by Gary Mintchell | Mar 14, 2016 | Automation, Operator Interface

“Siri, what’s the weather in Bangor?”

“Alexa, buy some toilet paper.”

“Zelda, check the status of the control loop at P28.”

Operator interface is many years removed from its last significant upgrade. Yes, the Abnormal Situation Management Consortium (led by Honeywell) and Human-Centered Design used by Emerson Process Management and the work of the Center for Operator Performance have all worked on developing more readable and intuitive screens.

But, there is something more revolutionary on the horizon.

A big chunk of time last week on the Gillmor Gang, a technology-oriented video conversation, discussed conversational interfaces. Apple’s Siri has become quite popular. Amazon Echo (Alexa) has gained a large following.

Voice activation for operator interface

Many challenges lie ahead for conversation (or voice) interfaces. Obviously many smart people are working on the technology. This may be a great place for the next industrial automation startup. This or bots. But let’s just concentrate on voice right now.

Especially look at how the technologies of various devices are coming together.

I use the Apple ecosystem, but you could do this in Android.

Right now my MacBook Air, iPad, and iPhone are all interconnected. I shoot a photo on my iPhone and it appears in my Photos app on the other two. If I had an Apple Watch, then I could communicate through my iPhone verbally. It’s all intriguing.

I can hear all the objections, right now. OK, Luddites <grin>, I remember a customer in the early 90s who told me there would never be a wire (other than I/O) connected to a PLC in his plant. So much for predictions. We’re all wired, now.

What have you heard or seen? How close are we? I’ve done a little angel investing, but I don’t have enough money to fund this. But for a great idea…who knows?

Hey Google, take a video.

by Gary Mintchell | Mar 11, 2016 | Automation, Workforce

I just read yet another survey where people think we won’t have any manufacturing jobs in 50 years (or pick your number). Robots and automation will do everything. We will all just sit around, be poor and miserable–except for the few owners.

That begs one essential question. If no one has money to buy things, then what will manufacturing produce? Think about it. Who would be able to buy gasoline, dish washing detergent, Oreo cookies? What we have is a virtuous circle: people have jobs -> people have money -> they buy things -> companies develop new things for them to buy -> people work at those companies to develop and manufacture things -> people have jobs-> etc.

We’ve invested in automation and robots for years. Productivity has not necessarily gone up as a direct result. Read between the lines of yesterday’s post from MAPI.

I’m not arguing from some abstract economic theory. Nor am I sanguine about automation. Nor from a Luddite point of view.

Automation and robots have replaced workers. But if you were in manufacturing plants prior to 1970 and then returned in 2000, you’d have been shocked. Jobs that literally destroyed the bodies of the workers over time had been redesigned such that repetitive lifting of 50 lb. to 75 lb. objects all day, for example, were no longer done manually. Manufacturing jobs that put people in harms’ way were now done with robots. People were moved to safety.

Plants are healthier, cleaner, safer than ever thought possible. Manufacturing jobs that remain are better paying, more satisfying, and safer than before.

Then let’s look at the human spirit. We were made to create.

I have visited the old city dump in Tijuana. A veritable city exists in the dump. People had no where to go. They moved to the dump. They scrounged around and found things with which to build simple houses. The last time I was there I was amazed. People (probably women) had done many things to make those shacks in the dump livable. I saw curtains of a type on the windows. People trying to plant flowers. I wondered how many people were electrocuted climbing up utility poles to tap into the electrical grid so that their house could have some electrical appliances.

It’s a dump. It’s a terrible place to live. The human spirit of the people was amazing. They made the best of what they had.

I didn’t grow up in an upper middle class enclave. I grew up in a small town where all social classes (OK, we didn’t have many of them) mingled. I hung out with “rednecks” as an adolescent. Guys that drank cheap beer and worked on cars. They could do mechanical things that few today can do. Sort of the spirit of the old blacksmiths who build all manner of things for people.

The spirit to build and create is human. We can organize a macro economy any way we want. We’ll still have people figuring out things to do to help people and figuring out ways to do it.

by Gary Mintchell | Mar 10, 2016 | News

A new study by the MAPI Foundation (Manufacturers Alliance for Productivity and Innovation) analyzes productivity growth in manufacturing over the past 25 years and provides “compelling statistical evidence on the importance that capital investment and educated labor have on productivity performance.”

I guess what this study highlights are factors that should have already been well known. Plus the study was financed by Rockwell Automation—a technology developer and supplier—which is an interesting caveat. MAPI is an organization composed of manufacturers and suppliers. I’d really see one of the follow-ups discuss what manner of investment makes the most difference.

The research explores the drivers of productivity performance on subsectors. In particular, the study looks for ways that manufacturers who have already invested in capital equipment can increase productivity and innovation.

Productivity Series

The report is the first in a series on productivity that the MAPI Foundation is producing this year. Cliff Waldman, director of economic studies at the MAPI Foundation, produced the study using well-accepted theory and regression analysis of several decades’ worth of data. The study reveals evidence that innovation and capital investment play a significant role in driving multifactor productivity growth (i.e., output per unit of a combined set of inputs including labor, materials, and capital) in a wide range of manufacturing subsectors. Capital investment is the mechanism by which productivity-enhancing innovation spreads through companies, supply chains, and the broad economy.

“In the manufacturing sector, strong productivity performance is needed to meet the globally driven challenges of cost pressures and competitiveness,” Waldman observes. “For both manufacturing and the economy as a whole, the recent slowdown in productivity causes concern, because it contributes to both slow output and wage growth.”

“Isolating the critical investments required to improve productivity performance is an important foundational element in the MAPI Foundation’s first study,” added Joe Kann, vice president of global business development at Rockwell Automation. “We look forward to the conclusions regarding industry-specific productivity drivers that will be identified in the remaining studies.”

Educated Labor

Waldman’s research finds that another key link to productivity performance is the labor force participation rate of the population holding a B.A. degree or higher, in effect the economy’s supply of educated labor.

The manufacturing sector, a traditional driver of overall productivity, has seen its pace of productivity growth slow over the last 15 years. As Waldman notes, part of this is due to slowing productivity growth in the computer and electronic products industry, which has played an outsized role in driving manufacturing productivity growth in recent decades.

According to the study, industry subsectors that have experienced relative improvements in productivity performance since 1993 include machinery, transportation equipment, and printing. But their growth has not been enough on an absolute basis to replace the decline in computer subsector productivity. Industries with a noticeable drop since 1993 in their relative pace of productivity growth include primary metals and petroleum and coal products.

Sector Correlations

The paper reveals strong cross-subsector correlations for both labor productivity growth and multifactor productivity growth. The apparent interconnectedness of productivity performance across industries, says Waldman, is likely the result of supply chain linkages, innovation spillovers, cluster impacts, and trade channels. Such evidence suggests that, where investments in any one industry lead to faster productivity growth, such expenditures can have impacts that extend to other subsectors as well.

Waldman concludes that a beneficial policy response must consist of a coordinated program that stimulates manufacturing equipment investment as well as innovation investment and increases the supply of educated labor in the broad economy. The MAPI Foundation’s next study on productivity builds on this work and will reveal the findings of a national survey on technology and automation investment that was conducted to determine the drivers and pace of change in various manufacturing industries.

Summary of major findings include:

- While the computer and electronic products subsector has historically played an outsized role in the relatively strong productivity performance of the broader manufacturing sector, productivity growth in the information technology space has slowed dramatically in recent years. This has happened as the high-impact innovation that led to persistent and rapid increases in computer processing speeds, which are necessarily accounted for in the calculation of computer-sector productivity growth, naturally reached physical limits. This is reducing manufacturing’s rate of productivity growth.

- Though the machinery and transportation equipment subsectors have shown notable improvement in their productivity performance over the past 15 years, it has not been enough on an absolute basis to make up for diminishing computer subsector productivity; overall manufacturing productivity growth is therefore languishing at historically weak rates.

- More than two decades’ worth of government statistics and regression analysis demonstrate that innovation and capital investment are directly correlated to and thus play a significant role in driving multifactor productivity growth in a wide range of manufacturing subsectors.

- An increase in the labor force participation rate of those with a B.A. degree and higher correlates to faster labor productivity growth in multiple industries. The supply of educated labor plays a definitive role in driving labor productivity growth across diverse subsectors.

- Statistical analysis shows a strong interconnectedness of productivity performance across subsectors. This evidence supports the hypothesis that because of supply chain linkages, innovation spillovers, cluster impacts, and trade channels, productivity determination is not independent across manufacturing industries. When changes are made in one industry that promote productivity, these can affect productivity performance in other industries as well.

by Gary Mintchell | Mar 9, 2016 | Automation, Internet of Things, Interoperability, Operations Management, Technology

I’ve been thinking deeply about the industrial internet and the greater industrial ecosystem. A friend passed along an article from ZD Net written by Simon Bisson, “There’s A Huge Void At the Heart of the Internet of Things.”

The deck of the article reads, “Closed systems do not an internet make. It’s time to change that before it’s too late.”

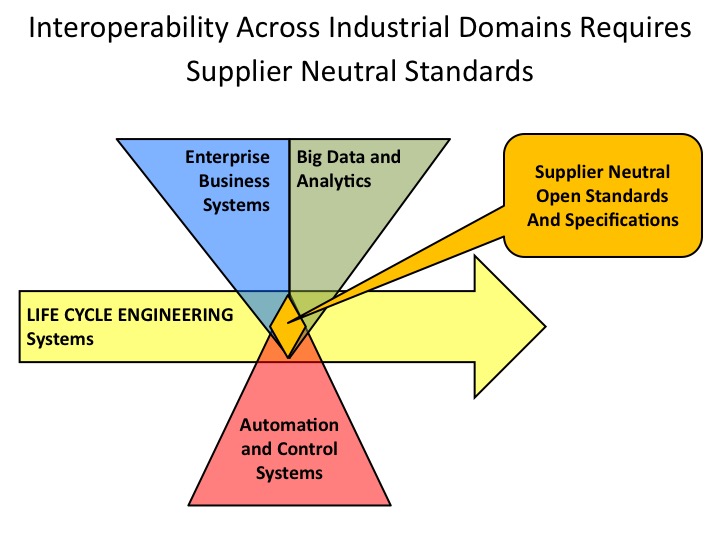

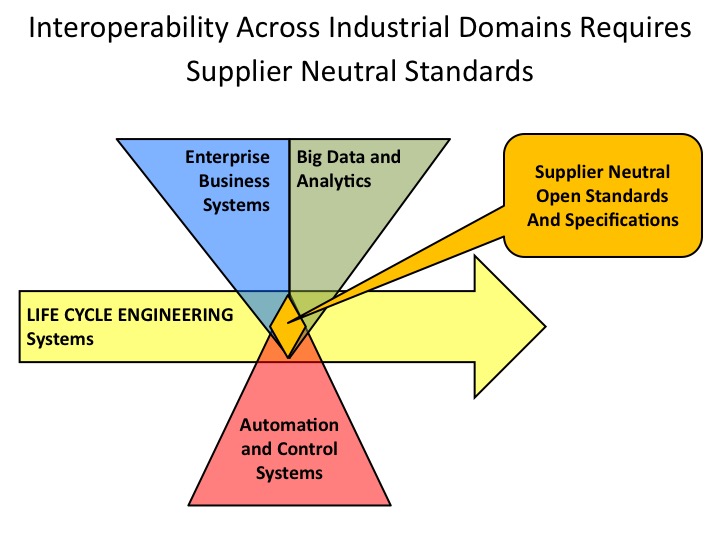

He knew I was working on some white papers for MIMOSA and the OpenO&M Initiative on interoperability of standards in the larger industrial ecosystem. In the case of what I’m writing, there exists a gap in areas covered by Enterprise Business Systems, Big Data and Analytics, Automation and Control Systems, and Life-Cycle Engineering Systems. The gap can be filled with Supplier Neutral Open Standards and Specifications.

Bisson writes, “Sensors are everywhere, but they’re solitary devices, unable to be part of a holistic web of devices that exposes the world around us, giving us the measurements we need to understand and control our environments.”

He notes a few feeble movements toward developing “communication and API standards for these devices, through standards like AllJoyn and Open Connectivity Foundation, the backbone is still missing: a service that will allow us to work with all the devices in our homes.”

Industrial Internet broadly speaking

Typical of a consumer-facing publication, he’s thinking home. I’m thinking industrial in a broad scope.

He continues, “Building that code isn’t hard, either. One of the more interesting IoT development platforms is Node-RED. It’s a semi-visual programming environment that allows you to drag and drop code modules, linking them to a range of inputs and outputs, combining multiple APIs into a node.js-based application that can run on a PC, or in the cloud, or even on devices like the Raspberry Pi.”

Bisson concludes, “The road to an interoperable Internet of Things isn’t hard to find. We just need to remember that our things are now software, and apply the lessons we’ve learnt about building secure and interoperable systems to those software things. And once we’ve got that secure, interoperable set of things, we can start to build the promised world of ubiquitous computing and ambient intelligence.”

I’d take his consumer ideas and apply them to industrial systems. The work I’m doing is to explain an industrial interoperable system-of-systems. I’m about ready to publish the first white paper which is an executive summary. I’m about half done with the longer piece that dives into much greater detail. But he is right. Much has already been invented, developed, and implemented at a certain level. We need to fill the gap now.

by Gary Mintchell | Mar 8, 2016 | Commentary

One set of questions popping up frequently over the past few years among corporate executives of industrial technology supplier companies concerns response to the Industrial Internet of Things regarding industrial merger and acquisition.

Are we in the IIoT market? What acquisitions should we search out to further exploit the IIoT? Should we look at expanding into other aspects of the IIoT market?

Executives analyzing the IIoT system check out networking products plus sensor products plus analysis products. Should I buy into an adjacent area?

One of my favorite new media sites is The Information. It is subscription only. Maybe a model I might morph to someday. Jessica Lessin and her team have assembled a top quality news site covering Silicon Valley entrepreneurs and start ups.

Jessica wrote recently about Yahoo and all the vultures, er companies, circling around to see what sort of deals they may get picking over the various parts of the company that is obviously for sale.

She made this point, “But these two reasons reflect the biggest mistake companies make when it comes to M&A. Executives focus on how a potential deal would help the company get into a new business. But those type of deals, while attractive in theory, often fail miserably. On the other hand, deals that help companies double down on a core business do much better.”

She offers some examples such as AT&T’s purchase of John Malone’s TCI cable company in the late 1990s and News Corp’s $580 million acquisition of MySpace in 2005.

Her advice to those itching to make a deal—just like Pilates, look to your core.

“But the best deals strengthen a company’s core business. The reason is simple: Organizations act in their self-interest; it is how they make money and keep growing. That’s their DNA, more than wishy-washy things like whether employees wear suits or hoodies or work out of a loft or a high-rise.”

Example? “Google pulled that off when it spent $3 billion for DoubleClick in 2007, for example. It was a steep sum but Google already knew search advertising. DoubleClick helped it grow further by selling the similar products to similar customers with display.”

If I’m advising a company again today, I’d pretty much stay with what I thought three years ago—be wary of buying into adjacent or new market areas. To do so requires a clear strategy—and a lot of money.

The only one in the IIoT space of which I’m aware right now is the effort by PTC to enter that space entirely through acquisition. See my post. PTC has acquired at least four companies in the space. A couple it bought for technology. Two it paid huge premiums for. I’m guessing they see such an upside revenue stream that the premium looked small in comparison.

Do you see any other major IIoT plays? I mean other than the German companies focusing on Industrie 4.0 (sort of IIoT plus)—Siemens, Bosch, and others. Rockwell Automation with Connected Enterprise. ABB, GE, and Schneider Electric on IIoT. The big companies are simply focusing efforts they’ve made for years into the new paradigm.

But are there startups to watch? Mid-level acquisitions? Any excitement out there at all? Let me know.