by Gary Mintchell | Mar 1, 2017 | Commentary, News

My friends over at the PwC industrial manufacturing practice have taken a look at 2017 industrial manufacturing trends. The report was composed by Marian Mueller, Bobby Bono, Steve Pillsbury, and Barry Misthal. I will summarize here. Check out the link for more in-depth discussion.

I think they have nailed most of the ideas coming up. Some of these will be difficult for suppliers to either swallow or develop. Likewise, customers may not always like increased connectivity back to the supplier. Pay for performance, so far, has not been a winner. Customers begin to think they are paying too much if performance really does increase. Then they want to go back to a fixed price <sigh>.

Six Industrial Manufacturing Trends

1. Leverage data and analytics in a new business model

By upgrading their technical capabilities, industrial manufacturers can bundle a variety of services enabled by connectivity and data, replacing the increasingly outmoded model of selling one big complex machine under warranty and a service agreement for maintenance and repair.

2. Innovate pricing

As technology begins to alter the relationship between industrial manufacturers and their customers, the traditional pricing model for the service contract must be changed as well, from pay-for-product to pay-for-performance. Condition-based maintenance, driven by predictive and interconnected industrial technology, will become commonplace. This should translate into fewer visits from repair technicians. As a result, customers will naturally expect more favorable terms, which can be facilitated by sharing risk.

3. Develop strategic partnerships — carefully

Industrial manufacturers must become more active players in the technology ecosystem, seeking expertise outside the industry in order to develop equipment connectivity, data analysis, and software development that are beyond their current abilities. For example, recognizing that it cannot grow the ecosystem alone, at least one major industrial company has aligned with a wide range of technology firms to create a dedicated cloud-based platform that can run industrial workplaces. Leaders have to balance the practice of close collaboration with strategic partners against the need to stay flexible in contracting and partner selection, all while maintaining their hold on their markets.

4. Mine operational data

If connected machines — the primary components of IoT — are to be the backbone of industry in the near future, industrial manufacturers will have to figure out how to manage the data coming from an avalanche of sensors, integrated equipment and platforms, and faster information processing systems. There is a critical need to hire people who can mine these bits and bytes of information and work more closely with customers to use the data to improve equipment performance and open new revenue streams. Indeed, the anticipated efficiency returns from digitization over the next five years across all major industrial sectors are substantial: nearly 3 percent in additional revenue and 3.6 percent in reduced costs per year, according to a recent PwC survey of companies.

5. Decide what intellectual property to share and what to develop

Many industrial manufacturers find it difficult to manage digitization and big data analytics because their internal IT systems are so unwieldy. As company operations have grown more complex, expanding into new global markets and product lines and integrating newly acquired firms over many years, the old enterprise resource planning (ERP) systems that were meant to drive efficiency and coordination have proliferated into a tangled mass of disparate networks.

Industrial manufacturers must begin the process of overhauling their IT systems, creating a completely new architecture that can serve as the backbone for internal and external technology initiatives. In this new approach, it is imperative that IT systems communicate throughout the organization with standardized protocols.

6. Create strategies for talent development and retention

In the digitization sweepstakes, industrial manufacturers often find themselves at a disadvantage when trying to attract and retain talent. For example, in the U.S. many of the best and brightest STEM (science, technology, engineering, and math) students would prefer to work in Silicon Valley, where innovation is on the menu for breakfast, lunch, and dinner, rather than in the stodgier old-world locales where many industrial manufacturers have their plants and headquarters.

Succeeding in challenging times

The next wave of leaders in industrial manufacturing will build an ecosystem that capitalizes on the promise of analytics and connectivity to maximize efficiency for themselves and their customers.

by Gary Mintchell | Jan 16, 2017 | Commentary, News

PwC just sent over its latest Industrial Manufacturers forecast survey—Q4 Manufacturing Barometer. PwC surveyed US industrial manufacturers on their sentiment in the fourth quarter of last year, and one thing was clear – optimism regarding the prospects of the U.S. economy surged in Q4. This was due to an improved outlook by industrial manufacturers, citing higher company forecasts and increased capital spending plans.

Economic Sentiment Shifts Upward as Industrial Manufacturers Forecast Higher Growth Rates Ahead

Optimism regarding the prospects of the U.S. economy surged in our fourth quarter Manufacturing Barometer survey, as industrial manufacturers pointed to an improved outlook, including higher company revenue forecasts and increased capital spending plans. The renewed sense of optimism regarding the direction of domestic commerce raises the question of whether an inflection point has taken place in attitudes among industrial manufacturers. The overall rise in economic sentiment occurred despite continued uncertainty regarding the state of the global economy.

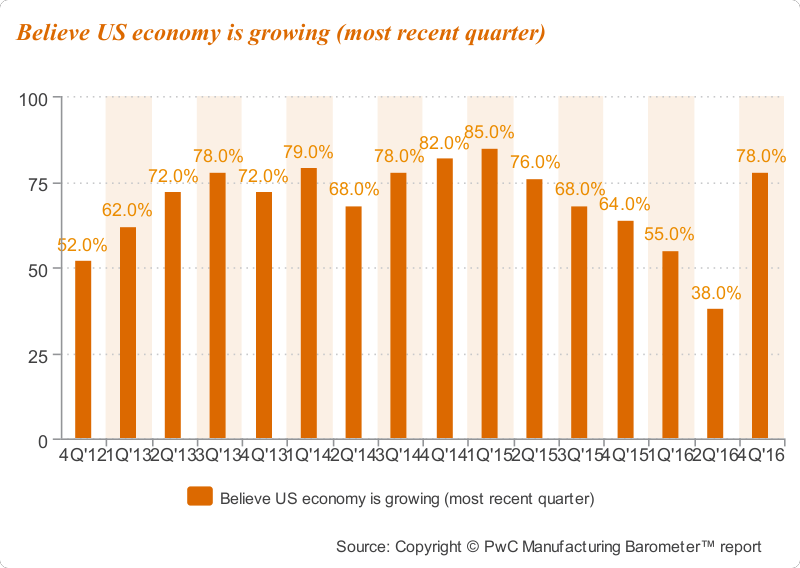

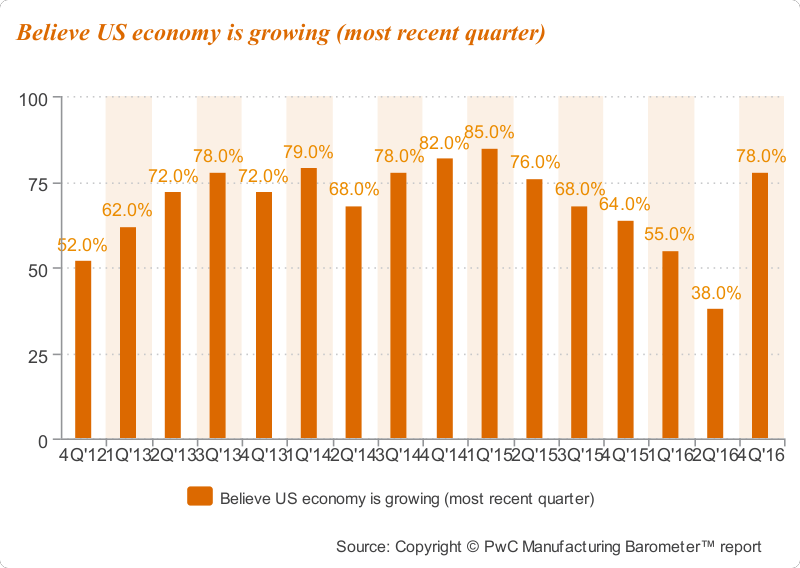

Attitudes concerning the domestic economy soar

Highlighting the positive findings, 78 percent of the survey respondents believed the domestic economy was growing. This elevated level of sentiment is a dramatic increase from only 38 percent two quarters ago, representing an increase of 40 points. These levels were only 14 to 16 points below the highs of 94 percent back in the second quarter of 2004 and 92 percent in the first quarter of 2006. Moreover, optimism about the domestic economy’s prospects over the next 12 months rose, increasing to 57 percent, up from 35 percent two quarters, a notable 22-point gain.

While international sentiment remains depressed

Conversely, these same industrial manufacturing panelists remain consistently low in their outlook for the world economy. Only 13 percent cited growth in the fourth quarter of 2016, down from 20 percent at mid-year. Their level of optimism about the world economy’s prospects over the next 12 months was only 30 percent, largely in line with the 29 percent level two quarters ago. The majority, 54 percent, remained uncertain, while 16 percent were pessimistic. These numbers tell us that the persistent dichotomy between perceptions of the health of the domestic and worldwide economies has not only lingered among industrial manufacturers, but has become even more dramatic. As prospects for U.S. commerce improve, continued uncertainty regarding the global stage has kept a lid on overseas sentiment.

Company revenue forecasts increase

On the heels of the increase in domestic economic sentiment, industrial manufacturers also raised their forecasts regarding average own-company revenue growth to 4.6 percent, up considerably from 3.6 percent a year ago, with 85 percent of industrial manufacturers expecting positive growth in 2017, and only 4 percent expect negative or zero growth. It is also important to note that a consistency in their expected revenue contribution from international sales to total revenues remained high at 33 percent, despite their general feelings of uncertainty toward the world economy.

Leading to a plan to increase spending

The increased level of optimism regarding the domestic economy supported an uplift in forecasted spending over the next 12 months among industrial manufacturers. Plans for increased capital spending rose to the 60 percent level, close to the manufacturing panel’s high of 67 percent in the fourth quarter of 2011. Increased budget spending was also found for most areas, led by new products or service introductions, 67 percent, up 23 points from a year ago. Still, the capital spending forecasts represented only 2.2 percent of projected sales. In addition, plans for new hiring remained fairly stable at 35 percent, compared to 32 percent two quarters ago, and down from 42 percent in the fourth quarter of 2015.

While headwinds to growth remain the same

Headwinds to growth over the next 12 months remained consistent, led by monetary exchange rate barriers (48 percent), lack of demand (43 percent), and legislative/regulatory pressures (43 percent).

Sentiment points to a brighter future for industrial manufacturers

We certainly welcome the renewed sense of optimism regarding the domestic economy uncovered in our fourth quarter survey. Expectations for higher growth and increased investment spending bode well for the year ahead. The U.S. remains the bright spot in a persistently challenged and uncertain global economy. Time will surely tell if we have entered an inflection point in the industrial manufacturing sector.

by Gary Mintchell | Jan 7, 2016 | Commentary, News

Just in from PwC–results of its latest manufacturers survey. And it sort of fits with this week’s stock market news–not all that optimistic right now.

Sentiment regarding the direction of the domestic economy moderated further among U.S. industrial manufacturers, according to the Q4 2015 Manufacturing Barometer, released by PwC US today. A number of factors ranging from concerns about the global economy, particularly China, to the impact of the strong dollar and weak energy prices, have prompted manufacturers to reign in growth forecasts, while taking a more measured approach to hiring and capital spending outlays.

During the fourth quarter of 2015, optimism regarding the direction of the domestic economy over the next 12 months dropped to 46 percent from the prior quarter’s 60 percent, and 22 points below a year ago (68 percent). This represented the lowest level of optimism since 37 percent was recorded in the third quarter of 2012. Looking at the world stage, only 27 percent of industrial manufacturers expressed optimism regarding the global economy over the next 12 months, 11 points below a year ago (38 percent).

As a result of the decreased economic sentiment, the projected average revenue growth rate over the next 12 months among panelists declined to 3.6 percent, representing a significant deceleration from the prior quarter’s 5.3 percent. The benchmark represented the lowest revenue growth rate since three percent was recorded in the first quarter of 2011. Despite the lower rate, 70 percent of panelists still expect positive revenue growth for their own companies in the year ahead, with the majority (65 percent) forecasting single-digit growth.

“Sentiment among U.S. industrial manufacturers decelerated in the fourth quarter, primarily reflecting the uncertain outlook for the global environment,” said Bobby Bono, PwC’s U.S. industrial manufacturing leader. “The overall economic picture has become more complex as management teams navigate slower growth in China, coupled with a stronger dollar and weak energy prices. Nearly one-third of annual revenue among survey panelists is derived internationally, reflecting the significant exposure of domestic industrial manufacturers to the world economy. Turning more cautious, they are prudently dialing back on the overall level of capital spending and hiring as they prepare to transition to a more challenging business climate. However, a healthy majority still anticipate revenue growth, albeit at a more moderate pace, in the year ahead.”

Barriers to Growth and Challenges

Looking at perceived barriers to growth, monetary exchange rate has become the leading headwind over the next 12 months, up 11 points sequentially to 49 percent in the fourth quarter. A year ago, it was 15 percent, 34 points lower. Other barriers included lack of demand (39 percent), oil/energy prices (32 percent), decreasing profitability (29 percent) and legislative/regulatory pressure (22 percent). In addition, competition from foreign markets rose to 22 percent, up 10 points from the previous quarter.

PwC also surveyed respondents on the most prominent challenges in preparing for the year ahead. At the top of the list was the condition of the world economy, which was cited by 80 percent of respondents, while 67 percent rated it as a top-three issue. This was significantly higher than the last time this special survey was conducted in 2011. At that time, only 64 percent cited the condition of the world economy and only 18 percent listed this challenge among the top-three. Conversely, 71 percent of panelists flagged higher costs of goods and services as a major challenge, down from 92 percent in 2011. Additional major challenges cited by panelists included greater opportunities for new product and service introductions (67 percent), increased price flexibility (62 percent) and strength of the US dollar (53 percent).

Hiring

As a result of the pullback in growth forecasts, manufacturers have continued to take a more conservative approach to hiring. In total, 42 percent plan to add employees to their workforce over the next 12 months, up from the low of 37 percent in the third-quarter of 2015, but down from 60 percent reported a year ago. The total net workforce growth projection was flat this quarter, below last year’s 1.1 percent, indicating continued cutbacks in hiring among these manufacturing firms.

Among the 42 percent of panelists planning to hire within the next 12 months, the most sought-after employees will be blue collar/skilled labor (29 percent) and professionals/technicians (27 percent). Among professionals/technicians, hiring of technology/engineering employees led the way, while hiring in the blue collar category was split between skilled/specialized workers and semi-skilled workers.

“Industrial manufacturers are continuing to seek avenues to improve productivity, while favoring professionals with strong technical skills,” Bono added. “In a slower growth environment, management teams appreciate the benefits of staying lean while ensuring they have the right talent to harness continued advances in engineering, technology and supply chain management.”

Spending

The tempered global outlook has also served to moderate the total level of capital spending plans among U.S. industrial manufacturers. They are continuing to spend, but they are spending less. Overall, 49 percent plan major new investments of capital during the next 12 months, up from the prior quarter’s 37 percent, and above last year’s 43 percent. However, the mean investment as a percentage of total sales dropped to 1.9 percent, sharply down from last quarter’s 5.6 percent and the 3.3 percent a year ago.

Conversely, 86 percent of respondents plan to increase operational spending over the next 12 months, up four points from both the previous quarter and the comparable period last year. Leading categories were new product or service introductions (44 percent), research and development (41 percent), business acquisitions (34 percent) and information technology (36 percent). “Given the prospects for a less robust economic climate, management teams continue to focus on investing in what they do best, while fostering innovation in an effort to strengthen their competitive positions,” Bono added.

by Gary Mintchell | Oct 19, 2015 | News

Many years ago I read a book about the stock market. It poked fun at the news reports that would go—there is a wave of selling. Hmm, for every seller there is a buyer. Someone bought all the shares being sold.

I bring that up just as a note about economics (and maybe life in general). Some things are good and bad simultaneously.

Take the strength of the dollar. American nationalists think that a strong dollar means a strong nation, or that we “won” some contest. However, for manufacturers and other suppliers looking to sell overseas a strong dollar makes our products more expensive and therefore less competitive.

The latest PwC US Manufacturing Barometer just came my way. It states, “Sentiment regarding the direction of the global economy took a sharp turn downward among U.S. industrial manufacturers, according to the Q3 2015 Manufacturing Barometer, released by PwC US today. Global concerns also served to moderate optimism regarding the domestic outlook, while slowing plans to hire more workers. At the same time, capital and operational spending forecasts among U.S. companies remained healthy.”

Details:

During the third quarter of 2015, optimism regarding the direction of the global economy dropped to 23 percent from 38 percent in the previous quarter and 30 percent in the third quarter of 2014. In addition, pessimism rose to an equal level with optimism (23 percent), reflecting an uncertain outlook for international commerce. Further, 40 percent of respondents indicated they believed the world economy was declining, showing greater concern than in the previous quarter (25% in Q2).

Conversely, optimism regarding the U.S. economic outlook remained positive but dropped to 60 percent in the third quarter of 2015 from 69 percent in the second quarter. Despite the renewed sense of caution regarding the global stage, company revenue forecasts for the next 12 months rose to a moderately high 5.3 percent in the third quarter, compared to a forecast of 4.9 percent in the second quarter.

“U.S. industrial manufacturers became increasingly cautious on the outlook for the global environment as they assessed the impact of the slowdown in China and the strengthening dollar,” said Bobby Bono, PwC’s U.S. industrial manufacturing leader. “Despite the downward turn in overseas sentiment, overall domestic growth prospects remained healthy and manufacturers continue to focus on further strengthening core products and services. They are keeping their cash at home and directing investment toward enhancing their value propositions in an effort to remain competitive and drive future revenues.”

As a result of the decline in global sentiment, U.S. industrial manufacturers scaled back hiring plans in the third quarter, with only 37 percent planning to add employees to their workforce over the next 12 months, down 15 points from the 52 percent level indicated in both the second-quarter and year ago comparable period. The total net workforce growth projection in the third quarter was minus 0.2 percent, indicating further cutbacks in hiring among industrial manufacturing firms.

Among the minority of panelists planning to hire within the next 12 months, the most sought-after employees will be blue collar/skilled labor (23 percent) and professionals/technicians (25 percent). Limited white collar support, middle management and sales/marketing hiring is planned. “The drop in hiring plans may indicate an expectation for slower growth in the near future,” Bono added. “Management teams will likely intensify avenues to improve productivity across their organizations, while continuing to search for professionals with strong technical skills.”

Despite the tempered global outlook, 37 percent of U.S. industrial manufacturers surveyed plan major new investments of capital during the next 12 months, up slightly from the second quarter and same period last year. In addition, the mean investment as a percentage of total sales was a moderately high 5.6 percent, well above 3.3 percent in the second quarter and on par with 5.7 percent in last year’s third quarter. Operational spending plans remained healthy as well with 82 percent indicating plans to increase operational spending, up from 75 percent in the second quarter and 69 percent last year. Leading increased expenditures were new product or service introductions (48 percent), research and development (37 percent), business acquisitions (23 percent) and information technology (22 percent).

“In the face of global uncertainty and the impact of a strengthening U.S. currency, management teams continue to focus investment on developing new products and driving innovation in an effort to sustain and build market share,” Bono added. “Companies are doubling down on what they do best and aggressively building their competitive moats. At the same time, they are continuing to pull back from overseas expansion, with only five percent indicating plans to open facilities abroad.”

Looking at perceived barriers to entry, monetary exchange rate became the leading headwind to growth over the next 12 months, as indicated by 38 percent of respondents. A year ago, it was only 14 percent (24 points lower). Typical barriers to growth—lack of demand (32 percent) and legislative/regulatory pressures (25 percent)—were lower as monetary exchange rate took center stage.

PwC also surveyed respondents on investment in information technology, and found that 80 percent of manufacturers report having a multiyear plan (3-5 years) that addresses business capabilities and processes as well as IT systems. Industrial manufacturing companies’ IT investments are made primarily to reduce costs (84 percent) and support growth (72 percent). Overall, 90 percent are planning to invest in IT technologies over the next 12-18 months, with upgrading infrastructure the leader at 82 percent.

About the Manufacturing Barometer

PwC’s Manufacturing Barometer is a quarterly survey based on interviews with 60 senior executives of large, multinational U.S. industrial manufacturing companies about their current business performance, the state of the economy and their expectations for growth over the next 12 months. This survey summarizes the results for Q3 2015 and was conducted from June 24, 2015 to September 28, 2015.

by Gary Mintchell | Aug 20, 2015 | Commentary, News

Today’s news stream brought to my iPad an item about disappointing results from an auction for Gulf of Mexico oil leases. The oil industry is in the doldrums with $50 per barrel oil. That affects technology companies who supply to the industry. We’ve seen that result in stock prices of those companies.

While considering that economic fact, this survey from PwC US came my way. Optimism regarding the direction of the domestic economy softened in the second quarter of 2015 compared to the previous nine-year high recorded in the first quarter among U.S. industrial manufacturers, according to the Q2 2015 Manufacturing Barometer, released by PwC US.

Respondents also trimmed overall growth forecasts and spending plans, reflecting caution around the strengthening of the U.S. dollar and potential rise in domestic interest rates, as well as continued uncertainty regarding the direction of global economy.

Optimism regarding the prospects of the U.S. economy during the next 12 months decreased to a still healthy 69 percent among manufacturers in the second quarter of 2015, compared to 76 percent in the first quarter, but up from 65 percent in the second quarter of 2014. Optimism about the world economy declined to 38 percent, compared to 42 percent in the previous quarter. Reflecting the reduced sentiment, projected company revenue growth for the next 12 months slowed to 4.9 percent in the second quarter, compared to 5.1 percent in the previous quarter.

“As a result of several macro-economic factors taking shape, U.S. industrial manufacturers seem to be taking a more measured view of business conditions in the year ahead,” said Bobby Bono, U.S. industrial manufacturing leader, for PwC. “Slower GDP growth, the impact of the strong dollar, issues in China and uncertainty in Europe are among the developments that are likely causing industrial manufacturers to reassess the broader economic picture, as well as spending plans across a range of categories. Still, the overall outlook for U.S. industrial manufacturers appears to be positive, marked by relatively high levels of optimism regarding both the domestic economy and company revenue growth forecasts.”

Operational Spending

Reflecting the more cautious outlook, operational spending plans dropped to 75 percent, down from a two year high of 83 percent in the first quarter. Looking at sequential changes among the top spending categories, plans for new products or service introductions dropped to 44 percent from 55 percent, while research and development decreased to 34 percent from 40 percent and information technology decreased to 22 percent from 33 percent during the first quarter. “While these spending decreases are notable, we believe they reflect more of a pause in sentiment, as management teams evaluate strategies to adjust to evolving market conditions, including the possibility of Federal Reserve action later this year” Bono added.

Capital Spending

According to the survey, sentiment regarding capital spending also trailed off with only 34 percent of respondents indicating plans for major new investments of capital in the year ahead, down from 52 percent in the first quarter. Following the recent trend, plans for M&A moderated during the second quarter as well, with 29 percent of respondents indicating an interest, compared to 43 percent in the first quarter and 38 percent in the second quarter of last year.

Headwinds to Growth

Looking at perceived headwinds, survey respondents identified lack of demand, legislative/regulatory pressures and monetary exchange rate as the top perceived barriers to growth in the year ahead. Concern about monetary exchange rate showed the biggest gain, rising to 37 percent of respondents, up from 21 percent in the first quarter. In addition, lack of demand rose to 39 percent, up ten points sequentially, while legislative/regulatory pressure jumped to 39 percent as well, up from 33 percent in the first quarter.

Of interest, the perceived barrier of lack of qualified workers dropped to 24 percent in the second quarter from 35 percent in the first quarter, representing the lowest level in six quarters. The reduced anxiety regarding identifying qualified workers dovetailed with a flat (52 percent) indication sequentially regarding plans to hire more workers in the year ahead. “It’s too early to tell,” Bono added. “But, the softer outlook might be reducing some of the near-term pressure on management teams to add more workers, though the shortage in skilled workers, or the talent gap, remains a long-term challenge across the sector.”

Global Expansion

With regard to global expansion, only 12 percent of manufacturers plan to expand to new markets abroad, and nine percent plan for new facilities abroad, both continuing a trend of reduced overseas expansion seen in recent quarters. Along similar lines, among respondents with international operations, the projected contribution from international sales to total revenue over the next 12 months remained in line with the first quarter at 27 percent, the lowest level since the fourth quarter of 2006.

Impact of Strong Dollar

PwC’s survey also included a section on the stronger U.S. dollar, which found that 82 percent of respondents expect an impact on revenues, average 3.5 percent, in the year ahead. In view of the stronger dollar, panelists believe reform of U.S. corporate taxes might be helpful (53 percent very/extremely helpful) to their own companies’ bottom line over the next 12-18 months. Three other U.S. government actions were also cited as potentially helpful: more sensible U.S. regulations, including financial regulations (49 percent); repatriation of U.S. companies’ international profits at low tax rates, less than 10% (39 percent); and international trade treaties with Asia: China, India, Japan (33 percent). In addition, a majority of panelists believe the stronger dollar may lead to new or strengthened strategic alliances (47 percent) or new or strengthened joint ventures (31 percent) over the next 12-18 months.