by Gary Mintchell | May 21, 2015 | Automation, News

For some reason, I keep getting requests for information and analysis on robotics. The standard models of robots have remained pretty much the same for years. The market has not grown much. The association magazine devoted to robots folded years ago. Yet, there remains some interest in the market.

For some reason, I keep getting requests for information and analysis on robotics. The standard models of robots have remained pretty much the same for years. The market has not grown much. The association magazine devoted to robots folded years ago. Yet, there remains some interest in the market.

Given that, ABB had a robot technology day May 20. It was on my calendar to drive up to the Detroit area and attend. A sudden business meeting relating to one of my angel investments interfered. Here is the big news from the event.

ABB announced it is to start producing robots in the United States. Production is to commence immediately. ABB claims it is the only major international robotics player to actually manufacture in the US.

The new plant is ABB’s third robotics production facility, alongside Shanghai, China, and Västerås, Sweden, and will manufacture ABB robots and related equipment for the North American market.

The United States is ABB’s largest market with US$7.5 billion in sales. The company has invested more than US$10 billion in local R&D, capital expenditure and acquisitions since 2010, taking local employment from 11,500 to 26,300. Continued investment in the North American value chain and manufacturing constitutes a significant part of ABB’s global growth plans reflecting the company’s Next Level strategy.

“Today, we are marking and celebrating the next stage of our commitment and growth in North America with the start of local robot manufacturing in Auburn Hills, US,” said ABB CEO Ulrich Spiesshofer. “ABB is the first global automation company to open a robot manufacturing facility in the United States. Robotics is a fundamental enabler of the next level of North American industrial growth in an increasingly competitive world. With our continued commitment and investment, our local team is well positioned to support our customers with robotics solutions made in the United States. Our leading technology of web-enabled, collaborative and safe robots will contribute to job security and quality of work.”

“The new North American manufacturing presence elevates our offering and service to robotics customers in the United States, Mexico and Canada, allowing us to achieve best-in-class delivery schedules and technical support in North America,” said Per Vegard Nerseth, Managing Director of ABB Robotics. “The expansion is consistent with our global strategy, which is to establish a local presence in key robotics growth markets to provide our leading technology to our customers.”

The portfolio of products manufactured at the new facility will expand in phases, with the goal that most ABB robots and robot controllers delivered in the United States, Canada and Mexico will be manufactured in Auburn Hills. Localized manufacturing streamlines the delivery process and results in significantly reduced robot lead times for customers.

by Gary Mintchell | Jan 12, 2015 | Automation, Internet of Things, News, Operations Management, Technology, Workforce

Manufacturing output and manufacturing employment are important factors in our economy. They are also sources of endless speculation and angst.

Manufacturing output and manufacturing employment are important factors in our economy. They are also sources of endless speculation and angst.

Last week I ran across this graph from “FRED”, the St. Louis Fed. The graph combines year-over-year change in manufacturing production and employment curves.

Notice that usually employment tracks production although not varying as much as production. I also noticed that whereas most months from October 1998 to November 2010 showed growing production, employment lost every one of those months.

The blog writer from the Fed wrote, “The role of manufacturing in the U.S. economy is often discussed. As shown in the FRED graph above, as a year-over-year percent change, the level of manufacturing has generally grown. (One striking exception is during the recent recession.) The number of employees working in manufacturing is a different story, however. It has sometimes grown, but it has nearly always grown less than the growth in manufacturing. This suggests that growth in manufacturing does not equal growth in manufacturing jobs. What’s the explanation? A prime candidate is productivity growth. Another is that the sectoral mix has shifted toward industries with higher value added, such as computers and electronics.”

I think they are on the right track. Could we also add process industries (refining and chemicals fall into the manufacturing NAICS, but upstream does not)? I couldn’t find the numbers quickly, but I think those industries require fewer employees than, say, automobile and machinery manufacturing. There were huge shifts in the technology and market fundamentals in those subsectors.

What’s coming

I’ve been listening to reports from last week’s edition of the International CES (formerly Consumer Electronics Show). I draw your attention, for example to this video/podcast roundup from This Week in Tech (TWiT), a popular technology industry round table.

During the first 45 minutes or so there was a discussion of autonomous vehicles. Whereas the usual fare at the show includes TVs, mobile phones, electronic gadgets, this year’s news—even outstripping Internet of Things—was dominated by car manufacturers. This was to the extent that the Detroit Auto Show was pushed back one week so that the manufacturers could focus effort on CES.

Car designers have increasingly incorporated electronics into vehicles. First was control systems, then HVAC, then entertainment systems. Now we are seeing a rapid uptake of taking control to the next level—controlling not only the engine and transmission, but driving itself. Autonomous vehicles were front and center. And these are not only concept cars.

Let’s consider the economic impact of autonomous vehicles. There is every potential that widespread adoption of these vehicles could reduce vehicle demand. I live in a rural area where cars are pretty much a necessity for getting anywhere.

Even so, what if there were a model where I could click an app on my iPhone and summon a car to pick me up and take me down to Dayton (40 miles of rural interstate) for a meeting. On my way to the meeting, I could be preparing for the meeting. Or, perhaps just reading. Either way, I don’t have to concentrate on driving.

In my grandfather’s day, that would have been called the Trolley. There was a passenger light rail system that went from Sidney to Dayton (and through Piqua, Troy, Tipp City and Vandalia). We haven’t had that since before WWII.

Especially in cities. It could really cut down on need for cars in suburbs where cabs are infrequent and expensive. But if you don’t need a car full time, you could have an on-demand car.

If electric cars get added to this mix, many more jobs would be eliminated by eliminating engines, complex transmissions, and the like.

Yes, I can see where manufacturing production could continue to increase, but the need for employees would drop.

However, in that same time frame, we will be faced with a declining labor force. This could be something fortuitous for our grandkids.

Other CES news

Check out this article about Toyota’s hydrogen automobile.

I also wrote about this cool little gadget that gives early warning of driver fatigue.

by Gary Mintchell | Jan 5, 2015 | News

BLS Statistics

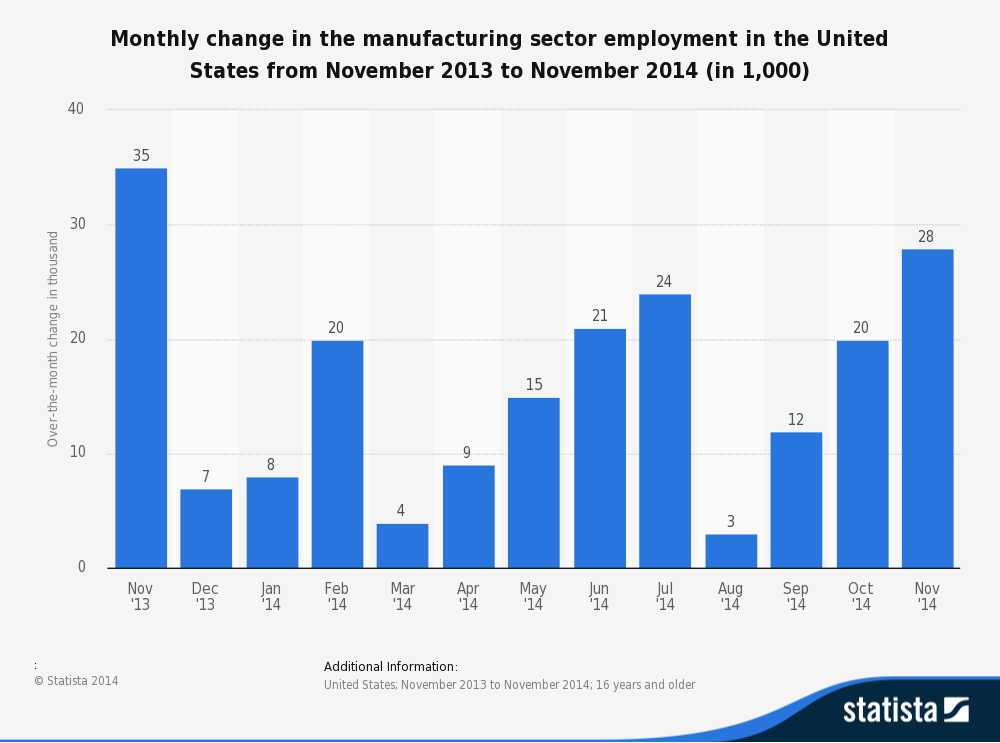

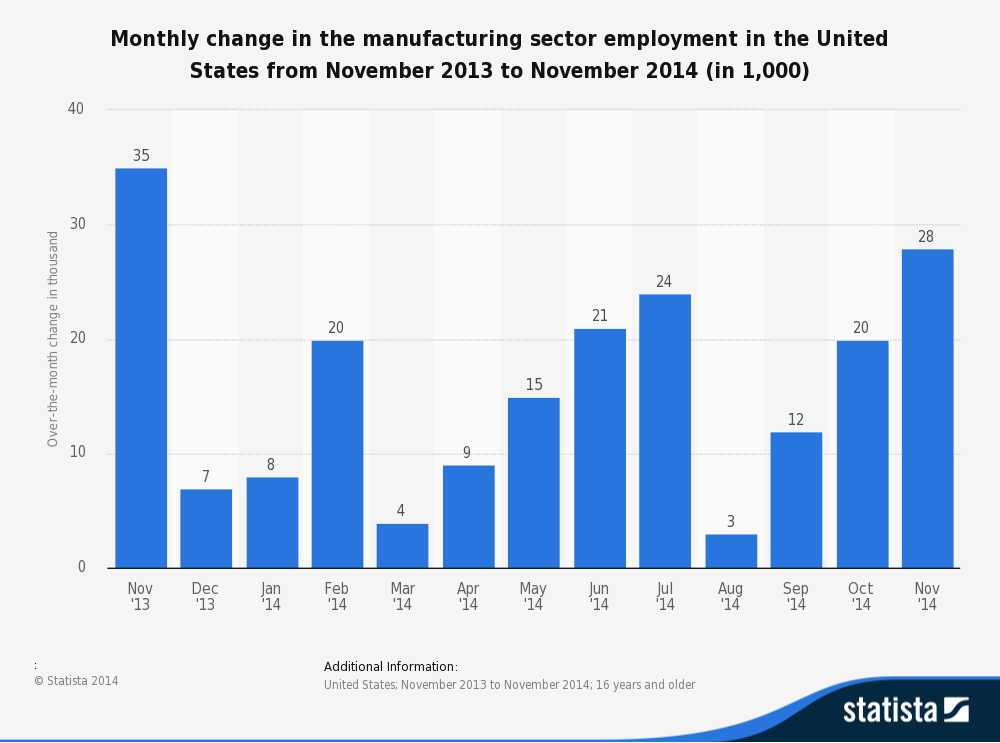

This statistic from the US Bureau of Labor Statistics shows the monthly change in the manufacturing sector employment in the United States. The data are seasonally adjusted. According to the BLS, the data is derived from the Current Employment Statistics (CES) program which surveys each month about 140,000 businesses and government agencies, representing approximately 440,000 individual worksites, in order to provide detailed industry data on employment. In the goods-producing sector, manufacturing increased by 28,000 in November 2014.

This statistic from the US Bureau of Labor Statistics shows the monthly change in the manufacturing sector employment in the United States. The data are seasonally adjusted. According to the BLS, the data is derived from the Current Employment Statistics (CES) program which surveys each month about 140,000 businesses and government agencies, representing approximately 440,000 individual worksites, in order to provide detailed industry data on employment. In the goods-producing sector, manufacturing increased by 28,000 in November 2014.

The Fed

The news from the Federal Reserve was also good.

Industrial production increased 1.3 percent in November after edging up in October; output is now reported to have risen at a faster pace over the period from June through October than previously published. In November, manufacturing output increased 1.1 percent, with widespread gains among industries. The rise in factory output was well above its average monthly pace of 0.3 percent over the previous five months and was its largest gain since February. In November, the output of utilities jumped 5.1 percent, as weather that was colder than usual for the month boosted demand for heating. The index for mining decreased 0.1 percent. At 106.7 percent of its 2007 average, total industrial production in November was 5.2 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.8 percentage point in November to 80.1 percent, a rate equal to its long-run (1972–2013) average.

Manufacturing output rose 1.1 percent in November, and the rates of change for prior months are stronger than reported previously. Factory output is now estimated to have been above its late-2007 pre-recession peak in both October and November. In November, the indexes for both durables and nondurables increased more than 1 percent, and the output of every major industry group increased or remained unchanged. Among durable goods industries, the output of motor vehicles and parts jumped 5.1 percent as a result of an increase of 900,000 units at an annual rate in total motor vehicle assemblies. Miscellaneous manufacturing, wood products, and machinery each recorded gains exceeding 1 percent. Among nondurable goods industries, output advances of more than 2 percent were registered by petroleum and coal products and by apparel and leather. The indexes for food, beverage, and tobacco products and for plastics and rubber products both increased 1.4 percent.

The capacity utilization rate for manufacturing moved up 0.8 percentage point in November to 78.4 percent, a rate 0.3 percentage point below its long-run average. The operating rates for nondurable goods and durables goods increased, and the rate for other manufacturing (non-NAICS) remained unchanged. The utilization rate for mines fell 0.8 percentage point to 87.9 percent, while the rate for utilities increased 3.9 percentage points to 82.4 percent.

by Gary Mintchell | Dec 12, 2014 | Events, News, Operations Management

We’ve probably all witnessed the declining prices at the gasoline pump. If we’re investors heavily invested in oil stocks, we may be feeling a reverse emotion. Depends. There is no doubt that the current shale gas/shale oil boom in the US has a significant impact on the economy and our financial health. Here’s a report revealing the impact on manufacturing.

PwC US increased its forecast on cost savings and long term employment gains in U.S. manufacturing as a result of the surge in shale gas production on Dec. 11. The new estimates are part of PwC’s updated analysis on the significant contributions shale gas is making in revitalizing the U.S. manufacturing landscape.

According to PwC’s new report titled, Shale Gas: Still a boon to US manufacturing?, PwC estimates that the continued “shale effect” on U.S. manufacturing could bring an annual cost savings of $22.3 billion by 2030, assuming a high natural gas recovery and low price scenario. In terms of job creation, PwC estimates that continued shale gas activity will create 930,000 shale gas driven manufacturing jobs by 2030 and 1.41 million by 2040. These estimates are comparable to the analysis done in PwC’s 2011 study, which showed an annual cost savings of $11.6 billion and approximately one million jobs by 2025.

“There’s no doubt that the shale gas boom in the U.S. helped trigger a resurgence in manufacturing,” said Robert McCutcheon, U.S. industrial products leader, PwC. “Reducing costs, creating jobs and supporting investments and innovations are among the many impacts this game-changing resource has brought to the U.S. manufacturing space. Assuming shale continues to serve as a catalyst for the manufacturing sector, we revised our cost savings and longer term employment estimates significantly upward, and could see those numbers go even higher as more businesses and global interests look to exploit shale opportunities.”

Among the industries continuing to benefit are energy intensive manufacturing sectors such as metals, chemicals and petrochemicals, which all use natural gas as feedstock. According to the report, growing prospects for building pipelines for the infrastructure that’s needed to support natural gas demands in the U.S. could also bring additional benefits to U.S. manufacturers who support those build-outs.

The survey also uncovered a continued rise in the number of companies commenting to the investment community on how shale gas activity affects their business. In 2013, 40 U.S. manufacturing companies included shale gas impacts in their public filings, up from 29 in 2011. “More companies are publicly disclosing a link between natural gas production as a material advantage for their business and a source for growth in demand for their products,” noted McCutcheon.

PwC’s report also identified developments that could potentially impact the benefits of shale gas development to U.S. manufacturers. These include environmental issues, supply exceeding demand, insufficient natural gas refueling infrastructure, and changes in tax policy that could affect capital investments.

by Gary Mintchell | Sep 5, 2014 | Automation, News, Operations Management

I found this report on the Website of the Economics & Statistics Administration of the US Dept. of Commerce.

This report is a study of a number of statistics regarding manufacturing since the Great Recession. Interesting reading for all of us manufacturing geeks out there.

This is from the executive summary of the report:

The U.S. manufacturing sector has turned a corner. For the first time in over 10 years, output and employment are growing steadily. Manufacturing output has grown 38 percent since the end of the recession, and the sector accounts for 19 percent of the rise in real gross domestic product (GDP) since then. Through May, the sector has added 646,000 jobs, and manufacturers are actively recruiting to fill another 243,000 positions.

The steady growth across all three of these areas might have seemed like wishful thinking just a few years ago when manufacturing was hit especially hard. Yet, manufacturing output and exports have surpassed their pre-recession peaks, and employment has begun to grow again for the first time since 1998. Analysis by the President’s Council of Economic Advisors indicates that this is more than a cyclical rebound; the US has gained about four times as many manufacturing jobs since 2009 as would be expected from cyclical factors alone. Nonetheless, while the manufacturing expansion is robust, some industries and U.S. states have fared better than others. This report provides an overview of these trends in manufacturing, examining production, international trade, and the labor market.

Our analysis shows that:

Manufacturing has contributed decisively to GDP growth. Since the end of the recession in second quarter 2009, real manufacturing value added has climbed 18 percent, compared to an 11 percent rise in real U.S. GDP, increasing manufacturing’s share of total GDP to 12.5 percent at the end of 2013.

The manufacturing sector added 646,000 jobs from February 2010 to May 2014.

Average annual weekly hours for production workers in the manufacturing sector have climbed to their highest level since the mid 1940s.

Although growth has returned across manufacturing, just two industries have accounted for nearly half the rise in shipments: transportation equipment and petroleum and coal products.

Export sales account for more than a quarter of the rebound in shipments since 2009. Exports of U.S. manufactured goods totaled $1.2 trillion in 2013. Transportation equipment and refined petroleum (and coal) products captured 43 percent of the export gains.

Foreign investors also are helping build the U.S. manufacturing sector. As of 2012, total direct investment in the U.S. from abroad totaled $2.7 trillion, of which $899 billion (34 percent) was placed in the manufacturing sector.

The number of manufacturing establishments is growing for the first time since 1999.

87 percent of the job gains in manufacturing have been in three durable goods industries: transportation equipment, fabricated metal products, and machinery.

Job gains in manufacturing have been widespread throughout the country. More than half of the jobs added were in five states: Michigan, Texas, Indiana, Ohio, and Wisconsin.

For some reason, I keep getting requests for information and analysis on robotics. The standard models of robots have remained pretty much the same for years. The market has not grown much. The association magazine devoted to robots folded years ago. Yet, there remains some interest in the market.

For some reason, I keep getting requests for information and analysis on robotics. The standard models of robots have remained pretty much the same for years. The market has not grown much. The association magazine devoted to robots folded years ago. Yet, there remains some interest in the market.