by Gary Mintchell | Jan 31, 2017 | Automation, News, Operations Management, Software

HMI SCADA software builds the platform of the Industrial Internet of Things. Yet, many of the traditional companies apparently are not pursuing it as actively as in the past as they spend more time on somewhat “higher end” software—business intelligence and analytics.

So, is there money to be made in this business?

To that end, I have been watching the growth of Inductive Automation for more than ten years. It has introduced the Software as a Service, or cloud-based application, to the industrial space greatly lowering costs for customers. At the same time, everything it builds is IT-friendly. So the OT people can make friends with the IT people.

Well, business has been good enough that Inductive Automation has purchased a building for its corporate headquarters that’s 2½ times larger than its current space. The fast-growing company will remain in Folsom, and will move into its new location in July.

Inductive Automation makes industrial automation software that’s used in virtually every industry and in more than 100 countries. The company’s key product is Ignition by Inductive Automation. Ignition is an industrial application platform with fully integrated tools for building solutions in human-machine interface (HMI), supervisory control and data acquisition (SCADA), and the Industrial Internet of Things (IIoT).

The company has grown rapidly since its inception in 2003. Since the launch of Ignition in 2010, Inductive Automation’s revenues have grown at an average annual rate of more than 60 percent. The company’s growth has been fueled by powerful software and an unlimited licensing model, which together remove economic and technological barriers for industrial organizations seeking more data from their operations and processes.

“We’re committed to Folsom,” said Steve Hechtman, president and CEO of Inductive Automation. “When we first moved here from Sacramento, we had 20 employees. Now we have more than 100, and we look forward to continuing our growth at our new site. The larger building will allow us to expand to about 300 team members, as we continue to serve the global marketplace in industrial automation.”

Folsom community leaders are very happy with the company’s decision to stay in Folsom. “We are pleased that Inductive Automation calls Folsom home,” said Evert W. Palmer, city manager for Folsom. “We celebrate their success, and we are thankful for their contributions to Folsom’s strong and growing ecosystem of industry-leading technology companies.”

“Inductive Automation is a shining example of strong leaders with a well-defined vision to grow their company strategically and profitably,” said Joe Gagliardi, CEO/president of the Greater Folsom Partnership. “Their commitment to stay in Folsom and build their business is adding energy to the already-strong job growth we are experiencing in 2017. All segments of the Folsom economy benefit from the success of Inductive Automation.”

by Gary Mintchell | Jan 27, 2017 | Commentary

Ah, the warmth. It feels so good. Is it getting warmer? I’m not sure, but the warmth eases muscle stress. Frees the joints. And it gets warmer.Then, it’s too hot.

It could be the proverbial frog being slowly boiled. Or it could be me in the steam room.

Or it could be any of us in our organization.

How easily we don’t notice we’re not growing anymore. We’re not developing new services for our customer.

We just sort of gently slid into the routine.

Same people. We’re comfortable with them. No one around to upset things with new ideas.

We’re comfortable with the same surroundings. We enter and everything is familiar. We feel like we belong. We don’t notice the things that would turn off an outsider–or our customer.

What was our mission again? I sort of forget. I know it’s printed somewhere. Probably posted on a wall that has just become part of the environment.

It feels so good to be comfortable.

But…

Is that what we are placed here on Earth to experience? Is that what our stockholders or owners expect? Is that what our customers expect?

Or are we supposed to push through comfort? Find that place of discomfort that impels us toward fulfilling a mission.

What was that valuable service to people that gave passion to the founders?

Was it designing and making a product that will bring joy, relief, health to others?

Where are the big ideas that our technology can use to contribute to the growth and development of society?

“There are three types of people in this world: those who make things happen, those who watch things happen, and those who wonder what happened.”

Which are you? Are you a change agent? Or are you a frog in the pot of boiling water?

by Gary Mintchell | Jan 26, 2017 | Automation, Industrial Computers, Security

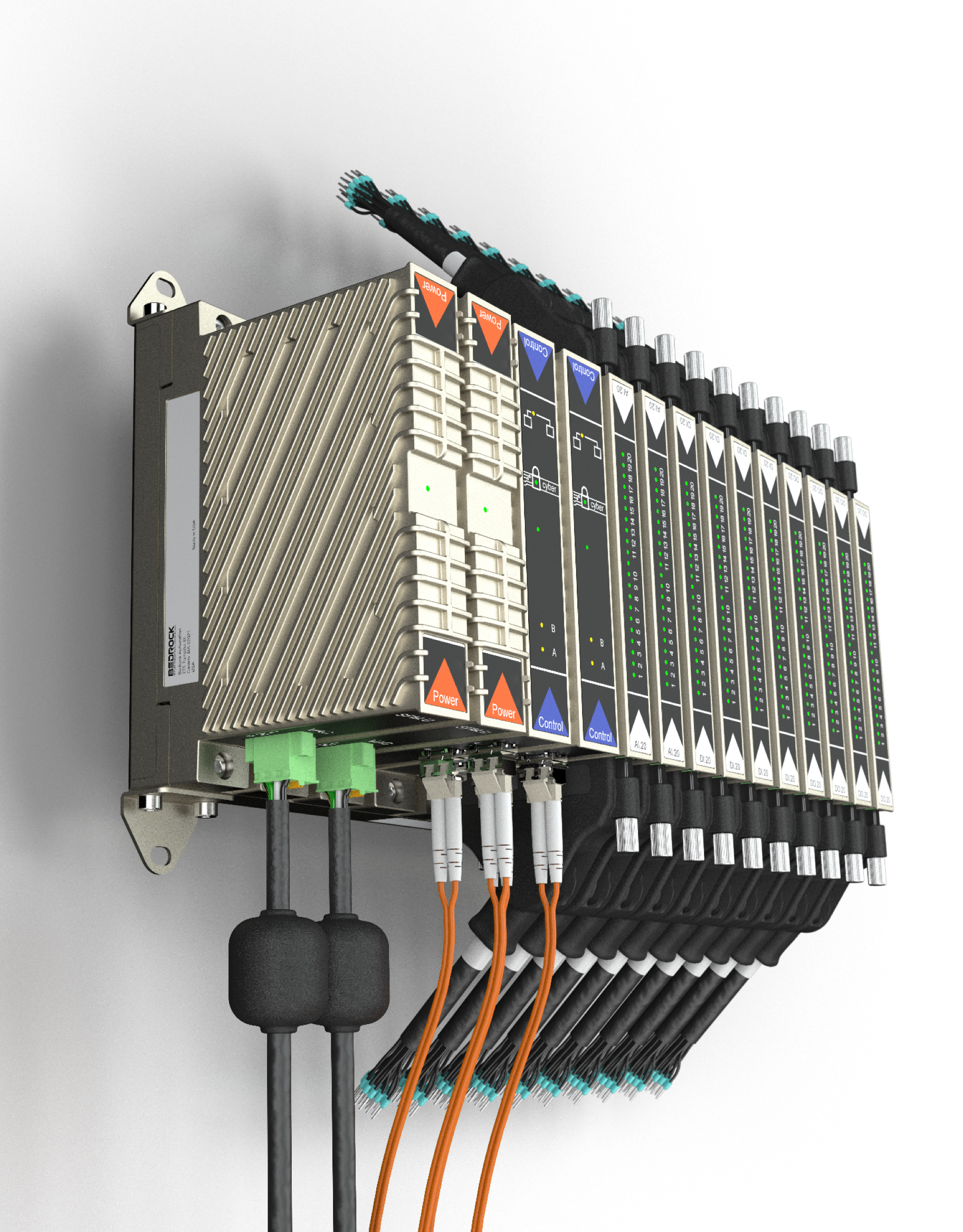

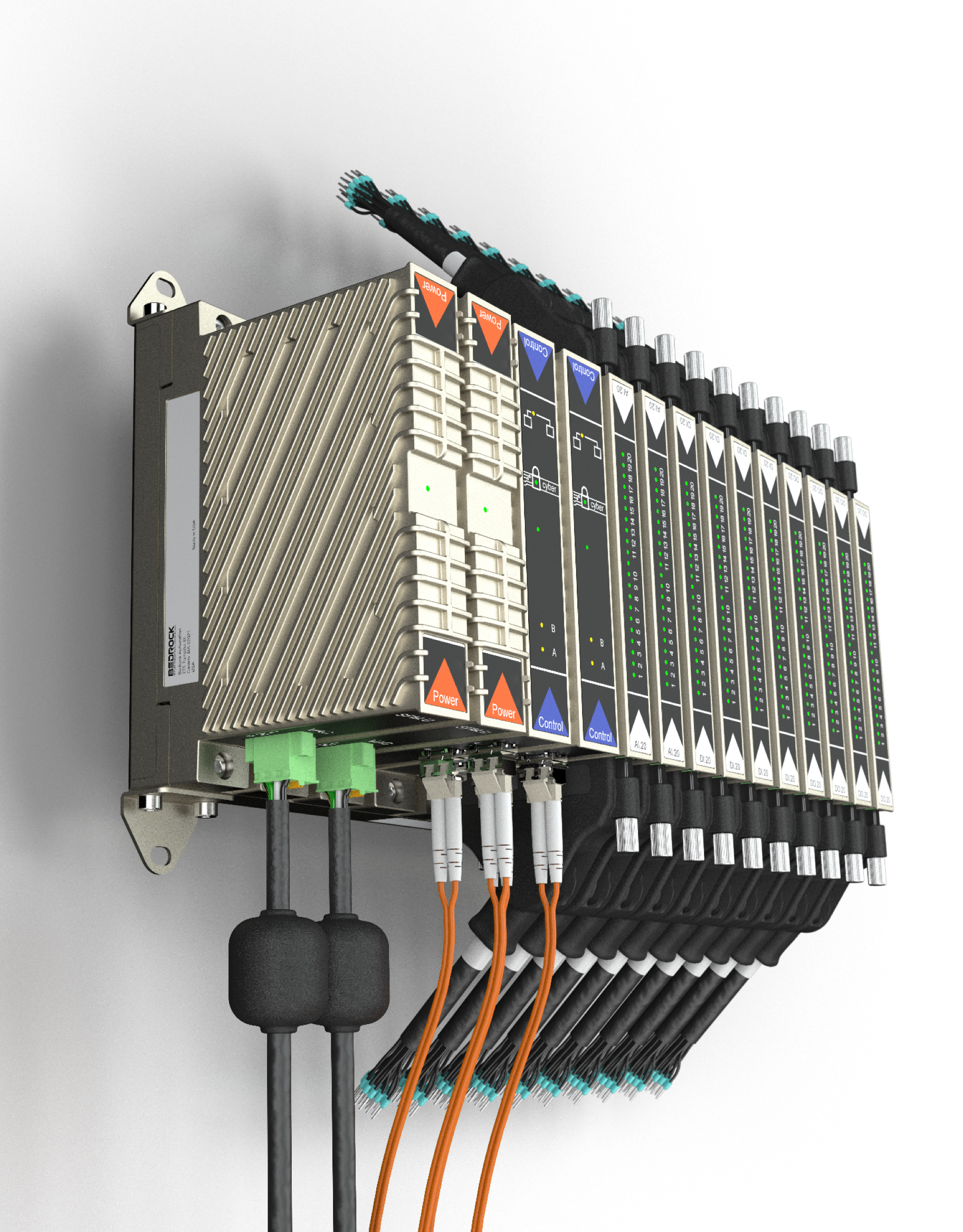

Bedrock Automation has built a good automation platform with built-in security and toughness. I’ve been watching to see just how disruptive it might be in the market. In this announcement, it is showing further growth in its go-to-market strategy of working with integrators. It has signed a memorandum of agreement with Jacobs Engineering Group Inc., one of the world’s largest and most diverse providers of full-spectrum technical, professional and construction services. Under the agreement, the companies will pursue selected projects with automation system requirements for potential implementation of the Bedrock Open Secure Automation (OSA) system.

Bedrock Automation has built a good automation platform with built-in security and toughness. I’ve been watching to see just how disruptive it might be in the market. In this announcement, it is showing further growth in its go-to-market strategy of working with integrators. It has signed a memorandum of agreement with Jacobs Engineering Group Inc., one of the world’s largest and most diverse providers of full-spectrum technical, professional and construction services. Under the agreement, the companies will pursue selected projects with automation system requirements for potential implementation of the Bedrock Open Secure Automation (OSA) system.

“Our clients are increasingly concerned about both cyber security and advanced automation and we have been creating innovative service packages to meet these needs. Bedrock Automation has excellent experience and superior designs in this area. I am impressed with their comprehensive background and knowledge in the industrial DCS and PLC arena,” said Jacobs’ Mission Solutions Chief Technology Officer Dr. Tommy Gardner.

The Bedrock control system is known for its patented Black Fabric Cybershield architecture, which provides an intrinsic cyber secure automation platform to protect user hardware, software and applications. Unlike other conventional industrial control systems, Bedrock was designed from a clean sheet of paper with advanced components and architecture to be simple, scalable and secure.

“Jacobs is taking a leadership role in integrating the next generation of information and automation technologies for its clients,” added Bedrock Automation President Bob Honor. “We see this as a tremendous opportunity to bring our technology and our vision of holistic cyber security to a much larger audience. We look forward to an exciting and mutually beneficial relationship with Jacobs.”

by Gary Mintchell | Jan 25, 2017 | News, Organizations

A couple of reports and studies on industrial manufacturing merger and acquisition activity have popped up recently. One came from my usual source—PwC. The other arrived from a new contact—Mergermarket.

First PwC.

The following is an analysis of Global Industrial Manufacturing deals with disclosed values greater than $50 million.

The Global Industrial Manufacturing sector closed 2016 with two strong quarters of deal activity. The deal market in the first half of 2016 was suppressed primarily due to geopolitical concerns such as Brexit, slowing growth in China, and the impending US presidential election.

Although 2016 finished strong, deal value ended down 3% and volume ended down 18% compared to 2015, principally driven by the softness in the deal market in the first half of the year.

The largest deal in 2016 was the Johnson Controls/TYCO megadeal valued at $22.7 billion, which occurred in Q1 of 2016. This drove the average deal size to $404 million from $342 million in 2015.

With two consecutive quarters of improved deal activity (both value and volume), we are optimistic 2017 will likely be a good environment for deal makers. The speculation of reduced tax rates, infrastructure investment, health care reform, and reduced government regulation in the US are positive factors for many deal makers. Further, similar to 2016, deal making in 2017 will be driven by inorganic growth strategies focused on product and service differentiation through access to new markets, customers, and technologies.

Key Trends and Highlights

- Aggregate disclosed deal value for 2016 vs. 2015 was $91.3 billion and $93.7 billion, a 3% decrease.

- Deal volume decreased by 18% in 2016 vs. 2015, with 226 vs. 274total deals, respectively.

- M&A activity showed signs of continued comeback as Q4 2016 had 65 deals with a total aggregate disclosed value of $25.1 billion vs. 60 deals and $20.2 billion of aggregate disclosed value in Q3 2016.

- The largest deals in Q4 2016 included CK Holdings intended acquisition of Japanese Calsonic Kansei Corp. for $4.5 billion and a US-based investor group’s acquisition of German Atotech BV for $3.2 billion.

- There were three transactions exceeding $1 billion in Q4 by financial buyers with a total aggregate value of $9.2 billion, 37% of total value for the period.

- M&A activity continues to be driven by deals in the Industrial Machinery subsector. Value increased 6% compared to 2015 and doubled compared to Q3 2016. This was the only category that recorded year-over-year growth and contributed to 59% of deal value and 41% of deal volume in 2016.

- Asia & Oceania remains as the region with the highest M&A activity. In 2016, acquirers in the region accounted for 41% of deal value and 61% of volume.

Now Mergermarket

Mergermarket has released its Global Industrials & Chemicals M&A Trend report for 2016 (Q1-Q4). Take a look at the full report Here.

A few key findings include:

Despite a series of political shockwaves leading to market uncertainty, global Industrials & Chemicals’ M&A activity still managed to hit its highest level on Mergermarket record (2001). A total of 3,356 deals worth US$ 525.2bn makes it the most active sector based on deal count and up 11.3% in terms of deal value compared to 2015 (US$ 471.8bn)

The US continued to dominate global Industrials & Chemicals activity last year, with 832 transactions valued at US$ 207.2bn, accounting for nearly 40% of the sector’s overall value. Bayer’s headline- grabbing US$ 65.3bn takeover of Monsanto contributed almost a third of the sector’s deal value. The deal also helped Germany boost its outbound activity to US$ 142bn. Germany’s appetite for outbound deals will likely continue into 2017 as German corporates take on the Industry 4.0 challenge – a government-backed initiative to unite technology within the manufacturing industry – according to Mergermarket intelligence

Industrials & Chemicals in Europe (US$ 159.4bn, 1,404 deals) saw a 45.4% jump in terms of deal value compared to 2015 (US$ 110bn, 1,361 deals). Chinese investors in particular showed a growing appetite for Europe Industrials & Chemicals, leading to a record value of US$ 58.4bn with 55 deals. This however is expected to ease this year over protectionism concerns against Chinese buyers and domestic capital controls. As such, Chinese companies may avoid overseas acquisitions for now and focus on organic growth

Drivers

Fueled by the government-backed Industry 4.0 initiative, in an effort to advance technology in the industrial space, German corporates are expected to have an even greater influence over the Industrials & Chemicals sector this year.

Activity across Asia-Pacific (including Japan) saw a significant uptick in the automotive sector driven by an increasing willingness from Asian industry players to carve out non-core businesses, such was the case in Nissan Motor’s US$ 4.5bn disposal of auto parts maker, Calsonic Kansei, to KKR. This is again likely to play a role this year as international industry players’ show an increasing hunger to acquire technology and know-how.

The rise of Chinese M&A has also contributed to the growth despite a relative slowdown in the manufacturing sector. A race to develop technology has created fierce competition among companies bidding for European and US targets to move up the supply chain and to gain industry know-how.

As the sector’s most dominant player, the US could experience a more uncertain 2017 as the effect of president-elect, Donald Trump, still remains a large unknown. But there are positive sounds being made with suggestions he would call for comprehensive tax reform and substantial changes to trade agreements, existing regulation and immigration policy, in addition to the claim that he would like to see significant investments in infrastructure.

by Gary Mintchell | Jan 24, 2017 | Automation, Events, News, Organizations

The Automation Industry (if you wish to call it an industry) has some interesting news of innovation. The ARC Advisory Group Industry Forum is coming up in a couple of weeks. I will be there. If you’re coming, let me know. Maybe we can chat over a coffee or something.

Automation Competition

Meanwhile, the Association for Advancing Automation (A3) has announced a call for startup companies in robotics, machine vision and motion control to enter the Automate Launch Pad Competition. The competition is a chance for the industry’s most innovative young companies to vie for the spotlight at the Automate 2017 Exhibition and Conference—the industry’s largest gathering in North America, taking place in Chicago, Illinois April 3-6, 2017—as well as a $10,000 cash award. The Automate Launch Pad Startup Competition seeks out startup companies looking to generate awareness of their technology and find new sources of funding.

“Investment in the automation and robotics market is rising sharply, with a record 128 companies receiving funding of $1.95 billion in 2016—which is a 50% increase over the previous record-breaking year,” noted Jeff Burnstein, president of A3. “The Automate Launch Pad Competition is a great opportunity for innovative young companies to gain some extra funding and garner the attention of key players in the automation industry.”

Call for submissions and application form for the Launch Pad Competition are now open. Eligible companies include those in the automation space (robotics, vision, motion control, etc.) who were founded in the last five years; raised less than US $2 million since creation; and are not affiliated with a larger group. Eight semi-finalist companies will be invited to participate in the competition at Automate on April 3, where they will have three minutes to pitch their technology to a panel of investors and automation experts. All semi-finalists will also be provided booth space on the Automate show floor, putting them in front of an expected audience of over 20,000 automation professionals, investors, scientists and journalists. The Automate Launch Pad Competition is sponsored by GE and the event is co-produced with Silicon Valley Robotics.

Systems Integrators To Meet

In other news, The Control Systems Integrators Association (CSIA) has announced its spring meeting information.

In other news, The Control Systems Integrators Association (CSIA) has announced its spring meeting information.

It is expecting more than 500 control system integrators and industry suppliers from around the globe in Fort Lauderdale, Florida, May 2 – 5 for the Control System Integrators Association (CSIA) 2017 Executive Conference. Themed From best practices to transformative business models, the conference will include over a dozen educational sessions, including several presented as part of two separate tracks.

- Track 1: Small Company SIs and Best Practices

CSIA’s Best Practices have helped hundreds of system integrators grow from younger, smaller companies into the well-established ones they are today. Attendees will learn how they, too, can use CSIA Best Practices for growth.

- Track 2: Transformative Business Models

Technology is creating a very exciting future filled with opportunity for SIs — opportunities that will require a shift away from traditional SI business models. Through a series of presentations, panel discussions and an unconference, SIs will gain an understanding of how to take advantage of these emerging models.

Economist Alan Beaulieu, president of ITR Economics, will open the conference with his latest economic outlook for manufacturing, providing a solid outlook for attendees to use to guide their companies’ into the future.

In addition to the educational sessions included during the conference, CSIA will offer a two-day intensive training workshop on Best Practices implementation on Monday, May 1 and Tuesday, May 2, just prior to the conference.

Those attending the conference will have opportunities for networking, including the annual industry expo, awards banquet and a closing reception. The CSIA Fun Run/Walk will be held again this year, along with other special events and tours.

See complete details and register at the CSIA 2017 Executive Conference website.

Bedrock Automation

Bedrock Automation

In other news, The Control Systems Integrators Association (CSIA) has announced its spring meeting information.

In other news, The Control Systems Integrators Association (CSIA) has announced its spring meeting information.