by Gary Mintchell | Jul 8, 2020 | Manufacturing IT, Operations Management, Software

When it was time to leave paid employment and head out on my own, I looked for a domain name I could buy with “connection” in it. Surveying the landscape of technology and applications in 2013, I saw that despite a couple of decades of thought on connecting sensors at one end to business systems on the other this was still the future.

I also thought that I’d make a living in the MES space. Wrong! That space has never supported media or analysts. But Internet of Things came along and changed the conversation. And the technologies that evolved with IoT have enabled connectivity at new levels.

Here is the story of plant level (Ignition SCADA from Inductive Automation) to the execution level (Sepasoft MES) to business level (SAP).

In brief, Sepasoft launches Sepasoft Business Connector & Interface For SAP ERP Modules for connecting Ignition to business systems. Easy-to-integrate toolset democratizes connectivity between manufacturing and the enterprise.

Sepasoft Business Connector and Interface for SAP ERP is a suite of modules for connecting Ignition by Inductive Automation to business systems like SAP ERP. Connecting the Enterprise Resource Planning (ERP) and Manufacturing Execution System (MES) layers of manufacturing operations, the Sepasoft Business Connector provides intuitive drag-and-drop interfaces for developing business logic, transforming data, and mapping data between Ignition and other systems.

The combination of Sepasoft and Ignition by Inductive Automation becomes a first-class MES and connectivity platform for the enterprise.

To ensure that the new product suite would present a unique offering and adhere to industry best practices, Sepasoft teamed up with 4IR Solutions due to their deep expertise in enterprise and SAP integration. “The Sepasoft Business Connector offers increased flexibility and substantial cost savings versus existing solutions. When factoring in licensing, maintenance, training, engineering, and support, customers can expect to pay an order of magnitude less compared to leveraging other middleware or developing custom solutions,” said Joseph Dolivo, Principal of Digital Transformation at 4IR Solutions.

“The Sepasoft Business Connector will allow our customers to improve their operations while reducing their costs,” said Keith Adair, Product Manager at Sepasoft. “The Sepasoft Business Connector can link directly to SAP via the Interface for SAP ERP module and provides built-in templates for common data exchange scenarios. With the addition of our Web Services module, the Sepasoft Business Connector can communicate with other ERP and business systems that support SOAP and RESTful endpoints.”

“We’re very excited to welcome a native SAP connector and business connectivity tool to the Ignition ecosystem,” said Don Pearson, Chief Strategy Officer for Inductive Automation. “As an integrated part of the Ignition platform, the Sepasoft Business Connector supports familiar idioms like drag-and-drop, tag binding, and scripting, while requiring minimal configuration of third-party systems.”

4IR Solutions Corp is the leading provider of Life Sciences and enterprise integration consulting services for the Fourth Industrial Revolution and beyond. 4IR’s consultants have decades of experience providing companies with enterprise-wide connectivity, partnering with leading vendors to capture and encapsulate that experience into new and innovative products.

by Gary Mintchell | Feb 19, 2020 | Uncategorized

While at the Hannover Messe Preview last week in Germany, I talked with the representatives of a German consortium with the interesting name of “it’s OWL”. Following are some thoughts from the various organizations that compose the consortium.

Intelligent production and new business models

Artificial Intelligence is of crucial importance for the competitiveness of industry. In the Leading-Edge Cluster it’s OWL six research institutes cooperate with more than 100 companies to develop practical solutions for small and medium-sized businesses. At the OWL joint stand (Hall 7, A12) over 40 exhibitors will demonstrate applications in the areas of machine diagnostics, predictive maintenance, process optimization, and robotics.

Prof. Dr. Roman Dumitrescu (Managing Director it’s OWL Clustermanagement GmbH and Director Fraunhofer IEM) explains: “Our research institutes are international leaders in the fields of machine learning, cognitive assistance systems and systems engineering. At our four universities and two Fraunhofer Institutes, 350 researchers are working on over 100 projects to make Artificial Intelligence usable for applications in industrial value creation. With it’s OWL, we bring this expert knowledge into practice. In 2020, we will launch three new strategic initiatives worth 50 million € to unlock the potential for AI in production, product development and the working world for small and medium-sized enterprises.”

In the initiative ‘AI Marketplace’ 20, research institutes and companies are developing a digital platform for Artificial Intelligence in product development. Providers, users, and experts can network and develop solutions on this platform. In the competence centre ‘AI in the working world of industrial SMEs’, 25 partners from industry and science make their knowledge of work structuring in the context of AI available to companies.

Learning machine diagnostics and ‘SmartBox’ for process optimization

The Institute for Industrial Information Technology at the OWL University of Applied Sciences and Arts will present new results for intelligent machine diagnostics at the trade fair. Using a three-phase motor, it will be illustrated how learning algorithms and information fusion can be used to reliably identify, predict, and visualize states of technical systems. Patterns and information hidden in time series signals are learned and presented to the user in an understandable way. Inaccuracies and uncertainties in individual sensors are solved by conflict-reducing information fusion. For example, motors can be used as sensors. Within a network of sensors and other data sources in production plants, motors can measure the “state of health” and analyze the causes of malfunctions via AI. This reduces scrap and saves up to 20 percent in materials.

The ‘SmartBox’ of the Fraunhofer Institute IOSB-INA is a universally applicable solution that identifies anomalies in processes in various production environments on the basis of PROFI-NET data. The solution requires no configuration and learns the process behavior.

With retrofitting solutions of the Fraunhofer Institute, companies can prepare machines and systems in their inventory for Industrie 4.0 applications without major investment expenditure. The spectrum ranges from mobile production data acquisition systems in suitcase format for studies of potential to permanently installable retrofit solutions. Intelligent sensor systems, cloud connections and machine learning methods build the basis for data analysis. This way, processes can be optimised and more transparency, control, planning, safety, and flexibility in production can be achieved.

Cognitive robotics and self-healing in autonomous systems

The Institute of Cognition and Robotics (CoR-Lab) presents a cognitive robotics system for highly flexible industrial production. The potential of model-driven software and system development for cognitive robotics is demonstrated by using the example of automated terminal assembly in switch cabinet construction. For this purpose, machine learning methods for environ- mental perception and object recognition, automated planning algorithms and model-based motion control are integrated into a robotic system. The cell operator is thereby enabled to perform different assembly tasks using reusable and combinable task blocks.

The research project “AI for Autonomous Systems” of the Software Innovation Campus Paderborn aims at achieving self-healing properties of autonomous technical systems based on the principles of natural immune systems. For this purpose, anomalies must be detected at runtime and the underlying causes must be independently diagnosed. Based on the localization it is necessary to plan and implement behavioral adjustments to restore the function. In addition, the security of the systems must be guaranteed at all times and system reliability must be increased. This requires a combination of methods of artificial intelligence, machine learning and biologically inspired algorithms.

Predictive maintenance and digital twin

Within the framework of the ‘BOOST 4.0’ project, the largest European initiative for Big Data in industry, it’s OWL is working with 50 partners from 16 countries on various application scenarios for Big Data in production. it’s OWL focuses on predictive maintenance: thanks to the systematic collection and evaluation of machine data from a hydraulic press and a material conveyor system, it is possible to identify patterns in the production process in a pilot company. The Fraunhofer IEM has provided the technological and methodological basis. And successfully so: over the past two years the prediction of machine failures has been significantly improved in this specific application by means of machine learning methods. The Mean Time To Repair (MTTR) has already been reduced by more than 30 percent. The Mean Time Between Failures (MTBF) is now six times longer than before. A model of the predictive production line can be seen at the stand.

The digital twin is an important prerequisite for increasing the potential for efficiency and productivity in all phases of the machine life cycle. Companies and research institutes are working on the technical infrastructure for digital twins in an it’s OWL project. Digital descriptions and sub-models of machines, products and equipment as well as their interaction over the entire life cycle are now accessible thanks to interoperability. Requirements from the fields of energy and production technology as well as existing Industrie 4.0 standards and IT systems are taken into account. This is expected to result in potential savings of over 50 percent. At the joint stand, Lenze and Phoenix Contact will use typical machine modules to demonstrate how digital twins can be used to exchange information between components, machines, visualisations and digital services across manufacturers. Interoperability proves for the first time how the combination of data can be used to create useful information with added value for different user groups. For example, machine operators and maintenance staff can detect anomalies and receive instructions for troubleshooting.

Connect and get started – production optimization made easy

The cooperation in the Leading-Edge Cluster gives rise to new business ideas that are developed into successful start-ups. For example, Prodaso—a spin-off from Bielefeld University of Applied Sciences—has developed a simple and quickly implementable solution for the acquisition and visualization of machine and production data. The hardware can be connected to a machine in a few minutes via plug-and-play. The machine data is displayed directly in the cloud.

Prodaso has succeeded in solving a central challenge: Until now, networking machines from different manufacturers have been complex and costly. The Prodaso system can be retrofitted to all existing systems, independent of manufacturer and interface. In addition, the start- up also provides automated analysis and optimization tools. This enables companies to detect irregularities and deviations in the process flow at an early stage and to initiate appropriate measures. The company, founded in 2019, has already connected approximately 100 machines at companies in the manufacturing industry.

by Gary Mintchell | Sep 19, 2018 | Automation, Industrial Computers, Internet of Things, Manufacturing IT, News, Operations Management, Operator Interface, Technology

IMTS has been a huge show for many years. As you might expect from a trade show, the theme is broad. Exhibitors are a diverse lot. Things I saw indicating a new wave of technologies including machines designed to work with humans (so-called “cobots”) and various aspects of Industrial Internet of Things. Following are a few specifics.

Formerly the International Machine Tool Show and now the International Manufacturing Technology Show, the South Hall of Chicago’s McCormick Place is still filled with huge machining centers. The North Hall was packed with robotics, components, and other automation products. Much of this flows over to the East Hall where several aisles were devoted to Hannover Messe automation companies—my sweet spot. Even the West Hall was packed.

Beckhoff proclaimed, “Solve the IoT hardware, software and networking puzzle.”

The company introduced ultra-compact Industrial PCs (IPCs). These IPCs are Microsoft Azure Certified and can work just as easily with other major cloud platforms such as Amazon Web Services (AWS) and SAP HANA.

Significant updates will span three key areas of the TwinCAT software suite: new HTML5-enabled TwinCAT HMI for industrial displays and mobile devices, important data processing expansions in the TwinCAT Analytics offering, and TwinCAT 3 Motion Designer, which adds a deep set of valuable tools to commission entire motor, drive and mechanical systems in software. Motion Designer can be integrated into the standard TwinCAT 3 software platform or it can be used as a stand-alone motion system engineering tool.

EK1000 EtherCAT TSN Coupler expands the industrial Ethernet capabilities of the EtherCAT I/O system to utilize TSN (Time-Sensitive Networking) technology. The EK1000 enables communication among high-performance EtherCAT segments with remote EtherCAT controllers via heterogeneous Ethernet networks.

Ideagen plc, the UK-based software firm, announced the acquisition of American quality inspection software provider, InspectionXpert. Based in Raleigh, North Carolina, InspectionXpert currently generates $2.8 million in revenue and will bring more than 1,000 clients including Boeing, Kohler and Pratt & Whitney to Ideagen’s existing customer base.

Speaking at IMTS, Chicago, Ideagen CEO, Ben Dorks, said: “As well as significantly enhancing our manufacturing supply chain product suite, the acquisition of InspectionXpert provides Ideagen with a fantastic opportunity for growth by broadening upsell and cross-selling opportunities, increasing our customer footprint and expanding our geographical reach.”

InspectionXpert’s products, InspectionXpert and QualityXpert, enable organizations in the precision manufacturing industry and associated supply chains to simplify inspection planning, execution and reporting and general quality through digitalization of paper-based processes.

InspectionXpert and QualityXpert will be integrated into Ideagen’s existing software suite, which will enhance Software as a Service (SaaS) revenues and provide excellent opportunities for future growth.

Energid released Actin 5, an update to its robot software development kit (SDK). Called the industry’s only real-time adaptive motion control software, it allows robotic system developers to focus on the robot’s task rather than joint movement and paths. It responds in real time to sensory input and directs the robot on the most efficient path while avoiding collisions. The robot motion is updated dynamically without requiring reprogramming, even in dynamic, mission-critical environments.

Forcam develops software solutions in the area of MES, IIoT, and OEE. It leans into the trend of developing platforms. Its platform is built with open APIs with the latest programming languages and tools. It supports Microsoft Azure Cloud, SAP ERP, Maximo maintenance/asset applications, and Apple iPads for input. The platform helps reduce integration time and expense.

I came across the Dell Technologies booth in the automation hall. The big news was a collaboration with Tridium and Intel for IIoT solutions.

The IIoT solution is built on the Niagara Framework, Tridium’s open technology platform, and combines software and consulting services to help customers begin the digital transformation of their businesses.

The Niagara-based IIoT solution built with Dell and Intel technology will comprise a complete hardware and software stack delivered as a finished solution for ease of adoption, and will encompass consulting services from subject matter experts to support implementation. The application layer of the IIoT solution is being developed and supported by Tridium and will expand over time with solutions designed for the telecom and energy sectors.

by Gary Mintchell | Aug 18, 2018 | Asset Performance Management, Operations Management, Software

Who buys enterprise software applications, how and why? I ran across this article by a contact of mine, Gabriel Gheorghiu, Founder and principal analyst at Questions Consulting, with a background in business management and 15 years experience in enterprise software. I thought it would be most useful. I’m not an ERP analyst, but I have some background and training on the financial side of things. I think this analysis fits with other large-scale software acquisition projects, though, including MES/MOM, analytics, asset performance, and the like.

This will summarize some interesting points. I highly recommend reading the whole thing.

Before we begin, my brief take on enterprise software applications. How many of you have been involved with an SAP acquisition and roll out? How many happy people were there? Same with Oracle or any other ERP, CRM, MES, APM, etc. application. Why did using Microsoft Excel seem to go better?

Well, the big applications all force you to change all your business processes to fit their template. You build Excel to fit what you’re doing. It’s just not powerful enough to do everything, right?

Gheorghiu conducted interviews with 225 companies who were all looking for enterprise resource planning (ERP). The goal of this survey was simple – listen and learn from what these companies had to say about their individual decision-making strategies. We all agree that this is not a simple task. But we also agree that selecting the best ERP software is a critical factor for business success.

Here is why the research phase of this process is considered to be so vital:

- It has the greatest impact on all the subsequent phases and consequently, your final decision.

- Research begins at home – in other words, the first step is to determine your company’s specific and unique needs.

- Once your company has thought through and determined its software requirement, then and only then does the process to evaluate vendors and their offerings begin. This can be a very challenging step because many companies are not equipped with the time, knowledge, or tools to perform this step.

Buyer Profiles: Who’s Looking for ERP and Why?

One problem for analysis is that many are not doing business in just one industry. The breakdown of companies in our business sample, by industry, was as follows: manufacturing (47%), distribution (18%), services (12%), construction (4%), retail (3%), utilities (3%), government (3%), healthcare (3%), and other (10%). However, to complicate matters a little, 20% of manufacturers also manage distribution and some distributors include light manufacturing in their operations, like assembly.

“Companies looking to invest in business software may very well be addressing this additional challenge – looking for a comprehensive package that integrates all aspects of a business. ERP software systems are powerful and comprehensive but are not necessarily known for their agility and ability to accommodate many disparate functions.”

Gheorghiu identifies as a strong influencer consumerization, which changes focus from organization-oriented offerings to end-user focused products. “This was a highly significant turning point in the IT marketplace. By developing new technologies and models that originate in the consumer space rather than in the enterprise sector, software producers opened up the market to a flood of small and medium-sized businesses looking for more cost effective, and less complicated solutions to run their businesses.”

The consumerization of software (as noted above) has precipitated the move by many companies away from enterprise IT towards more streamlined and user friendly consumer-oriented technology. This change is equally relevant for ERP software and manufacturing companies have participated in this very significant development, albeit more cautiously and slowly than SMBs.

Most industries follow a “purposeful implementation” strategy, managing software adoption as a series of “sprints in a well-planned program” rather than insisting on the “all or nothing” approach.

For example, a small company looking to invest in software might decide to begin with an accounting system which can be used alongside point solutions and spreadsheets. As companies grow and their transactions become more complex, they may find that they have also outgrown their initial software selections.

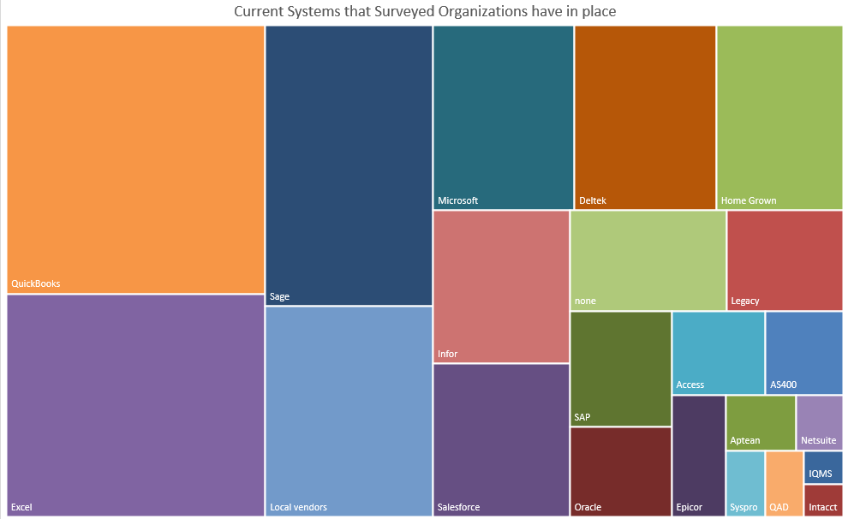

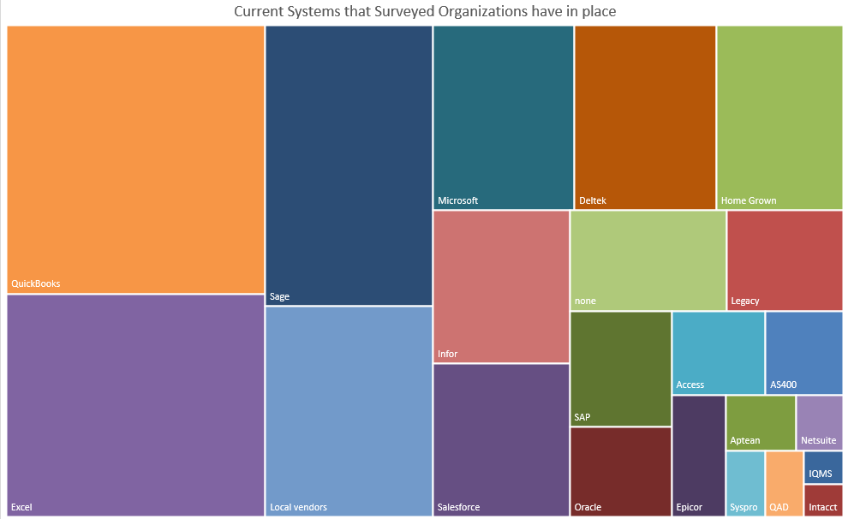

The chart below provides a visual analysis of the mix of software that is currently utilized by our business sample:

Some relevant comments we extracted from our survey included:

- The CEO of a small services company mentioned that he was “tired of the hodgepodge of systems”

- A manufacturer considered their current arrangement to be “very siloed.” Reconciling the inventory balance is a “constant battle.”

Buyer Behavior: How are Companies Approaching ERP Selection?

The selection process is most successful when companies adhere to some basic selection rules: involve as many direct stakeholders as possible and keep business priorities and strategies firmly in mind when making the final decision.

Feature Functions

A software change can trigger a vast administrative upheaval within the company. It is important to carefully analyze the business case for the change and whether it supports the level of disruption as well as the implementation time and spending that will be required. Even if the change may be entirely justified, a well thought out analysis is well worth the time and effort.

The Vendors in the Spotlight

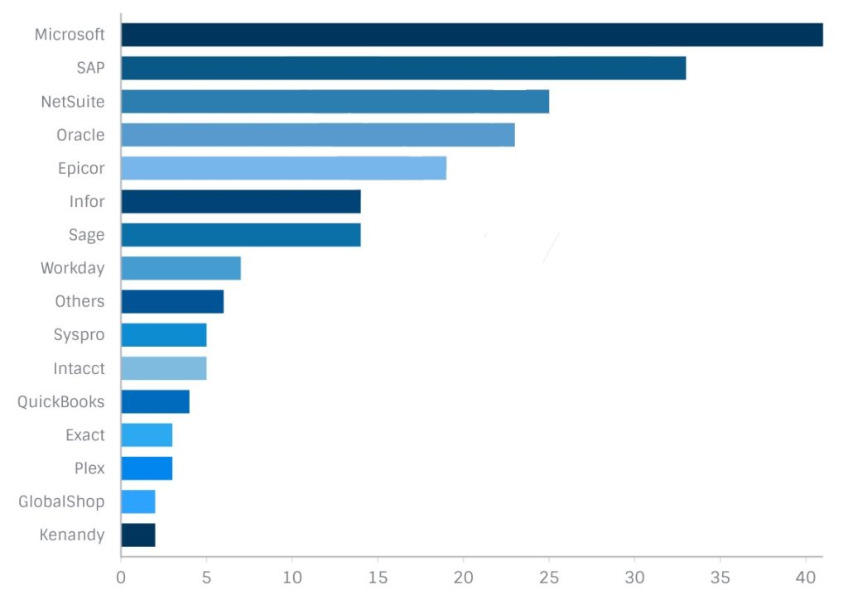

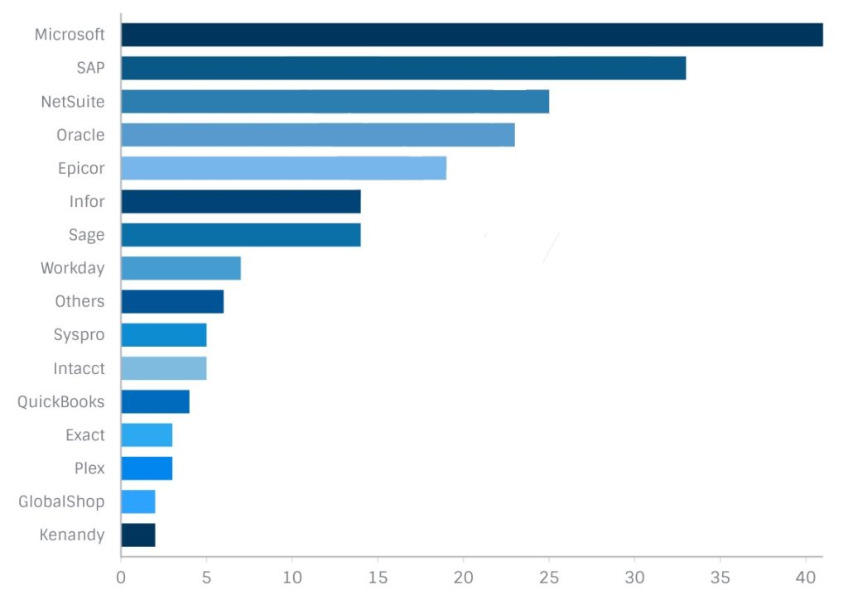

According to our survey results, the chart below identifies the vendors under consideration by the companies surveyed. A majority of companies (53%) were not, for the moment, looking at specific vendors. However 47% of respondents had narrowed their search to specific vendors.

Who’s Involved in this Decision Selection Process?

Our sample results indicate that the people in charge of the selection process are distributed as follows: employees in the finance and accounting departments (23%), IT department employees (23%). The other important categories were independent consultants helping companies with the selection process (17%), operations managers (17%) and presidents or CEOs (12%). It is worthwhile mentioning that project managers and business analysts only made up 5% of the total.

By far, the most effective method of choosing a software is to employ a collaborative system whereby the actual stakeholders of that system (the end-users) have a direct voice in the decision outcome. As the front-line users of the system, their insight and knowledge is very valuable. Their input along with all the other stakeholders input will produce the best possible outcome of this process.

An ERP system is a major business investment and is best handled with the appropriate amount of time and diligence given to the process.

The advent of cloud computing has indeed radically changed the landscape for deployment of business software. According to a recent press release by Gartner, “by 2020, a Corporate “No-Cloud” policy will be as rare as a “No-Internet” policy is today”. In other words, cloud deployment will become the default by 2020.

Our survey results, in fact, support Gartner’s analysis. Ninety-five percent of companies responded that they were open to a cloud deployment model, while just over 50% were willing to also consider on premises ERP. Of this latter group of respondents, 65% of them were manufacturers and distributors. This makes sense of course, given that these industries made significant investments in hardware and IT personnel and may not be as ready or as willing to move to the cloud model.

As for the preference for cloud computing (as demonstrated by our responses), we argue that it reflects the very strong tendency in the market to opt for simpler, more streamlined and less expensive computing solutions. As more information and assurances of security and stability by cloud providers enter the marketplace, more and more businesses will be convinced that the many benefits of the cloud outweigh some of their remaining concerns. Gartner’s prediction that cloud will increasingly be the default option for software deployment looks to be right on course.

Conclusion

An important consideration for companies embarking on an ERP software selection process – the average lifespan of an ERP system is approximately 5 to 10 years. If we consider important factors like the investment of capital, time, and loss of productivity that the selection and replacement of an ERP system requires, perhaps all companies would be more willing to invest the necessary effort in this process.

by Gary Mintchell | Aug 1, 2018 | Commentary, Internet of Things, Software

For the past couple of years, I’ve been convinced that there is a coming consolidation within the industrial software market. You would think that this would be a profitable business, but evidently it’s harder than it looks.

This thought converges with all the Industrial Internet of Things plays. We have platforms and a large variety of software—not to mention a variety of hardware plays. As buyers begin to sort out preferences, there will be changes.

GE Digital on the block

I was trying to figure out where GE was going to wind up in all this. Last fall I thought that GE Digital’s Minds + Machines conference was doomed. Then the 2018 edition was announced. Then yesterday morning I scan news feeds about 6 am and see that most of the GE Digital assets are on the auction block—evidently including Predix.

GE had a “not invented here” syndrome. Rolling your own platforms when other tried and perfected ones already exist is always shaky. So the new CEO mandated partnerships. There’s no reason to build a platform when Amazon’s AWS and Microsoft’s Azure are available. Now it appears that much of the portfolio is for sale.

Investments

But all is not lost. At the smaller end of the spectrum of industrial software there is investment money available according to a note I received from OSIsoft. The note pointed out IIoT company Seeq raised $23 million; Trendminer, Falkonry and Toumetis all recently received investments; and last year, SoftBank also invested in OSIsoft.

When we are consolidating at the top, that usually means it’s time for innovation in the newly available openings for small companies.

Consolidation

I could obviously point to PTC doing its part to consolidate in the IoT software space. But news just came about Plex Systems, a cloud-based ERP and MES supplier.

It announced it has acquired DATTUS Inc. Its solutions connect manufacturing equipment and sensors to the cloud, manage high-volume data streams, and analyze in-motion equipment data. The acquisition is expected to accelerate Plex’s IIoT strategy, extending the Plex Manufacturing Cloud to new streams of machine data and the underlying intelligence. The acquisition was completed in July 2018.

DATTUS brings to the Plex Manufacturing Cloud three major capabilities that will become central to Plex’s long-term IIoT roadmap: IIoT Connectivity, IIoT Data Management, and IIoT Data Analysis. IIoT Connectivity: DATTUS has simplified machine connectivity, providing plug-and-play solutions that work with the wide variety of protocols and data types used by equipment and sensors on the manufacturing shop floor. IIoT Data Management: the DATTUS IIoT platform captures and manages the extraordinary volume and variety of machine data to support real-time visibility into activity across production operations. IIoT Data Analysis: DATTUS analytics enable operational and business leaders to understand IIoT data in motion, providing decision support in areas such as predictive maintenance and machine performance.