by Gary Mintchell | Jun 11, 2018 | Commentary, News

So I decided not to make a cross country trip to San Diego for Rockwell Automation’s RATechEd event this year. I have cross country trips coming up the next two weeks followed by family time. So, I’m doing a one-day business trip plus taking my wife out for dinner in Chicago this week. Anyway, they had informed me that they wouldn’t be setting up interviews but that I’d be welcome to sit in any sessions I wanted. I passed.

Then I see a tweet from PTC today. Blockbuster news. Rockwell Automation’s Connected Enterprise just became connected. It has invested $1B in PTC for an approximate 8% ownership. PTC has [ERP], PLM, and IIoT (Kepware and ThingWorx). By connecting with these technologies, Rockwell now has the possibility of a technology convergence rivaling its rivals in Europe.

There are three of my questions about Rockwell answered:

- Other than a refreshing change of culture, what else was Blake Moret going to do to put his stamp on the company?

- When was Rockwell Automation going to really connect the enterprise like its slogan has held for several years (about the time I came up with Manufacturing Connection for the new title for my blog)?

- How was Rockwell going to answer the digital manufacturing and Industry 4.0 moves made by its European competitors Siemens, Schneider Electric, and ABB?

This is far from an acquisition and just a partnership right now. But it is a big step in the right direction.

Here is the press release I downloaded from Business Wire.

PTC Inc. and Rockwell Automation, Inc. today announced that they have entered into a definitive agreement for a strategic partnership that is expected to accelerate growth for both companies and enable them to be the partner of choice for customers around the world who want to transform their physical operations with digital technology.

As part of the partnership, Rockwell Automation will make a $1 billion equity investment in PTC, and Rockwell Automation’s Chairman and CEO, Blake Moret, will join PTC’s board of directors effective with the closing of the equity transaction.

The partnership leverages both companies’ resources, technologies, industry expertise, and market presence, and will include technical collaboration across the organizations as well as joint global go-to-market initiatives. In particular, PTC and Rockwell Automation have agreed to align their respective smart factory technologies and combine PTC’s award-winning ThingWorx IoT, Kepware industrial connectivity, and Vuforia augmented reality (AR) platforms with Rockwell Automation’s FactoryTalk MES, FactoryTalk Analytics, and Industrial Automation platforms.

“This strategic alliance will provide the industry with the broadest integrated suite of best-in-class technology, backed by PTC, the leader in IoT and augmented reality, and Rockwell Automation, the leader in industrial automation and information. Our combined customer base will benefit from two world-class organizations that understand their business and deliver comprehensive, innovative, and integrated solutions,” said Jim Heppelmann, President and CEO, PTC. “Leveraging Rockwell Automation’s industry-leading industrial control and software technology, strong brand, and domain expertise with PTC’s award-winning technology enables industrial enterprises to capitalize on the promise of the Industrial IoT. I am incredibly excited about this partnership and the opportunity it provides to fuel our future success.”

Blake Moret, Chairman and CEO, Rockwell Automation, said, “We believe this strategic partnership will enable us to accelerate growth by building on both companies’ records of innovation to extend the value of the Connected Enterprise and deepen our customer relationships. As IT and OT converge, there is a natural alignment between our companies. Together, we will offer the most comprehensive and flexible IoT offering in the industrial space. Our equity investment in PTC reflects our confidence in the partnership and the significant upside we expect it to create for both companies as we work together to profitably grow subscription revenue.”

Rockwell Automation’s solutions business will be a preferred delivery and implementation provider, supported by a robust ecosystem of partners that both companies have established. The strength of both companies across geographies, end markets, and applications is complementary.

Terms

Under the terms of the agreement relating to the equity investment, Rockwell Automation will make a $1 billion equity investment in PTC by acquiring 10,582,010 newly issued shares at a price of $94.50, representing an approximate 8.4% ownership interest in PTC based on PTC’s current outstanding shares pro forma for the share issuance to Rockwell Automation. The price per share represents an 8.6% premium to PTC’s closing stock price on June 8, 2018, the last trading day prior to today’s announcement. Rockwell Automation intends to fund the investment through a combination of cash on hand and commercial paper borrowings. Rockwell Automation will account for its ownership interest in PTC as an Available for Sale security, reported at fair value.

by Gary Mintchell | Jan 2, 2018 | Asset Performance Management, Operations Management

The product Rockwell Automation executives most wanted to talk to me about at the last Automation Fair event was its new analytics platform.

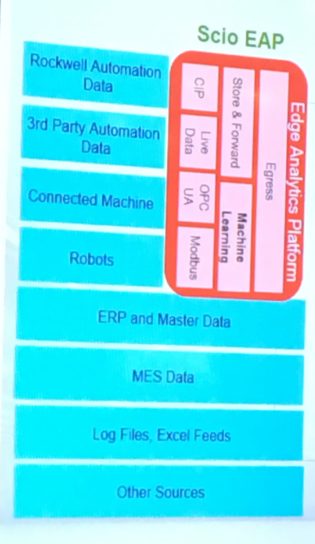

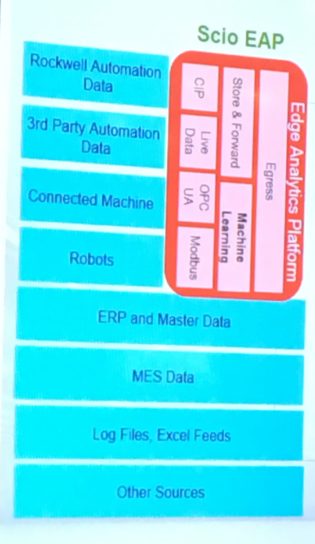

Immediately following the Rockwell event was Thanksgiving, then a trip to Madrid for a Hewlett Packard Enterprise event followed by catching up and Christmas. But I grabbed moments to contemplate the “Project Scio Edge Analytics Platform” (see image) and tried to place it in a context amongst all the platforms I saw this year. Which were many.

Executives including SVP and CTO Sujeet Chand and VP of Information Software John Genovesi were enthused over the new product. I wrote about it here.

I liked much of what I heard. There were many overtures to open connectivity that I have not heard at a Rockwell event—maybe ever. I even got an hour to discuss OPC UA and how Rockwell now intends to implement it. The demo during media days was also powerful.

I drew a mind map and exported an outline. Here is the list of positive things.

Positives

- Developed analytics from acquihire

- Good UX

- Platforms

- Open connectivity including OPC UA

- Should provide customers with insights into control systems and machine performance

However, I’m left with some questions—some of the same ones I often feel about Rockwell Automation. Check out the architecture diagram. It stops with machine level. I always expect to see more, but Rockwell always stops at the machine. Perhaps GE and Siemens have overreached with Predix and Mindsphere (and Schneider Electric with EcoStruxure?), so Rockwell stays closer to its roots on the plant floor? Is it more profitable and manageable that way?

I don’t know the answers. But I’m left thinking that with the rise of platforms [see for example Platform Revolution by Geoffrey G. Parker, Marshall W. Van Alstyne, and Sangeet Paul Choudary] and open ecosystems, Rockwell seems to have a much smaller vision. It talks of “Connected Enterprise”, but in the end I don’t see a lot of “enterprise” in the offerings.

Questions

- Is it platform or a piece of the Rockwell software stack that stops short of plantwide views?

- Is it anything that others (SIs and users?) can add to?

- Is there more coming?

- Is there a way to integrate supply chain and customer chain?

- Seems a natural to integrate with an asset management application–which Rockwell does not have.

I think they’ve done well for what they evidently set out to do. I also think there remains more to do to help customers leverage the Internet of Things and Digital Transformation. Interesting to see what next November brings.

by Gary Mintchell | Dec 12, 2017 | Automation, Operations Management

Rockwell Automation continues its path of Connected Enterprise. In the grand scheme of RA products, I’ve never thought of software and networking as having a major impact on sales numbers. But the company continues to roll out some innovation. The “Shelby” bot and Project Scio analytics reveal some unexpected software advances for what has been a devotedly hardware-centric company.

To accompany software and networking and connectivity, Rockwell has beefed up its services offering. Its Connected Services offerings are designed to help customers plan for, deploy, and maintain new digital transformation solutions.

This is the last of my reports from interviews during Automation Fair in November in Houston. It seems the more work that I complete, the more that comes my way. I don’t think I’ll catch up in January either since it appears that my off-season soccer administrative responsibilities keep growing.

Back to Connected Services.

Connected Services offerings include industrial infrastructure assessment, design, implementation, support and monitoring capabilities including Infrastructure-as-a-Service (IaaS), remote asset monitoring and predictive maintenance, cybersecurity threat detection and recovery, training and consulting offerings. These software-powered services build on existing application and product support services to help organizations access and use production data to improve asset utilization and productivity, while reducing risk and time-to-market.

“Industrial operators have been using cutting-edge technology since the Industrial Revolution,” said Sherman Joshua, global portfolio manager for Connected Services, Rockwell Automation. “Our customers understand that digitizing operations or building a Connected Enterprise is about much more than rolling out new technology. They need the right infrastructure, process and people in place to transform operations and capture the value new technology is unlocking. That value is huge. Our Connected Services are making it easier and faster for our customers to uncover it.”

For example, according to ARC Advisory Group, the cost of unscheduled downtime in industrial operations exceeds $20 billion. Through traditional means of detecting, diagnosing and fixing downtime, approximately 76 percent of downtime occurs before any corrective action is undertaken. Connected Services can help users detect and resolve issues quickly, reducing downtime by as much as 30 percent.

Connected Services offerings start with building a secure information infrastructure. Network and cybersecurity services include assessments and design, technical support, IT/OT training, remote monitoring, threat detection and recovery, turnkey implementation, pre-engineered network solutions, and network monitoring and management. These services can speed the integration of new equipment and systems, vastly improve security and help reduce downtime with access to technical resources.

Remote support, monitoring and response services can prove especially valuable for critical processes through around-the-clock operations and remote operations. These services can complement on-site maintenance teams, providing everything from continuous machine monitoring and incident response to 24/7 remote support and software/firmware updates. Deployments can make use of the FactoryTalk Cloud gateway, on-premise Rockwell Automation Industrial Data Center servers, or a hybrid model that combines both options to help improve productivity and reduce downtime.

Data integration and contextualization services can help capture a wealth of data and convert it into actionable information. These services can provide new opportunities to help increase productivity. Producers can reduce skills gap challenges by relying on Rockwell Automation to monitor, maintain and manage the network, equipment or entire applications. Additional digital transformation and data scientist consulting services will be available in 2018.

Connected Services offerings are also scalable, allowing producers to build ROI as they go, and rely more on OPEX than CAPEX funding. Rockwell Automation can deliver and execute Connected Services offerings globally, giving organizations consistent support across operations.

by Gary Mintchell | Oct 23, 2017 | Manufacturing IT, Operations Management

Infrastructure-as-a-Service. Remember several years ago when Amazon started selling space and time on its servers? And people thought they were crazy. Is this a business?

Well, as the old vaudeville comedian and TV pioneer Jimmy Durante used to say, “Everybody wants to get into the act.”

We have lots of “–as-a-service” things going on over the past 15 years or so. Software, Application, Platform. Here Rockwell Automation leverages its partnerships with Cisco, Panduit, and Microsoft (who has its own Infrastructure-as-a-Service) to offer an extension to its longtime strategy of using Ethernet as a networking backbone to its Connected Enterprise vision.

Designing, deploying and maintaining this infrastructure can be complex and time consuming for many companies, and is often too costly for their capital budgets. Rockwell Automation has introduced its Infrastructure-as-a-Service (IaaS) offering to address these challenges.

Rockwell’s IaaS reduces the burden of network deployments by combining pre-engineered network solutions, on-site configuration and 24/7 remote monitoring into a single five-year contract. The result is simplified ordering and commissioning upfront, and can help improve network reliability long term. The service can also ease budgetary strains by shifting networking costs from a capital expense to an operating expense.

Rockwell’s Solution

All aspects of IaaS are aligned to the Converged Plantwide Ethernet (CPwE) reference architectures developed by Rockwell Automation and Cisco. Leveraging best-in-class technologies and architectures, companies can optimize their network infrastructure’s performance, efficiency and uptime, as well as address security risks.

“Companies of all sizes are eager to digitally transform their operations in a Connected Enterprise, but many are limited in their ability to connect their infrastructure,” said Sherman Joshua, connected services portfolio manager, Rockwell Automation. “Often, a combination of time, talent and budgetary constraints hold them back. IaaS helps relieve these pressures by combining turnkey networking solutions with our highest level of support.”

IaaS is offered with two Rockwell Automation pre-engineered network solutions, including the Industrial Data Center (IDC) and the Industrial Network Distribution Solution (INDS). These solutions are designed for industrial use and incorporate industry-leading technologies from Rockwell Automation Strategic Alliance partners Cisco, Panduit and Microsoft.

The IDC provides all the hardware and software needed to transition to a virtualized environment, and is designed to deliver high availability and fault tolerance. The INDS is a network distribution package that helps end users achieve secure, high-capacity connectivity between the control room and throughout the plant floor.

Under an IaaS contract, Rockwell Automation will size, assemble and test the infrastructure, including configuration and on-site deployment at the customer’s facility. Contracts include 24/7 remote monitoring of critical system parameters to help prevent outages and failures, as well as proactive system maintenance and checks to improve reliability. Support response is guaranteed within 10 minutes, but actual response times average three minutes.

by Gary Mintchell | Aug 11, 2017 | Automation, Commentary

I wrote about FoxConn building a plant (maybe) in Wisconsin.

“Retired” Rockwell Automation Communications Director John Bernaden commented on my LinkedIn post of the article:

Good perspective Gary Mintchell. FoxConn’s been trying to replace its Chinese workers with automation and robotics for several years now with limited success. They’re realizing what’s no surprise to you — advanced systems integration of complex connected enterprises is extremely difficult. But FoxConn like too many at traditional IT companies underestimate these challenges and difficulties. In a related example, top Apple execs invited Rockwell’s CTO to a meeting in Cupertino a few years ago where they informed him that Apple planned to develop its own factory automation systems. Rockwell’s CTO literally laughed at their naïveté and politely left. Similarly Google acquired seven industrial robotics companies bragging in big New York Times articles about their X Division plan to produce armies of industrial robots. However they’ve quietly now sold or spun off most those industrial Robotics companies. The bottom line is that IT giants like Apple, Google, and FoxConn need traditional discrete automation companies like Rockwell, Siemens, GE and others to be successful.

John raises interesting points. IT programming often has some similar terminology to industrial automation—control loops, input/output, timers, and so forth. But the specific underlying technologies of industrial sensors and transmitters, industrial controllers, deterministic messaging, and the like make things much different.

I have been getting many behind the scenes looks at what Dell Technologies has been doing with Internet of Things in an industrial setting with its gateways and partnerships. Monday will find me in Houston, Texas, at a Hewlett-Packard Enterprise (HPE) event looking at what HPE is doing in the same arena.

These IT companies have formulated a strategy of working from IT (CIO) down to the factory floor, whereas Rockwell Automation and Siemens are pursuing a similar end game with a strategy beginning in the plant and working up to enterprise.

This middle ground is the new battlefield.

Connecting the enterprise is where the action exists at this time. That’s why I named my blog The Manufacturing Connection.

Watch next week as I update what HPE is up to and catch up with someone I had several great conversations with while he was at National Instruments discussing Big Analog Data—Dr. Tom Bradicich.