by Gary Mintchell | Dec 20, 2019 | News, Technology

I have received three different robotic market research reports from two different research firms. Both of these firms seem to do the work that it takes. I’ve done some private contract research and analysis and have an grasp on the work it takes. These reports have major agreements and a few different takes. The short take is that we finally have momentum in new forms of robotics–and that is a good thing.

[Note: In moving this post from my text editor this morning, I inadvertently had left the setting as “publish” instead of “draft”, therefore you received an email with no link. Oops. Sorry.]

Cobot Market Growth

Cobot Market to account for 30% of Total Robot Market by 2027 according to market research firm Interact Analysis.

- The growth rate of collaborative robots is leading the robotics industry

- Logistics will surpass automotive to be the second largest end user of cobots by 2023, with electronics in first place

- In the next five years, the fastest growing regions for collaborative robot shipments will be China and the USA

Market intelligence firm Interact Analysis has released a new market report – The Collaborative Robot Market – 2019 – which indicates strong and sustained growth for the collaborative robot industry.

In 2018, global revenues from cobot production exceeded $550 million. This was almost a 60% increase over 2017; and over 19,000 cobots were shipped. Interact Analysis forecasts that revenues for cobots will reach $5.6 billion in 2027, accounting for almost one third of the total robotics market, and that <5kg and 5-9 kg cobots, popular in small to medium-sized industrial settings, will represent the majority of sales in 2023.

Material handling, assembly and pick & place will be the three biggest applications of collaborative robots. But these functions, which accounted for 75% of cobot revenues in 2018, will drop to below of 70% total revenues by 2023, as other functions for cobots are developed. The use of cobots in non-industrial applications will play a significant role in the coming years – in sectors such as life sciences, logistics, and the hospitality sector. In part this is because they are flexible and easy to set up, making them attractive to smaller companies which may not have previously considered using robots.

Labour shortages and the drive to improve efficiency mean that China will be the fastest growing region for cobot shipments. The demand for simple, cost-effective, entry-level robots, together with different regulations surrounding industrial equipment in China has fuelled the growth of Chinese cobot manufacturers who only supply their local market. This has arguably distorted the market figures. Interact Analysis has responded to this by including in its report two data sets, one with and one without the impact of China. It is important to note, however, that growth outside of China is still forecast to rise at a CAGR of over 30% in the next 5 years.

Maya Xiao, lead analyst on cobots for Interact Analysis, says: “The collaborative robot market is still relatively immature, but Interact Analysis has identified clear potential growth areas, both in industrial and non-industrial settings, enabling manufacturers to respond effectively, and take full advantage of what we predict to be an area which will occupy a significant market share in the coming years”.

Robot Market Declines then Rebounds

- Automotive and smartphone production declines played a significant part in 2019 slowdown

- New applications, lower prices and wider use cases will lead to a significant upturn by 2023

- China shows its strength, both domestically and in attracting external investment

Market intelligence firm Interact Analysis has released a new market report focusing on the industrial robot market. The research outlines reasons to be positive in the sector, despite an immediate, short term decline in revenues.

The report goes into detail around specific headwinds that have challenged growth within the sector, including the slowing global economy, trade wars and uncertainty in the global automotive industry. Compared to 2017, where revenues associated with industrial robots increased by 20%, forecasted declines of 4.3 per cent in 2019 have caused some concern.

Jan Zhang, research director at Interact Analysis, said: “Automotive and smartphone production declines play a significant part in this downturn. As the largest end-user segment for industrial robots – accounting for over 30% share of revenues – any downturn in this area is always keenly felt in automation and robot investment.

“Despite this, however, there are reasons to be optimistic. Long term drivers, both for industrial robots and for automation as a whole, remain very strong. Growth is expected to pick up on 2020, and then accelerate further in 2021 due to new industry applications, lower prices and wider use cases.”

The report’s findings, based on interviews with all leading robotics companies (as well as a wide selection of innovative robot start-ups, system integrators and component suppliers), highlight the importance of new robot types in fuelling this growth. In particular, cobots – collaborative robots – which work alongside humans are finding favour in industries not traditionally associated with the use of robots. Among those industries identified are food and beverage, logistics, packaging and life sciences.

“Growth in these industries can’t fully compensate for the decrease in the automotive industry, but it does warrant optimism for the future,” said Jan.

A central element to the report’s findings is the impact China is having on the global industrial robot market in 2019. While Japan remains the largest producer of industrial robots, with an estimated 45% of total production, there has been significant growth in production capacity and output in China. This can be attributed a number of factors, including Chinese vendors entering the market and inward investment from traditional industrial giants like ABB, Fanuc, KUKA and YASKAWA.

Jan added: “While it is true growth of industrial robot revenues has slowed down, the reasons for this are clear and, for the most part, beyond the control of the vendors. Despite this, however, there is evidence that the industry is diversifying and putting the foundations in place for significant future growth, making this one of the more exciting spaces to operate in.”

Mobile Systems Drive Robot Market Growth

Robotics Industry Set for Seismic Change as Growth Shifts from Fixed Automation to Mobile Systems in Enterprise.

Of the 8 million robots shipped in 2030, nearly 6 million will be mobile.

The robotics market is set to transform over the next 10 years, based on the most comprehensive robotics tracker yet released by global tech market advisory firm, ABI Research. There will be enormous growth across all subsectors, highlighted in a total market valuation of US$277 billion by 2030. That growth will not be distributed evenly, however. By 2022, the burgeoning mobile robotics space will start to overtake the traditional industrial robotics market. Currently, mobile autonomy is concentrated in material handling within the supply chain, but mobile robots are set to touch every sector of the global economy for a wide range of use-cases.

“Everyone talks about self-driving passenger vehicles, but mobile automation is far more developed in intralogistics for fulfillment and industry,” said Rian Whitton, Senior Analyst at ABI Research. “The automation of material handling will see huge segments of the global forklift, tow truck, and indoor vehicle market consumed by robotics vendors and Original Equipment Manufacturers (OEMs) that bring indoor autonomy.”

Amazon Robotics is the leader that has driven growth in mobile robotics for the last 7 years since their acquisition of Kiva Systems. With an estimated 256,000 automated guided vehicles deployed to date, Amazon holds close to 50% of material handling robot market share and is broadening its portfolio of robot subtypes with autonomous mobile robots for transport and delivery. Other major Automated Guided Vehicle (AGV) developers like Quicktron, JD.com, Geek, and Grey Orange are deploying thousands of robots yearly, while Automated Mobile Robot (AMR) developers are just beginning to scale up. Brain Corp. has deployed 5,000 systems primarily in retail, and BlueBotics has deployed some 2,000 robots for intralogistics in and around the supply chain. Meanwhile MiR, an AMR company acquired by Teradyne in 2018, is beginning to achieve growth rates in excess of the company’s other robotics acquisition of major cobot developer, Universal Robots.

The distinction between AGVs and AMRs can be contested, but AMRs do not require external infrastructure to localize themselves and are built with sensors and cameras to self-navigate their environments. Currently, AGVs represent the majority of mobile robot shipments, but by 2030, this will change. While there will be 2.5 million AGVs shipped in 2030, the total shipments of AMRs will reach 2.9 million in the same year. This is due to the declining costs of superior navigation and the desire to build flexibility into robotic fleets. “Many new verticals, like hospitality, delivery, and infrastructure, will demand systems that do not require external physical infrastructure to move about. While AGVs will thrive in intralogistics for fulfillment, especially in greenfield warehouses, AMRs solve the challenges faced by many end-users by offering incremental automation that does not require a complete change of environmental infrastructure,” Whitton explains.

In a major example of automation extending to new and important vehicle-types, the shipments of automated forklifts are set to grow from 4,000 in 2020 to 455,000 in 2030, with a CAGR of 58.9%. Meanwhile, the revenue for all mobile robotics is expected to exceed US$224 billion by 2030, compared to US$39 billion for industrial and collaborative systems.

Leading the way in mobile robotics are French manufacturer Balyo (which partnered with Amazon), Seegrid (who have sold over 800 units) and a number of smaller actors that are just beginning to scale. This opportunity is leading vehicle manufacturers such as Toyota, Yale & Hyster, and Raymond to partner with robotics companies to offer automation to manufacturers. Given the global shipments for forklifts is close to 1 million, half of all shipments could be automated by 2030.

Another significant sector for mobile automation will be maintenance and cleaning. There are already over 5,000 autonomous floor scrubbers in U.S. retail stores and commercial buildings. With Softbank’s deployment of mobile cleaners for offices being rolled out in Asia and the United States, cleaning robots will become a common sight within the service economy.

Even more esoteric form factors, like quadrupeds, are expected to increase significantly for data collection purposes, particularly for real estate, construction, and industrial inspection. ABI Research predicts that quadrupeds, exemplified by vendors like Boston Dynamics, Zoa Robotics, ANYbotics, and Ghost Robotics, will increase to 29,000 yearly shipments by 2030. “As mature sectors of the robotics industry achieve growth more in line with established technology markets, mobile robotics are set to create lasting transformative effects across the supply chain and will become increasingly ubiquitous throughout the global economy,” Whitton concludes.

These findings are from ABI Research’s Commercial and Industrial Robotics market data report. This report is part of the company’s Industrial, Collaborative & Commercial Robotics research service, which includes research, data, and ABI Insights. Market Dataspreadsheets are composed of deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight where opportunities lie.

by Gary Mintchell | Sep 4, 2019 | Automation, Events, Productivity, Technology

That engineers would develop ways for humans and robots to co-exist, yes even collaborate, seemed inevitable. Why should we consign robots to cages as safety hazards when the future assuredly requires close collaboration. Therefore the burgeoning area of collaborative robotics or cobots.

I’m thinking not just about industrial applications. Robots surely will assist an aging population cope with everyday tasks in our (near) future of fewer people to populate those jobs.

Several of the “old guard” robotics companies have developed “co-bots” but I’ve watched the development of Universal Robots for some time. The company sponsored this blog for a while a few years ago. Here I’ve picked up on a couple of items. The UR marketing team was a bit surprised to discover that I have more than a passing interest in packaging. As a matter of fact, I noticed packaging as a likely growth area for automation about 18 years ago, and that feeling has been borne out.

One story concerns a packaging demonstration with a socially worthwhile goal mixed in. The other reports on a recent market study by ABI Research.

Universal Robots Solves Random Picking Challenge, Providing Food for At-Risk Youth

The challenge: Pick six differently sized food items randomly oriented on a moving conveyor and place each of these items into the same pouch. Then do this again 1,199 more times, ensuring each pouch has the same six items. This is the challenge Universal Robots and Allied Technology will address, quickly identifying and picking items – ranging widely from packs of Craisins to cans of beef ravioli – in Pack Expo’s Robotics Zone during the three-day show.

“Random picking is quickly becoming one of the most sought-after automation tasks from industries such as e-commerce, fulfillment centers and warehousing,” says Regional Sales Director of Universal Robots’ Americas division, Stuart Shepherd. “At Pack Expo, Universal Robots and Allied Technology will demonstrate how UR cobots can be quickly deployed in a compact, modular system, handling the entire process from box erecting, to vision-guided conveyor tracking, part picking, tote assembly, pouch filling and sealing, kitting and palletizing,” he says, adding how the packaging line is also a testament to the capabilities of Universal Robots’ growing number of Certified System Integrators (CSIs). “Allied Technology was able to quickly create this fully-automated solution. We are delighted to see our cobots competently integrated in so many new packaging applications now.”

Allied Technology and Universal Robots’ packaging line features four UR cobots equipped with products from the UR+ platform that certifies grippers, vision cameras, software, and other peripherals to work seamlessly with UR’s collaborative robot arms. The latest flexible grasping technology will be showcased by a UR5e with Piab’s new Kenos® KCS vacuum gripper guided by a vision camera from UR+ partner Cognex.

Once completed, the 1,200 bags of food will be delivered to “Blessings in a Backpack” a leader in the movement to end childhood hunger, ensuring that children receiving free or subsidized school lunches during the week do not go hungry over the weekends. “We look forward to showcasing this demo that is meaningful in so many ways,” says Shepherd. “We are excited to partner with Blessings in a Backpack while also addressing the needs of the packaging industry with solutions that will simplify and fast-track cobot deployment on their lines.”

Unlike traditional robots caged away from show attendees, visitors to the UR booth are able to walk right up to the UR cobots and interact with them. The booth “playpen area” will feature several cobot arms including a U53e with Robotiq’s new UR+ certified E-Pick Vacuum Gripper, allowing attendees to explore on-the-spot programming. The gripper is one of the recent additions in a rapidly expanding UR+ product portfolio that now includes no less than 195 UR+ certified products with 400+ companies participating in the UR+ developer program.

Market Leadership

Meanwhile, Universal Robots maintains top spot in ABI Research’s Ranking of Cobot Companies in Industrial Applications; Doosan, Techman Robot, and Precise Automation are closing in.

This news originates with ABI Research. There are well over 50 manufacturers of collaborative robots (cobots) worldwide, but only a handful of these companies have so far deployed cobots on any meaningful level of scale. Tens of thousands of cobots have been sold as of 2019 and earned US$500 million in annual revenue for world markets. In its new Industrial Collaborative Robots Competitive Assessment, global tech market advisory firm, ABI Research finds Universal Robots (UR) to be the clear forerunner, particularly in implementation.

The Industrial Collaborative Robots Competitive Assessment analyzed and ranked 12 collaborative robot vendors in the industry – ABB, Aubo Robotics, Automata, Doosan Robotics, FANUC, Franka Emika, Kuka AG, Precise Automation, Productive Robotics, Techman Robot, Universal Robots, and Yaskawa Motoman – using ABI Research’s proven, unbiased innovation/implementation criteria framework. For this competitive assessment, innovation criteria included payload, software, Ergonomics and human-machine interaction, experimentation and safety; implementation criteria focused on units and revenue, cost and ROI, partnerships, value-added services, and the number of employees.

“Market leaders in cobots generally have well-developed cobot rosters, in many cases backed up by an ecosystem platform that integrates applications, accessories, and end-of-arm-tooling (EOAT) solutions in with the base hardware,” said Rian Whitton, Senior Analyst at ABI Research. With 37,000 cobots sold so far, UR leads, followed by Taiwanese provider Techman with 10,000, and Korea-based Doosan with over 2,000. Precise Automation, which uses an advanced direct drive solution to develop faster collaborative robots, was cited as the most innovative of the 12 providers, just edging out Universal Robots, who claimed the overall top spot due to their significant lead in implementation.

There are several companies that are too young to be challenging the dominant parties in the cobot market but are developing new and disruptive technologies that will allow them rise to prominence in the years to come. Productive Robotics is a case-in-point. The California-based developer has an arm with inbuilt vision, 7 axes for superior flexibility, long reach, and a very affordable price point, but has yet to deploy at scale. Automata, a British company that develops a ‘desk-top’ cobot costing less than US$7,000, is significantly lowering the barriers to entry for smaller actors and is championing the use of open-source middleware like ROS to program cobots for industrial use-cases. Germany-based Franka Emika and Chinese-American provider Aubo Robotics also represent relatively new entrants to the market who are building on the success of Universal Robots and are beginning to compete with them.

Perhaps surprisingly, while the major industrial robotics providers have developed cobot lines, they have generally been less successful in marketing them or gaining market traction relative to the pure-cobot developers. In part, this is down to focus. While collaborative robots are valuable, they generally suit deployments and use-cases with smaller shipments and a wider variety of small and large end-users. For industrial players like ABB, FANUC, KUKA AG and Yaskawa Motoman, their client-base tends to be large industrial players who buy fixed automation solution through bulk orders. Aside from this, all four of these companies are competing extensively for greater shipment figures in China, where the cobot oppurtunity relative to the market for traditional industrial systems is much less apparent than in Europe or North America.

“Though many of the cobots deployed by these companies are impressive, and they have a lot of software services, the high-cost and lack of easy use among their systems largely defeat the current value proposition of cobots, making them the laggards in this competitive assessment.” says Whitton.

Looking forward, the larger industrial players are likely to improve their relative position, as future growth in cobots rests on scaling up and large deployments. “Universal Robots, though likely to remain the market leader for the foreseeable future, will be increasingly competing on an even footing with near-peer cobot developers, who are already developing second-generation cobots with significant hardware improvements. Meanwhile, some more innovative companies will be able to accelerate adoption through price decreases, improved flexibility, and common platforms to retrofit collaborative capability on industrial robots,” Whitton concluded.

These findings are from ABI Research’s Industrial Collaborative Robots Competitive Assessment report. This report is part of the company’s Industrial Solution, which includes research, data, and analyst insights. Competitive Assessment reports offer comprehensive analysis of implementation strategies and innovation, coupled with market share analysis, to offer unparalleled insight into a company’s performance and standing in comparison to its competitors.

by Gary Mintchell | Aug 26, 2019 | Automation, Technology, Workforce

I think even mainstream media has caught up to the current hiring situation—it is hard to find qualified people to fill positions. Heck, even last night stopping at a Cracker Barrel on the drive home from Tennessee we saw a harried staff and only about half the tables filled. They didn’t have enough people to staff the place.

Now try to find skilled welders. How about hiring a robotic welder? Easy to program and install. Always shows up for work. No drug test required. A very interesting idea.

The new for-hire BotX Welder—developed by Hirebotics and utilizing Universal Robots’ UR10e collaborative robot arm—lets manufacturers automate arc welding with no capital investment, handling even small batch runs not feasible for traditional automation.

The press release tells us, “Nowhere in manufacturing is the shortage of labor felt as urgently as in the welding sector, which is now facing an acute shortage of welders nationwide. The industry’s hiring challenge, combined with the struggle metal fabrication companies experience in producing quality parts quickly and in small runs, prompted Hirebotics to develop the BotX Welder.

“Many people didn’t believe that collaborative robots could perform such heavy-duty tasks as welding,” says Rob Goldiez, co-founder of Hirebotics. “We realized the need of a solution for small and medium sized metal fabricators trying to find welders.” Hirebotics’ hire-a-robot business model built on the Universal Robot, set the foundation for the BotX. It is a welding solution powered by the UR10e cobot that is easy to teach, producing automation quality with small batch part runs.

The BotX is now available to early access customers and will officially launch at FABTECH in Chicago, November 11-14.

In developing BotX, Hirebotics addressed two major hurdles of robotic welding: the ease of programming and the ease in which a customer can obtain the system without assuming the risk of ownership. There are no installation costs with BotX and with cloud monitoring, manufacturers pay only for the hours the system actually welds. “You can hire and fire BotX as your business needs dictate,” explains Goldiez.

The complete product offering comes with the UR10e cobot arm, cloud connector, welder, wire feeder, MIG welding gun, weld table, and configurable user-input touch buttons. The customer simply provides wire, gas, and parts. Customers can teach BotX the required welds simply via an intuitive app on any smartphone or tablet utilizing welding libraries created in world-class welding labs. A cloud connection enables 24/7 support by Hirebotics.

“We chose Universal Robots’ e-Series line for several reasons,” says Goldiez. “With Universal Robots’ open architecture, we were able to control, not only wire feed speed and voltage, but torch angle as well, which ensures a quality weld every time,” he says. “UR’s open platform also enabled us to develop a cloud-based software solution that allows us to ensure a customer is always running with the latest features at no charge,” explains the Hirebotics co-founder. “We can respond to a customer’s request for additional features within weeks and push those features out to the customer with no onsite visits,” says Goldiez, emphasizing the collaborative safety features of the UR cobots. “The fact that they’re collaborative and don’t require safety fencing like traditional industrial robots means a smaller foot print for the equivalent working space, or put another way; less floor space to produce same size part. In many cases less than half the floor space of traditional automation,” he says. “The collaborative nature of the solution enables an operator to move between multiple cells without interrupting production, greatly increasing the productivity of an employee.”

PMI LLC in Wisconsin, was one of the first customers of the BotX. “A large order would mean, we need to hire 10-15 welders to fulfill it – and they’re just not out there,” says VP of Operations at PMI, Erik Larson. “Therefore, we would No Bid contracts on a regular basis. With the BotX solution, we now quote that work and have been awarded contracts, so it has really helped grow our business,” says Larson. “The BotX Welder doesn’t require expensive, dedicated fixturing and robot experts on the scene.” Now PMI’s existing operators can handle the day-to-day control of the BotX, which welds a variety of smaller product runs.

The Wisconsin job shop has now stored weld programs for more than 50 different parts in their BotX app. “We are now able to deliver quality equivalent to what we could accomplish manufacturing with very expensive tooling typically used with higher-volume part runs,” says PMI’s VP of Operations, mentioning the ease of accessing the solution. “Being able to simply hire the BotX Welder, and quickly switch between welds by using our smart phone—and only pay for the hours it works—is huge for us. It took our area lead, who had no prior robotics experience, half an hour to teach it how to weld the first part.”

Another significant benefit was PMI’s ability to get the BotX welds certified for customers who require this. “This now means we do not need to use certified welders to oversee the operation. As long as the cobot welder’s program is certified, any operator can tend the cobot welder. This really unlocks a lot of resources for us,” says Larson. “Hirebotics and Universal Robots really hit the mark with this, we’re looking forward to a long partnership with them.”

by Gary Mintchell | Aug 3, 2018 | Automation, Technology

Enrico Krog Iversen, former CEO of the industry-leading collaborative robot pioneer, Universal Robots, along with the Danish Growth Fund, is addressing the next challenge in automation with the merger of three innovative end-of-arm tooling companies to facilitate the ongoing growth of collaborative robotics; an industry expected to reach $8.5 billion by 2025.

The new company combines U.S.-based Perception Robotics, Hungary-based OptoForce, and Denmark-based On Robot to become OnRobot, which will drive innovation and ease-of-use for robotic end-of-arm tooling. OnRobot’s headquarters will be located in Denmark under the management of Enrico Krog Iversen, and the three entities will continue their individual operations and development as well. In addition, OnRobot’s global network of distributors will have access to local sales support, technical assistance and product training from the company’s regional offices in Germany, China, U.S., Malaysia, and Hungary. More offices to come in 2018.

“The aim is to build a world-leading organization in development and production of end-of-arm tooling. Through further acquisitions and collaborations, we expect to reach a revenue exceeding one hundred million dollars in a few years,” says Iversen and continues: “Safe, cost-effective, and versatile cobots are becoming increasingly common because they offer sophisticated and intuitive programming that enables them to be easily deployed and redeployed. Easy-to-integrate end-of-arm tooling, such as grippers and sensors, become vital elements in adapting these powerful automation tools for a wide range of applications.”

In 2015 Enrico Krog Iversen and the Danish Growth Fund sold the Danish cobot pioneer company Universal Robots to U.S.-based Teradyne for $285 million. With their new venture, the two investors now further strengthen Denmark’s global position in the robotics field.

“In recent years Denmark has successfully established itself as a global hub for robotic technologies. Universal Robots was a pioneer, and since then many more strong and innovative companies have been formed with roots in Odense, Denmark. The new OnRobot has the potential to become not only a world-leading company, but also a catalyst for further development of the Danish robotics cluster. We are pleased to promote this trend through our investments and invite both companies and investors from around the world to come join us,” says Christian Motzfeldt, CEO of the Danish Growth Fund.

Collaborative robots, which work safely alongside humans in applications such as packaging, quality testing, material handling, machine tending, assembly and welding, currently represent 3% of global robot sales, according to the International Federation of Robotics, but the share is expected to rise to 34% of a $25 billion market by 2025.

“This growth will most definitely depend on cobots being used in more applications,” Iversen added. “Their small footprint and ability to work safely alongside humans make them ideal for small and medium-sized manufacturers who need to compete globally. Cobots are also increasingly integrated into very large manufacturers such as automotive plants, where they are taking over processes that can’t be automated using traditional robotics. As the types of cobot applications expand, so does the need for new tooling that can be quickly and easily integrated into the cobot’s user interface. The new OnRobot is championing a current mega trend in the field of automation. Combining the unique capabilities of these end-of-arm technologies under one umbrella company that is led by some of the smartest minds in the robotics industry will make them even easier to implement and program. By the way, the new OnRobot is currently looking to add employees in R&D,” says Iversen.

Companies Chosen for Synergies, Ease of Integration, Vision

The three companies that will form the new OnRobot were chosen because of their synergistic end-of-arm technologies, the ability of these technologies to easily integrate to provide improved support and the long-term vision and capabilities of each company’s founders.

• On Robot, founded in 2015, provides plug-and-play electric grippers — RG2 and RG6 — that mount directly on the robot arm, are highly flexible and are simple enough to be programmed and operated from the same interface as the robot without the need of engineers.

• OptoForce, founded in 2012, provides force/torque sensors that bring the sense of touch to industrial robots so that they can automate tasks that would otherwise require the dexterity of the human hand.

• Perception Robotics, founded in 2012 and based in Los Angeles, develops bio-inspired robot grippers: 1) a gecko-inspired gripper for handling large, flat objects and 2) a tactile gripper with compliant rubber tactile sensors (“skin”) to give robots a sense of touch. Its first grippers will be available this year.

OnRobot presented its first new products at automatica 2018. The Gecko Gripper, Polyskin Tactile Gripper, RG2-FT gripper and a technical upgrade of the HEX force-torque sensor product line based on OptoForce technology will open up new applications for collaborative robotics and make implementation even easier. In this fast-growing market segment, OnRobot has positioned itself from the ground up as the innovative provider for collaborative grippers and end-of-arm tooling.

“Collaborative robots have the potential to become the comprehensive standard in industrial automation,” says Enrico Krog Iversen, CEO of OnRobot. “We want to unleash this potential by making collaborative applications even easier to implement and to carry them into completely new applications – that is the idea behind all our new products that we are presenting here at automatica.”

The Gecko Gripper, developed by Perception Robotics, was inspired by nature and uses the same adhesive system for gripping as the feet of a gecko, with millions of fine fibers that adhere to the surface of the workpiece and generate strong van der Waals forces. For the Gecko Gripper technology, OnRobot licenses a concept originally developed by the NASA Jet Propulsion Laboratory (JPL) and brought it to market maturity.

This unique and fast-moving solution for handling large, flat objects makes vacuum grippers and their compressed air system unnecessary. In contrast to vacuum grippers, the Gecko Gripper can also handle perforated or porous workpieces such as printed circuit boards without any problems. The gripper is compatible with Universal Robots and Kawasaki robotic arms.

The Polyskin Tactile Gripper also comes from the innovation forge of Perception Robotics. The solution specializes in sensitive gripping: Both fingers can be individually aligned and have integrated tactile sensors at the fingertips. This allows the gripper to precisely measure the condition of the surface of workpieces and align its gripping processes accordingly. These properties take tactile gripping to a whole new level, especially when working with sensitive or irregular workpieces. The Polyskin Tactile Gripper is also compatible with Universal Robots and Kawasaki.

OnRobot is launching a variation of its established RG2 gripper, the RG2-FT with integrated force-torque sensors and a proximity sensor, which also accurately detects the condition of objects. The gripper detects the danger of objects slipping off even before it happens, making handling even safer – for workers as well as for the workpiece. This gripper model is particularly suitable for use in precision assembly and is compatible with lightweight robots from Universal Robots and KUKA.

The OnRobot product line for force-torque sensors based on OptoForce HEX technology has received a substantial technical upgrade, making installation and handling of the sensors even easier and faster. Mounting is now up to 30 percent faster, partly thanks to overload protection integrated in the sensor, which no longer has to be removed and mounted separately when attaching to the robot arm. Furthermore, the weight of the sensor can be reduced by 20 percent. A new, improved sealing ring also protects the HEX products better against dust or water in the environment.

by Gary Mintchell | Jul 25, 2018 | Automation, Technology

Collaborative describes the latest and most important trend in robots. Even if I was summarily dismissed when I asked that question of the CEO of a robotic arm company at an IT event, I stand by that analysis.

Lately Mobile Industrial Robots (MiR) news came to my attention. I’ve put off writing until I connected with Ed Mullen, US VP of Sales for this Danish company.

He told me that MiR designs and manufactures Autonomous Mobile Robots (AMR) which are a bit like a quantum jump from the older Automated Guided Vehicles (AGVs) with which you may be familiar. Especially if you’re older, like me.

AGVs followed a path which was usually a wire laid in the floor. It followed its route around the facility. Cool, but not really very intelligent.

AMRs operate similar to modern autonomous technology using a 2D map of the facility and a location system plus laser scanning LIDAR. Tell it a place to go, and like a GPS it calculates the best route and directs the mobile robot to its destination—safely. I have actually interacted with one of the company’s earlier versions at a trade show where it continuously ran a route around the booth.

He tells me that the company is really more of a software company than hardware. The object is to take open source software and package it so that the customer has great flexibility for applications while usually going from unboxing to operations in under an hour.

Product news

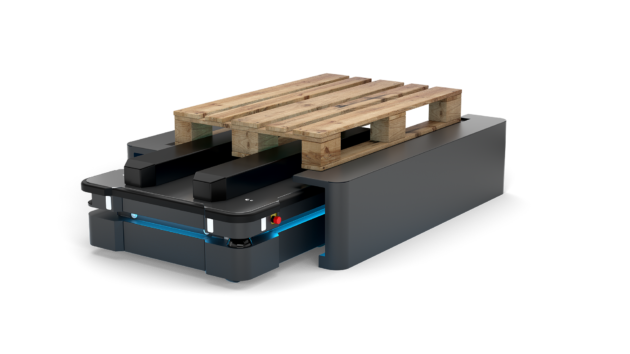

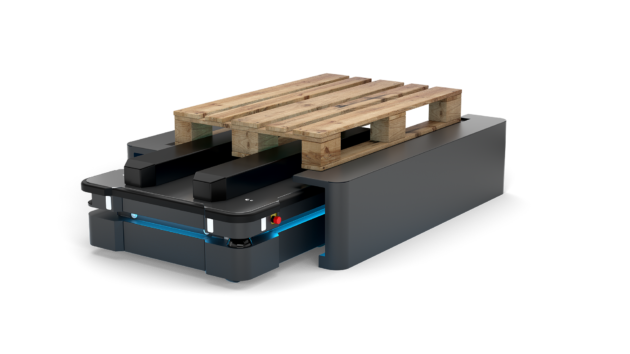

The latest product news is the launch of its MiR500 AMR. The robot has a lifting capacity of 500 kg (1102 lbs) and can automatically collect, transport and deliver pallets with speeds of nearly 4.5 miles per hour (mph). The MiR500 joins the MiR100 and MiR200 to form a complete fleet of flexible and easy-to-program MiR robots for both heavy and light transport that can optimize logistics throughout the entire production chain, from the warehouse to the delivery of goods.

“With the MiR500, we are extending the proven, strong technology and safety features that have made us the leading global supplier of autonomous mobile robots,” said Thomas Visti, CEO of Mobile Industrial Robots. “The MiR500 was developed to meet the needs of customers who have used our other robots and now see huge potential in the automation of the internal transport of heavy items and Euro-pallets. With MiR500, we’re setting new standards for how companies can use autonomous mobile robots.”

The user interface matches that used in the MiR100 and MiR200, which already optimize production processes in many of the world’s biggest multinational companies such as Airbus, Flex, Honeywell, Hitachi and Danone. The difference is the MiR500’s size, lifting capacity and areas of application.

“MiR500 is an extremely robust robot, so it’s perfect in industrial environments,” Visti said. “We’ve also incorporated the principles from the MiR100 and MiR200, where flexibility and user-friendliness are key attributes. This means that the MiR500 can be programmed without prior experience. It’s also simple to develop and replace top modules such as pallet lifters, conveyor belts and robot arms, so the robot can be used for different transport purposes.”

MiR has grown quickly since its founding in 2013, with sales rising by 500 percent from 2015 to 2016, and 300 percent from 2016 to 2017. With its second US office opening in San Diego this spring, and strong growth continuing worldwide, MiR expects to increase the number of employees from 65 to about 120 in 2018.

Acquisition

But wait, there’s more. Teradyne Inc. and the shareho6lders of Mobile Industrial Robots (MiR) announced the acquisition of privately held MiR of Odense, Denmark for €121 million ($148 million) net of cash acquired plus €101 million ($124 million at current exchange rate) if certain performance targets are met extending through 2020.

“We are excited to have MiR join Teradyne’s widening portfolio of advanced, intelligent, automation products,” said Mark Jagiela, President and CEO of Teradyne. “MiR is the market leader in the nascent, but fast growing market for collaborative autonomous mobile robots (AMRs). Like Universal Robots’ collaborative robots, MiR collaborative AMRs lower the barrier for both large and small enterprises to incrementally automate their operations without the need for specialty staff or a re-layout of their existing workflow. This, combined with a fast return on investment, opens a vast new automation market. Following the path proven with Universal Robots, we expect to leverage Teradyne’s global capabilities to expand MiR’s reach.”

MiR was profitable in 2017 with annual revenue of $12 million USD, more than triple 2016 revenues and had Q1’18 sales of $5 million.

“Joining Teradyne allows us to advance our engineering and development investments to provide greater value to our customers and further expand our market leadership in industrial autonomous mobile robots,” said Thomas Visti, CEO of MiR. “Teradyne’s worldwide reach, world-class engineering and support capabilities, financial strength and proven model for leveraging those strengths will help us grow in new and existing markets worldwide.”

“My main focus is to get our mobile robots out to the entire world,” said Niels Jul Jacobsen, CSO, founder of MiR. “With Teradyne as the owner, we will have strong backing to ensure MiR’s continued growth in the global market.”