by Gary Mintchell | Aug 1, 2018 | Commentary, Internet of Things, Software

For the past couple of years, I’ve been convinced that there is a coming consolidation within the industrial software market. You would think that this would be a profitable business, but evidently it’s harder than it looks.

This thought converges with all the Industrial Internet of Things plays. We have platforms and a large variety of software—not to mention a variety of hardware plays. As buyers begin to sort out preferences, there will be changes.

GE Digital on the block

I was trying to figure out where GE was going to wind up in all this. Last fall I thought that GE Digital’s Minds + Machines conference was doomed. Then the 2018 edition was announced. Then yesterday morning I scan news feeds about 6 am and see that most of the GE Digital assets are on the auction block—evidently including Predix.

GE had a “not invented here” syndrome. Rolling your own platforms when other tried and perfected ones already exist is always shaky. So the new CEO mandated partnerships. There’s no reason to build a platform when Amazon’s AWS and Microsoft’s Azure are available. Now it appears that much of the portfolio is for sale.

Investments

But all is not lost. At the smaller end of the spectrum of industrial software there is investment money available according to a note I received from OSIsoft. The note pointed out IIoT company Seeq raised $23 million; Trendminer, Falkonry and Toumetis all recently received investments; and last year, SoftBank also invested in OSIsoft.

When we are consolidating at the top, that usually means it’s time for innovation in the newly available openings for small companies.

Consolidation

I could obviously point to PTC doing its part to consolidate in the IoT software space. But news just came about Plex Systems, a cloud-based ERP and MES supplier.

It announced it has acquired DATTUS Inc. Its solutions connect manufacturing equipment and sensors to the cloud, manage high-volume data streams, and analyze in-motion equipment data. The acquisition is expected to accelerate Plex’s IIoT strategy, extending the Plex Manufacturing Cloud to new streams of machine data and the underlying intelligence. The acquisition was completed in July 2018.

DATTUS brings to the Plex Manufacturing Cloud three major capabilities that will become central to Plex’s long-term IIoT roadmap: IIoT Connectivity, IIoT Data Management, and IIoT Data Analysis. IIoT Connectivity: DATTUS has simplified machine connectivity, providing plug-and-play solutions that work with the wide variety of protocols and data types used by equipment and sensors on the manufacturing shop floor. IIoT Data Management: the DATTUS IIoT platform captures and manages the extraordinary volume and variety of machine data to support real-time visibility into activity across production operations. IIoT Data Analysis: DATTUS analytics enable operational and business leaders to understand IIoT data in motion, providing decision support in areas such as predictive maintenance and machine performance.

by Gary Mintchell | Jul 25, 2018 | Automation, Technology

Collaborative describes the latest and most important trend in robots. Even if I was summarily dismissed when I asked that question of the CEO of a robotic arm company at an IT event, I stand by that analysis.

Lately Mobile Industrial Robots (MiR) news came to my attention. I’ve put off writing until I connected with Ed Mullen, US VP of Sales for this Danish company.

He told me that MiR designs and manufactures Autonomous Mobile Robots (AMR) which are a bit like a quantum jump from the older Automated Guided Vehicles (AGVs) with which you may be familiar. Especially if you’re older, like me.

AGVs followed a path which was usually a wire laid in the floor. It followed its route around the facility. Cool, but not really very intelligent.

AMRs operate similar to modern autonomous technology using a 2D map of the facility and a location system plus laser scanning LIDAR. Tell it a place to go, and like a GPS it calculates the best route and directs the mobile robot to its destination—safely. I have actually interacted with one of the company’s earlier versions at a trade show where it continuously ran a route around the booth.

He tells me that the company is really more of a software company than hardware. The object is to take open source software and package it so that the customer has great flexibility for applications while usually going from unboxing to operations in under an hour.

Product news

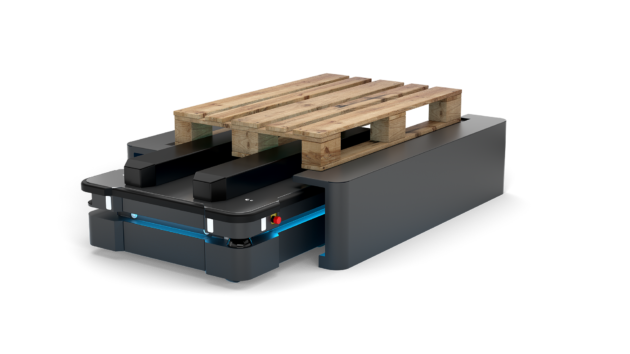

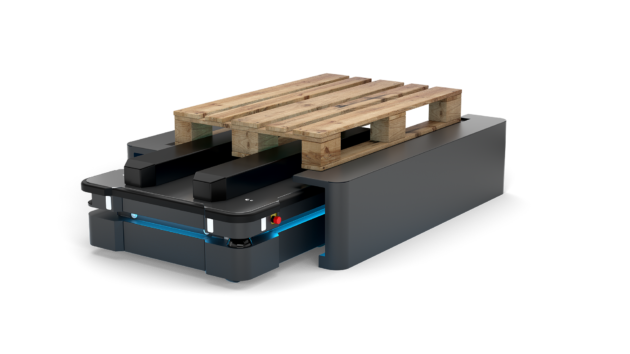

The latest product news is the launch of its MiR500 AMR. The robot has a lifting capacity of 500 kg (1102 lbs) and can automatically collect, transport and deliver pallets with speeds of nearly 4.5 miles per hour (mph). The MiR500 joins the MiR100 and MiR200 to form a complete fleet of flexible and easy-to-program MiR robots for both heavy and light transport that can optimize logistics throughout the entire production chain, from the warehouse to the delivery of goods.

“With the MiR500, we are extending the proven, strong technology and safety features that have made us the leading global supplier of autonomous mobile robots,” said Thomas Visti, CEO of Mobile Industrial Robots. “The MiR500 was developed to meet the needs of customers who have used our other robots and now see huge potential in the automation of the internal transport of heavy items and Euro-pallets. With MiR500, we’re setting new standards for how companies can use autonomous mobile robots.”

The user interface matches that used in the MiR100 and MiR200, which already optimize production processes in many of the world’s biggest multinational companies such as Airbus, Flex, Honeywell, Hitachi and Danone. The difference is the MiR500’s size, lifting capacity and areas of application.

“MiR500 is an extremely robust robot, so it’s perfect in industrial environments,” Visti said. “We’ve also incorporated the principles from the MiR100 and MiR200, where flexibility and user-friendliness are key attributes. This means that the MiR500 can be programmed without prior experience. It’s also simple to develop and replace top modules such as pallet lifters, conveyor belts and robot arms, so the robot can be used for different transport purposes.”

MiR has grown quickly since its founding in 2013, with sales rising by 500 percent from 2015 to 2016, and 300 percent from 2016 to 2017. With its second US office opening in San Diego this spring, and strong growth continuing worldwide, MiR expects to increase the number of employees from 65 to about 120 in 2018.

Acquisition

But wait, there’s more. Teradyne Inc. and the shareho6lders of Mobile Industrial Robots (MiR) announced the acquisition of privately held MiR of Odense, Denmark for €121 million ($148 million) net of cash acquired plus €101 million ($124 million at current exchange rate) if certain performance targets are met extending through 2020.

“We are excited to have MiR join Teradyne’s widening portfolio of advanced, intelligent, automation products,” said Mark Jagiela, President and CEO of Teradyne. “MiR is the market leader in the nascent, but fast growing market for collaborative autonomous mobile robots (AMRs). Like Universal Robots’ collaborative robots, MiR collaborative AMRs lower the barrier for both large and small enterprises to incrementally automate their operations without the need for specialty staff or a re-layout of their existing workflow. This, combined with a fast return on investment, opens a vast new automation market. Following the path proven with Universal Robots, we expect to leverage Teradyne’s global capabilities to expand MiR’s reach.”

MiR was profitable in 2017 with annual revenue of $12 million USD, more than triple 2016 revenues and had Q1’18 sales of $5 million.

“Joining Teradyne allows us to advance our engineering and development investments to provide greater value to our customers and further expand our market leadership in industrial autonomous mobile robots,” said Thomas Visti, CEO of MiR. “Teradyne’s worldwide reach, world-class engineering and support capabilities, financial strength and proven model for leveraging those strengths will help us grow in new and existing markets worldwide.”

“My main focus is to get our mobile robots out to the entire world,” said Niels Jul Jacobsen, CSO, founder of MiR. “With Teradyne as the owner, we will have strong backing to ensure MiR’s continued growth in the global market.”

by Gary Mintchell | Jul 10, 2018 | Automation, Commentary

Rockwell Automation’s recent huge investment in PTC for only 8% of the company has sparked a number of thoughts on strategies not only of Rockwell Automation, but also other companies in the market. We’re looking not only at Rockwell Automation in this brief analysis, but also Siemens, Schneider Electric, and ABB.

I’ve left out Emerson, Honeywell, and Yokogawa. The only interesting thing in that part of the market is Emerson’s abortive run at acquiring Rockwell. That was strange. I don’t think that Emerson could have digested such a meal.

The analysis is not to knock anyone but to look for trends and strategies of some of our major suppliers.

I think it begins with Siemens. An executive explained the company’s digital factory strategy and vision many years ago. Then the company acquired UGS and added PLM, CAD, and other digital technologies. There followed other similar acquisitions. I’m thinking mainly of the COMOS product, here.

If you are looking for an articulation of the strategy, I suggest looking no further than Industrie 4.0 and cyber-physical systems.

Sticking with Europe and the competition over there, let’s consider Schneider Electric. This company has been building the “electrification” side of the business which also brought industrial control products and some automation–think Modicon. While it lost considerable market share in PLCs, it did remain in the market. Then it acquired Invensys adding a lot of software (something it never really was good at) but especially process control (Foxboro, etc.). This latter helps it in the power market segment and positions it well against ABB. Siemens of course is the main competitive target. Then is a strange move, Schneider used its software businesses (Wonderware, etc.) as an investment in AVEVA grabbing 51% of the company. Now it, too, has a digital factory strategy in place.

ABB, a strong competitor in the power side of the business and also in process control, acquired B+R Automation. That company was a strong second-tier machine automation supplier fleshing out ABB’s portfolio in the discrete, or machine, automation market. Then it acquired GE’s industrial business strengthening ABB in the “electrification” market. Sounding familiar.

Now look at Rockwell’s investment. That company has flirted with Dassault Systemes over many years for a PLM-to-Control strategy. But nothing ever came of it.

A couple of years ago it acquired thin-client manufacturer ACP and systems integrator Maverick Technologies and MagneMotion a supplier of motion control and conveyor technologies. Then came a large investment in PTC for a small percentage of the company. I speculated that this could be a Digital Factory play along with the respected analyst Joe Barkai, but my friend Keith Larson writing for Putman Publishing (and someone I trust to accurately report on what suppliers are saying) reported that the sought-after prize was a closer integration with ThingWorx. This would be a piece of the Rockwell strategy of “Connected Enterprise” and Larson reported that the target RA product is its MES offering.

In other words, Rockwell Automation seems focused not on the current buzz of Industry 4.0/Industrial Internet of Things/Cyberphysical systems/Digital Factory, but on “making our customers more productive.” Its roots are plant floor and it remains a plant floor supplier.

I am NOT predicting any acquisition of Rockwell Automation, but I do believe that the market needs some continued consolidation. The next five years will be interesting in this market.

by Gary Mintchell | Jun 11, 2018 | Commentary, News

So I decided not to make a cross country trip to San Diego for Rockwell Automation’s RATechEd event this year. I have cross country trips coming up the next two weeks followed by family time. So, I’m doing a one-day business trip plus taking my wife out for dinner in Chicago this week. Anyway, they had informed me that they wouldn’t be setting up interviews but that I’d be welcome to sit in any sessions I wanted. I passed.

Then I see a tweet from PTC today. Blockbuster news. Rockwell Automation’s Connected Enterprise just became connected. It has invested $1B in PTC for an approximate 8% ownership. PTC has [ERP], PLM, and IIoT (Kepware and ThingWorx). By connecting with these technologies, Rockwell now has the possibility of a technology convergence rivaling its rivals in Europe.

There are three of my questions about Rockwell answered:

- Other than a refreshing change of culture, what else was Blake Moret going to do to put his stamp on the company?

- When was Rockwell Automation going to really connect the enterprise like its slogan has held for several years (about the time I came up with Manufacturing Connection for the new title for my blog)?

- How was Rockwell going to answer the digital manufacturing and Industry 4.0 moves made by its European competitors Siemens, Schneider Electric, and ABB?

This is far from an acquisition and just a partnership right now. But it is a big step in the right direction.

Here is the press release I downloaded from Business Wire.

PTC Inc. and Rockwell Automation, Inc. today announced that they have entered into a definitive agreement for a strategic partnership that is expected to accelerate growth for both companies and enable them to be the partner of choice for customers around the world who want to transform their physical operations with digital technology.

As part of the partnership, Rockwell Automation will make a $1 billion equity investment in PTC, and Rockwell Automation’s Chairman and CEO, Blake Moret, will join PTC’s board of directors effective with the closing of the equity transaction.

The partnership leverages both companies’ resources, technologies, industry expertise, and market presence, and will include technical collaboration across the organizations as well as joint global go-to-market initiatives. In particular, PTC and Rockwell Automation have agreed to align their respective smart factory technologies and combine PTC’s award-winning ThingWorx IoT, Kepware industrial connectivity, and Vuforia augmented reality (AR) platforms with Rockwell Automation’s FactoryTalk MES, FactoryTalk Analytics, and Industrial Automation platforms.

“This strategic alliance will provide the industry with the broadest integrated suite of best-in-class technology, backed by PTC, the leader in IoT and augmented reality, and Rockwell Automation, the leader in industrial automation and information. Our combined customer base will benefit from two world-class organizations that understand their business and deliver comprehensive, innovative, and integrated solutions,” said Jim Heppelmann, President and CEO, PTC. “Leveraging Rockwell Automation’s industry-leading industrial control and software technology, strong brand, and domain expertise with PTC’s award-winning technology enables industrial enterprises to capitalize on the promise of the Industrial IoT. I am incredibly excited about this partnership and the opportunity it provides to fuel our future success.”

Blake Moret, Chairman and CEO, Rockwell Automation, said, “We believe this strategic partnership will enable us to accelerate growth by building on both companies’ records of innovation to extend the value of the Connected Enterprise and deepen our customer relationships. As IT and OT converge, there is a natural alignment between our companies. Together, we will offer the most comprehensive and flexible IoT offering in the industrial space. Our equity investment in PTC reflects our confidence in the partnership and the significant upside we expect it to create for both companies as we work together to profitably grow subscription revenue.”

Rockwell Automation’s solutions business will be a preferred delivery and implementation provider, supported by a robust ecosystem of partners that both companies have established. The strength of both companies across geographies, end markets, and applications is complementary.

Terms

Under the terms of the agreement relating to the equity investment, Rockwell Automation will make a $1 billion equity investment in PTC by acquiring 10,582,010 newly issued shares at a price of $94.50, representing an approximate 8.4% ownership interest in PTC based on PTC’s current outstanding shares pro forma for the share issuance to Rockwell Automation. The price per share represents an 8.6% premium to PTC’s closing stock price on June 8, 2018, the last trading day prior to today’s announcement. Rockwell Automation intends to fund the investment through a combination of cash on hand and commercial paper borrowings. Rockwell Automation will account for its ownership interest in PTC as an Available for Sale security, reported at fair value.

by Gary Mintchell | Jun 4, 2018 | Standards, Technology

Microsoft acquiring GitHub, the repository of many open source projects, on the surface appears almost as an oxymoron. However, as I’ve written previously about big companies and OPC UA standard big companies now find open source and interoperability to be sound business decisions rather than threatening to their proprietary hold on technology.

OPC and Standards

Two years ago in my Podcast Gary on Manufacturing 149 also found on YouTube, I asked the question why major suppliers of automation technology for manufacturing/production hated OPC UA—an industry information model standard. That is by far the most viewed YouTube podcast I’ve ever done. I followed up with Gary on Manufacturing 175 and YouTube to update the situation to current situation.

It is still getting comments, some two years later. Some guy (probably works for a big company?) even dissed me about it.

However, the industry witnessed an almost tectonic shift in the approach of these automation suppliers toward standards. First Siemens went all in on OPC UA. Then last November and following Rockwell Automation has had several deep discussions with me about the adoption of OPC UA.

Why? Users demand more interoperability. And using standards is the easiest way forward for interoperability. Suppliers have discovered that standards allow them to continue to push development of their “black boxes” of technology while allowing themselves and their customers to assemble systems of technology.

Microsoft News

In my favorite news site, Axios, Ina Fried writes:

Microsoft announced this morning it is acquiring GitHub, the social network for coders as well as home to millions of different software projects, for $7.5 billion.

“The era of the intelligent cloud and intelligent edge is upon us. Computing is becoming embedded in the world, with every part of our daily life and work and every aspect of our society and economy being transformed by digital technology. Developers are the builders of this new era, writing the world’s code. And GitHub is their home.”

— Satya Nadellla, CEO, Microsoft

Why it matters: This would further highlight the complete turnaround the company has already made in its stance toward source software.

Behind the scenes: While former Microsoft CEO Steve Ballmer once called Linux a cancer, the company has steadily warmed to open source, with Nadella embracing it with open arms.

GitHub plays into that strategy as it’s used by developers of all stripes to store their code projects. The San Francisco-based company was founded in 2008 and is now home to 80 million software repositories. The company has been searching for a new CEO since last year.

Why it matters: Playing host to the world’s code doesn’t necessarily make Microsoft a more central player, but it could tightly integrate GitHub into its developer tools. Microsoft decided last year to shut down its own CodePlex software repository, bowing to GitHub’s popularity.

What about Windows? Though certainly a fan of its homegrown operating system, Microsoft’s main goal these days is to be in tight with developers and get them writing code that can live in its Azure cloud.

Microsoft even dropped the Windows name from Azure, reflecting the fact you don’t have to use Windows to work with Azure.

History lesson: Microsoft’s shift to embrace Linux is somewhat reminiscent of the earlier move IBM made to do so. Both companies are now seen as the mature veterans of the enterprise market, more interested in meeting corporate computing needs than pushing homegrown architectures.

This information was also posted on the Microsoft Blog.

Other Open Source Information

My other travels and interviews have yielded other companies who have invested heavily in open source.

Within the last two years I have had a few conversations with Microsoft about their open source code donations. While I am a little surprised at acquiring GitHub, perhaps this will lend financial stability to the platform (although we do have to note that large company investments do not always insure financial stability.

Dell Technologies and Hewlett Packard Enterprise, two companies I have more recently studied are both proud to be contributors to open source. A couple of years ago considerable time at one of the keynotes at Dell World to open source projects.

I think that some of these companies are realizing that they don’t have to invent everything themselves. Being good software citizens benefits them as well as the community.