number of factors ranging from concerns about the global economy, particularly China, to the impact of the strong dollar and weak energy prices, have prompted manufacturers to reign in growth forecasts, while taking a more measured approach to hiring and capital spending outlays.

During the fourth quarter of 2015, optimism regarding the direction of the domestic economy over the next 12 months dropped to 46 percent from the prior quarter’s 60 percent, and 22 points below a year ago (68 percent). This represented the lowest level of optimism since 37 percent was recorded in the third quarter of 2012. Looking at the world stage, only 27 percent of industrial manufacturers expressed optimism regarding the global economy over the next 12 months, 11 points below a year ago (38 percent).

As a result of the decreased economic sentiment, the projected average revenue growth rate over the next 12 months among panelists declined to 3.6 percent, representing a significant deceleration from the prior quarter’s 5.3 percent. The benchmark represented the lowest revenue growth rate since three percent was recorded in the first quarter of 2011. Despite the lower rate, 70 percent of panelists still expect positive revenue growth for their own companies in the year ahead, with the majority (65 percent) forecasting single-digit growth.

“Sentiment among U.S. industrial manufacturers decelerated in the fourth quarter, primarily reflecting the uncertain outlook for the global environment,” said Bobby Bono, PwC’s U.S. industrial manufacturing leader. “The overall economic picture has become more complex as management teams navigate slower growth in China, coupled with a stronger dollar and weak energy prices. Nearly one-third of annual revenue among survey panelists is derived internationally, reflecting the significant exposure of domestic industrial manufacturers to the world economy. Turning more cautious, they are prudently dialing back on the overall level of capital spending and hiring as they prepare to transition to a more challenging business climate. However, a healthy majority still anticipate revenue growth, albeit at a more moderate pace, in the year ahead.”

Barriers to Growth and Challenges

Looking at perceived barriers to growth, monetary exchange rate has become the leading headwind over the next 12 months, up 11 points sequentially to 49 percent in the fourth quarter. A year ago, it was 15 percent, 34 points lower. Other barriers included lack of demand (39 percent), oil/energy prices (32 percent), decreasing profitability (29 percent) and legislative/regulatory pressure (22 percent). In addition, competition from foreign markets rose to 22 percent, up 10 points from the previous quarter.

PwC also surveyed respondents on the most prominent challenges in preparing for the year ahead. At the top of the list was the condition of the world economy, which was cited by 80 percent of respondents, while 67 percent rated it as a top-three issue. This was significantly higher than the last time this special survey was conducted in 2011. At that time, only 64 percent cited the condition of the world economy and only 18 percent listed this challenge among the top-three. Conversely, 71 percent of panelists flagged higher costs of goods and services as a major challenge, down from 92 percent in 2011. Additional major challenges cited by panelists included greater opportunities for new product and service introductions (67 percent), increased price flexibility (62 percent) and strength of the US dollar (53 percent).

Hiring

As a result of the pullback in growth forecasts, manufacturers have continued to take a more conservative approach to hiring. In total, 42 percent plan to add employees to their workforce over the next 12 months, up from the low of 37 percent in the third-quarter of 2015, but down from 60 percent reported a year ago. The total net workforce growth projection was flat this quarter, below last year’s 1.1 percent, indicating continued cutbacks in hiring among these manufacturing firms.

Among the 42 percent of panelists planning to hire within the next 12 months, the most sought-after employees will be blue collar/skilled labor (29 percent) and professionals/technicians (27 percent). Among professionals/technicians, hiring of technology/engineering employees led the way, while hiring in the blue collar category was split between skilled/specialized workers and semi-skilled workers.

“Industrial manufacturers are continuing to seek avenues to improve productivity, while favoring professionals with strong technical skills,” Bono added. “In a slower growth environment, management teams appreciate the benefits of staying lean while ensuring they have the right talent to harness continued advances in engineering, technology and supply chain management.”

Spending

The tempered global outlook has also served to moderate the total level of capital spending plans among U.S. industrial manufacturers. They are continuing to spend, but they are spending less. Overall, 49 percent plan major new investments of capital during the next 12 months, up from the prior quarter’s 37 percent, and above last year’s 43 percent. However, the mean investment as a percentage of total sales dropped to 1.9 percent, sharply down from last quarter’s 5.6 percent and the 3.3 percent a year ago.

Conversely, 86 percent of respondents plan to increase operational spending over the next 12 months, up four points from both the previous quarter and the comparable period last year. Leading categories were new product or service introductions (44 percent), research and development (41 percent), business acquisitions (34 percent) and information technology (36 percent). “Given the prospects for a less robust economic climate, management teams continue to focus on investing in what they do best, while fostering innovation in an effort to strengthen their competitive positions,” Bono added.

by Gary Mintchell | Nov 13, 2015 | Commentary, News

Merger and acquisition (M&A) activity in the industrial manufacturing industry showed continued strength in the third quarter of 2015, with more than 50 deals worth more than $50 million for the sixth quarter in a row, according to Assembling Value, a quarterly analysis of global deal activity in the industrial manufacturing industry by PwC US. While growing uncertainty about the future prospects for the global economy has created serious underlying fears about the years ahead, manufacturing executives continue to re-evaluate their business portfolios, add scale to better leverage core capabilities, and divest or spin-off non-core operations.

According to PwC, there were 55 transactions (worth more than $50 million) in the third quarter for a total deal value of $20.9 billion. Both value and volume declined from the previous quarter which recorded 66 deals totaling $28.2 billion. However, deal activity year-to-date remained healthy with 180 deals raising $69.6 billion. Four megadeals (transactions worth more than $1 billion) were announced for a total deal value of $9.8 billion or 47 percent of the quarter’s total deal value.

“The continued interest in deal making in the third quarter has been especially notable given weakening global manufacturing activity and increased uncertainty regarding the economic outlook,” said Bobby Bono, U.S. industrial manufacturing leader for PwC. “Manufacturing executives in our latest Manufacturing Barometer reported a drop in optimism towards the world economy’s prospects as the economic slowdown in China, along with weak global demand and a strong dollar, continued to weigh heavily on the growth of the manufacturing sector. As we enter the final quarter of the year, we expect the level of deal activity to remain stable as mixed global economic results steer manufacturing executives toward further portfolio reshuffling.”

Similar to previous quarters, strategic buyers continued to align product portfolios with high-growth markets, such as automotive, aerospace, and electric through acquisitions. Strategic investors represented 66 percent of deal activity in the quarter. With plenty of cash at their disposal, both strategic and financial buyers have been active in deals involving diverse end markets, particularly in Asia and areas of Europe on the verge of recovery.

Bono added: “Strategic acquirers remain concerned about the broad economic environment and are taking a cautious approach to their deal strategies. While they continue to execute on sizable transactions, they are continuously evaluating their portfolios and taking advantage of opportunities to divest non-core assets. Divestitures continue to be a viable exit option, representing 27 percent of deal activity this quarter.”

On a regional basis, the U.S. share of global activity remained among its lowest levels in a decade as local activity in Asia continued to dominate deal making. Acquirers from Asia and Oceania accounted for 62 percent of total deal activity in the quarter, while targets in the region represented 56 percent of all deals. The majority (75 percent) of deals in the third quarter were local market deals; however, the strength of the dollar could lead to an increase in U.S. outbound deals in the coming months.

PwC’s industrial manufacturing M&A analysis is a quarterly report of announced global transactions with value greater than $50 million analyzed by PwC using transaction data from Thomson Reuters.