by Gary Mintchell | Aug 18, 2018 | Asset Performance Management, Operations Management, Software

Who buys enterprise software applications, how and why? I ran across this article by a contact of mine, Gabriel Gheorghiu, Founder and principal analyst at Questions Consulting, with a background in business management and 15 years experience in enterprise software. I thought it would be most useful. I’m not an ERP analyst, but I have some background and training on the financial side of things. I think this analysis fits with other large-scale software acquisition projects, though, including MES/MOM, analytics, asset performance, and the like.

This will summarize some interesting points. I highly recommend reading the whole thing.

Before we begin, my brief take on enterprise software applications. How many of you have been involved with an SAP acquisition and roll out? How many happy people were there? Same with Oracle or any other ERP, CRM, MES, APM, etc. application. Why did using Microsoft Excel seem to go better?

Well, the big applications all force you to change all your business processes to fit their template. You build Excel to fit what you’re doing. It’s just not powerful enough to do everything, right?

Gheorghiu conducted interviews with 225 companies who were all looking for enterprise resource planning (ERP). The goal of this survey was simple – listen and learn from what these companies had to say about their individual decision-making strategies. We all agree that this is not a simple task. But we also agree that selecting the best ERP software is a critical factor for business success.

Here is why the research phase of this process is considered to be so vital:

- It has the greatest impact on all the subsequent phases and consequently, your final decision.

- Research begins at home – in other words, the first step is to determine your company’s specific and unique needs.

- Once your company has thought through and determined its software requirement, then and only then does the process to evaluate vendors and their offerings begin. This can be a very challenging step because many companies are not equipped with the time, knowledge, or tools to perform this step.

Buyer Profiles: Who’s Looking for ERP and Why?

One problem for analysis is that many are not doing business in just one industry. The breakdown of companies in our business sample, by industry, was as follows: manufacturing (47%), distribution (18%), services (12%), construction (4%), retail (3%), utilities (3%), government (3%), healthcare (3%), and other (10%). However, to complicate matters a little, 20% of manufacturers also manage distribution and some distributors include light manufacturing in their operations, like assembly.

“Companies looking to invest in business software may very well be addressing this additional challenge – looking for a comprehensive package that integrates all aspects of a business. ERP software systems are powerful and comprehensive but are not necessarily known for their agility and ability to accommodate many disparate functions.”

Gheorghiu identifies as a strong influencer consumerization, which changes focus from organization-oriented offerings to end-user focused products. “This was a highly significant turning point in the IT marketplace. By developing new technologies and models that originate in the consumer space rather than in the enterprise sector, software producers opened up the market to a flood of small and medium-sized businesses looking for more cost effective, and less complicated solutions to run their businesses.”

The consumerization of software (as noted above) has precipitated the move by many companies away from enterprise IT towards more streamlined and user friendly consumer-oriented technology. This change is equally relevant for ERP software and manufacturing companies have participated in this very significant development, albeit more cautiously and slowly than SMBs.

Most industries follow a “purposeful implementation” strategy, managing software adoption as a series of “sprints in a well-planned program” rather than insisting on the “all or nothing” approach.

For example, a small company looking to invest in software might decide to begin with an accounting system which can be used alongside point solutions and spreadsheets. As companies grow and their transactions become more complex, they may find that they have also outgrown their initial software selections.

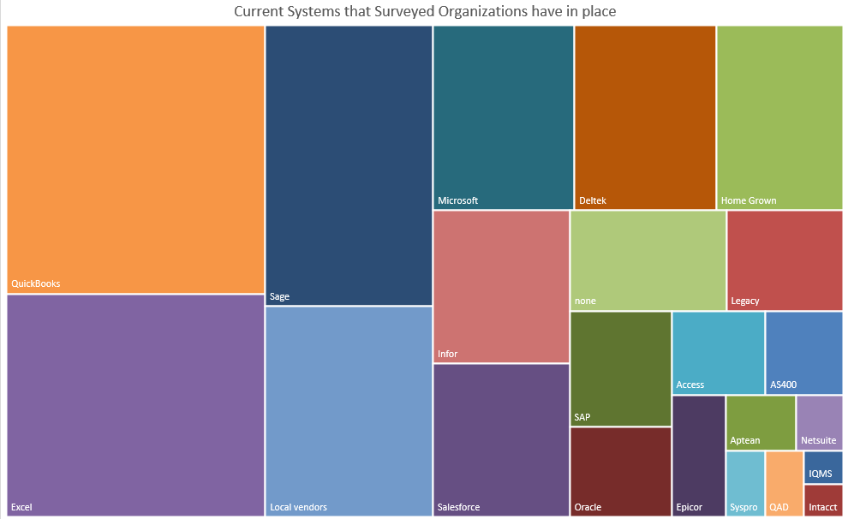

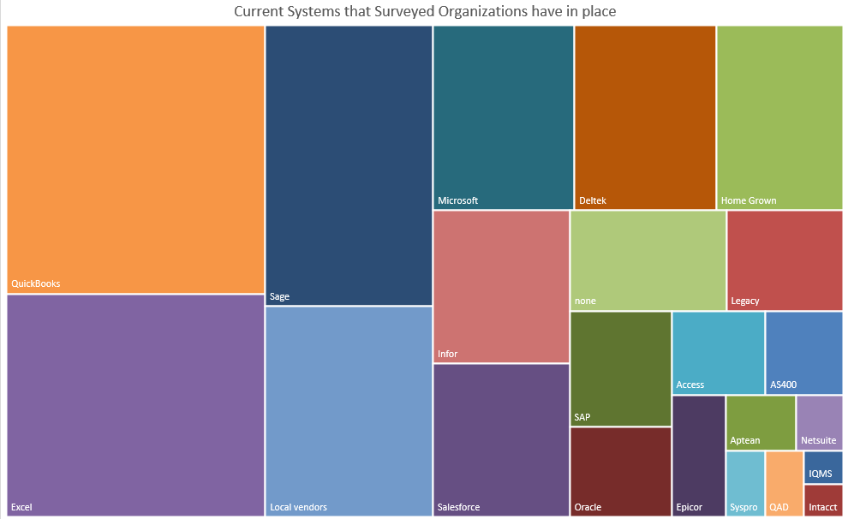

The chart below provides a visual analysis of the mix of software that is currently utilized by our business sample:

Some relevant comments we extracted from our survey included:

- The CEO of a small services company mentioned that he was “tired of the hodgepodge of systems”

- A manufacturer considered their current arrangement to be “very siloed.” Reconciling the inventory balance is a “constant battle.”

Buyer Behavior: How are Companies Approaching ERP Selection?

The selection process is most successful when companies adhere to some basic selection rules: involve as many direct stakeholders as possible and keep business priorities and strategies firmly in mind when making the final decision.

Feature Functions

A software change can trigger a vast administrative upheaval within the company. It is important to carefully analyze the business case for the change and whether it supports the level of disruption as well as the implementation time and spending that will be required. Even if the change may be entirely justified, a well thought out analysis is well worth the time and effort.

The Vendors in the Spotlight

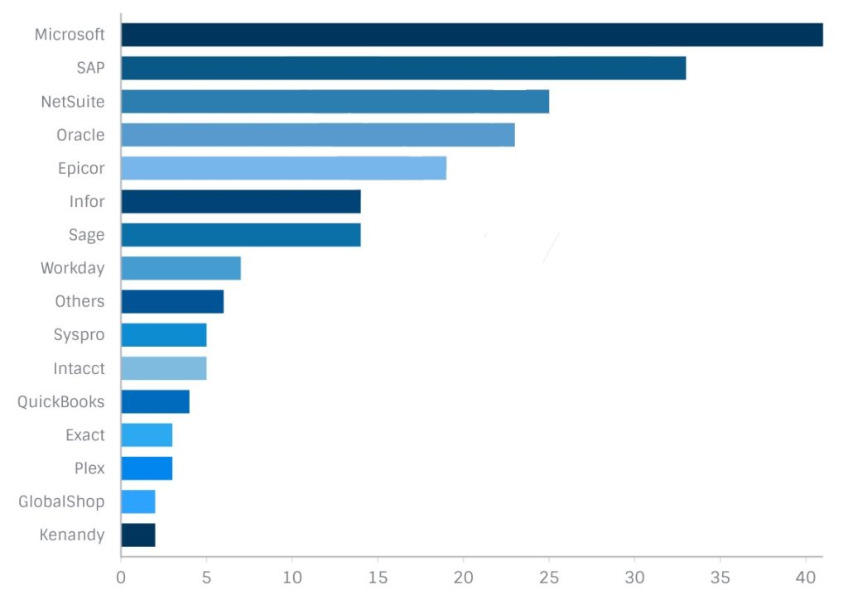

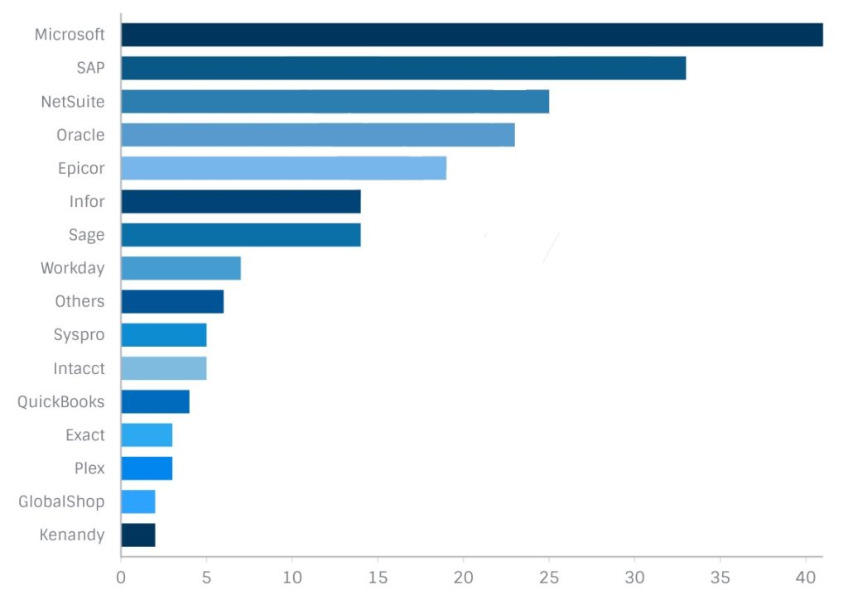

According to our survey results, the chart below identifies the vendors under consideration by the companies surveyed. A majority of companies (53%) were not, for the moment, looking at specific vendors. However 47% of respondents had narrowed their search to specific vendors.

Who’s Involved in this Decision Selection Process?

Our sample results indicate that the people in charge of the selection process are distributed as follows: employees in the finance and accounting departments (23%), IT department employees (23%). The other important categories were independent consultants helping companies with the selection process (17%), operations managers (17%) and presidents or CEOs (12%). It is worthwhile mentioning that project managers and business analysts only made up 5% of the total.

By far, the most effective method of choosing a software is to employ a collaborative system whereby the actual stakeholders of that system (the end-users) have a direct voice in the decision outcome. As the front-line users of the system, their insight and knowledge is very valuable. Their input along with all the other stakeholders input will produce the best possible outcome of this process.

An ERP system is a major business investment and is best handled with the appropriate amount of time and diligence given to the process.

The advent of cloud computing has indeed radically changed the landscape for deployment of business software. According to a recent press release by Gartner, “by 2020, a Corporate “No-Cloud” policy will be as rare as a “No-Internet” policy is today”. In other words, cloud deployment will become the default by 2020.

Our survey results, in fact, support Gartner’s analysis. Ninety-five percent of companies responded that they were open to a cloud deployment model, while just over 50% were willing to also consider on premises ERP. Of this latter group of respondents, 65% of them were manufacturers and distributors. This makes sense of course, given that these industries made significant investments in hardware and IT personnel and may not be as ready or as willing to move to the cloud model.

As for the preference for cloud computing (as demonstrated by our responses), we argue that it reflects the very strong tendency in the market to opt for simpler, more streamlined and less expensive computing solutions. As more information and assurances of security and stability by cloud providers enter the marketplace, more and more businesses will be convinced that the many benefits of the cloud outweigh some of their remaining concerns. Gartner’s prediction that cloud will increasingly be the default option for software deployment looks to be right on course.

Conclusion

An important consideration for companies embarking on an ERP software selection process – the average lifespan of an ERP system is approximately 5 to 10 years. If we consider important factors like the investment of capital, time, and loss of productivity that the selection and replacement of an ERP system requires, perhaps all companies would be more willing to invest the necessary effort in this process.

by Gary Mintchell | Aug 8, 2018 | Automation, Process Control, Technology

Foxboro and Triconex looks to be on the path to health under Schneider Electric. Its annual user conference is this week in San Antonio. I‘d love to be there, but personally more important is “grandparent duty” that I’m on this week. So, I had the opportunity to talk with Gary Freburger, leader of the group, and Peter Martin, VP of marketing, to get an update and view of what I’ll be missing.

Gary Freburger began with the market rebounding due to current oil pricing. Business is starting to get strong. IA product line has done well and the process business also did well going up 6% in the first half of the year. He’s expecting majority of growth over the next two years. Schneider Electric is still investing around EcoStruxure system. Foxboro is continuing on the path they discussed with us at the last user conference—how to get more value from control systems going from “necessary evil” to value add in the eyes of customer executives. The strategy is to turn data and connectivity into a business driver. The goal is enabling better decisions and improving profitability.

Freburger discussed cooperating with OPAF for a comprehensive strategy. Then he dropped in an interesting tidbit—cooperation with AVEVA. I’ve wondered about how AVEVA with the inclusion of previous Schneider Electric software would work with the Foxboro side of things. He told me they now have and end-to-end relationship to improve time to market. He noted as oil prices dropped customers thought “what can I afford to do?” Now, all have reset expectations. As oil prices rebound, they have not changed expectations. Some interesting applications and strategies include AVEVA auto populate control system, digital twin of facility, operations feedback our systems to AVEVA’s, then customer asset management upgrade works easier.

Martin discussed how Schneider is trying to change the question—from how to do control to how do we help customers solve problems that impact business? He pointed out that they’ve been doing digitization for years. What’s new is how to drive this new approach. 40 years ago controls was a solution-driven business; then with digitization the industry went from solutions to technology-driven. The times now require a need to flip flop. Solutions oriented but with today’s portfolios taking it to a much higher level. The speed of industrial business has increased—what was stable, e.g. cost of electricity—is stable no longer. The speed means IT world can’t keep up. Built-in real-time accounting control helps plants go beyond control to profitability. Foxboro is still dedicated to taking the use of technology to the next level.

During the conference (while I am writing from the forests in southern Ohio while the grandkids are in bed), Schneider Electric announced the release of EcoStruxure Foxboro DCS Control Software 7.1.With expanded capabilities and an enhanced HMI, the updated software simplifies engineering and enhances the user experience, while expanding the ability of EcoStruxure Foxboro DCS to drive measurable operational profitability improvements, safely.

The EcoStruxure Foxboro DCS is an open, interoperable and future-proof process automation system that provides highly accurate and effective control over a manufacturing plant’s operational profitability. It is the only process control system that provides measurable operational profitability improvements and a future-proof architecture, enabling a measurable 100 percent ROI in less than one year.

EcoStruxure is Schneider Electric’s open, interoperable, IoT-enabled system architecture and platform. This includes Connected Products, Edge Control, and Apps, Analytics and Services. EcoStruxure has been deployed in 480,000+ sites, with the support of 20,000+ system integrators and developers, connecting over 1.6 million assets under management through 40+ digital services.

EcoStruxure Foxboro DCS Control Software 7.1 runs on Windows 10 and Windows Server 2016, to provide maximum flexibility while ensuring robust cybersecurity. When planning upgrades, Schneider Electric customers can mix Windows XP, Windows 7 and Windows 10 on the same system, allowing flexibility in scheduling and timing for upgrades. Customers can upgrade individual sections of the plant in any order, at any pace, to best accommodate plant production schedules. With Microsoft support for Windows 7 due to end in 2020, transitioning to Windows 10 allows EcoStruxure Foxboro DCS customers to benefit from the strongest operating system with the most up-to-date cybersecurity features.

Among other new and updated features, the continuously current EcoStruxure Foxboro DCS Control Software 7.1 now includes:

• EcoStruxure Field Device Expert that improves efficiency, safety and profitability, while considerably reducing time for startup and restarts. It includes:

◦ Intelligent Commissioning Wizard, to reduce commissioning time up to 75 percent by automating HART device commissioning and documentation processes.

◦ Device Replacement Wizard to significantly reduce time and expertise to replace or commission HART devices, either individually or in bulk.

◦ Bundled HART DD library for increased security, faster device deployment, eradication of version mismatch and elimination of cybersecurity risks previously created by moving documents from the HART consortium web page into the system.

• New HMI Bulk Graphics Editor for increased operational efficiency and reliability by greatly reducing engineering hours and improving quality during testing. Use in major projects shows that replicating hundreds of displays with the new Bulk Graphics Editor saves months of man hours and improves quality by delivering highly predictable results. The Bulk Graphics Editor makes migrating from the classic FoxView HMI to the new Foxboro DCS Control HMI easier, requiring far fewer engineering hours, which reduces the time and cost to transition between technologies.

• Control Editors Activity Monitor for increased efficiency by improving communication, workflow and collaboration.

• Real-time asset health condition monitoring for increased reliability.

• Future-proof technology supporting the latest FTD 2.0 standard, which improves compatibility with digitized field devices from Schneider Electric and third-party vendors.

• New migration path, along with the new HMI Bulk Graphics Editor, simplifies the transition from existing FoxView HMI displays to the EcoStruxure Foxboro DCS Control Software 7.1 HMI platform for a continuously current and future-proof system. An upgrade migration path is available from previous Control Software Versions 5.x, 6.x and 7.0. After upgrading, users can tap into newer technologies that improve productivity, cybersecurity, efficiency and profitability.

by Gary Mintchell | Feb 15, 2017 | Automation, Process Control

A long-time dream of enabling operators to see the profit impacts of process changes is a giant step closer to reality.

Much of my early career involved the intersection of engineering and profitability. No surprise that I valued my conversations with Peter Martin over the years. He has long been a proponent of just such technology and workflow.

Now at Schneider Electric (but still Foxboro), he has an organizational stability that may get the job done. Enter “EcoStruxure Profit Advisor.”

Developed through a partnership with Seeq, a leading provider of software and services that enable data-driven decision making, EcoStruxure Profit Advisor uses Big Data analytics to measure the financial performance of an industrial operation in real time, from the equipment asset level of a plant up to the process unit, plant area, plant site and enterprise levels. On-premise or cloud-enabled, it works seamlessly with any process historian to mine both historical and real-time data. It then processes that data through Schneider Electric’s proprietary segment-specific accounting algorithms to determine real-time operational profitability and potential savings.

Controlling Business Variables in Real Time

“While many companies are getting really good at controlling the efficiency of their operations in real time, they’re still managing their business month to month. That just doesn’t work anymore,” said Peter Martin, vice president of innovation, Schneider Electric Process Automation. “Business variables are changing so quickly—sometimes by the minute—that by the time companies receive updates from whatever enterprise resource planning systems they use, the information is no longer relevant to the business decisions they need to make or should have made. If they want to change the game, they need to control their other real-time business variables, including their safety, their reliability and especially their operational profitability. Profit Advisor allows them to do that.”

Because current cost accounting systems only measure the financial performance of the industrial operation at the overall plant level, it is difficult for companies to truly understand the financial impact—positive and negative—operational changes have on business performance. To address that need, Profit Advisor allows plant personnel to see and understand the ROI and business value their actions, activities and assets are contributing to the business in real time. It empowers the workforce to make better business decisions with a variety of data analytics, which can be displayed in various formats, to help drive operational profitability improvements, safely.

Innovating at Every Level to Deliver Value-focused IIoT

“Our customers are struggling with many issues, including the sheer speed of business and how to manage and use emerging technology to their advantage,” said Chris Lyden, senior vice president, Process Automation, Schneider Electric. “Everyone wants to talk about all this new technology without focusing on what value it can deliver. From our perspective, the digitization of industry is a real opportunity for our customers. We’re taking a value-focused approach to IIoT because we know our ability to innovate at every level can help our customers control their productivity and profitability in real time. That’s the only reason we should be talking about IIoT to begin with.”

Profit Advisor layers real-time accounting models onto the Seeq Workbench to become a scalable, repeatable and easy-to-implement solution for multiple segments, enabling customers to both measure and control their profitability. And because it can be integrated with Schneider Electric’s simulation and modelling software in a digital twin environment, users are further enabled to forecast profitability under different conditions or if changes to the operation are made.

Overall, the software provides

- Historical Data Review: Profit Advisor can evaluate the historical performance of the plant to assess its operational profitability, helping plant personnel analyze and understand how the

operation performed during different conditions. It enables the workforce to identify true performance-improving initiatives. And since it can be tied to individual pieces of equipment, it can provide that information down to even the smallest asset in the operation.

- Real Time Performance Indication: Profit Advisor can indicate current performance and inform plant personnel when their operating decisions are making the business more profitable. Actual ROI and return on improvements will be visible, enabling plant personnel to concentrate and refine their efforts to the actions that provide the greatest financial returns. It also enables plant personnel to determine which parts of operation are constraining operational profitability and accurately estimate the business value their decisions might actually create.

- Profit Planning: Profit Advisor empowers process engineers to predict the profitability of the changes they are proposing, which will substantially minimize project risk and help to eliminate waste.

Check out this YouTube video.

Control Advisor

Schneider Electric, the global specialist in energy management and automation, has added a new enterprise-wide IIoT plant performance and control optimization software to its PES and Foxboro Evo process automation systems and Foxboro I/A Series distributed control system. Leveraging Expertune PlantTriage technology, EcoStruxure ControlAdvisor, a native smart decision-support tool, provides plant personnel actionable real-time operating data and predictive analytics capabilities so they can monitor and adjust every control loop across

multiple plants and global sites 24/7. The software empowers them to optimize the real-time efficiency of the process throughout the plant lifecycle and to contribute directly to improved business

by Gary Mintchell | Dec 4, 2015 | Operations Management

Early in my career management decided that I would be a good candidate to learn cost accounting. I never had that position, but I went deep into manufacturing cost.

That is why I like to keep up with the area. Several years ago John Jackiw at a MESA meeting recommended I contact the Resource Consumption Accounting Institute and Larry White, the executive director. Larry wrote columns for me during my time at Automation World. One of his columns was the most read on the Website for years.

Here is a column from the latest newsletter. If you’re interested in a deeper dive, RCAI’s monthly Webcast is next Friday, Dec. 12, at 12:00 EST for 30 minutes.

From Larry White:

As I attend professional accounting activities on local, national, and international levels, I get no arguments against my statements that traditional financial accounting, the supporting general ledger structure, and the internal and external financial reports that result do a poor job of providing cost information for internal decision support. So I’ve taken to asking the question: If you aren’t doing great costing, what information compensates for the shortfall?

The most frequent answer I get is “nothing”. If I can extend the inquiry, I ask a series of questions to see if I can figure out how the organization compensates. My usual inquiry path is:

- Does the company has a large gross margin and, therefore, is revenue information really sufficient for decision making? I seldom get a “yes” answer.

- Is the operations area of the organization aggressively focusing on process improvement and creating efficiencies? The typical answer is “to some extent”.

- Is there a strong organizational focus on the cash flow impacts of improvement and other decisions? Again, I get “to some extent”.

- Do you have a particularly strong budgeting and planning process, insightful budget performance reviews, and ongoing evaluation and analysis activities? The answer is usually “not particularly”.

The conclusion is that most organizations muddle through with the costing they have. They address decisions as special situations, requiring a special analysis, or use existing cost information and historical decision precedents. Most say they really don’t know how to put in place something better and don’t think executive management would support the effort.

If you are reading this, you know solid approaches exist for creating integrated internal and cost information. What’s your experience with how companies compensate for low quality cost information and what activities or other information are used to compensate?

Don’t hesitate to send me your comments or questions pertaining to any RCA related topic.

by Gary Mintchell | Jun 19, 2015 | Automation, Internet of Things, Networking, Operations Management, Process Control

There are a couple of interesting notes I’ve picked up recently.

Before I get to the first one, I took a long weekend and attended a conference on developing small businesses in developing nations. I met some successful business people who have a passion for helping others survive and thrive in difficult places.

We have learned (or should have) that sending huge chunks of aid money to developing countries has had little effect on changing people’s lives. A significant number of people engage in going to these areas and starting businesses, employing local people, treating all of them ethically, and making a profit for all involved.

If you wish to use your business and/or engineering talents to directly impact people, send me a note. I will get you in touch with the right people.

Are Democrats Throwing In the Towel On Manufacturing

Bill Waddell writes about Lean manufacturing. He is a practitioner and an evangelist. About the only place where he and I part ways relates to accounting. He is a Lean accounting follower. I follow Resource Consumption accounting.

At any rate, Industry Week ran an article authored by the Alliance of American Manufacturing asking if the Democratic Party had thrown in the towel regarding the importance of manufacturing in America.

Waddell responded with his typical acerbic wit by taking political leaders in America (both parties) to task for misunderstanding economics and manufacturing’s place at the table.

If you are a manufacturing professional, I dare you to put aside your party preference blinders for a second and just look at what politicians have to say about manufacturing. Comments are by-and-large ignorant (in the sense of not knowing something).

Where do they get it? Try reading articles about manufacturing in The New York Times or The Wall Street Journal. They also have trouble really understanding what’s going on in manufacturing. Those are two sources of information for politicians.

Drones And Internet of Things

Interesting article in Uptime magazine poses the idea of drones as a part of the infrastructure for the Internet of Things. At the time I write this, the article has not made it from print to Web, so I cannot link to it. Hey Terry, try “Web first” journalism 😉

Expanding our thinking about what constitutes “sensing” and how we get the information is a great service to the industry. As we move past the buzz of IoT and start to look for innovative ways to get the information we need, these ideas are needed.

Modbus as Fieldbus?

John Rezebek, a Foundation Fieldbus evangelist and process control engineer writing in Control magazine takes Grant Le Sueur of Schneider Electric (Foxboro) to task for making a comment about Modbus as a fieldbus.

Schneider Electric became the owner (or leader) of Modbus when it acquired Modicon almost 20 years ago. And Modbus was long in the tooth then. So it was an interesting comment.

However, Foundation is difficult to use. It perhaps tried to solve too many problems in one package. Modbus is too slow and lacking bandwidth for much of what we do in process control and in the Internet of Things for industrial/manufacturing use.

One thing I find surprising about trying to reinvigorate Modbus is that Schneider (again from absorbing Modicon an early Ethernet supporter) became an ODVA member supposedly to support the CIP protocol and EtherNet/IP. Wonder what’s going on there? I’m writing a post for next week about that protocol’s growth in process.

Check out John’s comments and let us know what you think. Is there a third way? Are we still lacking an adequate fieldbus? (OK, Carl, open mic night 😉 ).