Who buys enterprise software applications, how and why? I ran across this article by a contact of mine, Gabriel Gheorghiu, Founder and principal analyst at Questions Consulting, with a background in business management and 15 years experience in enterprise software. I thought it would be most useful. I’m not an ERP analyst, but I have some background and training on the financial side of things. I think this analysis fits with other large-scale software acquisition projects, though, including MES/MOM, analytics, asset performance, and the like.

This will summarize some interesting points. I highly recommend reading the whole thing.

Before we begin, my brief take on enterprise software applications. How many of you have been involved with an SAP acquisition and roll out? How many happy people were there? Same with Oracle or any other ERP, CRM, MES, APM, etc. application. Why did using Microsoft Excel seem to go better?

Well, the big applications all force you to change all your business processes to fit their template. You build Excel to fit what you’re doing. It’s just not powerful enough to do everything, right?

Gheorghiu conducted interviews with 225 companies who were all looking for enterprise resource planning (ERP). The goal of this survey was simple – listen and learn from what these companies had to say about their individual decision-making strategies. We all agree that this is not a simple task. But we also agree that selecting the best ERP software is a critical factor for business success.

Here is why the research phase of this process is considered to be so vital:

- It has the greatest impact on all the subsequent phases and consequently, your final decision.

- Research begins at home – in other words, the first step is to determine your company’s specific and unique needs.

- Once your company has thought through and determined its software requirement, then and only then does the process to evaluate vendors and their offerings begin. This can be a very challenging step because many companies are not equipped with the time, knowledge, or tools to perform this step.

Buyer Profiles: Who’s Looking for ERP and Why?

One problem for analysis is that many are not doing business in just one industry. The breakdown of companies in our business sample, by industry, was as follows: manufacturing (47%), distribution (18%), services (12%), construction (4%), retail (3%), utilities (3%), government (3%), healthcare (3%), and other (10%). However, to complicate matters a little, 20% of manufacturers also manage distribution and some distributors include light manufacturing in their operations, like assembly.

“Companies looking to invest in business software may very well be addressing this additional challenge – looking for a comprehensive package that integrates all aspects of a business. ERP software systems are powerful and comprehensive but are not necessarily known for their agility and ability to accommodate many disparate functions.”

Gheorghiu identifies as a strong influencer consumerization, which changes focus from organization-oriented offerings to end-user focused products. “This was a highly significant turning point in the IT marketplace. By developing new technologies and models that originate in the consumer space rather than in the enterprise sector, software producers opened up the market to a flood of small and medium-sized businesses looking for more cost effective, and less complicated solutions to run their businesses.”

The consumerization of software (as noted above) has precipitated the move by many companies away from enterprise IT towards more streamlined and user friendly consumer-oriented technology. This change is equally relevant for ERP software and manufacturing companies have participated in this very significant development, albeit more cautiously and slowly than SMBs.

Most industries follow a “purposeful implementation” strategy, managing software adoption as a series of “sprints in a well-planned program” rather than insisting on the “all or nothing” approach.

For example, a small company looking to invest in software might decide to begin with an accounting system which can be used alongside point solutions and spreadsheets. As companies grow and their transactions become more complex, they may find that they have also outgrown their initial software selections.

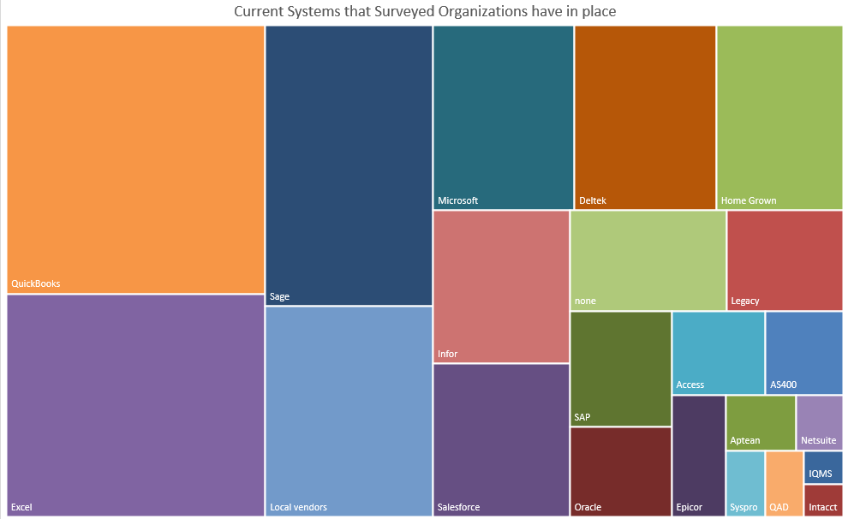

The chart below provides a visual analysis of the mix of software that is currently utilized by our business sample:

Some relevant comments we extracted from our survey included:

- The CEO of a small services company mentioned that he was “tired of the hodgepodge of systems”

- A manufacturer considered their current arrangement to be “very siloed.” Reconciling the inventory balance is a “constant battle.”

Buyer Behavior: How are Companies Approaching ERP Selection?

The selection process is most successful when companies adhere to some basic selection rules: involve as many direct stakeholders as possible and keep business priorities and strategies firmly in mind when making the final decision.

Feature Functions

A software change can trigger a vast administrative upheaval within the company. It is important to carefully analyze the business case for the change and whether it supports the level of disruption as well as the implementation time and spending that will be required. Even if the change may be entirely justified, a well thought out analysis is well worth the time and effort.

The Vendors in the Spotlight

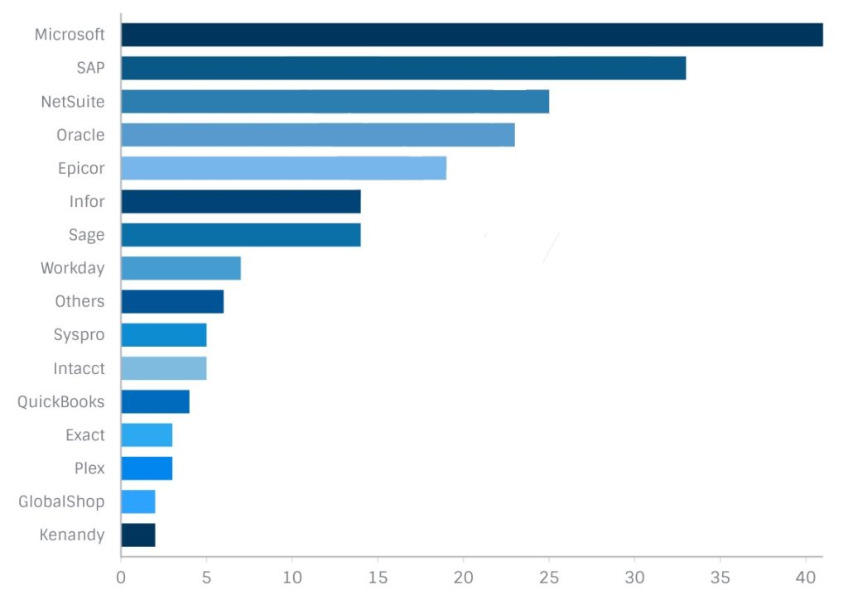

According to our survey results, the chart below identifies the vendors under consideration by the companies surveyed. A majority of companies (53%) were not, for the moment, looking at specific vendors. However 47% of respondents had narrowed their search to specific vendors.

Who’s Involved in this Decision Selection Process?

Our sample results indicate that the people in charge of the selection process are distributed as follows: employees in the finance and accounting departments (23%), IT department employees (23%). The other important categories were independent consultants helping companies with the selection process (17%), operations managers (17%) and presidents or CEOs (12%). It is worthwhile mentioning that project managers and business analysts only made up 5% of the total.

By far, the most effective method of choosing a software is to employ a collaborative system whereby the actual stakeholders of that system (the end-users) have a direct voice in the decision outcome. As the front-line users of the system, their insight and knowledge is very valuable. Their input along with all the other stakeholders input will produce the best possible outcome of this process.

An ERP system is a major business investment and is best handled with the appropriate amount of time and diligence given to the process.

The advent of cloud computing has indeed radically changed the landscape for deployment of business software. According to a recent press release by Gartner, “by 2020, a Corporate “No-Cloud” policy will be as rare as a “No-Internet” policy is today”. In other words, cloud deployment will become the default by 2020.

Our survey results, in fact, support Gartner’s analysis. Ninety-five percent of companies responded that they were open to a cloud deployment model, while just over 50% were willing to also consider on premises ERP. Of this latter group of respondents, 65% of them were manufacturers and distributors. This makes sense of course, given that these industries made significant investments in hardware and IT personnel and may not be as ready or as willing to move to the cloud model.

As for the preference for cloud computing (as demonstrated by our responses), we argue that it reflects the very strong tendency in the market to opt for simpler, more streamlined and less expensive computing solutions. As more information and assurances of security and stability by cloud providers enter the marketplace, more and more businesses will be convinced that the many benefits of the cloud outweigh some of their remaining concerns. Gartner’s prediction that cloud will increasingly be the default option for software deployment looks to be right on course.

Conclusion

An important consideration for companies embarking on an ERP software selection process – the average lifespan of an ERP system is approximately 5 to 10 years. If we consider important factors like the investment of capital, time, and loss of productivity that the selection and replacement of an ERP system requires, perhaps all companies would be more willing to invest the necessary effort in this process.

Trackbacks/Pingbacks