by Gary Mintchell | Jan 20, 2017 | Automation, Internet of Things, Operations Management, Technology

The strongest trend among larger automation suppliers includes signing up partners for their solution ecosystem. Honeywell Process Solutions has built an ecosystem it calls Inspire and it announced recently Aereon will collaborate on solutions to help industrial customers boost the safety, efficiency and reliability of their operations by leveraging Honeywell’s Industrial Internet of Things (IIoT) ecosystem.

The strongest trend among larger automation suppliers includes signing up partners for their solution ecosystem. Honeywell Process Solutions has built an ecosystem it calls Inspire and it announced recently Aereon will collaborate on solutions to help industrial customers boost the safety, efficiency and reliability of their operations by leveraging Honeywell’s Industrial Internet of Things (IIoT) ecosystem.

“For years, manufacturers and producers have looked for ways to solve operational problems that were believed to be unsolvable – such as unplanned downtime, underperforming assets and inefficient supply chains,” said Andrew Hird, vice president and general manager of Honeywell Process Solutions’ Digital Transformation business. “With the capabilities of the IIoT, we can find new ways to solve those problems. A key part is the creation of an industrial ecosystem that leverages the depth of knowledge and experience of a range of equipment and service providers such as Aereon.”

The Inspire ecosystem is a key part of Honeywell’s Connected Plant initiative that helps manufacturers leverage the IIoT to improve the safety, efficiency and reliability of operations across a single plant or several plants across an enterprise.

Aereon is widely recognized for its innovative air emissions solutions for the complete oil and gas sector, from the wellhead to the gas station. It offers products for flare systems, enclosed combustion systems, high efficiency thermal oxidizers and vapor/gas recovery units.

“Aereon’s fundamental strength is its wide array of fit-for-purpose combustion and vapor recovery products supported by in-house expertise to design, manufacture and support its field-installed base,” said Mark Zyskowski, senior global vice president, Aereon. “We are pleased to be able to bring our expertise to the IIoT ecosystem that Honeywell is developing to help customers around the globe maximize value from their operations by tapping into the power of the IIoT.”

Honeywell and its ecosystem partners are building a simple-to-use infrastructure that gives customers secure methods to capture and aggregate data, and apply advanced analytics. This infrastructure leverages domain knowledge from a vast and unique ecosystem of leading equipment vendors and process licensors, and allows customers to use this information to determine methods to reduce or even eliminate manufacturing upsets and inefficiencies.

With a larger, consolidated data set, manufacturers and producers can apply higher analytics for more detailed insight, scale the data as needed to meet the varied needs of single-site or enterprise-wide operations, and leverage a wider pool of data experts for monitoring and analysis.

“Honeywell’s capabilities in data consolidation, cyber security and software development, combined with the deep industry knowledge of its collaborators, including Aereon, will help customers solve previously unsolvable problems,” said Hird. “These problems include eliminating unplanned shutdowns, maximizing output, maintaining regulatory compliance, increasing safety and optimizing supply chain strategies.”

by Gary Mintchell | Jan 19, 2017 | News

I received another survey of manufacturers’ economic outlook. This one shows definitely mixed opinions. Reading through the lines of the report reveals some uncertainty with shades of hope hear and there.

From the report:

While manufacturers across the U.S. are generally optimistic about revenues for 2017, small manufacturers are far more optimistic than larger manufacturers by more than a 2:1 margin.

That is just one of the findings from the 2017 National Manufacturing Outlook Survey, conducted by the Leading Edge Alliance (LEA Global).

“We found that 44 percent of small manufacturers expect revenue growth of 10 percent or more in 2017, while only 19 percent of large manufacturers do,” explained LEA Global President Karen Kehl-Rose.

With more than 250 participants, LEA Global’s survey report contains the expectations and opinions of manufacturing executives in more than 20 states across the U.S., producing a wide variety of products including industrial/machining, transportation/automotive, construction, food and beverage, and other products.

“Half of the large manufacturers we surveyed expect three to nine percent revenue growth this year, while a still strong 30 percent of small manufacturers have that same optimism,” Kehl-Rose added.

More results from the survey include:

- Manufacturers are more optimistic about their local/regional economies than the national or global economies.

- The top priority for manufacturers in 2017 is “cutting operations costs,” however, high-growth manufacturing respondents are more focused on “research and development,” with 12 percent of high-growth respondents reinvesting more than 10 percent of annual revenue.

- Labor continues to be a challenge for manufacturers with 67 percent of respondents expect labor costs to “increase” and an additional 7 percent expect labor costs to “increase significantly” in 2017.

- Appropriate cost allocation and accurate and timely data will become required capabilities for successful businesses in the industry.

- More manufacturers will be considering both sales and mergers in 2017 as well as strategic acquisitions.

Kehl-Rose said U.S. manufacturing industry “headwinds” are significant and include both internal issues, such as high inventory-to-sales ratios, the cost of technology, and labor shortages, as well as external issues like the price of raw materials and strength of the dollar.

“To stiffen up and fight through these headwinds,” Kehl-Rose said, “strategic manufacturers should have ongoing conversations with all their advisors, including their accounting and tax provider, as to how to overcome these challenges and achieve their business goals.

“There are a range of solutions our members can offer manufacturers, from tax credits and entity structuring, to technology and transaction preparation,” Kehl-Rose said.

“What manufacturers cannot afford to do, is take a ‘wait and see’ approach,” she added.

About LEA Global

Founded in 1999, LEA Global, is the second largest international association in the world, creating a high-quality alliance of 220 firms focused on accounting, financial and business advisory services. LEA Global firms operate in 107 countries, giving clients of LEA Global firms access to the knowledge, skills and experience of over 2,000 experts and nearly 23,000 staff members.

by Gary Mintchell | Jan 18, 2017 | Podcast

Another manufacturing podcast has been published. You can subscribe on iTunes or other places or subscribe on YouTube and watch me talk.

This one discusses Tech Trends I’ve picked up on for 2017. Most are connectivity oriented, others expand our powers. Intelligent devices, conversational systems, augmented reality, blockchain. One I forgot is the coming IEEE standard on Time Sensitive Networks.

Anything you can think of to add?

by Gary Mintchell | Jan 17, 2017 | News, Organizations

MESA International has found a willing home for its annual North American conference once again aligning with the IndustryWeek Manufacturing & Technology (M&T) Conference & Expo. Both events will be held at the Huntington Convention Center in Cleveland, Ohio, USA, May 8 – 10, 2017. Registration for the global MESA community is now open.

I remember when one of the early leaders of the Smart Manufacturing Leadership Coalition was worried that it would lose its branding for Smart Manufacturing. Lately I’ve held conversations with marketing directors in the industry who use the SM term in a more or less generic way. So that leader was correct—Smart Manufacturing has become a phrase in alignment with other global phrases such as Industrie 4.0.

Saying that, the theme of the MESA North American Conference is “The Real Value of Smart Manufacturing” and will focus on highlighting the quantified business value realized by practitioners who have implemented “Smart” solutions. The MESA event will have one dedicated track of speakers and a pre-conference networking and problem-solving workout within the IndustryWeek M&T schedule-of-events. MESA will also have a booth in the M&T Expo, International and Americas Board-of-Directors meetings, committee and Working Group collaboration and networking opportunities for the global MESA community. Event information is available here.

Commenting on the event, Stephanie Mikelbrencis, Chair of MESA’s Americas Board, said, “The business leaders who read IndustryWeek want to know how to demystify Smart Manufacturing. I encourage them to join us in Cleveland to learn and to interact with others on the same journey to improved operations and business performance.”

The three-day IndustryWeek M&T Show brings together over 1,200+ senior manufacturers, 100+ exhibitors and 50+ conference sessions across eight tracks in manufacturing operations and design engineering. Conference content focuses on the key elements of advanced manufacturing: technology integration, leadership, operational excellence, design/engineering, talent development and supply chain.

Mike Yost, MESA President, added, “This is our 3rd year formally co-locating our NA Conference with IndustryWeek because it’s our opportunity to connect a company’s drive for continuous improvement to the IT-based solutions that can empower them. If your ‘Manufacturing-IT Strategy’ and the expected business value aren’t clear to everyone in your organization, you need to get your teams to this event.”

About MESA

MESA (Manufacturing Enterprise Solutions Association) International is a global, not-for-profit community of manufacturers, producers, industry leaders and solution providers who are focused on improving Operations Management capabilities through the effective application of Information Technologies, IT-based solutions and best practices. Goals:

- Enable members to connect, contribute, cultivate understanding, and exchange strategies to drive operations excellence.

- Collect, share, and publish best practices and guidance to drive greater productivity and the overall profitability of the manufacturing enterprise.

- Educate the marketplace on manufacturing operations best practices through the MESA Global Education Program.

by Gary Mintchell | Jan 16, 2017 | Commentary, News

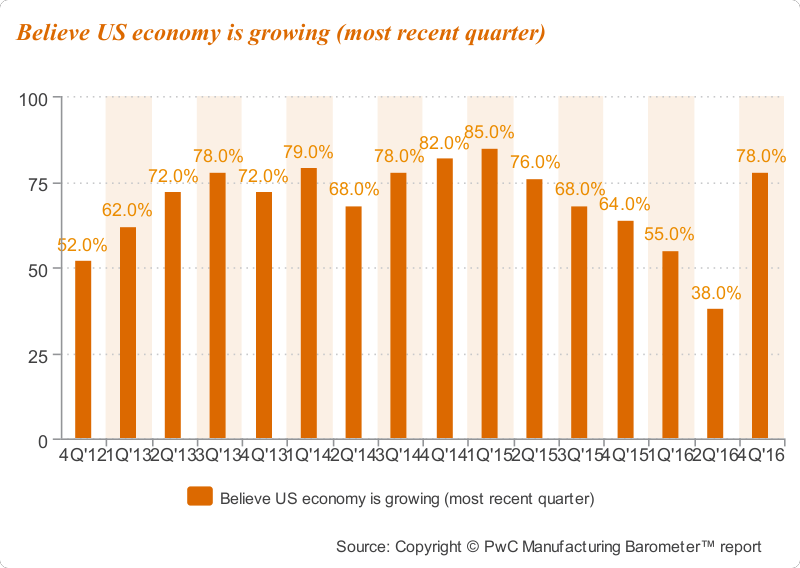

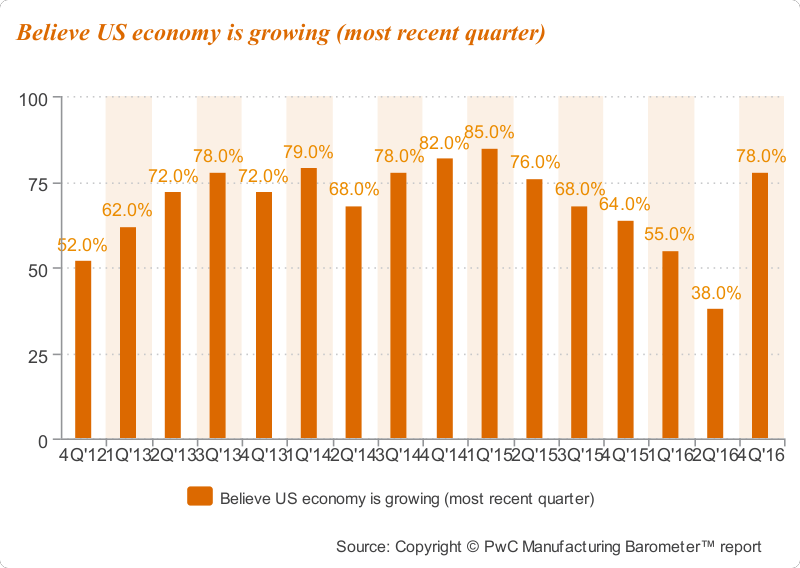

PwC just sent over its latest Industrial Manufacturers forecast survey—Q4 Manufacturing Barometer. PwC surveyed US industrial manufacturers on their sentiment in the fourth quarter of last year, and one thing was clear – optimism regarding the prospects of the U.S. economy surged in Q4. This was due to an improved outlook by industrial manufacturers, citing higher company forecasts and increased capital spending plans.

Economic Sentiment Shifts Upward as Industrial Manufacturers Forecast Higher Growth Rates Ahead

Optimism regarding the prospects of the U.S. economy surged in our fourth quarter Manufacturing Barometer survey, as industrial manufacturers pointed to an improved outlook, including higher company revenue forecasts and increased capital spending plans. The renewed sense of optimism regarding the direction of domestic commerce raises the question of whether an inflection point has taken place in attitudes among industrial manufacturers. The overall rise in economic sentiment occurred despite continued uncertainty regarding the state of the global economy.

Attitudes concerning the domestic economy soar

Highlighting the positive findings, 78 percent of the survey respondents believed the domestic economy was growing. This elevated level of sentiment is a dramatic increase from only 38 percent two quarters ago, representing an increase of 40 points. These levels were only 14 to 16 points below the highs of 94 percent back in the second quarter of 2004 and 92 percent in the first quarter of 2006. Moreover, optimism about the domestic economy’s prospects over the next 12 months rose, increasing to 57 percent, up from 35 percent two quarters, a notable 22-point gain.

While international sentiment remains depressed

Conversely, these same industrial manufacturing panelists remain consistently low in their outlook for the world economy. Only 13 percent cited growth in the fourth quarter of 2016, down from 20 percent at mid-year. Their level of optimism about the world economy’s prospects over the next 12 months was only 30 percent, largely in line with the 29 percent level two quarters ago. The majority, 54 percent, remained uncertain, while 16 percent were pessimistic. These numbers tell us that the persistent dichotomy between perceptions of the health of the domestic and worldwide economies has not only lingered among industrial manufacturers, but has become even more dramatic. As prospects for U.S. commerce improve, continued uncertainty regarding the global stage has kept a lid on overseas sentiment.

Company revenue forecasts increase

On the heels of the increase in domestic economic sentiment, industrial manufacturers also raised their forecasts regarding average own-company revenue growth to 4.6 percent, up considerably from 3.6 percent a year ago, with 85 percent of industrial manufacturers expecting positive growth in 2017, and only 4 percent expect negative or zero growth. It is also important to note that a consistency in their expected revenue contribution from international sales to total revenues remained high at 33 percent, despite their general feelings of uncertainty toward the world economy.

Leading to a plan to increase spending

The increased level of optimism regarding the domestic economy supported an uplift in forecasted spending over the next 12 months among industrial manufacturers. Plans for increased capital spending rose to the 60 percent level, close to the manufacturing panel’s high of 67 percent in the fourth quarter of 2011. Increased budget spending was also found for most areas, led by new products or service introductions, 67 percent, up 23 points from a year ago. Still, the capital spending forecasts represented only 2.2 percent of projected sales. In addition, plans for new hiring remained fairly stable at 35 percent, compared to 32 percent two quarters ago, and down from 42 percent in the fourth quarter of 2015.

While headwinds to growth remain the same

Headwinds to growth over the next 12 months remained consistent, led by monetary exchange rate barriers (48 percent), lack of demand (43 percent), and legislative/regulatory pressures (43 percent).

Sentiment points to a brighter future for industrial manufacturers

We certainly welcome the renewed sense of optimism regarding the domestic economy uncovered in our fourth quarter survey. Expectations for higher growth and increased investment spending bode well for the year ahead. The U.S. remains the bright spot in a persistently challenged and uncertain global economy. Time will surely tell if we have entered an inflection point in the industrial manufacturing sector.

The strongest trend among larger automation suppliers includes signing up partners for their solution ecosystem. Honeywell Process Solutions has built an ecosystem it calls Inspire and it announced recently Aereon will collaborate on solutions to help industrial customers boost the safety, efficiency and reliability of their operations by leveraging Honeywell’s Industrial Internet of Things (IIoT) ecosystem.

The strongest trend among larger automation suppliers includes signing up partners for their solution ecosystem. Honeywell Process Solutions has built an ecosystem it calls Inspire and it announced recently Aereon will collaborate on solutions to help industrial customers boost the safety, efficiency and reliability of their operations by leveraging Honeywell’s Industrial Internet of Things (IIoT) ecosystem.