by Gary Mintchell | Jan 27, 2020 | Automation, Technology

As you add electronic sensing and control and networking to machinery, you can take a process to the next level. I’ve been impressed with the growing development of tighter tolerances and then better variety of materials for 3D printing (additive manufacturing). Here is an example of expanding the use of automated “subtractive” manufacturing—micro machining.

6-D Laser LLC was formed in 2018 as an affiliate of leading nanometer-level motion control specialist ALIO Industries, with the mission of integrating ultrafast laser processing with precision multi-axis motion systems. 6-D Laser offers Hybrid Hexapod-based laser micromachining systems for wide-range taper angle control, 5-Axis Laser Gimbal-based systems for laser processing 3D substrates, and unlimited field of view scanning solutions for laser processing large-format substrates.

Coming out of stealth mode and coinciding with its official launch in 2020, 6-D Laser has launched its website (www.6dlaser.com), and has also announced that the company will be showcasing its radical new approach to laser micro processing at the SPIE Photonics West event, booth 2149, 4-6 February in San Francisco, CA.

6D Laser’s central mission addresses limitations of existing laser processing systems which are largely due to sub-optimal positioning systems used by most system integrators. 6-D Laser tackles this problem by integrating ultra-fast laser material processing with the 6-D nanometer-level precision motion control solutions in which ALIO Industries specializes.

At the heart of 6-D Laser’s integrated ultrafast laser micromachining system is ALIO Industries’ Hybrid Hexapod, which takes a different approach to traditional 6 Degree of Freedom (6-DOF) positioning devices, and exhibits much higher performance at extremely competitive prices. Rather than 6 independent legs (and 12 connection joints) ALIO’s approach combines a precision XY monolithic stage, tripod, and continuous rotation theta-Z axis to provide superior overall performance.

The combination of serial and parallel kinematics at the heart of ALIO’s 6-D Nano Precision® is characterized by orders-of-magnitude improvements (when compared to traditional hexapods) in precision, path performance, speed, and stiffness. The Hybrid Hexapod® also has a larger work envelope than traditional hexapods with virtually unlimited XY travel and fully programmable tool center point locations. The Hybrid Hexapod® has less than 100 nm Point Precision® repeatability, in 3-dimensional space.

6D Laser vertically integrates all of the sub-systems required for precision laser micro-processing, and it does this by forming strategic partnerships with key component and subsystem suppliers that are required to achieve the goals of demanding precision applications. In addition to its association with ALIO, 6-D Laser has also partnered with SCANLAB GmbH, which together with ACS Motion Control, has developed an unlimited field-of-view (UFOV) scanning solution for coordinate motion control of the galvo scanner and positioning stages called XLSCAN. 6-D Laser has also partnered with NextScanTechnology to provide high-throughput scanning systems that take advantage of the high rep-rates in currently available in ultrafast lasers, and Amplitude Laser, a key supplier of ultrafast laser systems for industrial applications.

Dr. Stephen R. Uhlhorn, CTO at 6-D Laser says, “Introducing an integrated ultrafast laser micromachining system that combines the positioning capabilities of the Hybrid Hexapod®, with high-speed optical scanning leads to a system that can process hard, transparent materials with wide-range taper angle control for the creation of high aspect ratio features in thick substrates, without limitations on the feature or field size.”

Ultrafast laser ablative processes, which remove material in a layer-by-layer process, result in machined features that have a significant side wall taper. For example, a desired cylindrical hole will have a conical profile. Taper formation is difficult to avoid in laser micromachining processes that are creating deep features (> 100 microns). Precision scanheads can create features with near-zero angle side walls, but they are limited to small angles of incidence (AOI) and small field sizes by the optics in the beamline.

Uhlhorn continues, “6-D Laser’s micromachining system controls the AOI and resulting wall taper angle through the Hybrid Hexapod® motion system, and the programmable tool center point allows for the control of the AOI over the entire galvo scan field, enabling the processing of large features.”

About 6-D Laser LLC

6D Laser, LLC, an affiliate of ALIO Industries, Inc, was founded in 2018 by C. William Hennessey and Dr. Stephen R. Uhlhorn. ALIO Industries is an industry-leading motion system supplier, specializing in nano-precision multi-axis solutions. 6D Laser was formed with the mission of integrating ultrafast laser processing with precision multi-axis motion systems, including ALIO’s Patented Hybrid Hexapod. The integration of ALIO True Nano motion systems with key sub-system suppliers, through strategic partnerships with Amplitude Laser, SCANLAB, and ACS Motion Control, enables a new level of precision and capability for advanced manufacturing.

www.6DLaser.com

www.microprm.com

by Gary Mintchell | Jan 20, 2020 | Automation, Technology

Originally 3D printing, aka additive manufacturing, seemed more a Maker’s machine and novelty with possible future applications. “Printers” were developed for one material, and one company sold the package. I did not think deeply about the machines but continued to watch developments.

The first constraint I discovered for widespread manufacturing adoption was holding tolerances. Researchers and engineers have tackled that problem.

A recent survey of manufacturers revealed that virtually all (99%) manufacturing executives surveyed believe an open ecosystem is important to advance 3D printing at scale. While 85% of manufacturers reported that industrial-scale AM has the potential to increase revenue for their business.

However, the research sponsored by 3D printing / additive manufacturing company Essentium and said to be conducted by an independent global research firm also reported that 22% said their 3D printing efforts have resulted in vendor lock-in that limits flexibility. Note that Essentium manufactures open systems. I have witnessed and written about the value of open ecosystems as a fulcrum for fostering innovation. I don’t know enough to endorse Essentium, but I do endorse the concept.

According to Essentium, the industrial AM market has been dominated by closed systems where customers are locked into vendors’ hardware, processes and materials. As the technology obstacles around economics, scale, strength and speed of production fall away, the number of manufacturers using 3D printing for full-scale production has doubled compared to last year (40% in 2019; 21% in 2018). Manufacturers are now demanding open ecosystems to overcome system inflexibility and use the materials of their choice – 50% of companies said they need high quality and affordable materials to meet the growing demand for industrial 3D printed parts.

An open additive ecosystem will see more partnerships focused on giving customers greater control of their innovation, more choice in materials, and industrial-scale production at ground-breaking economics. Market demand for Essentium’s open 3D printing ecosystem, developed in collaboration with multinational chemical company BASF and 3D software developer Materialise NV, is a clear indication that an open ecosystem approach is addressing unmet needs in the industrial additive market.

Blake Teipel, CEO and Co-founder, Essentium, said: “At Essentium, we strongly believe that an open ecosystem will be key to the evolution of Additive Manufacturing. Being locked into proprietary solutions that limit flexibility and choice is no longer an option if 3D printing is to become a serious contender as an industrial process for end-use products. An open market focused on developing new materials and better and faster machines is the only way for manufacturers to unlock new applications and new business opportunities. With this approach, the future belongs to the customer, not to the OEM.”

162 managers and executives from large manufacturing companies across the world completed the survey on their current experiences, challenges and trends with 3D printing for production manufacturing. Participants included a mix of roles and were from companies across industries including aerospace, automotive, consumer goods and contract manufacturing.

by Gary Mintchell | Aug 20, 2018 | Automation, Technology

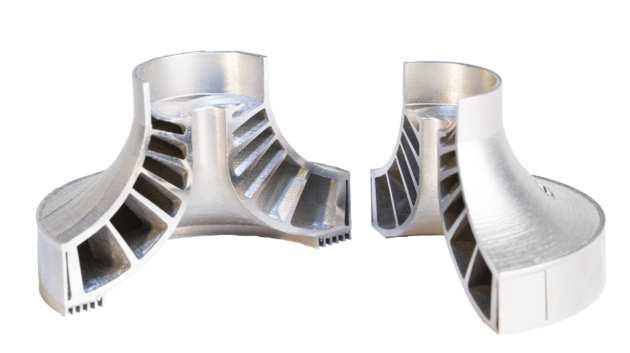

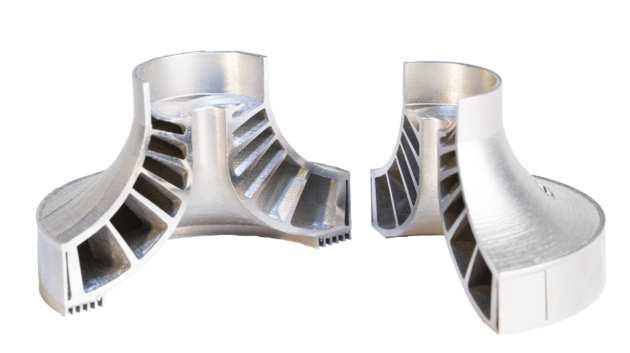

Moving additive manufacturing from plastics to metal and from hobbyist bench to the factory has attracted much attention. One of the problems with metal 3D printing (additive manufacturing) has been holding high tolerance for consistency. Velo3D today announced general release of its end-to-end metal additive manufacturing (AM) solution comprised of the Sapphire system, Flow print preparation software, and Intelligent Fusion technology. Together, the integrated solution solves some of the most difficult AM challenges including product design limitations, part-to-part consistency, process control and cost-effective manufacturing.

“Additive manufacturing has the potential to be revolutionary,” said Ashley Nichols, general manager at 3D Material Technologies (3DMT), a leading metal additive manufacturing services bureau. “Systems are getting bigger, but not delivering on the promises of metal additive manufacturing. Through a collaborative partnership, 3DMT and Velo3D are unlocking new applications, pushing the envelope of what is currently considered possible. We look forward to continued success, and to delivering on the promises of the potential of metal additive manufacturing.”

Sapphire System

The Sapphire system is a laser powder bed metal additive 3D printing system designed for high volume manufacturing. Sapphire is capable of building complex geometries including designs with overhangs that are less than five degrees and large inner diameters without supports – something previously unheard of in the AM industry. To deliver superior part-to-part consistency, Sapphire’s integrated in-situ process metrology enables first-of-its-kind closed loop melt pool control. To maximize productivity, the Sapphire system contains a module that enables automated change-over with offline unpacking.

Flow Print Preparation Software

Flow print preparation software includes support generation, process selection, slicing and simulation of complex part designs to validate execution feasibility before the build. Geometrical feature-driven processing enables low angles below five degrees. In addition, deformation correction technology enables the user to produce parts without the need for iterations, achieving a first print success rate of up to 90 percent. Flow minimizes the need for supports, reducing typical support volume by 3-5 times, which removes or reduces the laborious post processing necessary with conventional approaches.

Intelligent Fusion Technology

Enabling an end-to-end integrated workflow, Intelligent Fusion is the technology that powers Flow software and the Sapphire system. Intelligent Fusion optimizes the AM process by combining thermal process simulation, print prediction, and closed-loop control during print execution.

“Four years ago, we set out with the bold vision of creating technology that could manufacture parts with any geometry to take additive manufacturing mainstream,” said Benny Buller, founder and CEO of Velo3D. “Our approach relies on creating deep insights in physics fundamentals, enabled by research, characterizing and understanding of core mechanisms, developing intelligent process control through software simulation and in-situ metrology. Today, Velo3D is working with some of the top OEMs and service bureaus creating parts that were once considered impossible.”

Velo3D systems are currently used by original equipment manufacturers (OEMs) and manufacturing service providers.

www.velo3D.com.

by Gary Mintchell | Jul 30, 2018 | Commentary, Technology

Everybody has a list of transformative technologies. A news release from an advisory firm, ABI Research, came my way a few weeks ago. Its analysts came together and compiled a list of eight technologies they feel will be transformative in manufacturing and then they fit them with Smart Manufacturing. That latter phrase is one of the descriptors for the new wave of manufacturing strategy and technology.

We will have difficulty contesting the list. Most of these are, indeed, already well along the adoption path. I find it interesting that they refer to IIoT platforms, but they don’t view those as transforming technologies but rather as a sort of sandbox for the technologies to play in.

[This is a Gary aside—when an analyst firm makes a list of suppliers, I’d advise not considering it to be comprehensive. Rather the list is usually comprised of companies that the firm’s analysts get to sit down with and receive in-depth briefings.]

The ABI report identifies eight transformative technologies:

1 Additive manufacturing

2 Artificial intelligence (AI) and machine learning (ML)

3 Augmented reality (AR)

4 Blockchain

5 Digital twins

6 Edge intelligence

7 Industrial Internet of Things (IIoT) platforms

8 Robotics

From the ABI news release, “The manufacturing sector has already seen increased adoption of IIoT platforms and edge intelligence. Over the next ten years, manufacturers will start to piece together the other new technologies that will eventually lead to more dynamic factories less dependent on fixed assembly lines and immobile assets. Each step in this transformation will make plants and their workers more productive.”

“Manufacturers want technologies they can implement now without disrupting their operations,” says Pierce Owen, Principal Analyst at ABI Research. “They will change the way their employees perform jobs with technology if it will make them more productive, but they have no desire to rip out their entire infrastructure to try something new. This means technologies that can leverage existing equipment and infrastructure, such as edge intelligence, have the most immediate opportunity.”

ABI summary of its research

The transition towards a lights-out factory has started, but such a major disruption will require an overhaul of workforces, IT architecture, physical facilities and equipment and full integration of dozens of new technologies including connectivity, additive manufacturing, drones, mobile collaborative robotics, IIoT platforms and AI.

IIoT platforms must support many of these other technologies to better integrate them with the enterprise and each other. Those that can connect and support equipment from multiple manufacturers, such as PTC Thingworx and Telit deviceWISE, will last.

After decades of producing little more than prototypes, the AM winter has ended and new growth has sprung up. GE placed significant bets on AM by acquiring Arcam and Concept laser in 2016, and Siemens announced an AM platform in April 2018. Other leading AM specialists include EOS, Stratasys, HP and 3D Systems.

ML capabilities and simulation software have made digital twins extremely useful for product development, production planning, product-aaS, asset monitoring and performance optimization. Companies with assets that they cannot easily inspect regularly will significantly benefit from exact, 3D digital twins, and companies that manufacture high-value assets should offer digital twin monitoring as-a-service for new revenue streams. Innovative vendors in digital twins and simulation software include PTC, SAP, Siemens, and ANSYS.

The above technologies have already started to converge, and robotics provide a physical representation of this convergence. Robotics use AI and computer vision and connect to IIoT platforms where they have digital twins. This connectivity and AI will increase in importance as more cobots join the assembly line and work alongside humans. The robotics vendors that can integrate the most deeply with other transformative technologies have the biggest opportunity. Such vendors include the likes of ABB, KUKA, FANUC, Universal Robots, Rethink Robotics and Yaskawa.

“The vendors that open up their technologies and integrate with both existing equipment and infrastructure and other new transformative technologies will carve out a share of this growing opportunity. Implementation will go step-by-step over multiple decades, but ultimately, how we produce goods will change drastically from what we see today,” concludes Owen.

by Gary Mintchell | Mar 28, 2017 | Automation, Education, Leadership, Technology

Manufacturing in America—an event bringing together vendors, academia, end users of controls and automation. Siemens Industry, collaborating with its local distributor Electro-Matic, held a trade show/seminar series/thought leadership summit at the Marriott Renaissance Center Detroit March 22-23. The show has a distinct automotive industry feel, as you might expect, even though Detroit, and indeed all of Michigan, is reforming itself along high tech lines with less reliance on traditional automotive.

There was certainly a lot of thought leadership opportunity at the event. There was the Siemens Industry President of Digital Factory. There was the Governor of the State of Michigan.

And then, there was the group of high school students competing in the FIRST Robotics competition known as the ThunderChickens—Engineering A Better Way To Cross The Road. The picture shows a model of their robot. Such passion. Such creativity. The mechanical guy pointed to the control module. “It limits me to 6 motors,” he said. “Last year we only had one, but this year I could have used many more.”

Six motors!! What I’d have given as a kid building stuff to have one! Oh well, they were great.

Raj Batra, President of Digital Factory for Siemens, said the focus is on digitalization. Digital Twin is a piece of digitalization. This is the digital representation of a physical thing—product, machine, or component. Siemens brought all this together through the 2007 investment in acquiring UGS to form Siemens PLM. “Companies thought it was hype back then, now we know it drives value,” said Batra. “If you are a pure automation company how do you accomplish all this without a design component? You can’t have the digital twin. Meanwhile, a CAE company that doesn’t have automation and control do manufacturing—what do you get?” Batra added challenging the competition.

Raj Batra, President of Digital Factory for Siemens, said the focus is on digitalization. Digital Twin is a piece of digitalization. This is the digital representation of a physical thing—product, machine, or component. Siemens brought all this together through the 2007 investment in acquiring UGS to form Siemens PLM. “Companies thought it was hype back then, now we know it drives value,” said Batra. “If you are a pure automation company how do you accomplish all this without a design component? You can’t have the digital twin. Meanwhile, a CAE company that doesn’t have automation and control do manufacturing—what do you get?” Batra added challenging the competition.

Batra continued, “We are close to a new era of autonomous manufacturing. And there is the growth of IIoT, we call Mindsphere. This all means manufacturing is no longer a black box to the enterprise. Indeed, it is strategic to the enterprise.”

Paul Maloche, vp sales and marketing Fori Automation, manufacturers of automated guided vehicles, discussed the methods by which collaboration with suppliers (in this case with Siemens) leads to innovation. Fori was diversifying from reliance on building machines for automotive applications, and evaluated the aerospace industry. The Siemens rep came in and said they could help get them into that market. But Fori would have to convert to Siemens control. The Fori team replied, “OK.” This led to development of automated guided vehicle technology and products. The partnership opened doors. Fori won several orders in aerospace market for the new AGVs with Siemens control.

Alistair Orchard, Siemens PLM, riffing off a space movie, began his talk, “Detroit, we have a problem.” All the old business models of trying to ship jobs overseas has not worked. We need to make stuff to be successful as a society. “So much of what we do has not changed in 50 years in manufacturing,” he noted, “but digitalization can change everything. Additive manufacturing can lead to mass customization due to 3D printing using the digital twin. You can try things out, find problems in design or manufacturing. You can use predictive analytics at design stage. Digital enterprise is about manufacturing close to the customer.”

Alistair Orchard, Siemens PLM, riffing off a space movie, began his talk, “Detroit, we have a problem.” All the old business models of trying to ship jobs overseas has not worked. We need to make stuff to be successful as a society. “So much of what we do has not changed in 50 years in manufacturing,” he noted, “but digitalization can change everything. Additive manufacturing can lead to mass customization due to 3D printing using the digital twin. You can try things out, find problems in design or manufacturing. You can use predictive analytics at design stage. Digital enterprise is about manufacturing close to the customer.”

Governor Rick Snyder, Michigan, touted his manufacturing background as former operations head at Gateway Computers. “As governor,” he said, “it’s about how you can build an ecosystem and platform for success. Long term, success needs talent. His philosophy contains the idea that we shouldn’t tell students what they should study, but let them know where opportunities are and how to prepare for them. The private sector needs to tell government what they need in the way of talent.”

Governor Rick Snyder, Michigan, touted his manufacturing background as former operations head at Gateway Computers. “As governor,” he said, “it’s about how you can build an ecosystem and platform for success. Long term, success needs talent. His philosophy contains the idea that we shouldn’t tell students what they should study, but let them know where opportunities are and how to prepare for them. The private sector needs to tell government what they need in the way of talent.”

Michigan has grown more manufacturing jobs than anywhere else in the country. Not only manufacturing, though, Michigan is also a center of industrial design. But the economy not only needs designers and engineers, but also people in skilled trades. “We need to promote that as a profession. We must break the silos that said your opportunities are limited to your initial career choice.”

Michigan has invested a lot in students, especially in FIRST Robotics, where Michigan teams have risen to the top. The state has also started a computer science competition in cyber security.

How are you innovating and making the world better?

Josh Linkner, CEO Detroit Venture Partners, gave the keynote address on innovation. I’ll leave you with his Five Obsessions of Innovators.

Josh Linkner, CEO Detroit Venture Partners, gave the keynote address on innovation. I’ll leave you with his Five Obsessions of Innovators.

1. Curiosity—ask open ended questions

2. Crave what’s next—future orientation

3. Defy tradition—use Judo flip to turn idea on its head

4. Get scrappy—grit, determination, tenacity

5. Adapt fast

Raj Batra, President of Digital Factory for Siemens, said the focus is on digitalization. Digital Twin is a piece of digitalization. This is the digital representation of a physical thing—product, machine, or component. Siemens brought all this together through the 2007 investment in acquiring UGS to form Siemens PLM. “Companies thought it was hype back then, now we know it drives value,” said Batra. “If you are a pure automation company how do you accomplish all this without a design component? You can’t have the digital twin. Meanwhile, a CAE company that doesn’t have automation and control do manufacturing—what do you get?” Batra added challenging the competition.

Raj Batra, President of Digital Factory for Siemens, said the focus is on digitalization. Digital Twin is a piece of digitalization. This is the digital representation of a physical thing—product, machine, or component. Siemens brought all this together through the 2007 investment in acquiring UGS to form Siemens PLM. “Companies thought it was hype back then, now we know it drives value,” said Batra. “If you are a pure automation company how do you accomplish all this without a design component? You can’t have the digital twin. Meanwhile, a CAE company that doesn’t have automation and control do manufacturing—what do you get?” Batra added challenging the competition. Alistair Orchard, Siemens PLM, riffing off a space movie, began his talk, “Detroit, we have a problem.” All the old business models of trying to ship jobs overseas has not worked. We need to make stuff to be successful as a society. “So much of what we do has not changed in 50 years in manufacturing,” he noted, “but digitalization can change everything. Additive manufacturing can lead to mass customization due to 3D printing using the digital twin. You can try things out, find problems in design or manufacturing. You can use predictive analytics at design stage. Digital enterprise is about manufacturing close to the customer.”

Alistair Orchard, Siemens PLM, riffing off a space movie, began his talk, “Detroit, we have a problem.” All the old business models of trying to ship jobs overseas has not worked. We need to make stuff to be successful as a society. “So much of what we do has not changed in 50 years in manufacturing,” he noted, “but digitalization can change everything. Additive manufacturing can lead to mass customization due to 3D printing using the digital twin. You can try things out, find problems in design or manufacturing. You can use predictive analytics at design stage. Digital enterprise is about manufacturing close to the customer.” Governor Rick Snyder, Michigan, touted his manufacturing background as former operations head at Gateway Computers. “As governor,” he said, “it’s about how you can build an ecosystem and platform for success. Long term, success needs talent. His philosophy contains the idea that we shouldn’t tell students what they should study, but let them know where opportunities are and how to prepare for them. The private sector needs to tell government what they need in the way of talent.”

Governor Rick Snyder, Michigan, touted his manufacturing background as former operations head at Gateway Computers. “As governor,” he said, “it’s about how you can build an ecosystem and platform for success. Long term, success needs talent. His philosophy contains the idea that we shouldn’t tell students what they should study, but let them know where opportunities are and how to prepare for them. The private sector needs to tell government what they need in the way of talent.” Josh Linkner, CEO Detroit Venture Partners, gave the keynote address on innovation. I’ll leave you with his Five Obsessions of Innovators.

Josh Linkner, CEO Detroit Venture Partners, gave the keynote address on innovation. I’ll leave you with his Five Obsessions of Innovators.