by Gary Mintchell | Nov 3, 2016 | Internet of Things, Manufacturing IT, Software

Back in the day when the Industrial Internet of Things (IIoT) was called Machine-to-Machine (M2M), the promised benefit was for OEMs monitoring their machines on customer sites. Providing that the customer allowed it, the OEM could collect data on performance of the machine and its components, offer maintenance services, and alert customers to potential problems.

Customers generally were leery about allowing connectivity to the outside world. This could become an open port for hacking and even open a gateway for stealing Intellectual Property. Over the ensuing 15 years, many improvements have been made in networking and security. Now, Rockwell Automation is releasing a gateway and cloud analytics platform that hopes to deliver just such benefits.

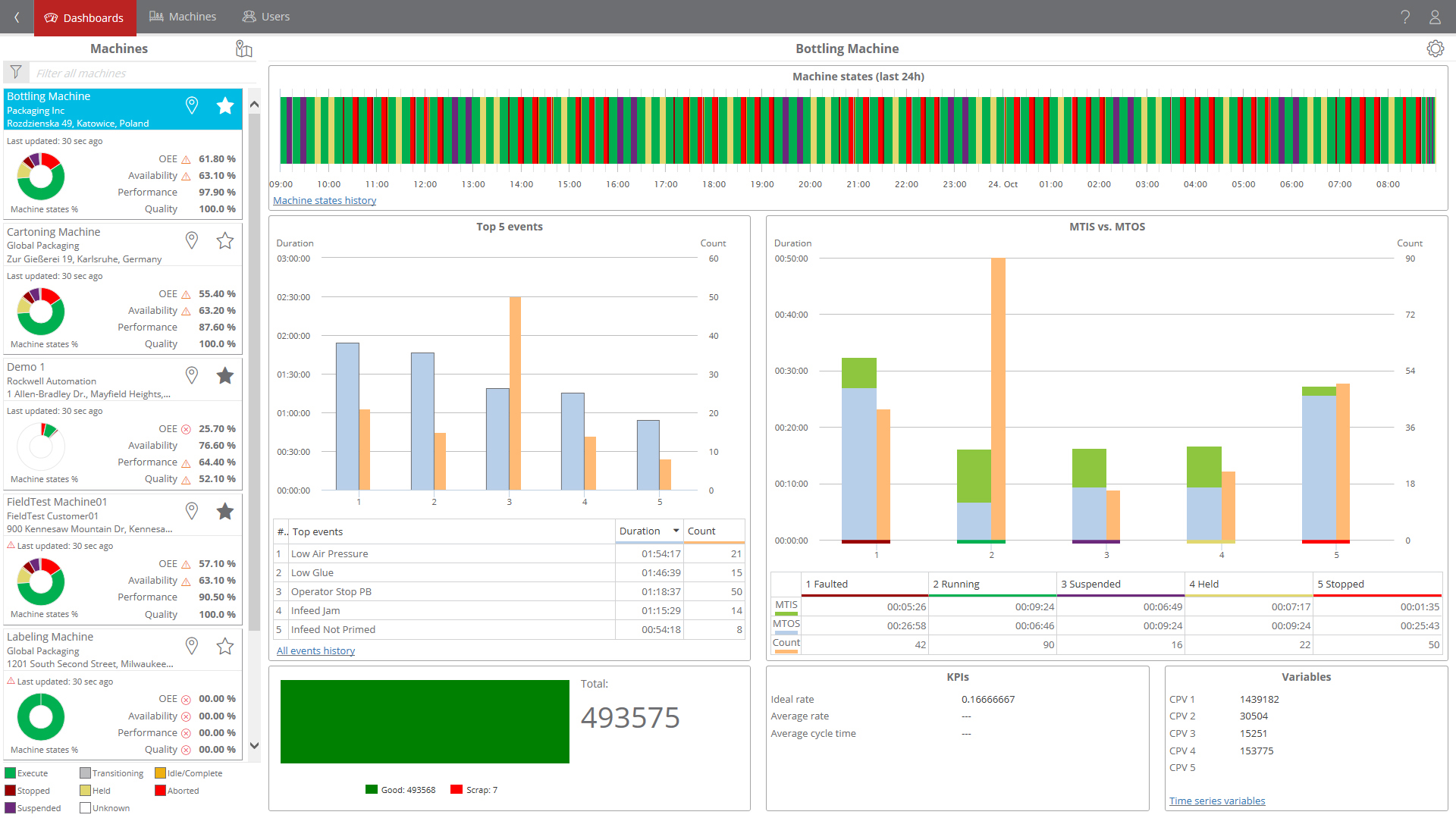

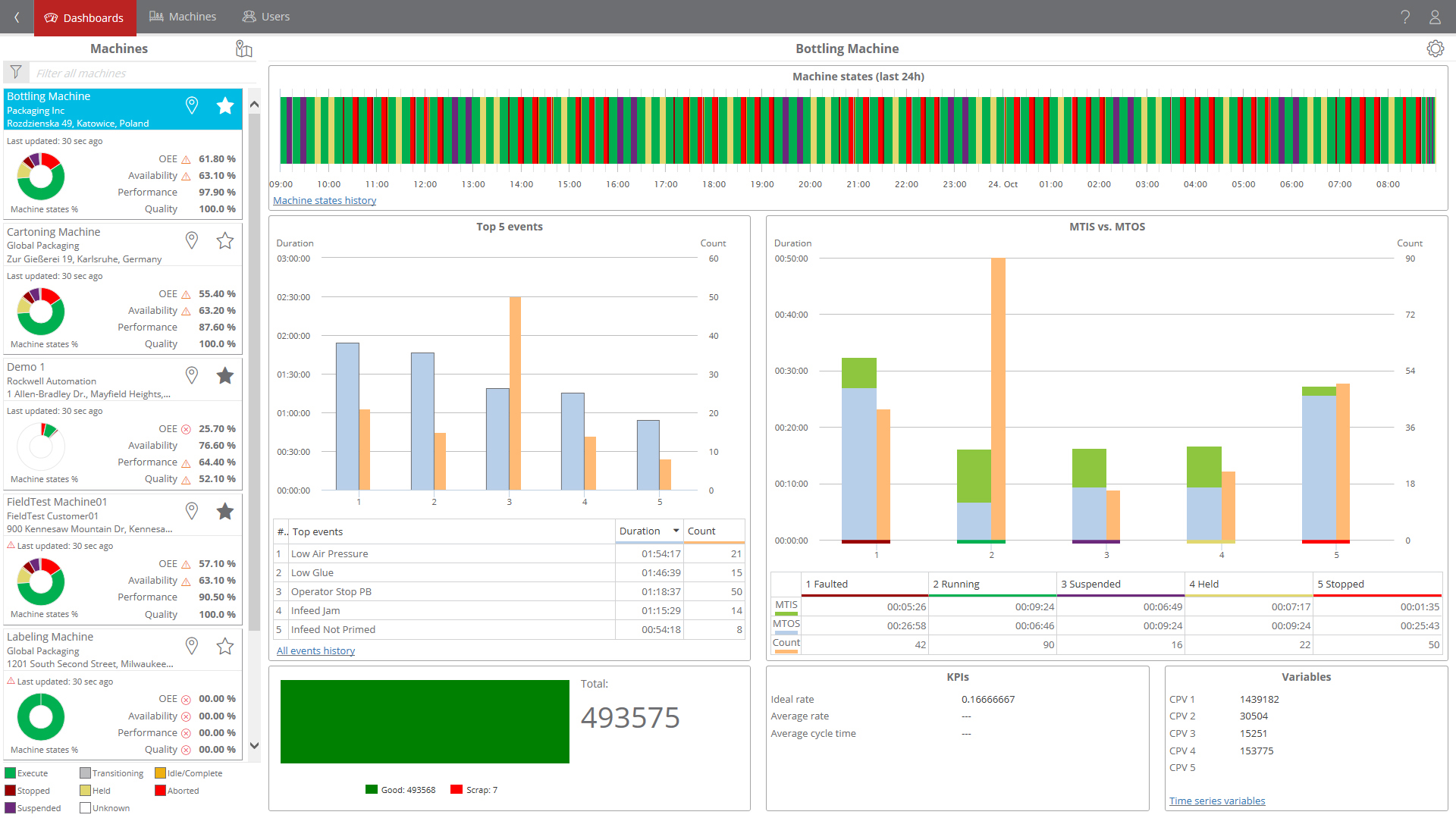

As Rockwell states in its release, “IoT-enabled assets and machines can improve operations when information that matters is delivered to the people who can use it best. Yet, equipment builders who invested heavily to build smart machines often are blind to the use and performance of their products after deployment.” Rockwell Automation announced FactoryTalk Analytics for Machines cloud application – a new Microsoft Azure cloud-enabled capability that empowers equipment builders with information.

As part of the company’s expanded Information Solutions strategy, the application provides access to performance analytics from deployed systems in order to gain valuable insight to support their customers. For manufacturers going through a digital transformation, this capability capitalizes on connected technologies to help drive higher availability and output while reducing maintenance costs.

“The sophistication of plants today has made specialization and collaboration essential,” said Axel Rodriguez, SaaS/Cloud products manager, Rockwell Automation. “Your manufacturing operations and maintenance teams have a lot on their plates. Allowing your equipment builders – who know their machines like the backs of their hands – to become collaborators in performance analytics can free up the best minds to focus on optimizing entire lines, plants or applications.”

OEMs can embed a FactoryTalk Cloud gateway device onto the machines they provide. Once commissioned, the machine starts collecting data. The data from selected controllers is sent to the FactoryTalk cloud application securely with minimal configuration by the equipment builder or the end user. The equipment builder then has access to real-time analytics and actionable information via prebuilt dashboards. It’s that simple!

by Gary Mintchell | Oct 17, 2016 | Automation, Motion Control, News, Technology

The Festo International Press Conference has taken me on manufacturing and technology tours to Germany and Hungary in the past. This year’s event was a short drive down Interstate 75 to Cincinnati, Ohio. Here a large international press contingent toured its new $70 M state-of-the-art distribution and manufacturing center.

The facility features a highly automated order picking system unique to the manufacturing industry in North America and only comparable to the highly sophisticated warehouse systems of the strongest retail brands. With these new premises Festo is now able to triple its capacities: This allows for more flexibility, improved services and offers plenty of space for future growth.

The facility features a highly automated order picking system unique to the manufacturing industry in North America and only comparable to the highly sophisticated warehouse systems of the strongest retail brands. With these new premises Festo is now able to triple its capacities: This allows for more flexibility, improved services and offers plenty of space for future growth.

Excellent growth prospects

The center is designed to allow for the speed and flexibility needed to accommodate Festo’s future growth in the NAFTA market (US, Canada and Mexico). The RSC will also support the expected growth in Mexico, which is becoming a recognized hub for the automotive industry. The new center has Foreign Trade Zone status, which makes it faster and more efficient to support customers in the US, Canada and Mexico from a central US location.

With a storage capacity of 65,000 bins, the highly automated warehouse system – implemented by Witron, the leading designer and supplier of fully automated warehouse and logistics systems – features seven high-performance picking stations and the capability to pick and pack 1,000 items per hour. “As regional and US sales continue to grow, this Regional Service Center will provide a strong product supply backbone for the North American market with best in class supply chain performance“, said Yannick Schilly, Head of Product Supply NAFTA

With a storage capacity of 65,000 bins, the highly automated warehouse system – implemented by Witron, the leading designer and supplier of fully automated warehouse and logistics systems – features seven high-performance picking stations and the capability to pick and pack 1,000 items per hour. “As regional and US sales continue to grow, this Regional Service Center will provide a strong product supply backbone for the North American market with best in class supply chain performance“, said Yannick Schilly, Head of Product Supply NAFTA

and RSC Mason.

and RSC Mason.

Festo Value Production (Lean)

The facility features an implementation of the Festo Value Production system (FVP). This system is based on closely involving employees in defining standards and continuously improving processes and technical solutions. Great emphasis is placed on consistent communication as well as the visualization of objectives and results. It is thus possible to produce globally over 30,000 products with countless variants and deliver tailor-made solutions to customers all over the world within a matter of days.

The Regional Service Center features both an assembly area and the warehousing/picking area. When assembly is completed, the finished product is transported to the Regional Service Center (RSC) for shipment. All components in a system are grouped by barcode, packaged for shipping, and then shipped out to schedule.

“Our customers in North America expect top quality ‘made by Festo’, with guaranteed supplies and next-day delivery at prices in keeping with local market conditions. At the same time, energy efficiency, environmental protection and occupational safety are becoming increasingly important. The Regional Service Center in Mason/Ohio will secure our regional supplies to the North American market for the years ahead,” concludes Dr. Dirk Erik Loebermann, Chief Operation Officer and Member of the Festo Management Board.

Training and Apprenticeship Program

Festo has established a separate group, Festo Didactic, which provides training and apprenticeship programs both for Festo products and systems as well as for automation in general. In Mason, Didactic has partnered with Sinclair Community College and five companies in the Cincinnati tri-state area (Art Metal Group, Clippard Instruments, Festo Inc., MQ Automation, Nestlé) to create a two-year Mechatronics Apprenticeship Program to help employers develop the skills that are missing in the workforce today by combining theoretical education, hands-on training, and on the job training. The apprenticeship is designed to help individuals learn advanced manufacturing skills as well as earn an associate’s degree in mechatronics.

Festo has established a separate group, Festo Didactic, which provides training and apprenticeship programs both for Festo products and systems as well as for automation in general. In Mason, Didactic has partnered with Sinclair Community College and five companies in the Cincinnati tri-state area (Art Metal Group, Clippard Instruments, Festo Inc., MQ Automation, Nestlé) to create a two-year Mechatronics Apprenticeship Program to help employers develop the skills that are missing in the workforce today by combining theoretical education, hands-on training, and on the job training. The apprenticeship is designed to help individuals learn advanced manufacturing skills as well as earn an associate’s degree in mechatronics.

The first cohort of the program includes 11 apprentices who are training for careers as maintenance technicians, automation specialists, service technicians, and manufacturing technicians. The program uses the German apprenticeship model of dual education, where apprentices learn in a classroom and maintain a steady job.

Every week each apprentice spends one day at Sinclair Community College for classes, one day using state-of-the-art equipment at the new Festo Learning Center in Mason, and three days working at their respective employers. The apprentices are able to take what they learn in class, practice it at the Festo Learning Center, and then use that new knowledge and skill in a real-life work environment. “In terms of educational modality, the apprenticeship model couldn’t be a better fit for manufacturing,” says Vice President for Regional Centers at Sinclair Community College Scott Markland.

The Festo Learning Center is a unique part of the program. The Center is designed to meet international standards for production facilities and labs. It provides the apprentices a training facility where they can work with instructors on high-end Festo workstations that simulate a work environment and corresponds to their classroom curriculum.

Industry 4.0

For manufacturing companies in high-wage countries, Industry 4.0 provides an opportunity for remaining competitive on a global scale. “We are talking here about the transformation of industrial manufacture into a fully networked, flexible production system. To remain competitive, we must take the initiative with our characteristic spirit of inventiveness and give shape to this new development”, says Prof. Peter Post, Head of Corporate Research and Technology of Festo AG & Co. KG.

This transformation in the world of production is founded on digitalization, a crucial element in the merging of the virtual and real worlds. Prof. Post sees great potential here: “Digital refinement will give rise to increasingly intelligent products. In future, the individual elements of an overall system will be able to communicate with each other and autonomously control and regulate themselves. They are the core of industrial digitalization and support the production process through enhanced functionality – from classic aspects such as productivity and quality on to increasing individualization.”

To optimally leverage these new capabilities of intelligent products, cooperation needs to be established with many systems and business processes. “Together with our partners in Industry 4.0, we’re currently defining the new language of Industry 4.0. The German ‘Plattform Industrie 4.0’ with its widespread members from office and shop floor, as well as from standardizations and associations, works on joint reference models and international standards. This will allow for engineering the digital work stream in a kind of plug&play manner! The intelligent devices will describe themselves and will autonomously find the right collaboration partners”, details Dr. Michael Hoffmeister, representing the portfolio management software of Festo AG & Co. KG. “In the future, digitizing these virtual added values of a component will be as important as manufacturing the physical part”, he says.

To optimally leverage these new capabilities of intelligent products, cooperation needs to be established with many systems and business processes. “Together with our partners in Industry 4.0, we’re currently defining the new language of Industry 4.0. The German ‘Plattform Industrie 4.0’ with its widespread members from office and shop floor, as well as from standardizations and associations, works on joint reference models and international standards. This will allow for engineering the digital work stream in a kind of plug&play manner! The intelligent devices will describe themselves and will autonomously find the right collaboration partners”, details Dr. Michael Hoffmeister, representing the portfolio management software of Festo AG & Co. KG. “In the future, digitizing these virtual added values of a component will be as important as manufacturing the physical part”, he says.

Being one of the main drivers of standardization within Industry 4.0, Dr. Hoffmeister points out, how important worldwide collaboration is: “We’re working technically closely together with our colleagues from the Industrial Internet Consortium. Our business scopes are complementing each other and our architectures are mapping together”.

Festo Customers in the Region

We toured two customer plants in the area. HAHN Automation and Storopack.

HAHN Automation is one of the leading manufacturers of special machinery for automated production. Its main customers are the automotive industry and its suppliers. “We have a firm focus on customer proximity, since that is the only way we can ensure our quality standards and guarantee intensive project support,” says John Baines.

This strategy has borne fruit, as shown by the successful cooperation with customers located within three hours’ drive of Cincinnati. The nationwide list of customers reads like a who’s who of the industry: from BMW to BorgWarner, Brose, Continental or Mitsubishi, HAHN Automation’s customers include most of the industry’s global players. Another practical point is the closeness of its own facilities to Cincinnati Airport, which is just ten minutes away. This also explains why the company is developing and supplying its site in Mexico from its US factory.

Modular cell concept

HAHN Automation’s main concept is the MasterCell. A MasterCell can either be used as an automatic single workstation with manual component placement or combined into technologically sophisticated automation systems. The modular system design is based on the principle of fast and cost-effective expansion in line with demand as production quantities increase. In the MasterCell modern robots as well as leading-edge assembly and testing technology are used, making it suitable for challenging assembly and testing processes.

The benefits for customers include the standardized cell structure, ease of handling and operation, ergonomic design, high quality, high availability, short delivery times, great economic efficiency, flexible degrees of automation and high levels of customizability.

Festo automation components play an important role in the MasterCell concept: from the modular automation platform CPX/MPA to pneumatic drives from the standard product range and pneumatic grippers, HAHN Automation uses key products from the automation specialist. These are used in almost all assembly cells.

Packaging Material

Packaging material is a typical throwaway product. Packages arrive, are opened, the goods are removed, and the filler material is thrown away. “Hardly anyone – apart from Storopack – thinks about how important it is to select the right protective packaging products in the right quantity and quality for a particular application,” explains Daniel Wachter, President of Storopack for North America in Cincinnati, Ohio. Incorrect or inadequate filler material can damage goods in transit, while excessive or incorrectly inserted protective packaging material can significantly reduce productivity at packing stations in distribution centers.

Storopack produces – among other things – its AIRplus film rolls to supply to distributors and customers throughout the world. During the primary process, plastic granulate is formed into basic plastic film at blown film lines. This is then wound onto rolls by winding machines. These machines are equipped with standard cylinders DSBC which allow the rollers of the winding machines to be correctly aligned, depending on the load.

Storopack produces – among other things – its AIRplus film rolls to supply to distributors and customers throughout the world. During the primary process, plastic granulate is formed into basic plastic film at blown film lines. This is then wound onto rolls by winding machines. These machines are equipped with standard cylinders DSBC which allow the rollers of the winding machines to be correctly aligned, depending on the load.

On configuration lines in the secondary process, the film is configured to the required dimensions and perforations and packed as finished AIRplus rolls. Stamping tools are used to seal and perforate the infinite plastic film to form air cushions of specific widths and lengths. These lines are also equipped with pneumatic cylinders DSBC, as well as rotary cylinders DSNU-PPS, compact cylinders ADN and short-stroke cylinders ADVC, controlled in each case by individual valves CPE 14.

by Gary Mintchell | Sep 2, 2016 | Automation, News, Technology

Ms. Ajarin Pattanapanchai, Deputy Secretary General, of Thailand Board of Investment, talked with me last week about the state of industry and innovation in that country.

She told me that productivity in Thailand is quite high, citing Toyota assembly as an example where it produces a car every 55 seconds in Japan and a nearly equal 58 seconds in Thailand.

While the main topic was robotics, which I will discuss below, she also pointed out that Thailand has a large petrochemical complex—the 5th largest in the world—with the environment a considerable concern. So, the government agency partnered for a real-time monitoring of air direct to the agency.

Given Thailand’s dominance in ASEAN automotive markets, the country has seen an increase in investments from companies such as robotics giant Nachi and other firms providing technology and supply chain products to Thailand’s growing automotive markets. Growth of the robotics industry in Thailand is expected to increase, as the vehicle manufacturing industry in the Kingdom continues to expand in both commercial and private use motorcycles, trucks, and cars.

Robotic and Automation Machinery

Currently, there are more than 60 companies producing robotic and automation machinery in Thailand, such as Eureka Automation, CT Asia Robotic, Yutaka Robot Systems, Ryoei, and Robosis. These companies have developed and produced industrial robots that meet international standards and are gaining ground with the competition because of their high quality and competitive pricing.

Just last year, ABB opened a Robot Applications Center in Thailand and introduced “YuMi,” the world’s first truly collaborative dual-arm robot. Other companies who have located robotics operations in Thailand include:

- Globax Robot System (Thailand) – a Japanese company that produces Robotic Production Line;

- Kuka Robotics – a German company, a world leader in robotics systems, which has located a business operation in Thailand;

- Fillomatic Global Industries – an Indonesian company that produces robotic bottle filling machines and robotic bottle capping machines;

- Cal-comp Electronics –a Taiwanese company that produces robotic computers.

Thailand has the highest concentration of automotive companies in Asia and the 12th largest automotive production capacity in the world, directly providing vehicles for Indonesia, Vietnam, the Philippines, and other nearby and ASEAN countries. Automotive companies with production facilities in Thailand include: Ford, Isuzu, Mazda, Mitsubishi, BMW, General Motors, Daihatsu, Honda, Mercedes-Benz, Nissan, Tata, Toyota, and Volvo.

Thailand Imports

In 2016, Thai imports of industrial robotics and automation systems are estimated to top $47.3 million USD, and this number is expected to grow. The imported machinery has mostly been used for automotive, electrical appliances and electronics, and in the food processing industry.

Both automation and robotics have gained an important foothold in Thailand’s growth and development. Many universities in Thailand offer courses for students interested in this field, with the most specialized course being offered by the Institute of Field Robotics (FIBO) at King Mongkut’s University of Technology, Thonburi.

Many robots developed in-house by universities and private companies, in both the industrial and service categories, have also found use in real world applications. Mahidol University’s Bartlab Rescue Robot, Hive Ground’s Flare Stack Inspection Drone and Zeabus Autonomous Underwater vehicle (AUV), and CT Asia Robotics’s Dinsow Robot are some prominent examples. Given these advances, it is evident that Thai researchers and engineers possess the necessary skills and technical knowhow, and that Thailand is ready to be a hub for investment in these areas.

The country is a hub for automotive and electrical and electronics production in ASEAN. Thailand ranked 12th globally for motor vehicle production and 6th for commercial vehicle production in 2015. As for the electrical and electronics industry, Thailand has experienced a 7% growth in export value as measured from 2011, reaching an impressive figure of THB 435 billion (USD 12 billion) in 2015. The country is also renowned for being the second largest global producer and exporter of data storage units like Hard Disk Drives (HDD).

The BOI recognizes the importance of automation and robotics and they belong to the future industries promoted under the Super Cluster category. Examples of activities eligible for incentives in these industries include microelectronics design, embedded system design, and embedded software. Recently, the BOI approved additional activities to expedite investment projects in these future industries.

High value-added software development is one of those additional activities and it includes developing system software for advanced technology devices (including business process management) and developing industrial software used to support manufacturing. Investors can apply for general incentives that include an 8 year income tax exemption and import duty on machinery, and raw materials. However, they can apply for incentives under the Super Cluster policy if they meet certain specific criteria and not only get an 8 year income tax exemption, but also 50% Corporate Income Tax (CIT) reduction for 5 years. Non-tax incentives include the right to own land and work permits for expatriates.

by Gary Mintchell | Aug 17, 2016 | Automation, Technology

The most exciting thing happening now with industrial robots is the new intimacy of human and machine–collaborative robots.

Since I had other plans and could not attend the Rockwell Automation track at the EHS Conference coming up in Pittsburgh, Rockwell brought a piece of the safety symposium to me. George Schuster, a member of the global safety team at Rockwell and a robotics safety expert, discussed the current state of the art with me.

Schuster told me that Rockwell Automation is working with Fanuc Robots to change the way people and machinery interact.

There is much interest in the work in the user community to create manufacturing processes that leverage the strengths of machines (stability, reliability, strength) and the intelligence and adaptability of humans.

“In the past we engineered to keep them separate or at least arbitrate the shared space. Now we’ve found good benefits to engineer ways for people and machines to work together,” said Schuster.

Three things are enabling this approach. First, there are the standards. ISO 10218 and ANSI/RIA 15.06-2012 give guidance for designers. They also make it clear that thorough risk assessments must be carried out when designing these processes. Next, Rockwell is blending its safety technology with robotics. Then design approaches are looking holistically at what is possible with human and machine working together. Together, this is actually more of an application space rather than just technology.

Increasingly working on removing barriers between robotics and controllers, technology includes connectivity and safety–EtherNet/IP Safe; GuardLogix system; Add-on profiles in software-pre-engineered common data structure; part of the Connected Enterprise, includes connection of devices plus communication to upper levels to collect and analyze information–all working together.

There are four key current applications: ability to stop robot without killing power to allow operator to interact for instance load/unload, can quickly enter/leave area; hand guided operation, person can move/guide robot kind of like ergonomic load assist; speed and separation monitor, sensor system detects presence and position of personnel, modulates robot, can stop if person gets too close, coordinates robot speed and approaching person; power force limiting-this one is a little tricky, it’s hard to know where the robot will come in contact and what force is acceptable to the human, difference between soft flesh and hard place, etc.

This is all cool. It is ushering in a new era of manufacturing.

by Gary Mintchell | Jan 26, 2016 | Automation, Internet of Things, News, Operations Management, Technology

The PwC Industrial Manufacturing Trends 2016 post has been released. Check it out. There are some interesting ideas.

The authors Stephen Pillsbury and Robert Bono cite the painful lessons of recovering from 2001 and 2008 as leading to caution now displayed by manufacturing leaders. We’ve had a bit of an economic jolt. Where is it headed? The uncertainty leads to caution.

They reach an interesting conclusion, “Manufacturing may be facing some headwinds, but it’s undeniably in the midst of a technological renaissance that is transforming the look, systems, and processes of the modern factory. Despite the risks — and despite recent history — industrial manufacturing companies cannot afford to ignore these advances. By embracing them now, they can improve productivity in their own plants, compete against rivals, and maintain an edge with customers who are seeking their own gains from innovation.”

It is time, they say, to envision and prepare for a data-driven factory of the future.

They reveal four technology categories that are already driving much of the change. I’ll summarize. Check out the report for more depth. Most of these are not surprising, but they certainly must be factored in the thinking of manufacturing leaders.

Industrial Manufacturing Technologies

- Internet of Things (IoT): The connected factory is an idea that has been evolving for the past few years. Increasingly, it means expanding the power of the Web to link machines, sensors, computers, and humans in order to enable new levels of information monitoring, collection, processing, and analysis.

But for industrial manufacturing companies, the next generation of IoT technology should go well beyond real-time monitoring to connected information platforms that leverage data and advanced analytics to deliver higher-quality, more durable, and more reliable products.

Before investing in IoT, however, industrial manufacturing companies must determine precisely what data is most valuable to collect, as well as gauge the efficacy of the analytical structures that will be used to assess the data. In addition, next-generation equipment will require a next-generation mix of workers, which should include employees who can design and build IoT products as well as data scientists who can analyze output.

- Robotics: In many cases, robots are employed to complement rather than replace workers. This concept, known as “cobotics,” teams operators and machines in order to make complex parts of the assembly process faster, easier, and safer.Cobotics is rapidly gaining momentum, and successful implementations to date have focused largely on specific ergonomically challenging tasks within the aerospace and automotive industries. But these applications will expand as automation developers introduce more sophisticated sensors and more adaptable, highly functional robotic equipment that will let humans and machines interact deftly on the factory floor.

- Augmented reality: Recent advances in computer vision, computer science, information technology, and engineering have enabled manufacturers to deliver real-time information and guidance at the point of use.

- 3D printing: Also known as additive manufacturing, 3D printing technology produces solid objects from digital designs by building up multiple layers of plastic, resin, or other materials in a precisely determined shape.

The authors conclude with recommendations of how to consider necessary investments in these emerging technologies.

The facility features a highly automated order picking system unique to the manufacturing industry in North America and only comparable to the highly sophisticated warehouse systems of the strongest retail brands. With these new premises Festo is now able to triple its capacities: This allows for more flexibility, improved services and offers plenty of space for future growth.

The facility features a highly automated order picking system unique to the manufacturing industry in North America and only comparable to the highly sophisticated warehouse systems of the strongest retail brands. With these new premises Festo is now able to triple its capacities: This allows for more flexibility, improved services and offers plenty of space for future growth. With a storage capacity of 65,000 bins, the highly automated warehouse system – implemented by Witron, the leading designer and supplier of fully automated warehouse and logistics systems – features seven high-performance picking stations and the capability to pick and pack 1,000 items per hour. “As regional and US sales continue to grow, this Regional Service Center will provide a strong product supply backbone for the North American market with best in class supply chain performance“, said Yannick Schilly, Head of Product Supply NAFTA

With a storage capacity of 65,000 bins, the highly automated warehouse system – implemented by Witron, the leading designer and supplier of fully automated warehouse and logistics systems – features seven high-performance picking stations and the capability to pick and pack 1,000 items per hour. “As regional and US sales continue to grow, this Regional Service Center will provide a strong product supply backbone for the North American market with best in class supply chain performance“, said Yannick Schilly, Head of Product Supply NAFTA and RSC Mason.

and RSC Mason. Festo has established a separate group,

Festo has established a separate group,  To optimally leverage these new capabilities of intelligent products, cooperation needs to be established with many systems and business processes. “Together with our partners in Industry 4.0, we’re currently defining the new language of Industry 4.0. The German ‘Plattform Industrie 4.0’ with its widespread members from office and shop floor, as well as from standardizations and associations, works on joint reference models and international standards. This will allow for engineering the digital work stream in a kind of plug&play manner! The intelligent devices will describe themselves and will autonomously find the right collaboration partners”, details Dr. Michael Hoffmeister, representing the portfolio management software of Festo AG & Co. KG. “In the future, digitizing these virtual added values of a component will be as important as manufacturing the physical part”, he says.

To optimally leverage these new capabilities of intelligent products, cooperation needs to be established with many systems and business processes. “Together with our partners in Industry 4.0, we’re currently defining the new language of Industry 4.0. The German ‘Plattform Industrie 4.0’ with its widespread members from office and shop floor, as well as from standardizations and associations, works on joint reference models and international standards. This will allow for engineering the digital work stream in a kind of plug&play manner! The intelligent devices will describe themselves and will autonomously find the right collaboration partners”, details Dr. Michael Hoffmeister, representing the portfolio management software of Festo AG & Co. KG. “In the future, digitizing these virtual added values of a component will be as important as manufacturing the physical part”, he says. Storopack produces – among other things – its AIRplus film rolls to supply to distributors and customers throughout the world. During the primary process, plastic granulate is formed into basic plastic film at blown film lines. This is then wound onto rolls by winding machines. These machines are equipped with standard cylinders DSBC which allow the rollers of the winding machines to be correctly aligned, depending on the load.

Storopack produces – among other things – its AIRplus film rolls to supply to distributors and customers throughout the world. During the primary process, plastic granulate is formed into basic plastic film at blown film lines. This is then wound onto rolls by winding machines. These machines are equipped with standard cylinders DSBC which allow the rollers of the winding machines to be correctly aligned, depending on the load.